Last updated on February 11th, 2022 , 09:01 am

TAKEAWAYS

- An iron condor consists of selling both a put spread (long put/short put) and a call spread (long call/short call) simultaneously

- Both of these spreads must be of the same width and expiration

- Iron condor’s profit when the options sold decrease in value

- Short iron condors are best suited for market-neutral traders

- Most iron condors have a greater than 50% chance of success

- Maximum loss is greater than maximum profit for most iron condors

- A high volatility environment allows traders to collect more premium from iron condors sold

- Iron condors with 30-60 days to expiration are ideal as this time frame allows traders to profit from time decay, or the Greek “theta”

Iron Condor Definition

The short iron condor is a market-neutral options trading strategy that involves simultaneously selling both a call spread and a put spread of the same width and expiration cycle.

Iron Condor Inputs

● Short Call Spread AB

- Long Call A

- Short Call B

● Short Put Spread CD

- Long Put C

- Short Put D

Short Iron Condor Profile

Maximum Profit: Net Credit Received

Maximum Loss: Spread Width – Credit Received

Breakeven Prices: 1. Short Put Strike – Net Credit 2. Short Call Strike + Net Credit

Probability of Profit: Greater than 50%

Assignment Risk: Increases with Falling Extrinsic Value

When it comes to the more advanced options trading strategies, the iron condor is by far the most popular.

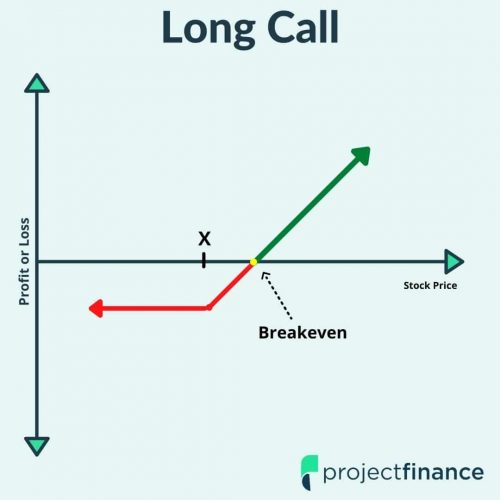

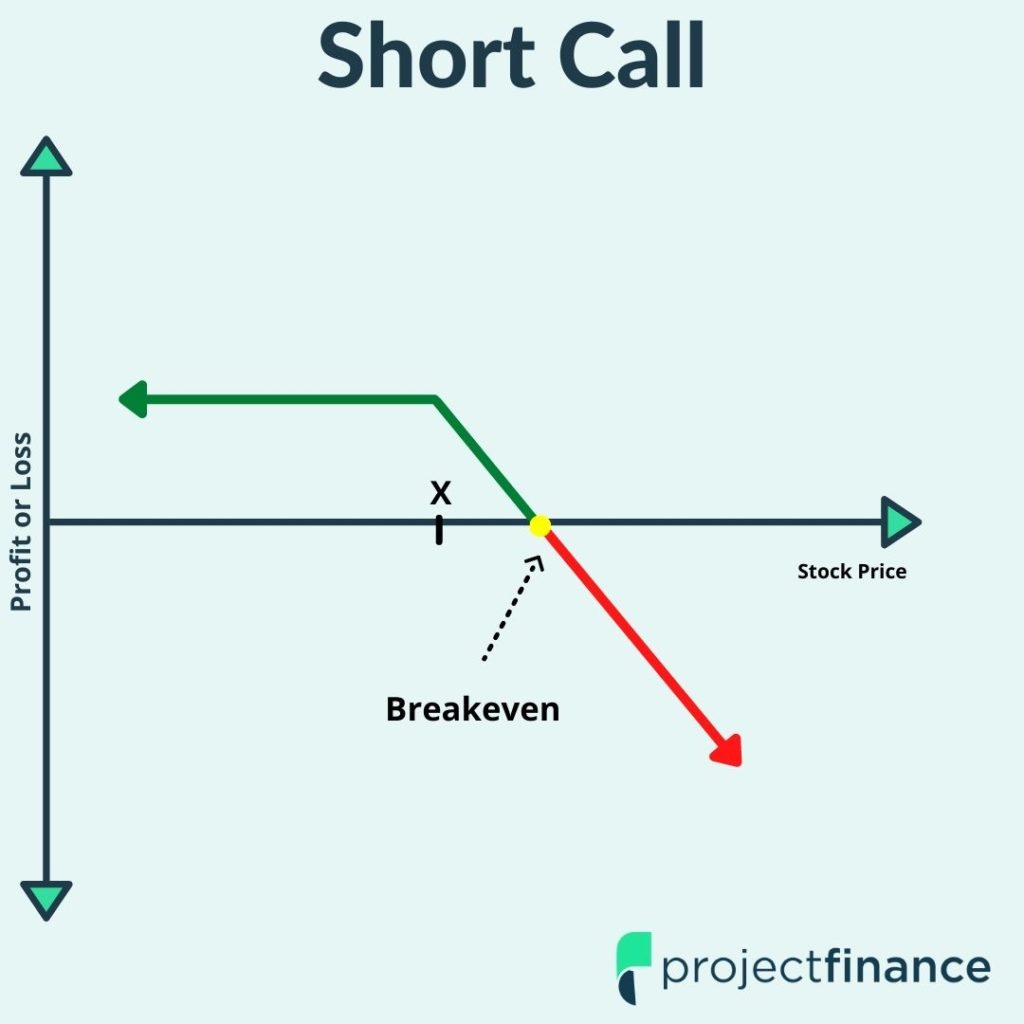

This options trading strategy is aptly named. Why? Because its profit/loss profile resembles the very wide wingspan of the condor bird.

These two “wings” each represent one spread. Since the wings go left and right, this tells us a short call spread and a short put spread are involved. When these vertical spreads are sold together simultaneously, they form the iron condor strategy.

