Last updated on March 24th, 2022 , 11:46 am

5 Option Strategies for a Sideways Market

One of the greatest advantages of options is the great versatility that they offer. With stock trading, you are betting on a binary outcome; the stock is either going to go up or down. Options trading, on the other hand, is custom-tailored.

Analysts can’t make up their mind about where the market is headed in 2022 . Often times, this results in a stagnating market.

If a stock is trading at $100 a share, you can utilize an option strategy to capitalize on pretty much any future price of that stock, for whatever date you desire. Think that $100 stock is going to soar past $105 post-earnings? You can buy a 105 call. What about if you’re not sure what the earnings will be, but you want to capitalize on a large up or down movement? Here, a long straddle (long call & long put) would make sense.

But what if you think a particular stock or index isn’t going to go anywhere at all? All traders will eventually find themselves in the doldrums of a market. Sometimes this stagnation period lasts for weeks, other times it can last for years.

Take a look at the below 10-year chart of SPX (S&P 500) on the tastyworks trading platform:

Market Neutral Advantage

If you were long or short during this period, you probably didn’t make or lose a lot of money. If you were market neutral (sometimes called “delta neutral”) on the other hand, your profitability would have clipped past those directional schooners at an impressive rate.

So let’s assume we are in a directionless market and you want to capitalize on this trend. Where do you begin? For beginner options traders, sometimes the most difficult decision to make is determining what option strategy to use. There are dozens of different template option strategies, and these don’t even count the innumerable “custom” strategies you can create on your own.

All of our below option trading strategies profit by something called “time decay (theta)”, or theta. Theta is one of the option Greeks. Over time, assuming all other variables stay the same (stock price, volatility) the premium of options goes down in value. This “theta”, as it is known, allows for all market-neutral strategies to profit. We are (for the most part) selling options, or, have “net credit” positions.

Now let’s jump right into it. Here are projectfinance’s top 5 strategies for a sideways market.

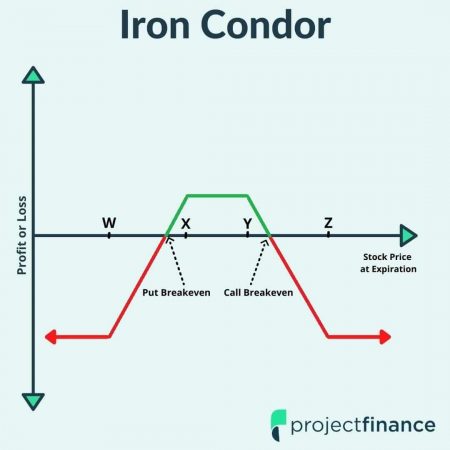

1. Short Iron Condor

Direction: Very neutral

Risk: Defined risk, low risk

Position

- Short call spread YZ

- Short put spread WX

Max Profit

Total credit received from both call spread YZ and put spread WX

Max Loss

Strike price width (same width for calls and puts) minus the total credit received

Breakeven

Downside: Short put strike X (minus) total premium received

Upside: Short call strike Y (plus) total premium received

The short iron condor is a great strategy for beginner options traders. It is a complex strategy, yet at the same time very intuitive and easy to understand.

Before placing your first iron condor trade, it is important to have a working understanding of how vertical credit spreads work. After you’ve mastered these concepts, the iron condor should be a cinch. Let’s get right into it.

An iron condor is simply the marriage of a call and put vertical spread on the same stock, of the same expiration, and of the same width. Since we are market neutral, both the call and the put spread we sell must be out of the money. To gain a better understanding of how this works, take a few moments to examine the chart under the heading of this section.

Long legs limit loss

The W and X points represent the strike prices of the two puts you sold, while the Y and Z points represent the two call strike prices. We can see the position makes the most money when the stock stays between X and Y, these being our short strikes.

The iron condor is one of the purest market-neutral plays for the risk-averse investor. Notice how the two red arrows at the bottom of the chart level off? That is our long call (on the right) and long put (on the left) coming in to save the day should the underlying skyrocket or plummet in value.

Though these two positions act as a great hedge for our short, the long call and put component of the iron condor also limit us from additional gain. What would happen if we didn’t buy them? Let’s take a look next at the short straddle and strangle strategies, which have very similar risk profiles.

