Last updated on February 11th, 2022 , 10:54 am

The long-awaited first futures-based bitcoin ETF is about to start trading.

ProShares will be the first to market with their BITO ETF.

Just a few days before this announcement, projectfinance coincidentally wrote an article on the risks of futures-based ETFs. Be sure to check that out for a more in-depth understanding of how these types of funds work.

Though many investors will surely buy ProShares BITO ETF on the day it begins trading, the savvy investor will do a little research before jumping the gun.

In this article, projectfinance aims to aid in this research by taking a step back, and examining what, exactly, is inside the ProShares BITO ETF.

Additionally, we will take a look at a few of the pros and cons that come from ProShares’ “futures-based” methodology to track bitcoin.

Highlights

A futures-based ETF poses significantly more risks when compared to traditional equity ETFs

Contango, futures markets halts and incredibly high expense ratios will eat away at the value of bitcoin ETFs, such as BITO.

A bitcoin ETF will introduce some benefits, such as ease of access, broker SIPC protection and potential backwardation

Net-net, investors will probably be better off investing directly in bitcoin rather than the BITO ETF

Introducing BITO: ProShares Bitcoin ETF

Most retail investors are familiar with equity-based ETFs, such as State Street’s S&P 500 ETF, SPY. This ETF invests directly in the stock of the companies which comprise America’s largest 500 companies. The correlation of the SPY ETF is tightly aligned to the S&P 500 index.

The value of ProShares BITO ETF, whoever, is not derived from stocks, nor is it derived from actual bitcoin; it is derived from the value of futures contracts that track bitcoin.

The below is taken from ProShares BITO “Prospectus”.

ProShares’ approach here will almost inevitably result in inefficiency. However, a futures-based ETF on bitcoin will also offer investors a few advantages when compared to investing in the actual coin.

Spoiler Alert: In my humble opinion, when compared to owning bitcoin outright, the risks of a futures-based bitcoin ETF far outweigh the potential rewards.

Let’s start off by exploring why a futures-based bitcoin ETF may be a disaster in waiting.

Cons of a Futures-Based Bitcoin ETF (BITO)

From a tracking risk perspective, a bitcoin ETF formed from futures products certainly poses numerous risks. Let’s look at a few of these risks now.

1. Contango in ProShares BITO

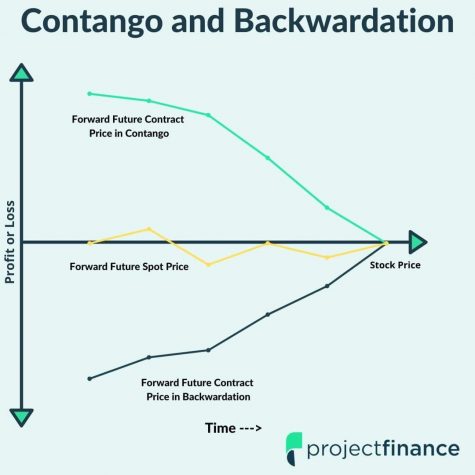

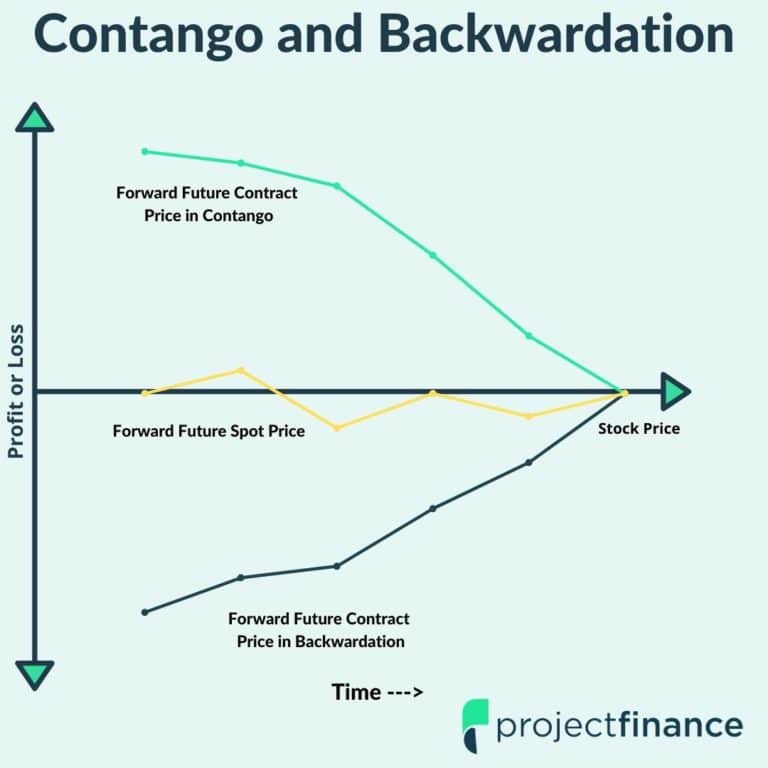

Contango is first here for a reason. In almost all futures-based ETFs (like BITO), the passing of time eats away at the value of the product. Why?