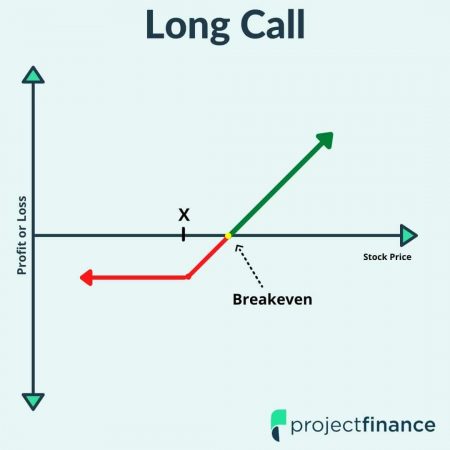

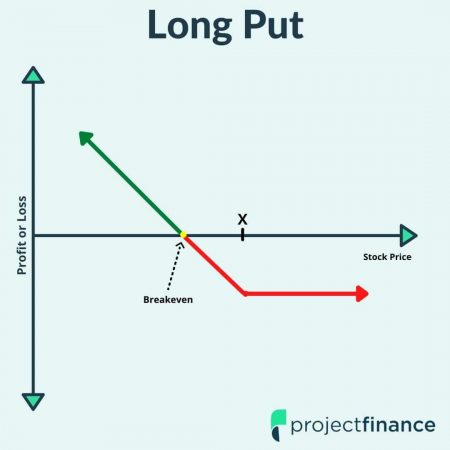

Therefore, in order to best understand this strategy, it will first help to have mastered the “vertical spreads” options trading strategies. If you are new to spread trading, please check out our guide below before moving on.

- The Vertical Spread Options Strategies

What Is an Iron Condor?

In options trading, the short iron condor strategy consists of selling both a call spread and a put spread. In order to be a true iron condor, these two vertical spreads must have the same width (distance between their strike prices) as well as the same expiration.

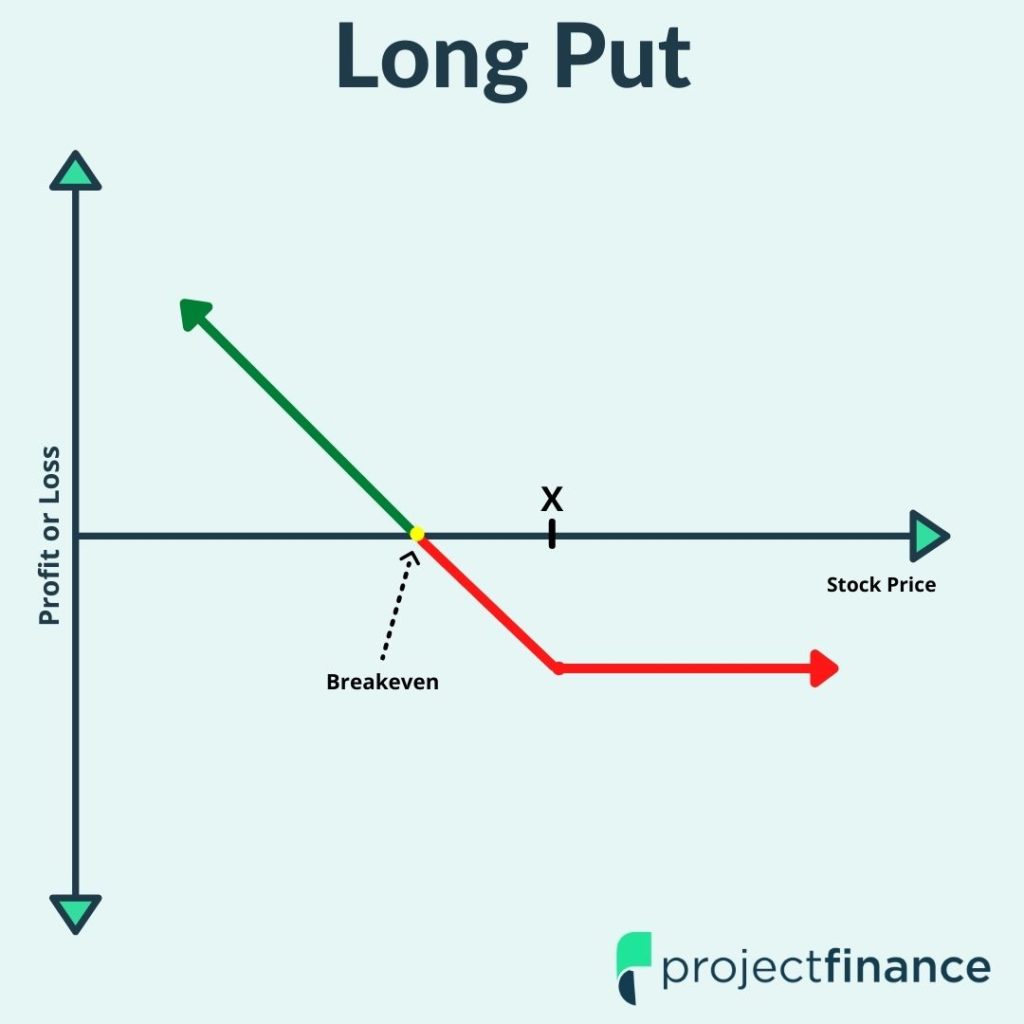

The vast majority of traders prefer to sell iron condors, so this article will be focusing on short iron condors. If you instead want to be a buyer, just switch the lines and red and green profit/loss profiles in our examples around!