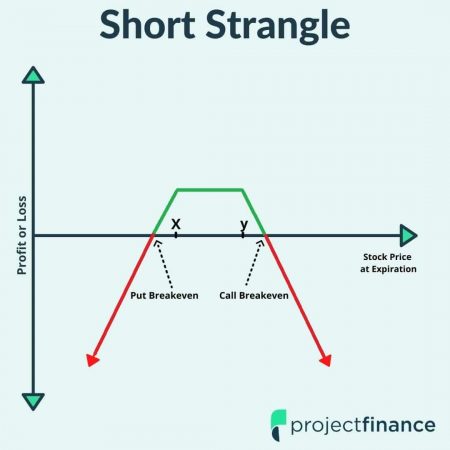

2. Short Strangle

Direction: Very neutral

Risk: Undefined risk, HIGH risk

Position

- Short call option Y

- Short put option X

Max Profit

Total credit received from both call and put option

Max Loss

Unlimited (in theory, the stock could go to infinity, thus our short call loss potential is infinite)

Breakeven

Downside: Short put strike X (minus) total premium received

Upside: Short call strike Y (plus) total premium received

The short strangle involves selling both a call (Y) and put option (X) on the same underlying stock/index of the same expiration. For a market-neutral position, both the call and the put will be out of the money.

The aim of the short strangle is that by expiration, the stock will be trading between the two strike prices sold.

You may notice a strong resemblance between the short strangle chart above and the previous iron condor chart. They are very similar indeed, with one incredibly important difference: your long call and long put aren’t there to save you this time should the stock/index burst outside your strikes.

This is a very risky strategy. I enjoy a good night’s sleep, so, therefore, have never had the courage to place a short strangle trade. Not only do you have unlimited risk on the upside, but the stock could also in theory go to zero, giving you an incredible downside loss potential as well.

There is only one strategy that is more market neutral than the short strangle, and that is the short straddle. With this option strategy (when sold at the money), you are betting that the stock/index isn’t going to move one bit. Let’s take a look at the straddle next.

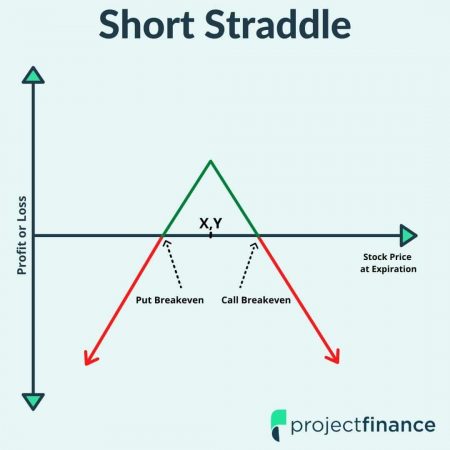

3. Short Straddle

Direction: Incredibly neutral

Risk: Undefined risk, as risky as it gets

Position

- Short call option Y

- Short put option X

Max Profit

Total credit received from both call and put option

Max Loss

Unlimited (in theory, the stock could go to infinity, thus our short call loss potential is infinite)

Breakeven

Downside: Short put strike X (minus) total premium received

Upside: Short call strike Y (plus) total premium received

The short straddle is an option strategy used by traders who hope to pin the future value of a stock/index to one particular strike at a particular expiration. Like the strangle, the straddle involves selling a call and a put on the same underlying and of the same expiration. Unlike the strangle, the straddle strike prices aren’t different but are exactly the same (XY).

If the short strangle had a great similarity to the iron condor, then the straddle has an uncanny resemblance to the straddle (listed above). Take a moment to study the chart above with your strike prices XY.

More Gambling than Investing

I like to compare the short straddle to a roulette wheel. You pick a number (the strike price of both your call and put) and if the ball lands on that number when the ball stops spinning (expiration), it’s winner winner chicken dinner. The ball doesn’t necessarily have to land on your strike price by expiration to realize a profit, as long as the premium received covers the width, you’ll profit.

For example, let’s say AAPL is trading at $125/share. You think that in one month from today, AAPL is going to be trading right where it is today. You sell a call and a put of the same strike price for this expiration (a straddle) and collect a total premium of $5. That $5 premium gives us a bit of room; our breakeven is now $5 to the upside and downside, or between $120 and $130 a share.