We mentioned earlier that BITO will not invest in actual cryptocurrency, but futures contracts on the Chicago Mercantile Exchange (CME) that track bitcoin.

But futures contracts expire. Therefore, to remain invested in bitcoin, ProShares must “roll” their bitcoin futures from one month to the next.

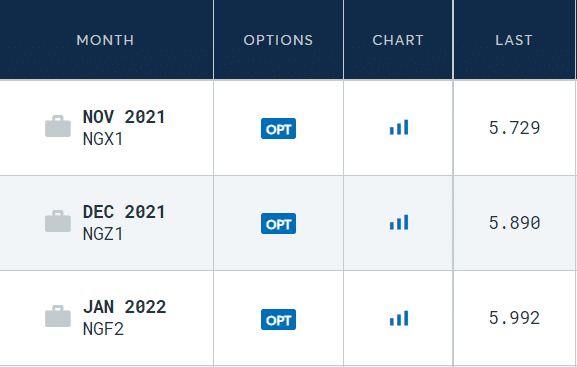

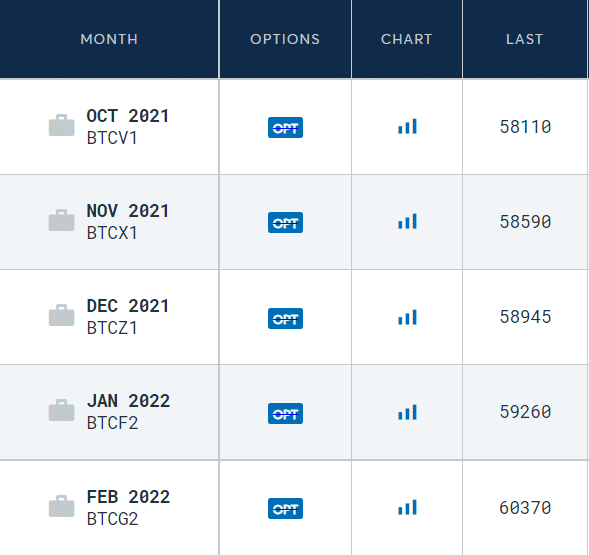

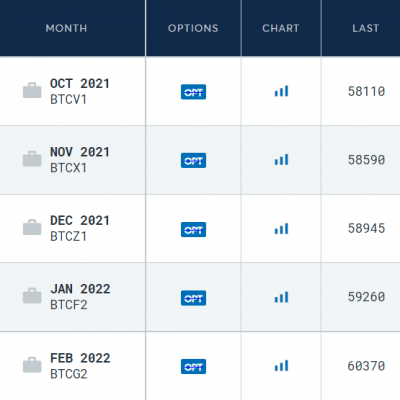

At the time of this roll, we will receive usually fewer proceeds for the closer, or “front-month” contract than we pay for next month’s contract. This doesn’t happen all the time (more on backwardation later), but it happens most of the time. Some months, the discrepancy in pricing can be quite material. You can see this discrepancy in the image below.

The result? Every month, the ETF will shed a little more value. Perhaps barely perceptible at first, added up over 12 months, you will for sure see this decay in action. And after 12 years? You’ll probably wish you had invested directly in the coin.

Bitcoin Futures Quotes

2. BITO ETF and Futures Market Halts

Products that trade on futures markets in the US are at risk of being halted. This happens when a product either increases or decreases in value too much over the course of a trading day.

In May of 2021, the price of bitcoin dropped so much, the Chicago Mercantile Exchange halted trading on bitcoin futures contracts.

At this time, Canada had already approved 2 bitcoin ETFs (issued by Horizon ETFs). Because of this halt, the issuer was at risk of not being able to honor the days buy and sell orders.

Bitcoin ultimately rallied and began trading again shortly after the halt, so we’ll never know how bad this situation could have gotten.

This could very well happen in the BITO ETF. Given bitcoins volatility, it seems more a question of when, not if.

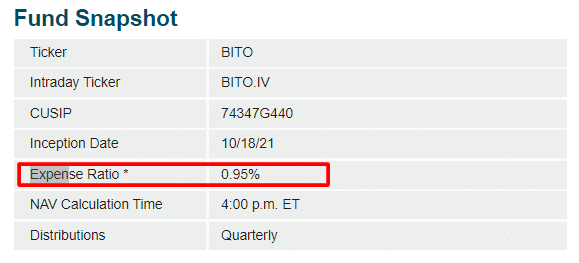

3. BITO’s Insanely High Expense Ratio

Let’s talk for a moment about what few are talking about: the painfully high expense ratio of 0.95% that ProShares BITO ETF is charging.

