Last updated on April 27th, 2022 , 02:53 pm

Market Maker Definition: A market marker acts as a liquidity provider by both buying and selling a security to satisfy the market.

Market makers are the backbone of all public markets. Without them, it would be very difficult indeed to both enter and exit any type of security, including stocks, options (derivatives), ETFs, and futures.

If you’ve ever placed a market order before, you’ve probably been surprised at how fast that order was filled. This is because a market maker was waiting, armed with a software-based trading system using algorithms, to take the other side of your trade.

In this article, we will explore the function of market makers, and how they contribute to the smooth running of our capital markets.

TAKEAWAYS

- The function of a market maker is to provide liquidity for the markets.

- Market makers make money from the “spread” by buying the bid price and selling the ask price.

- Market makers hedge their risk by trading shares of the underlying stock.

- Citadel and Virtu are the largest option market makers.

- A broker acts as an intermediary, facilitating orders from buyers and sellers; a market maker provides order execution.

What Is the Purpose of Market Makers?

Market makers are the reason our market orders get filled instantaneously. They also (eventually) fill stop orders, limit orders, and virtually any other type of order your broker offers. Without market makers, you would have to sit on the order until another counterparty came around and decided to take the other side of the trade. When might that time come? Who knows. This “illiquid” market would certainly cause us to distrust the markets.

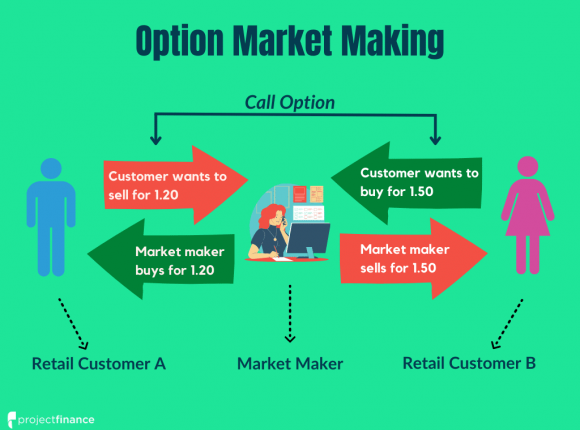

The ease to enter and exit trades is called liquidity. Providing liquidity is the primary function of all market makers. These market participants buy the bid price and sell the ask price on their specified security for any order that comes their way.

Of course, market making is no charity – the difference between the bid and the ask is called the spread, and this spread is how market makers make money.

What Are Examples of Option Market Makers?

Let’s jump right into an example to see how market makers help markets run smoothly.

