Last updated on March 22nd, 2022 , 11:44 am

Covered Calls Explained

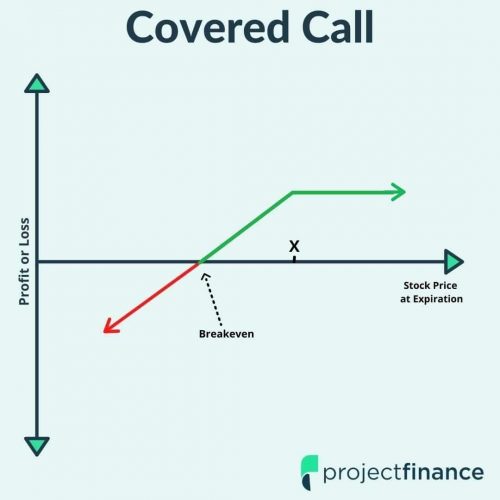

The above graph represents the profit/loss of a covered call position at expiration, where X is the strike price.

Best For:

Neutral To Slightly Bullish Investors

Risk:

Defined Risk, Low Risk (the risk is on the stock side)

Highlights

- 100 shares of long stock married to one short call comprise a covered call.

- Covered calls reduce both risk and reward.

- Most investors use covered calls to generate income.

- Covered Call Maximum Loss: Total stock value (minus) premium.

- Covered Call Maximum Gain: Short call strike price (minus) purchase price of the underlying stock (plus) premium received.

Covered Call Tutorial

What Is a Covered Call?

The covered call is a perfect strategy for beginner and professional options traders alike. Investors can watch first-hand how options react to elements such as time decay (theta) and implied volatility without the capricious gain/losses that come with many other strategies. Why? Your option position is hedged 100% by the underlying stock. There is, however, significant stock risk here.

The poor man’s covered call is an alternative strategy that requires much less capital and has lower loss potential compared to a traditional covered call.

Before we continue, let’s take a look at the textbook definition and components of a covered call:

Covered Call: A financial market transaction where the seller of a call option owns an equivalent amount of the underlying security.

Components:

- Long Stock (100 shares)

- Short Call (1 call/100 shares

To simplify things, we are going to assume that the underlying security is 100 shares of stock, as this is the amount of stock one option contract almost always represents in this strategy. This stock is only half of the strategy; we must sell a call to complete it.

In order to choose which strike price and expiration date call option we are going to sell against our stock, we must determine the reason we are placing this trade.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Reasons to Trade Covered Calls

Below are two potential reasons why an investor would use this strategy.

Collect Income: If an investor doesn’t believe a stock they own will rise to a certain point by a certain time, they can sell a call option at this strike price and collect the premium received.

Target an Exit Price: If an investor wishes to sell a stock once it reaches a certain level, they can sell a call at this corresponding strike price. Once the stock breaches this level, they will be “called out” of their long shares.

Covered Call = Lower Risk

The covered call strategy is one of the few option strategies that actually reduces an investor’s risk when compared to simply owning the underlying stock outright. The risk for any stock is always that the stock goes to zero.

Let’s say IBM is trading at $120/share. Your risk is, in theory, $120/share.

If an investor decides to sell a $125 strike price call option for $1.50, the premium they receive will offset a small portion of their long stock risk. In this example, their stock risk would be reduced from $120 per share to $118.5/share (stock price minus premium; 120-1.50).

Lower Risk = Lower Reward

However, when risk is reduced, so is the reward. If the stock instead rises above our strike price+premium, we won’t see any profit. Here, the short call acts as ballast on our long stock, tethering all future gains to strike price+premium, 125+1.50 = 126.50. After $126.50, no matter how high the stock goes, as long as we are still short that call, we won’t see a penny of additional profit.

This works well for the investor targeting their exit price, but not so much for the income generator who didn’t want to sell their stock, especially if they are concerned about paying a short-term capital gains tax on stock held under a year.

Let’s next take a look at 2 different outcomes on a covered call on Amazon (AMZN).

Amazon (AMZN) Scenario #1

Let’s say you’re currently long 100 shares of Amazon (AMZN) stock. The stock has been hovering around $3,200/share for the past few months while the rest of the market drifts higher. This is frustrating, yet you still want to own the stock as you believe in the company.