Source: ProShares.com

I couldn’t believe this expense ratio when I saw it. Perhaps I’m spoiled (most of my ETFs at Vanguard charge less than 0.10%), but, in 2021, I would never pay almost 1% for a company to manage my ETF. This is especially true when considering the fact BITO is almost sure to underperform the underlying.

If bitcoin performs half as well as many forecasters believe it will, that almost 1% over the course of thirty years could very well cost you a shiny new car.

When this expense ratio is coupled with the decaying risk of contango, investors should for sure second guess investing in the BITO ETF.

Pros of a Futures-Based Bitcoin ETF (BITO)

There are indeed a few advantages to a bitcoin ETF. For those that like to make lemonade out of lemons, read on.

1. BITO ETF Offers Better Correlation than Trusts

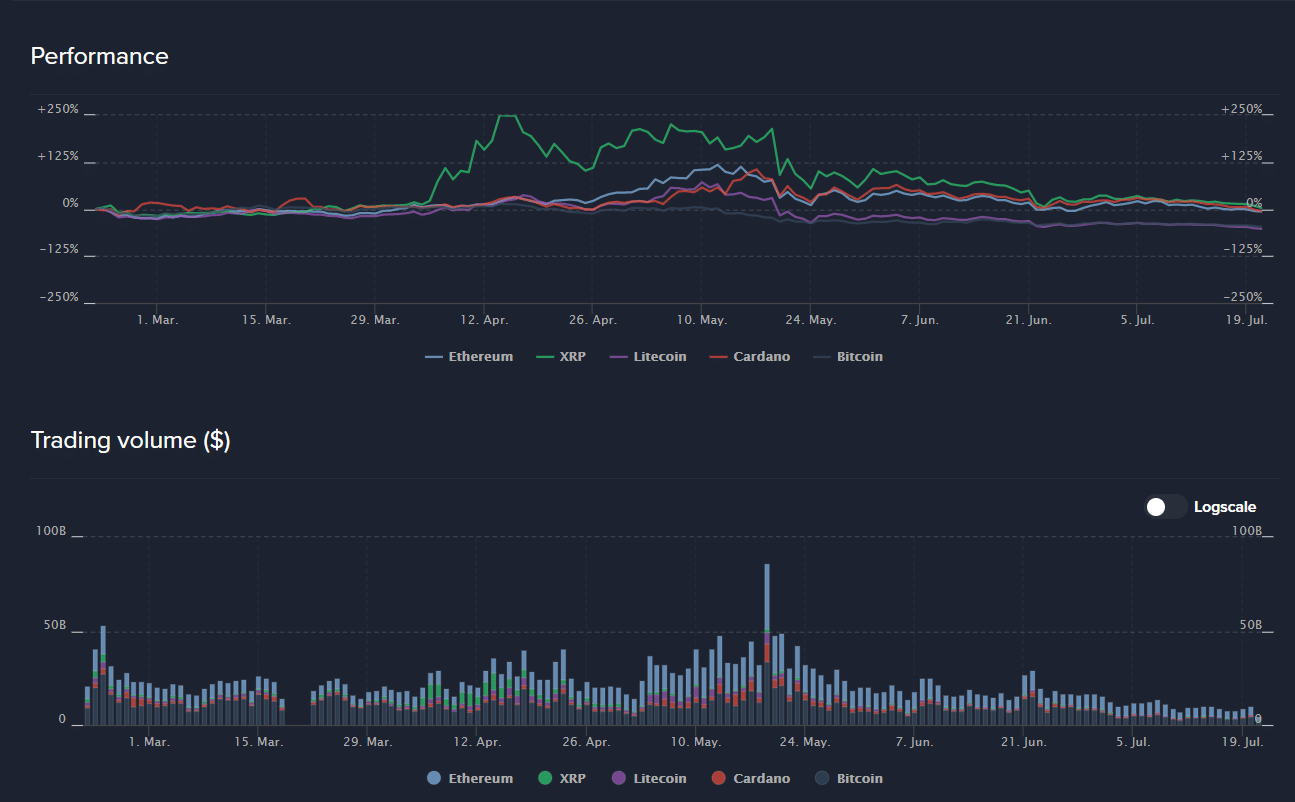

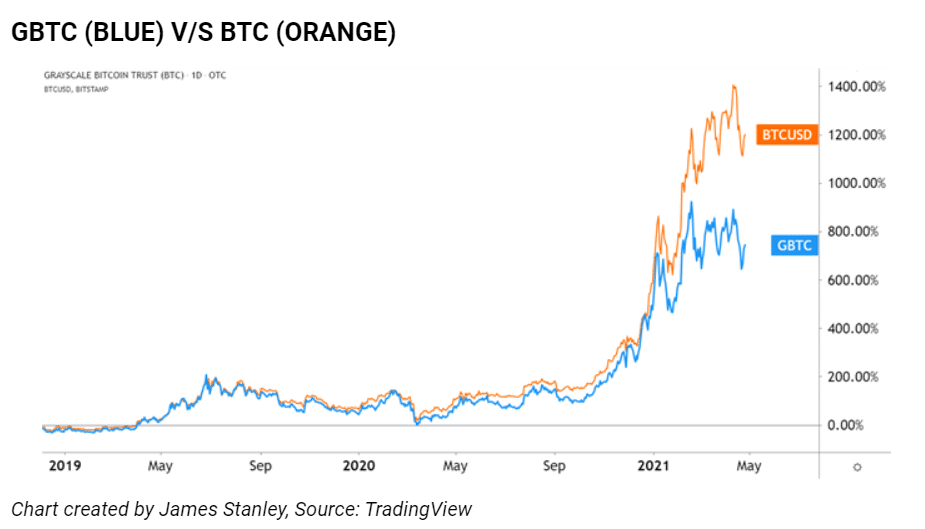

Up until the release of a bitcoin futures ETF, the only exposure retail investors had to cryptocurrency was either through futures contracts or trusts. Futures entail too much risk for the average investor, and the correlation between cryptocurrency trusts and their representative underlying coin has been undulating wildly.

Take a look at the below image from TradingView comparing the price performance of Grayscale’s GBTC Trust to Bitcoin.

When compared to cryprocurrency trusts (such as GBTC and ETHE), a bitcoin ETF should provide a better correlation with the coin itself. The futures ETF approach is formulaic and contingent less upon wavering supply/demand, which caused the above miscorrelation.

2. BITO ETF May Benefit from “Backwardation”

We talked earlier about the risks of BITO and “contango”. A possible benefit of BITO would come with an opposite market dynamic: backwardation. This market anomaly occurs when longer-dated bitcoin futures trade below front-month futures contracts. Just remember, this is a RARE event.

3. BITO ETF Eliminates General Hassle of Owning Bitcoin

Deciding to purchase bitcoin outright can be a lengthy, time-consuming process. If you want to own an actual bitcoin, you must:

1. Choose a crypto exchange

2. Create and set up an account verification method (which may be difficult for older, less technologically savvy investors)

3. Link the account to your bank and deposit funds

4. Trade the actual currency