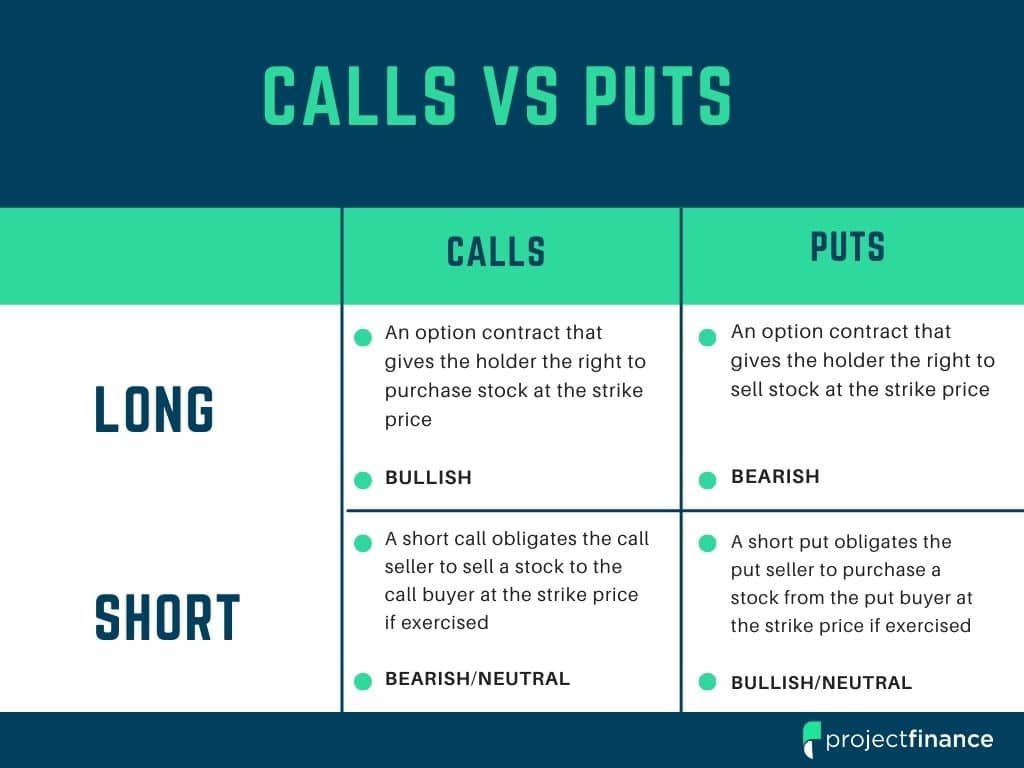

Short Iron Condor Components

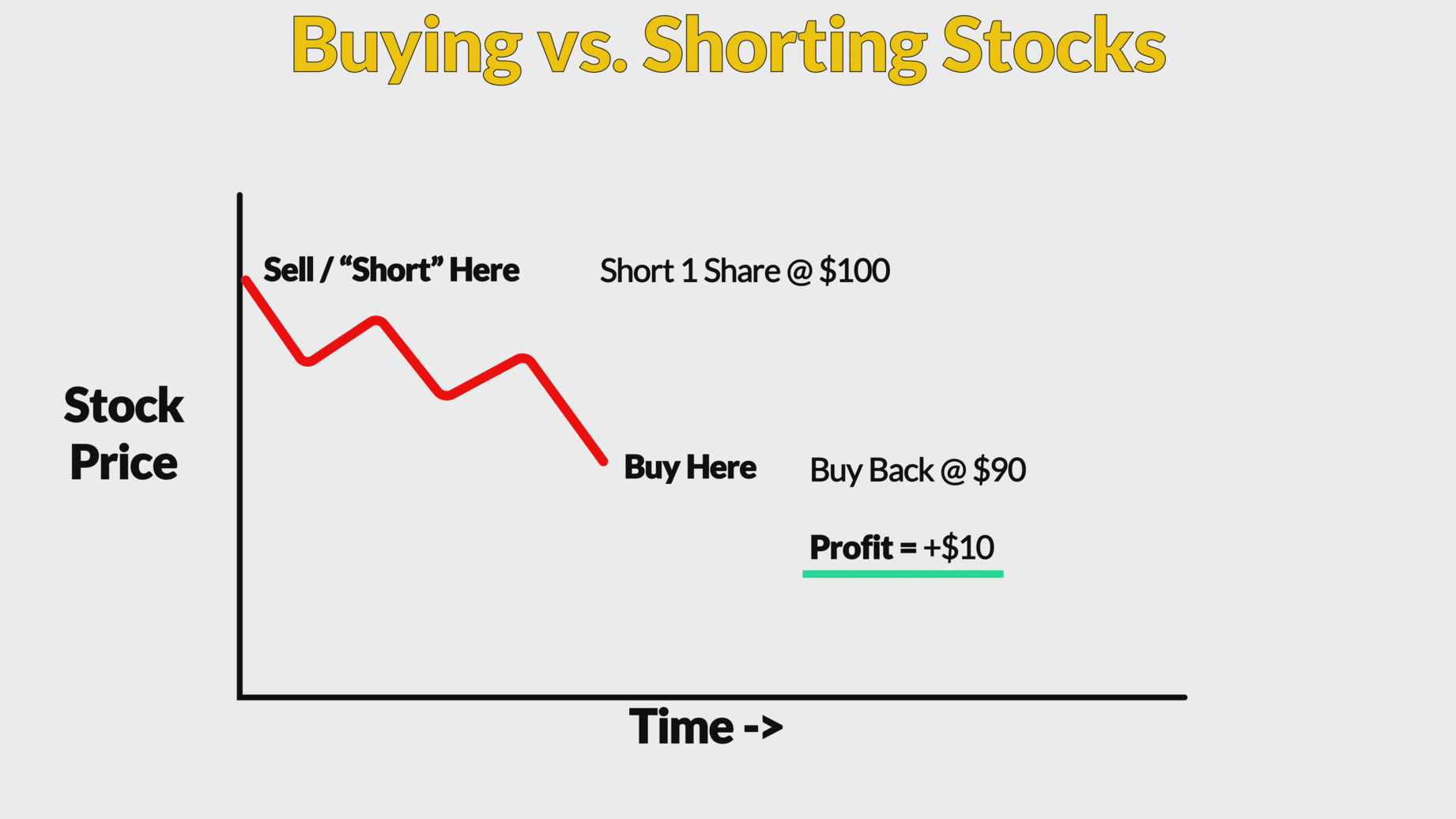

- Sell a call spread (bearish)

- Sell a put Spread (bullish)

So an iron condor is selling bearish and bullish market direction. We don’t want the underlying to go up or down. Another name for this aimless direction is “market neutral”. Sellers of iron condors profit when the underlying price does not move.