But when the stock breaks outside those levels, watch out. Just like in the strangle, the short call gives us unlimited loss potential here, and the short put risk is substantial as well (all stocks can go to zero).

It is because of this immense possible loss that short strangles are reserved only for the very experienced trader. Let’s next take a look at a far less risky option.

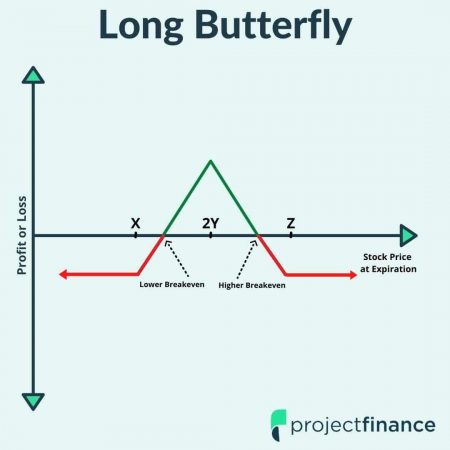

4. Long butterfly

Direction: Very neutral

Risk: Defined risk, low risk

Position

- Long one in-the-money call X

- Short two at-the-money calls 2Y

- Long one out-of-the-money call Z

Max Profit

Middle strike price Y (minus) lowest strike price X (minus) trade premium

Max Loss

Premium paid

Breakeven

Downside: Lowest strike X (plus) position premium

Upside: Highest strike Z price (minus) position premium

The long butterfly options strategy in the example above consists of both a long call vertical spread and a short call vertical spread of the same expiration and of equal width. The short options on these spreads must converge at strike price Y. The aim of this strategy is to profit from a neutral stock price that hovers near this short (center) strike.

Butterflies are like straddles in that in order to achieve maximum profit, the stock must expire at a very specific price (Y). Butterflies are unlike straddles in that they have defined risk. You will never lose more than the debit paid.

The long butterfly strategy will consist of either all calls or all puts. This example focuses on long calls, but the risk-reward profile will be identical for long puts.

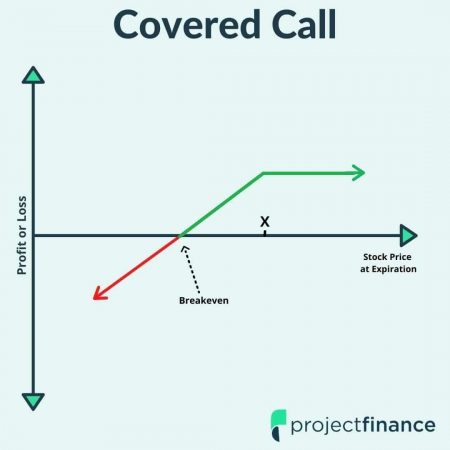

5. Covered Call

Direction: Neutral to slightly bullish

Risk: Defined risk, low risk (the risk is on the stock side)

Position

- Long 100 shares of stock

- Short one call option (X)

Max Profit

Short call strike X (minus) stock purchase price (plus) premium received.

Max Loss

Purchase price of stock (minus) credit received from selling call X

Breakeven

Stock purchase price (minus) call premium

The last pic on our market-neutral list is the covered call. This options strategy is a financial transaction that involves the combined position of 1.) long 100 shares of stock, and 2.) one short call.

Writing a covered call is a great way for investors to make a little extra income on their stock in a sideways market. While the other strategies on this list are speculative in nature, the covered call is a risk-averse position because it actually reduces losses on the long stock owned.

Why? If we didn’t have a short call, we would lose 1:1 for every penny the stock goes down in value. When you add the premium collected from a short call, your stock won’t start losing money until it falls beyond that extra premium we collected.

For example, if a stock is trading at $135, and we sell a $140 call for a premium of $2, the stock can fall all the way to $133 before we see a loss.

This is why the covered call is a great strategy to make extra money off your stock in a neutral market. However, if the market begins to rally past that short call we sold, our upside potential will be pinned to the strike price of that call (plus) premium sold.

Conclusion

Market neutral positions can be very profitable when the underlying stock/index stays within our range. That being said, many of these positions require non-stop attention and diligence. If you’re of the “never risk more than you can lose” mindset, the undefined risk strategies on our list will not be for you.

Happy trading.