5. Choose a storage method for the currency (the most time-consuming of all the steps)

6. Track buys/sells for year-end tax reporting

Now compare the above steps to simply queuing a buy order in your trading software for “BITO” and getting a 1099-B in the mail.

4. Buying BITO through a SIPC Recognized Broker Offers Security

Most futures-based ETFs are purchased through brokers. Many investors using brokerage accounts are protected under the Securities Investor Protection Corporation (SIPC). The SIPC provides financial insurance should your broker fail. Though this insurance does not protect the securities in your account, it will help to cushion the blow should your broker have a liquidity crisis.

Why is this important? You may remember a now-defunct crypto exchange out of Japan called Mt. Gox. At its zenith, the exchange handled more than 70% of crypto transactions worldwide. In 2011, hackers broke through the exchange’s security and began siphoning out bitcoins from customer accounts. We’re not talking one or two; the hack resulted in a loss of 850k bitcoins, which represented more than 5% of bitcoin in circulation at the time.

SIPC insurance provides some financial protection to you should your broker fail. The below is taken from the SIPC website:

Mt. Gox did not have SIPC insurance, but chances are, if you purchase BITO through a broker like Tastyworks or Ameritrade, your account is protected (up to the above listed dollar amount).

NOTE: Again, this insurance does not protect the value of BITO; it simply protects against your broker failing.

Of course, there still is a risk here. When Mt. Gox was hacked, bitcoin tanked by 20%. Can you imagine what would happen to the price of bitcoin today if Coinbase was hacked? A futures-based ETF would plummet right along with the underlying product.

Final Word

For investors who don’t want to spend the time or effort investing in bitcoin directly, futures-based bitcoin ETFs such as ProShares’ BITO is probably the next best option.

That being said, if in 20 years bitcoin has skyrocketed from its current level, you will likely regret not taking the time to invest in bitcoin the more traditional way. Additionally, you could also invest in a company that invests in bitcoin, such as Microstrategy.

With BITO, you will pay a premium that is not, in my opinion, worth it.