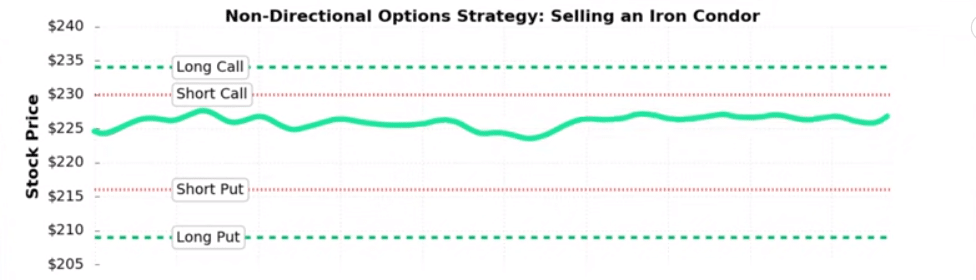

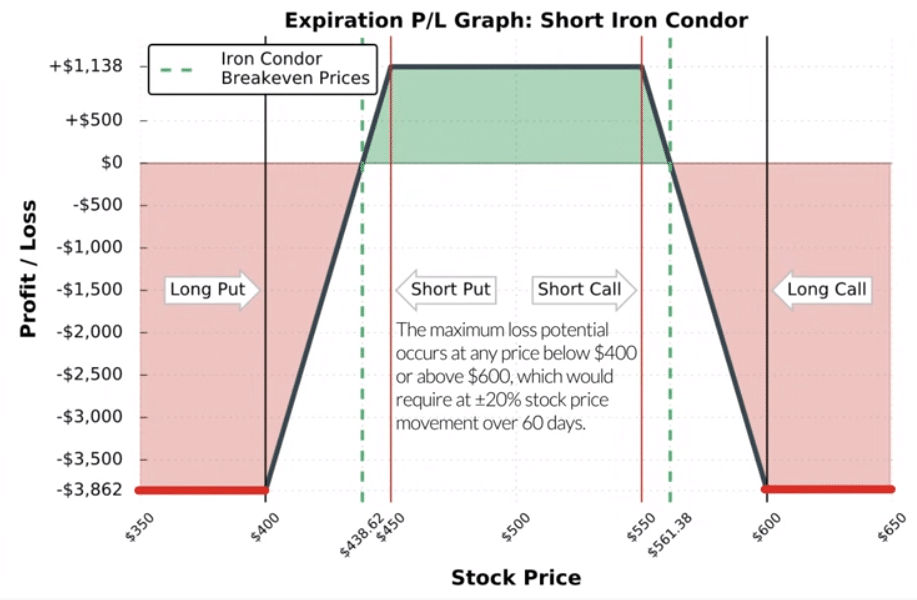

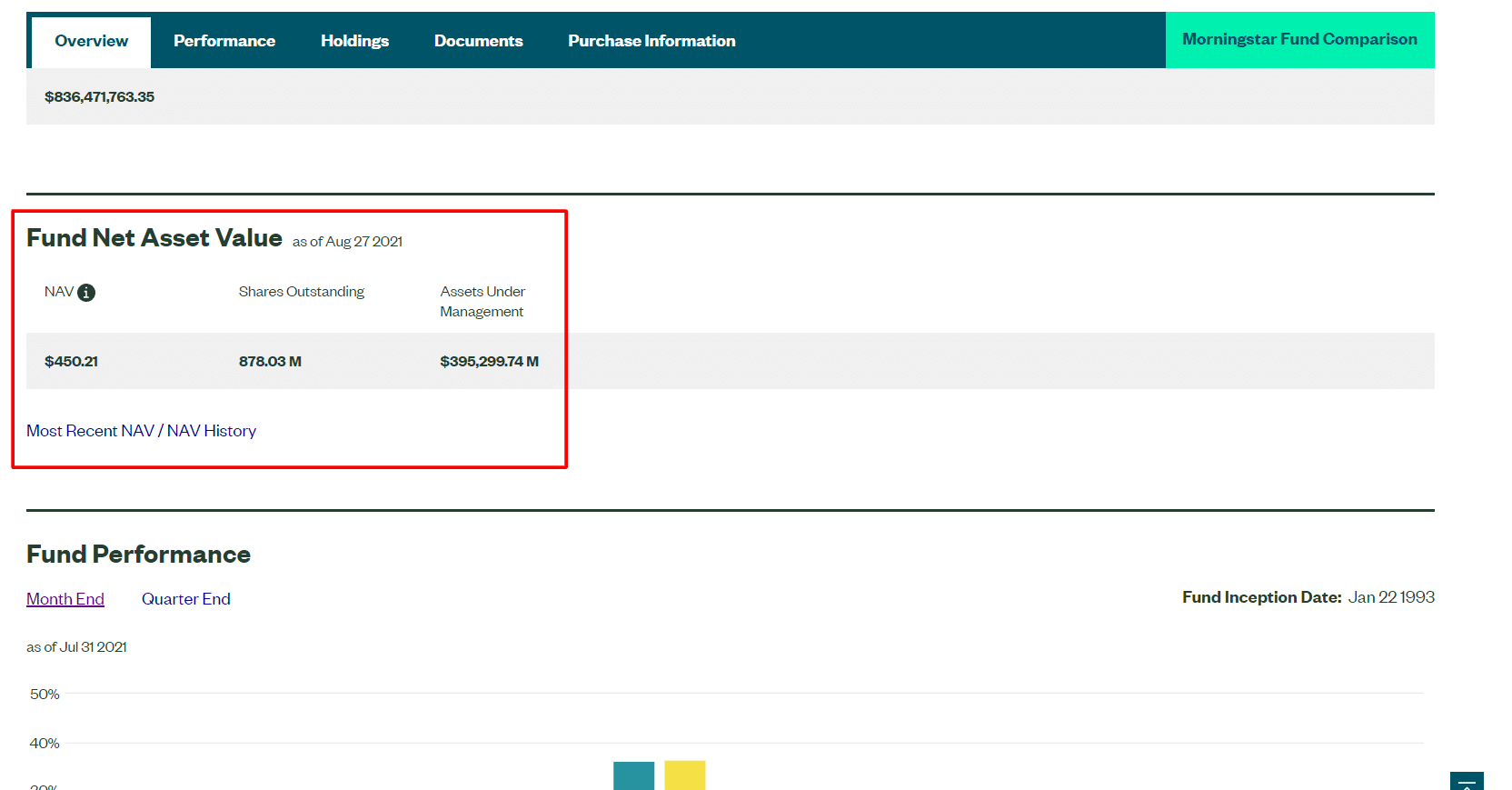

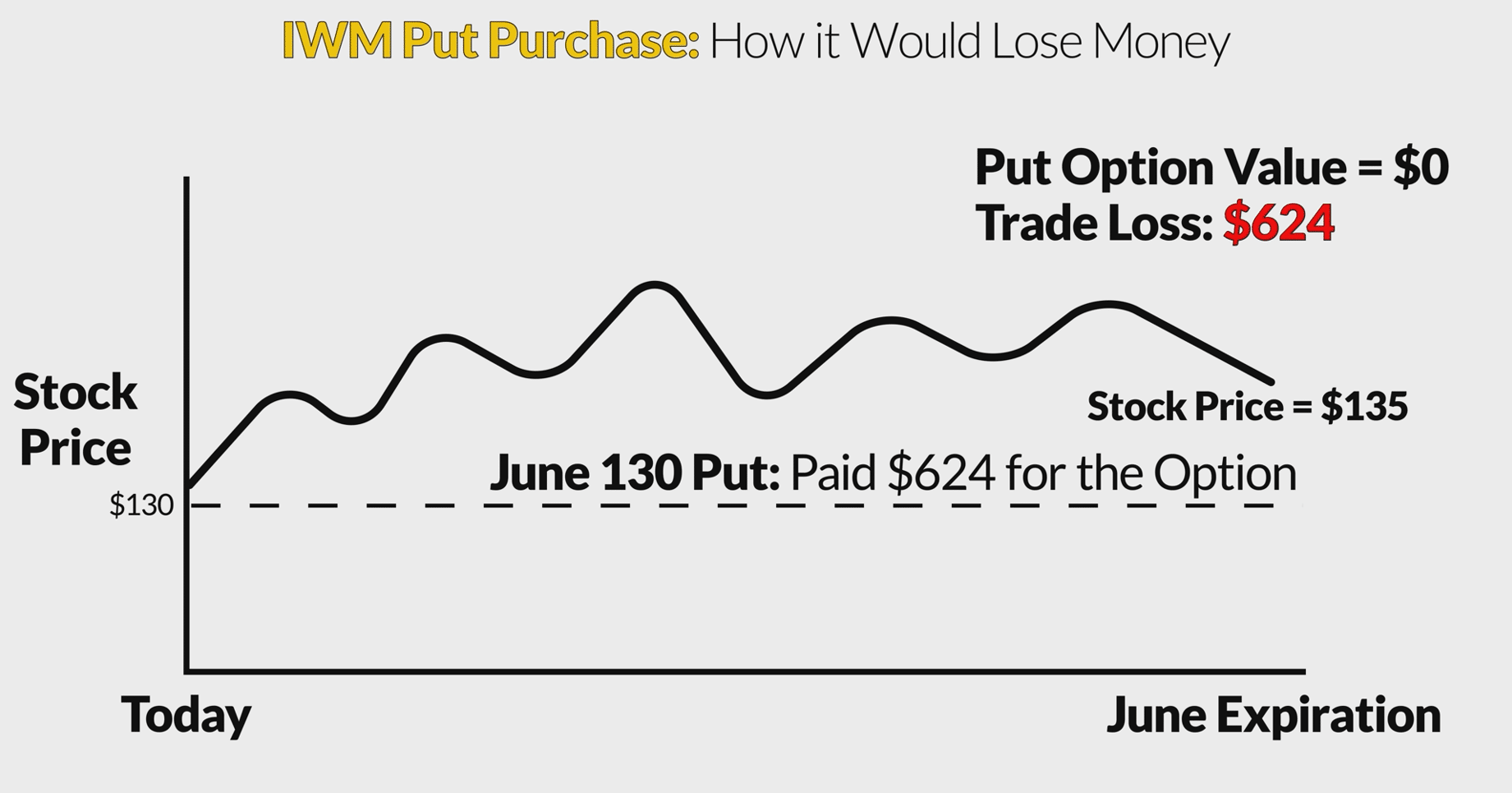

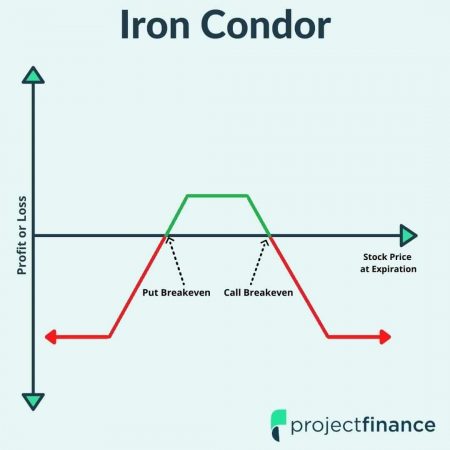

A short iron condor is profitable when the stock price remains between the short strike prices of both our call spread and put spread. Take a look at the below image, which shows how this strategy performs as the stock price remains between two short strike prices.

