Last updated on March 30th, 2022 , 02:50 pm

Option Traders Glossary: Definitions and Terms

Moneyness, time decay, assignment…what does it all mean? projectfinance created a glossary of elementary option trading terms so you’ll always have them close at hand. If you want to learn all the basics of options trading, be sure to check out our video below. Enjoy!

Table of Contents

Options Trading for Beginners

Call Option

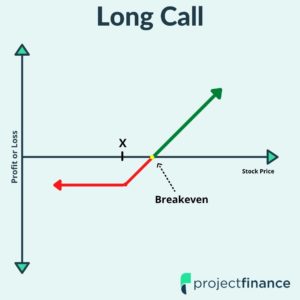

In options trading, a call option (call) is a financial contract between a buyer and seller that gives the owner the right to buy the underlying security (generally stock) at a certain strike price within a specific time frame.

The buyer of a call will profit when the underlying market increases in value. Since there is no cap on the price of most assets, the seller of a single call option has infinite risk.

Put Option

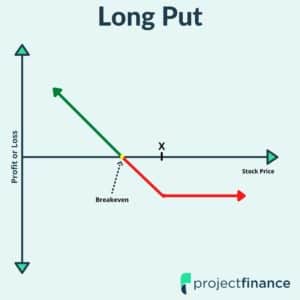

Put options are the opposite of call options. Whereas a call option is a financial contract that gives the holder the right to buy a security at a particular strike price on or before the expiration date, a put option gives the holder the right to sell the security (generally stock) under the same circumstances.

Put options increase in value when the underlying market decreases. An investment in a long put option thus acts as an insurance product if held with long stock.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Option Premium

Like stock, an option’s premium represents its current market value. However, unlike stock, options are quoted on a per-share basis. Since one options contract represents the right to purchase 100 shares of the underlying stock/index, the true cost of a call option or a put option trading at $1 would be $100. Factors such as strike price, intrinsic value, time value, and volatility all go into determining the price of options premiums.

Strike Price (Exercise Price)

In options markets, a strike price is a set price at which a put or call can be exercised. This exercise results in one party buying and the other party selling stock or other financial instruments at this pre-established price. The difference between this strike price and the current market value of the stock price tells us whether or not an option is in the money, out of the money, or at the money.

Expiration Date

Unlike stock, all options will eventually expire. The date this happens is called the expiration date. After this date, all option contracts for this time period are settled. The underlying price of the stock determines whether or not the option contract is in the money. If an option’s strike price is in the money at expiration, it will be exercised and assigned. If an options strike price is out of the money at expiration, it will expire worthless.

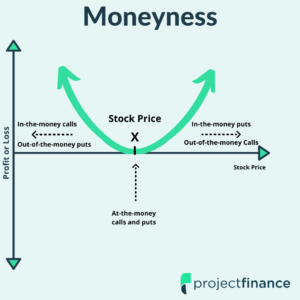

Moneyness

In options trading, the term “moneyness” is used to determine the intrinsic value of an option at any given time. An option can either be in the money, out of the money, or at the money. The relationship between the underlying stock price and the option strike price dictates where the option currently is on the money scale.

Out-the-money-Options

- A call is out of the money if its strike price is above the current market price of the stock

- A put is out of the money if its strike price is below the current market of the stock.

In-the-money-Options

- A call is in the money if its strike price is below the current market price of the stock

- A put is in the money if its strike price is above the current market of the stock.

At-the-money-options

- Both call and put options are considered at the money if the strike price equals the current market value of the stock.

Option Assignment/Exercisement

Option assignment and option exercisement go hand in hand; one can not happen without the other. The owner of a call or put has the right (but not obligation) to exercise their option contract at any time. When this occurs, the short party is obligated to either buy or sell 100 shares of stock at the strike price of the option contract.

- For a long call position, the contract is exercised and converted into 100 shares of long stock.

- In a short call position, the contract is assigned and converted into 100 shares of short stock.

- For a long put position, the contract is exercised and converted into 100 short shares of stock.

- In a short put position, the contract is assigned and converted into 100 long shares of stock.

There are many circumstances where it makes sense for the owner of an in-the-money option to exercise their right to buy the stock, such as the issuance of a dividend by the stock (options don’t pay dividends). Options can also be exercised arbitrarily. All in the money options at expiration, however, will be automatically exercised. It is important that all short option positions in the money are liquidated by this date unless the investor wishes to either sell or buy the stock.

Option Settlement

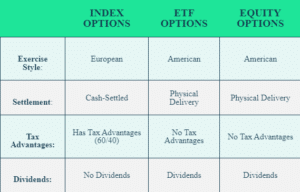

Options contracts are settled in either one of two ways: physical settlement or cash settlement.

1. Physical Settlement

The vast majority of trading equity options are settled via physical delivery. This means that upon the exercise/assignment of the put or call contract, a transference of stock occurs at the strike price, typically 100 shares of the underlying stock per option.

2. Cash Settlement

In options markets that are cash-settled, physical delivery of the underlying asset is not required. A simple and automatic transfer of cash settles these types of options. Cash-settled options typically include European-styled indexes such as NDX and SPX, as well as most binary options.

Credit and Debit Spreads (Verticals)

In options trading, credit and debit spreads (vertical spreads) are strategies that involve buying one option and selling a second option. Both options are in the same class (calls or puts) and expiration but differ in terms of strike prices.