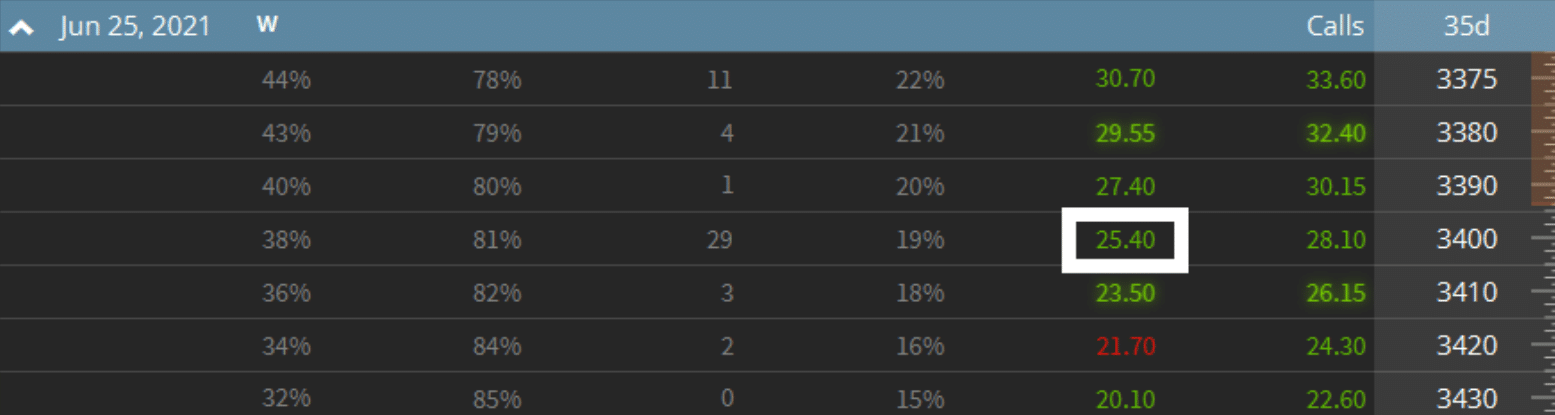

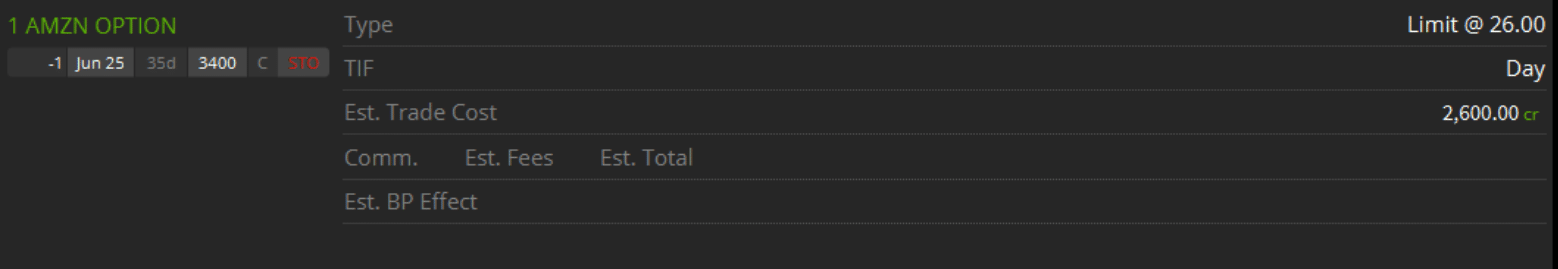

To generate income on this stock, you decide to sell a call against your 100 AMZN shares. You pull up the options chain and determine selling a call option 34 days out would work best for your time horizon, as this is before earnings. You decide to sell one June 25th 3400 Call, which we will do below on the tastyworks trading platform.

You click the bid and then send the order and are filled at $26.

Here is your final position:

- Long 100 shares AMZN

- Short 1 AMZN June 25th 3400 Call @ $26

Let’s fast forward now to the expiration date, where we will say AMZN has just closed at $3,300 per share.

What has happened to our 3400 call position?

Since we sold the 3400 call and the stock is trading under that price, our short call option will expire worthless and we will collect the full premium of $26, or $2,600. Additionally, we have made $100/share of profit on the stock. Not a bad trade!

The Ideal Outcome

This is a great outcome for us, but not the perfect outcome. The perfect outcome would come if the stock closed at our strike price of $3,400. If it would have closed there, we would have received the full credit premium on the call, as well as the maximum benefit from owning the stock.

Amazon (AMZN) Scenario #2

Let’s revisit the above AMZN trade and see what would happen if the stock closed at a drastically different price. As a reminder, our position is the following:

- Long 100 shares AMZN

- Short 1 AMZN June 25th 3400 Call @ $26

So expiration day has come again, but under this scenario, AMZN has blown past our strike price of 3400, all the way to $3,600 per share.

We didn’t lose money on this trade, but we would have done far better if we had no short call at all.

Why? The short call held us back from realizing the full potential of the stock gain. We are tethered to that $3,400 price level. The stock could go to $4,000 per share, but none of that matters to us: for every dollar we make on our long stock after $3,400, we’ll lose a dollar on the short call.

It is because of this that the covered call strategy is ideal for neutral to slightly bullish investors

Covered Call Profit/Loss

Now that we understand the mechanics of covered calls, figuring out the maximum loss, gain and breakeven should come easily.

Covered Call P/L

Maximum Loss: Total stock value (minus) premium. Downside risk on covered calls comes from the risk on the stock. In theory, a stock can go to zero. Selling out-of-the-money calls against long stock only mildly mitigates risk.

Maximum Gain: Short call strike price (minus) purchase price of the underlying stock (plus) premium received. The maximum profit potential of a covered call occurs if the stock price is at or above the call’s strike price at expiration.

Breakeven: Stock Price Paid (minus) premium received.

Lastly, let’s take a look at the three different ways a covered call position can be closed.

Closing a Covered Call

- If the short call is out of the money at expiration, it will expire worthless and no action is required. You will receive the full premium.

- Buy-back or roll the short call in the marketplace before the expiration.

- If you do not buy back an in-the-money short call by expiration, you will be assigned on your call and forced to sell 100 shares of stock, thus liquidating your long stock position in the underlying.

Final Word

For investors looking to generate income in a stagnating market, there are few better options than the covered call. Additionally, its low risk level makes it appropriate for traders of all levels.

If you’re reluctant when placing your first covered call trade, feel free to call the folks at tastyworks as they will love walking you through the steps, as well as explaining any risk involved.

Related Articles

projectfinance Options Tutorials

Additional Resources

Mike Martin

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.