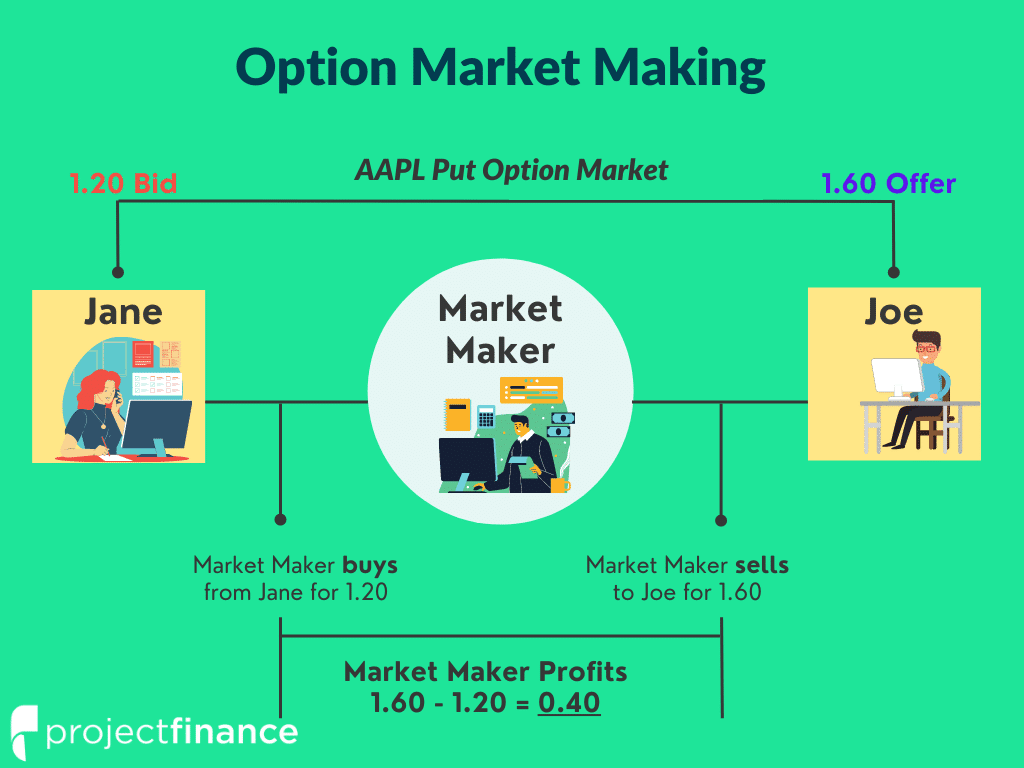

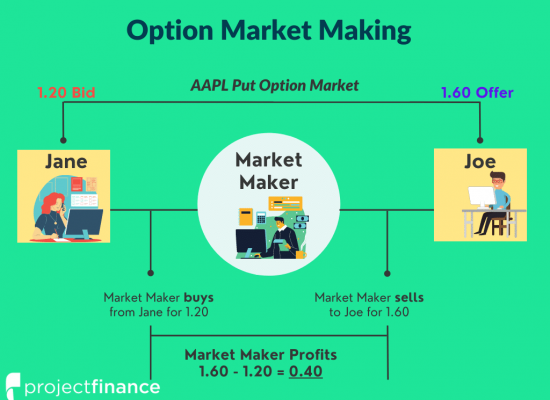

This example is going to involve a put option on AAPL with three market participants: Jane, Joe and a market maker.

- Jane is currently long a AAPL put option contract and wants to sell.

- Joe wants to buy the same contract Jane is selling.

- The AAPL put is currently bid for 1.20 and offered for 1.60

Market Making Visualized

Both Jane and Joe send a market to both sell and buy, respectively, their put option. These orders are sent to an exchange. Some major exchanges for options include:

- Chicago Board Options Exchange (CBOE)

- International Securities Exchange (ISE)

- NYSE (New York Stock Exchange) Arca

- Various Nasdaq Markets

After being sent to an exchange, the order is then seen on the screen of a market maker. The market maker buys the put from Jane while simultaneously selling the same put to Joe.

Since the market maker bought the option at the bid of 1.20 (from Jane) and sold the option for 1.60 (to Joe), the market maker made a profit of 0.40, or $40 taking into account the leveraged multiplier effect of options. Remember, one options contract represents 100 shares of stock.

Sometimes, Joe and Jane can trade directly together, but the vast majority of the time, a market maker is needed to facilitate these trades. What if there was no other trader out there who was willing to buy that put option Jane wanted to sell? How would she ever get out of her position?

How Do Market Makers Set Option Prices?

Market makers set option prices for all listed derivatives, including equity, ETF, and index options.

In the above example, the market for our put option was 1.20/1.60. This means that if you were to buy this option at 1.60 and wanted to sell it immediately, you would have to sell it for 1.20. In other words, you would lose 0.40 (1.60-1.20), or $40, immediately.

Of course what you lose, the market maker gains.

But why is this market 1.20/1.60? Is this some arbitrary price? No!

The width of a market (set by the various market markers for a security) depends on several factors. The more liquid a security is, the easier both you and a market maker can enter and exit positions in that security.

3 Liquidity Measures in Options

Before determining the spread of an option (or any security), a market maker considers several liquidity factors. Three of these are:

- Volume: How many option contract have been traded so far on any given day.

- Open Interest: How many contracts are outstanding in an option.

- Bid/Ask Size: How many contracts are bid/offered at that price.

The higher the volume and the more open interest an option has, the easier a market maker can exit the position they just bought or sold from you.

Remember, market makers have to exit positions as well! If markets are illiquid, they are going to widen out the spreads to make up for the risks of holding a position in an illiquid market.

How Market Makers Hedge

Market makers don’t generally turn around and immediately sell an option they bought from you. They’ll have to wait a bit for another trader to come around and give them a good price. So how do they hedge the risk of holding options?