- A credit spread results when a net credit is received from the buying and selling of these options. The investor will profit when the spread narrows by an amount less than the premium they received.

- A debit spread results when a net debit is paid from the buying and selling of these options. The investor will profit when the spread widens by an amount greater than the debit paid.

As opposed to simply buying or selling single call and put options, utilizing credit and debit spreads lowers the overall risk from market movements, as well as reward.

Equity Option

Equity option markets represent the vast majority of tradable options. The underlying asset in these types of options is shares of the underlying stock. If /when the owner of a long call or put equity option exercises their contract, they will either buy (call) or sell (put) 100 shares of the underlying asset (generally the stock of a specific company) at the strike price specified in the contract. Equity options are settled via physical delivery.

Index Option:

Unlike equity options, you can not purchase the underlying shares of index options as they are not actively traded in the market. Representative indices, such as SPX (S&P 500), dictate the value of these types of contracts. Calls and puts on index options give an investor the right to buy or sell the entire underlying stock index for a defined time period at the specified strike price. Since there is no actively traded stock on indexes, the options are cash-settled. This mitigates assignment risk for the seller.

To better understand the difference between index and equity (ETF) options, read our article, “SPX vs SPY Options: Here’s How They Differ“. If you want to trade volatility, our VIX vs VXX Guide may be more fitting.

ETF Options

ETF (exchange-traded fund) options are financial securities that possess characteristics of both index and equity options. Like equity options, they are settled in stock (American style); like index options, they represent an underlying composite or basket of stocks. ETF options often allow market participants greater liquidity and diversification than single stocks.

Comparing Option Types

Ex-Dividend date

The ex-dividend date is the day at which the stock of a company begins trading without the value of the issued dividend. To receive this dividend, an investor must own the stock by the market close on the day before it goes ex-dividend.

To capture this dividend, owners of in-the-money call options will most likely exercise their contract. The writers of these calls will therefore be assigned and forced to sell shares at the specified strike price. It is important for call writers to be aware of this date so they are able to trade out of their position to avoid assignment. The seller risks losing large sums of money if they are not aware of this date.

Pin Risk

Pin risk in options trading occurs when the price of the underlying security nears that of the option strike price on the contract’s expiration date. If the contract closes in the money after it expires, investors are unable to trade out of the option. At this point, the long option will be exercised and the short option will be assigned stock. It is therefore wise for investors to close any call or put positions close to being in the money while the market is still open unless they want to hold the shares.

Intrinsic and Extrinsic Value

The value of all option contracts can be calculated by summing up their extrinsic and intrinsic value. Intrinsic value represents what the option would be worth if there was no time remaining. At the moment of expiration, the price of a put or call option must therefore represent all intrinsic value.

Extrinsic value represents all of the remaining premium, which is determined by time remaining and volatility. A call or put option expiring in three months would therefore have a higher extrinsic value than an option of the same series expiring next month.

Since all option prices are derived from one or both of these values, knowing one value along with the current options market price will tell us the other. For example, if a call option is trading at $3 and has an intrinsic value of $2, the difference must represent an extrinsic value of $1.

Time Value

An option’s extrinsic value is determined by both its time value (theta) and volatility. The time value portion of this equation refers to the amount of time remaining until the expiration of the call or put option.

Historical Volatility

In options trading, historical volatility is a metric that uses the past performance of an underlying stock to calculate the price premiums of call and put options.

Implied Volatility

Implied volatility is a directionless and forward-looking pricing metric used in options trading. This kind of volatility accounts for the impact of future uncertainties, such as earnings, on the price of a call or put. Supply and demand are major components for determining implied volatility.

LEAPS

Long-term Equity Anticipation Securities (LEAPS) are extended options that track the price of underlying stocks or indices. Options with expiration dates greater than one year out fall into this category. LEAPS trade just like all other options of their class, with the exception of this prolonged expiration date. Investors sometimes use LEAP put options as a long-term insurance policy against their stock.

Margin Requirement

Compared to stock trading, determining margin requirements for options can be a complex process. The amount of cash/securities required in an account to place certain options trades will depend upon the broker you use.

This generally concerns the seller of options, where the risk can far surpass the amount of credit received (unlike long option buyers, whose risk is the debit paid). A long call option bought in the market for $3 has an infinite reward, yet a limited risk of $3, which is the premium paid.

The seller of this option will have the opposite: a limited reward of their $3 credit received and unlimited risk to the upside. Determining the amount necessary to hold this short position is the position’s margin requirement. These calculations will vary from broker to broker.

Option Roll

An options roll is a strategy that involves making an adjustment in a position’s strike and/or expiration date. Rolling options can help realign calls and puts to be better positioned relative to the underlying security. There are many reasons why options are rolled, two of which are to avoid early assignment and/or extend the duration of a trade so a loss is not realized.

Time Decay

Time decay (also called “theta”) measures the rate at which an option loses its value in response to the passage of time. Unlike stock, all put and call options have an expiration date. As that date nears, the price premium on an option contract decreases in value. After an option expires, there is zero time premium remaining. “Theta” is one of the option “Greeks“.

Next Lesson

projectfinance Options Tutorials

Additional Resources

Mike Martin

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.