Last updated on March 17th, 2022 , 05:46 pm

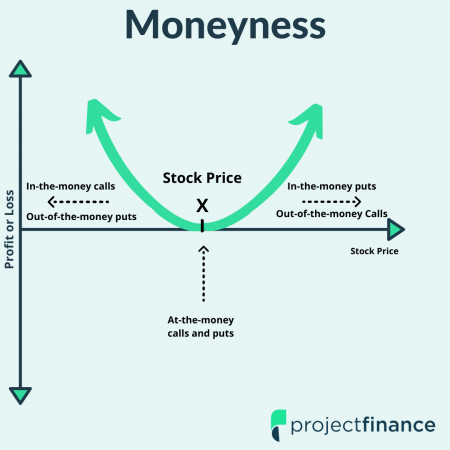

All call and put options contracts exist in one one three “moneyness” states: in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM).

To truly understand moneyness, we must first understand the difference between intrinsic value and extrinsic value.

Highlights

Option “Moneyness” refers to the relationship between an option’s strike price and the current stock price.

In-the-money options have intrinsic value. For calls, the strike price of these options resides below the current stock price. For puts, in-the-money options reside above the current stock price.

At-the-money options refer to strike prices that are trading at (or very close to) the current stock price.

Out-of-the-money options have zero intrinsic value. Calls are out-of-the-money if the strike price is above the current stock price. Put are out-of-the-money when the strike price is below the current stock price.

Intrinsic Value Explained

The price of an options contract consists entirely of intrinsic and/or extrinsic value.

Intrinsic value is simply how much value an option has on its own. In other words, this is the value an option would have if it were exercised at any given moment in time. Intrinsic value discounts time and implied volatility.

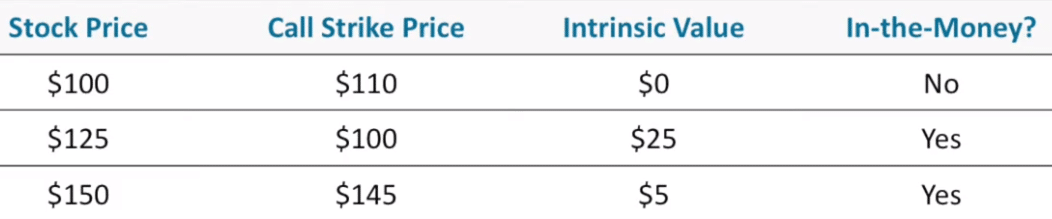

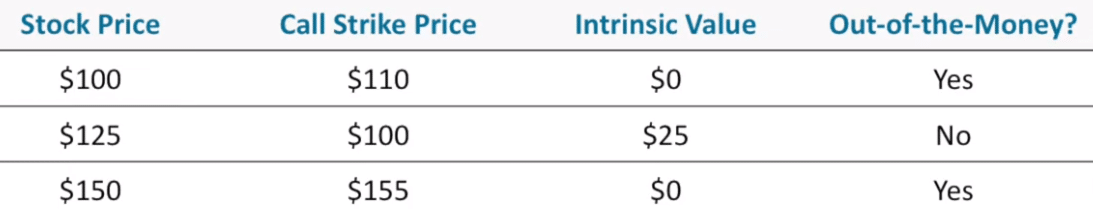

For call options, intrinsic value exists when the strike price of the option is trading below the current stock/security price. The amount of intrinsic value in a call option is calculated by subtracting the strike price from the current stock/security price.

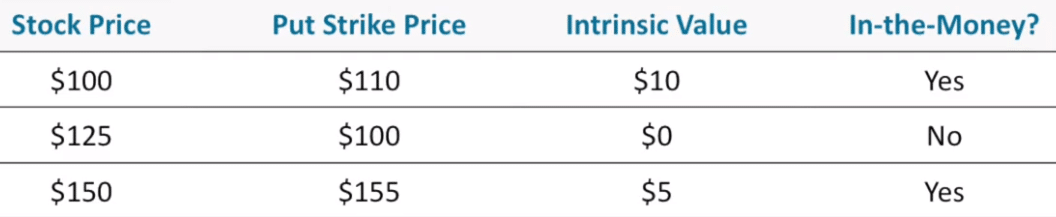

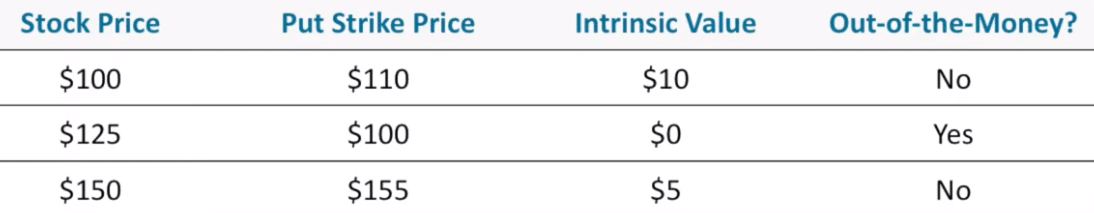

For put options, intrinsic value exists when the strike price of the option is trading above the current stock/security price. The amount of intrinsic value in a put option is calculated by subtracting the underlying stock price from the options strike price.