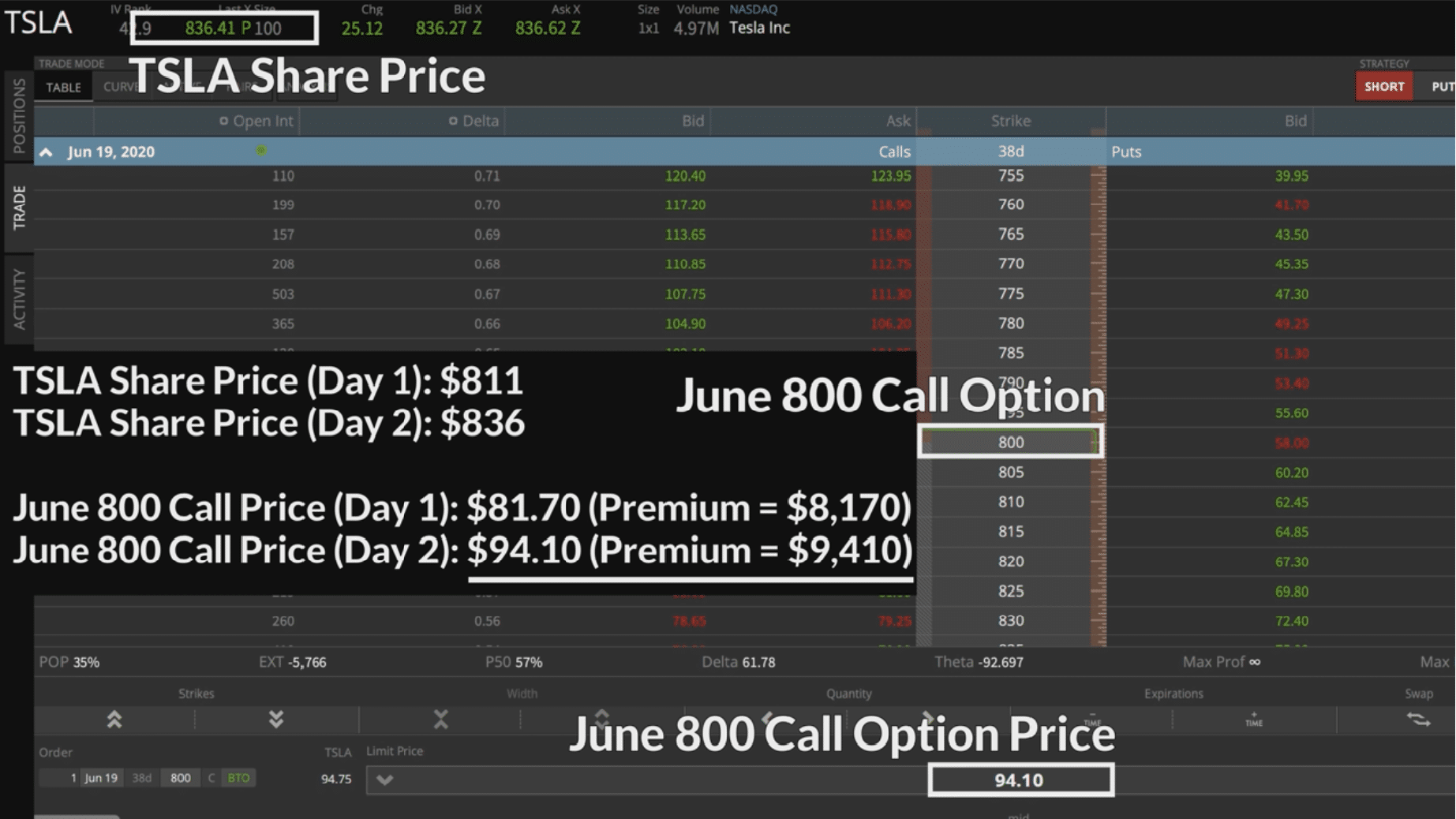

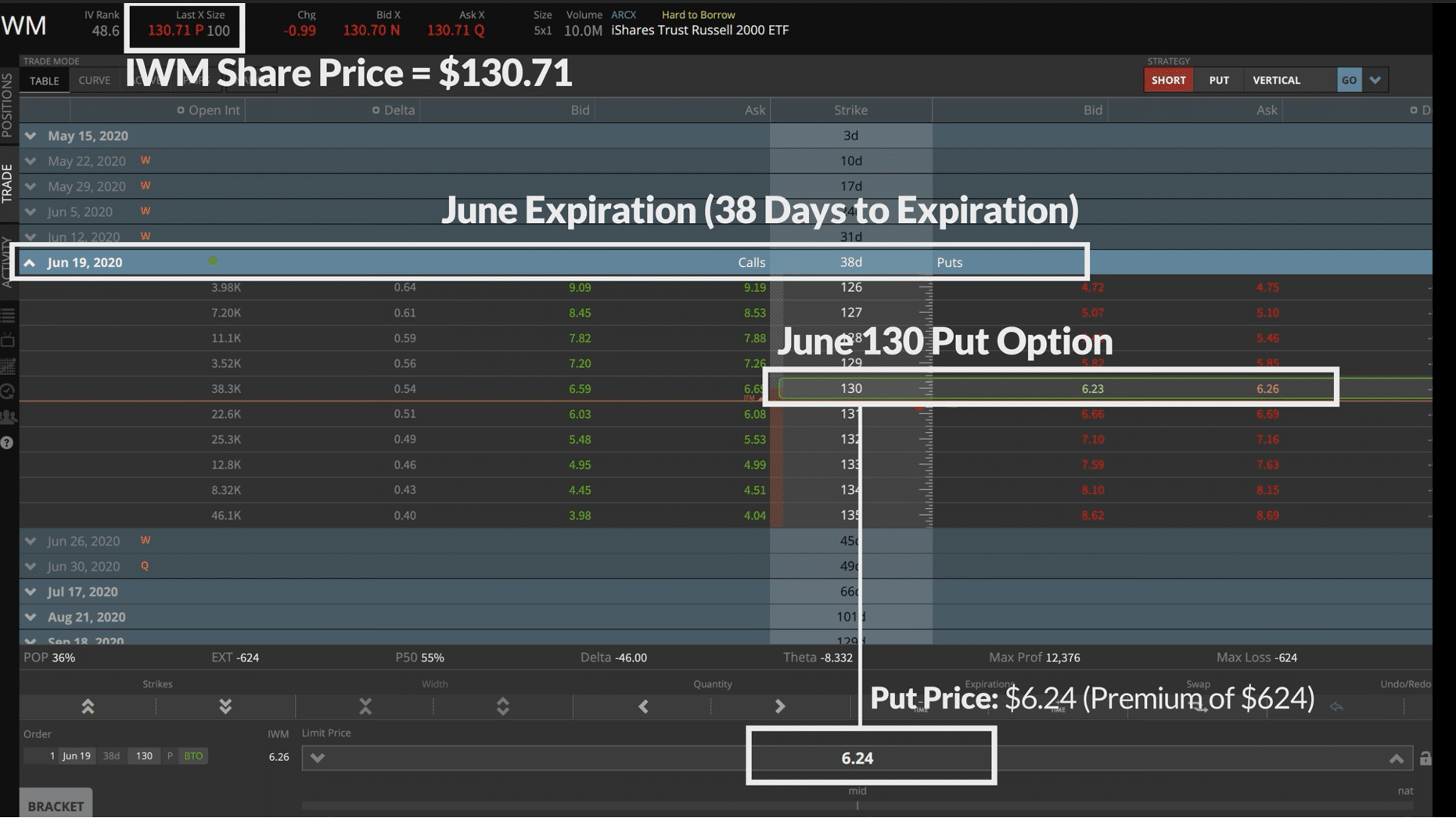

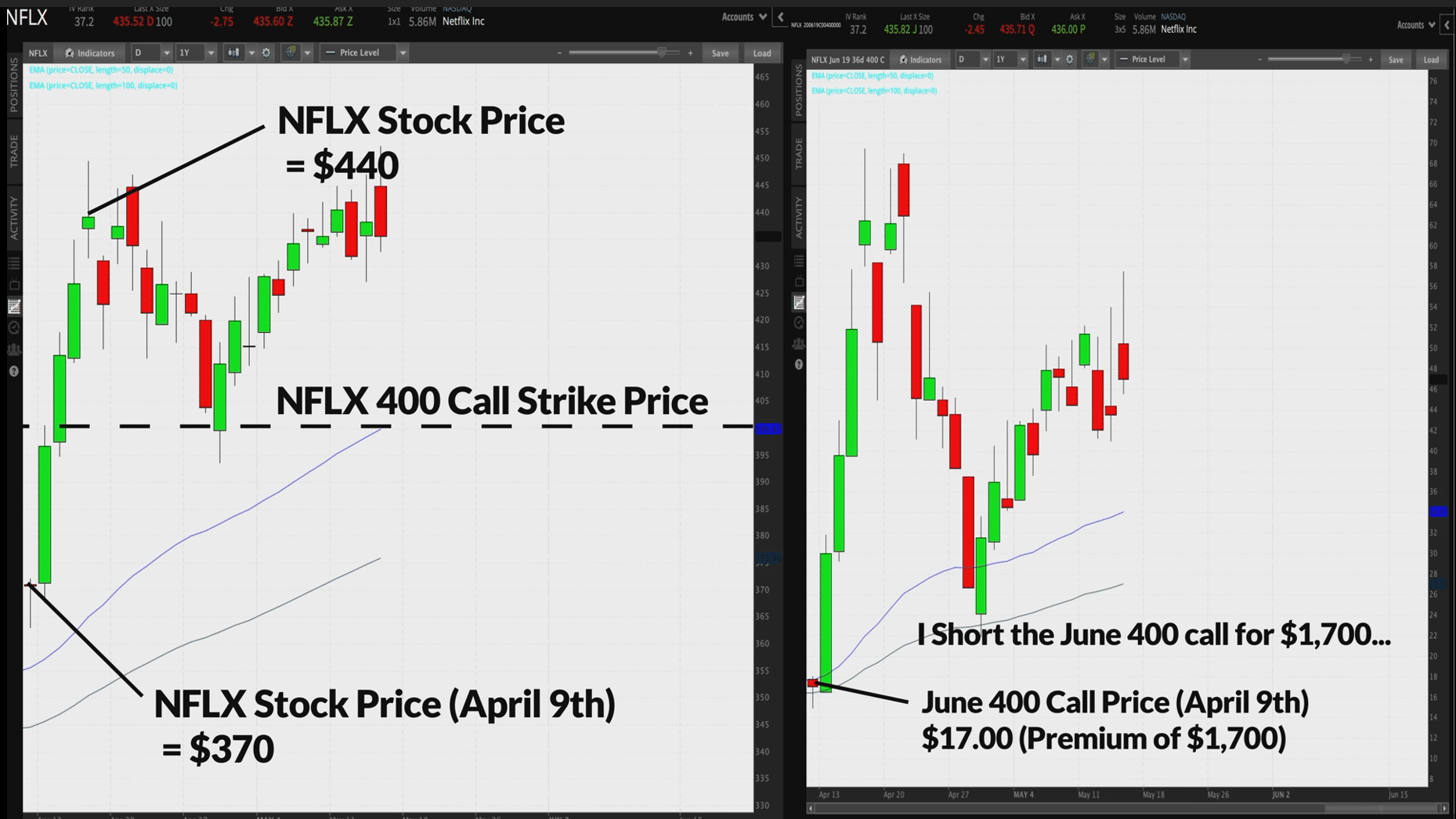

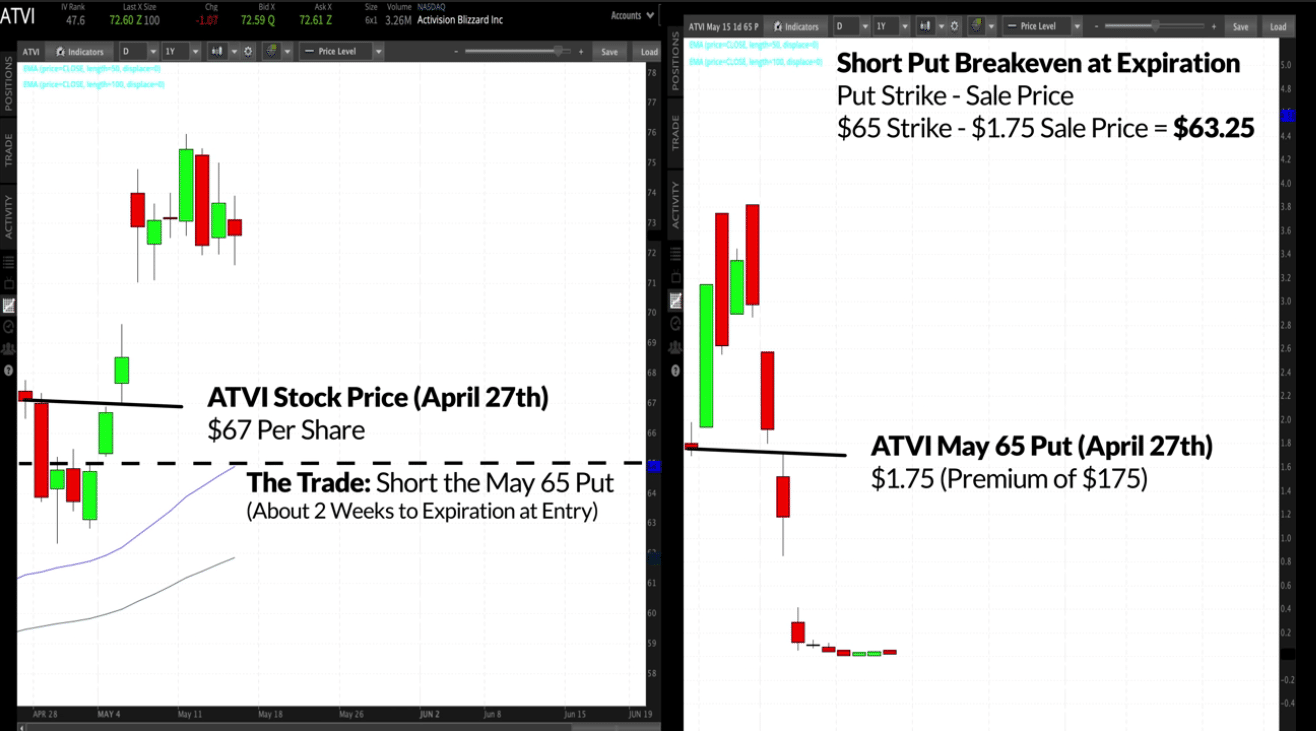

The best way to understand options trading is by looking at examples, so let’s get into one now!

Iron Condor Trade Example

Our below trade is a “50-Point” wide iron condor with 60 days to expiration (DTE).