Let’s take a look at an example to find out.

We’ll say AAPL just reported horrible earnings, and every trader out there is trying to sell their call options. A market maker in AAPL must therefore buy these options to fulfill their duty as a liquidity provider.

This will result in a boatload of long call options for the market maker. That’s a lot of risk! How do market makers offset this risk?

Delta and Gamma Hedging

To mitigate this risk, a market maker keeps an inventory of either long or short stock. How much stock? That depends on their position “delta” and “gamma“.

Δ β θ Read! Introduction To The Option Greeks

For example, if an out-of-the-money call option has a delta of 0.84, that means this contract trades like 84 shares of stock. To offset this risk, a market maker would sell 84 shares of stock.

Sometimes, in volatile markets, a lot of stock must be purchased or sold for a market maker to offset their risk. This can cause stock prices to both soar and tank in value. Market makers hedging their short call options with long stock is the reason many meme stocks soared in value in 2021. This rare market condition is called a gamma squeeze.

If you’d like to read more about delta hedging (which both market makers and traders utilize), read our article, Delta Hedging Explained (Visual Guide w/ Examples).

How Do Market Makers Make Money In Payment for Order Flow?

Retail traders are not known for their market savviness. Market makers want retail order flow, particularly in options. Why? The bid/ask spread in options is much wider than in stocks.

Market makers want this order flow so bad, that they are willing to pay brokers for the right to fill their customer’s orders.

This is known as payment for order flow.

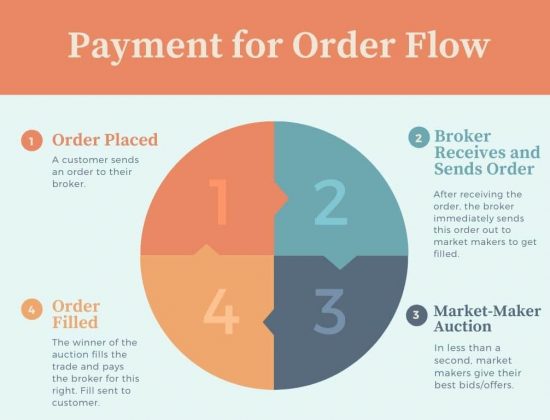

Every time you send an order through your broker (unless your broker internalizes their order flow), an auction takes place between your broker and numerous market makers to see who gets to fill your order.

In these flash auctions, the best bid/offer wins. Payment is sent from the market maker to the broker for filling the order, and the customer is filled.

Market makers do not get paid here – the brokers (like thinkorswim, Robinhood, or tastyworks) do. Market makers make their money in “arbitrage” by trading the products they are specialists for.

Read: 💲 Payment for Order Flow Explained Simply (w/ Visuals)

Who Are the Largest Options Market Makers?