If the strike price of a call option is trading above the current stock price, no intrinsic value exists. Likewise, if the strike price of a put option is trading below the current stock/security price, no intrinsic value exists.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Extrinsic Value Explained

In options trading, extrinsic value represents the portion of an options price that is not intrinsic value. It is everything that is “left over”. Both implied volatility and time affect the extrinsic value of an option.

If the strike price of a call option is above the stock price, it will have no intrinsic value. Since the value of an option must be entirely intrinsic and/or extrinsic value, we can deduce the price of these options must consist entirely of extrinsic value.

If the strike price of a put option is below the current stock price, this option will have no intrinsic value. Therefore (like call options), its entire premium must consist entirely of extrinsic value.

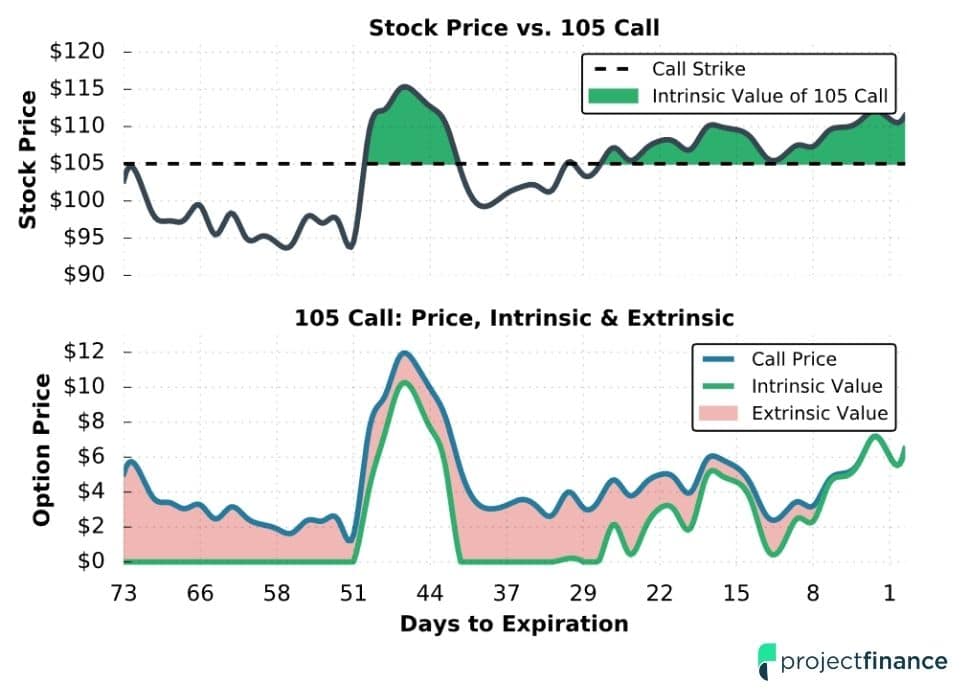

Determining how much intrinsic and/or extrinsic value exists in an option depends on where the stock is trading. These proportions can be in constant flux with the market, as illustrated in the 105 strike price call option graph below.

Extrinsic and Intrinsic Value Changing

Before we move on, let’s break down intrinsic and extrinsic value in an Apple call example.

AAPL Call Option Example

Stock Price: $150

Call Strike Price: 149

Call Option Price: $3

Extrinsic Value: $2

Intrinsic Value: $1

So now that you understand how these values work, understanding moneyness will be a cinch!

In-The-Money (ITM) Options Explained

If the strike price of a call option is below the stock price, the call option will be in-the-money. The depth of an options moneyness will determine its intrinsic value.

Call Options Chain: In-The-Money?

If the strike price of a put option is above the current stock price, that put option will be in-the-money. Like that of call options, the amount a put option is in-the-money by will determine its intrinsic value.

Put Options Chain: In-The-Money?

At-The-Money (ATM) Options Explained

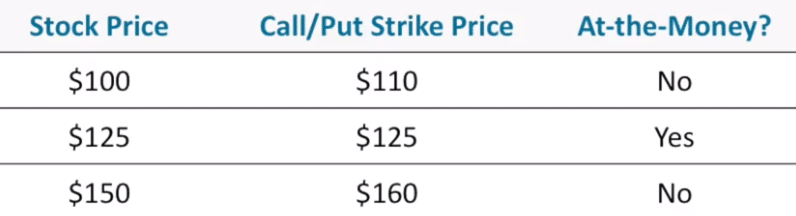

At-the-money options have a strike price that is trading at or very near the current stock price. Though technically just about all options will be in or out-of-the-money, this term is used as a generalization. If an option is a few cents in the money, though technically “in-the-money”, most traders will refer to the option as at-the-money.

Put & Call Options Chain: At-The-Money?

Out-Of-The-Money (OTM) Options Explained

Out-of-the-money options are composed completely of extrinsic value; they have zero intrinsic value.

A call option is “out-of-the-money” when the strike price is above the current stock price.

Call Options Chain: Out-Of-The-Money?

A put option is “out-of-the-money” when the strike price is below the current stock price.

Put Options Chain: Out-Of-The-Money?

Final Word

Understanding an options moneyness is simple. After determining the type of option (call or put), simply locate where the strike price of that option is in relation to the stock price. That’s it!

Not considering volatility and time, if an option has value on its own, it will be in-the-money. If an option has none of this “intrinsic” value, it will be out-of-the-money.

Next Lesson

projectfinance Options Tutorials

Mike Martin

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.