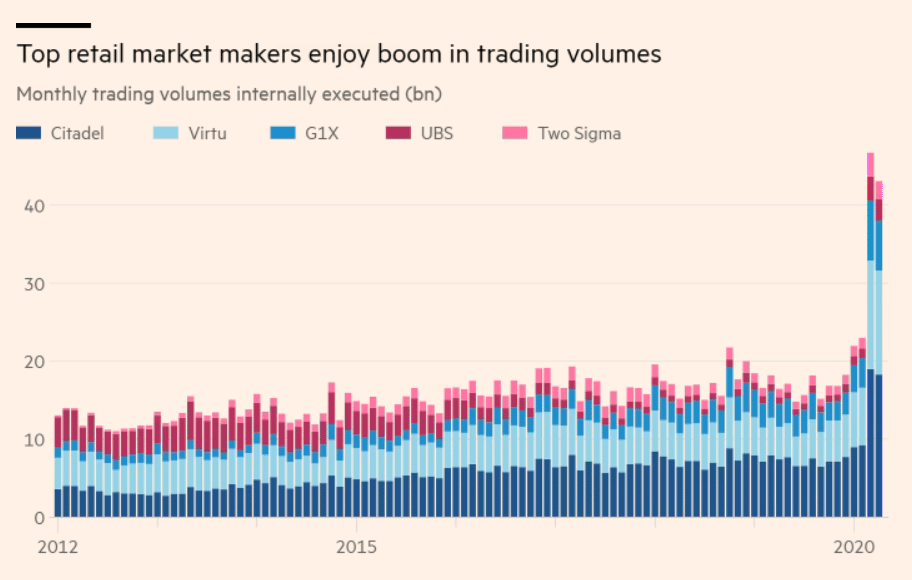

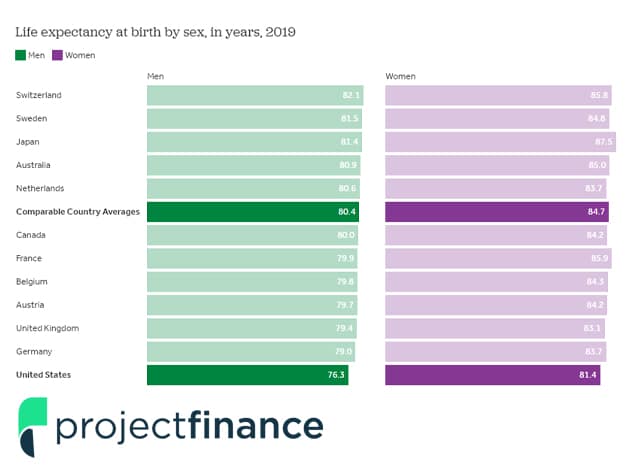

Although there are many market-making firms, two, in particular, dominate the space:

- Citadel Securities

- Virtu

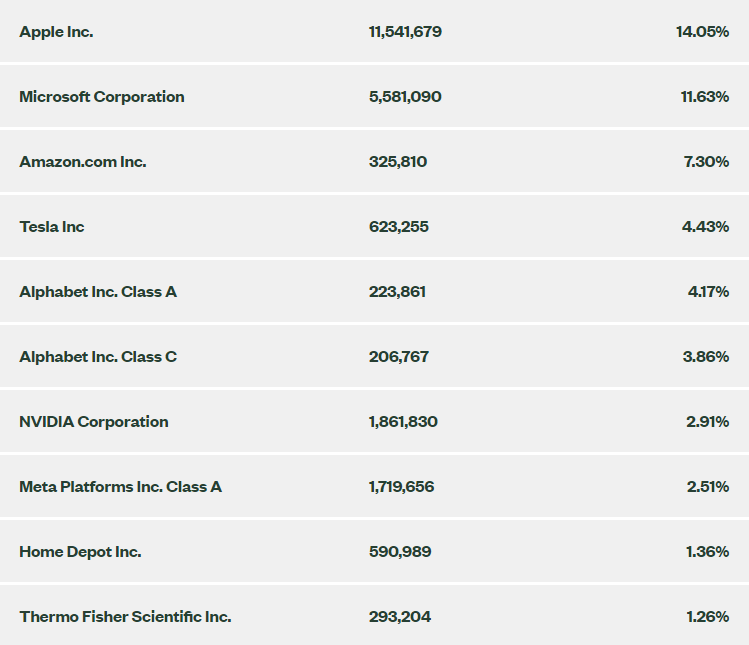

So what percentage of volume do these two firms take from the stock and options markets? The below image, from the Financial Times, shows just how much.

Market makers can be small independent businesses or large hedge funds. In the modern era, hedge funds are taking business from the smaller market makers. You must be very well capitalized to compete in this space!

What Is the Difference Between a Market Maker and a Broker?

With a few rare exceptions, (such as Interactive Brokers), retail brokers do not act as market makers. These two business models provide completely different services.

- Brokers act as intermediaries by facilitating trade orders from both buyers and sellers by bringing together assets.

- Market Makers are dealers in securities who provide liquidity to a market by buying and selling that market’s securities at all times. Market makers provide trade execution.

Option Market Makers FAQs

Market makers provide liquidity by both buying and selling options of all types, including call and put options. To offset the risk from selling call options, market makers must purchase stock. This can result in a gamma squeeze.

In order to adequately mitigate their risk, market makers in options must hedge their positions by either buying or selling shares of stocks. This can lead to fluctuations in the underlying share price, which some believe to be manipulation.

Market makers buy options to satisfy the market. As liquidity providers, the role of the market maker is not limited to buying options – they must stand ready to both buy and sell all options strategies to fulfill their obligation.