Trade Details

Stock Price at Trade Entry: $500

DTE: 60 Days

Call Spread: Short 550 Call for $7.89; Long 600 Call for $1.94

Put Spread: Short 450 Put for $6.15; Long 400 Puts for $0.72

Total Premium Sold: $7.89 + $6.15 = $14.04

Total Premium Bought: $1.94 + $0.72 = $2.66

Net Credit Received: $14.04 (collected) – $2.66 (paid) = $11.38

In the above trade, we netted a credit of $11.38. Don’t get too overwhelmed by all the numbers, we will be breaking them all down soon!

Since we received a net premium, this trade is therefore a credit spread. All short iron condors will be credit spreads.

Next up, let’s take a look at the profit/loss graph for this trade.

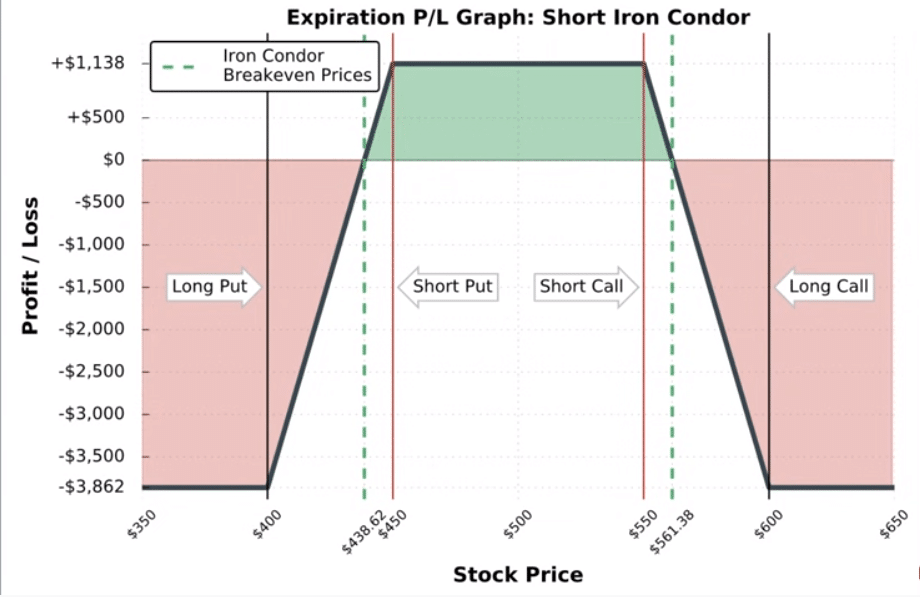

First off, let’s study the green portion of the above graph. As long as the stock stays within the bounds of both the short call and short put that we sold, we will achieve maximum profit. We said earlier that this strategy is a market-neutral strategy. Hopefully, now you can see why.

Now, what about the red-shaded areas? We can see that the losses begin to accelerate the further the stock price advances beyond both our short call and put strike prices.

Let’s compare the maximum profit and loss on this trade for a moment. We can see in the upper bounds of the Y-axis that the maximum profit is +$1,138. The maximum loss, however, is -$3.862.

So why would you risk more than you can possibly make? Because in this trade, you have a much higher chance of success than failure. Let’s take a closer look at these numbers now.

Iron Condor: Maximum Profit Potential

(Net Credit Received)

Maximum Profit: $11.38 Net Credit x 100 = $1,138

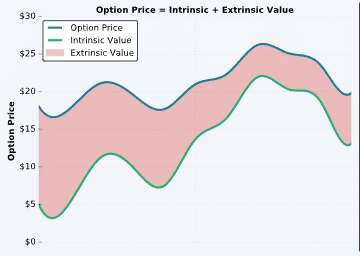

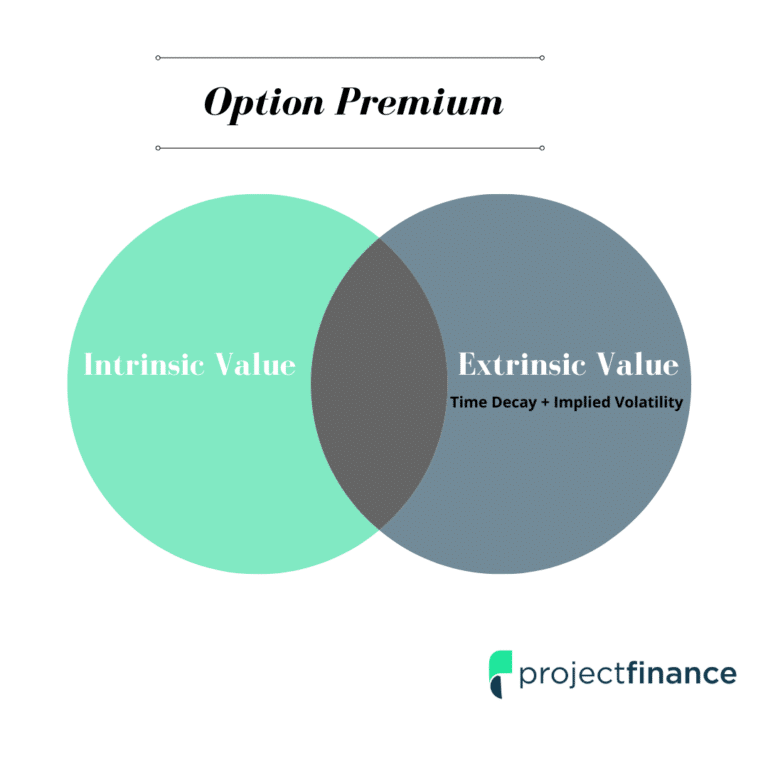

Whenever you are a net seller of options, the most you can ever make is the premium received.

We sold this iron condor for a net credit of $11.38. Therefore, our maximum profit (taking into account the option multiplier effect of 100) is $1,138.

When will this occur? If by expiration, the stock price resides between the strike prices of both of our short options. If this occurs, all of our options will expire worthless.

We sold the 450 put and the 550 call; therefore, as long as the stock closes between these two strike prices on expiration day, we’ll achieve maximum profit!

Iron Condor: Maximum Loss Potential

(Spread Width – Credit Received = Max Loss)

$50-Point Wide Spread Width – $11.38 Credit x 100 = $3,862

In order to determine the maximum loss on any iron condor, simply subtract the credit received from the width of the spread.

In our example, we are short the 450/400 put spread and the 550/600 call spread. Our spread is therefore 50 points wide. And how much credit did we take in? $11.38.

So, to determine the maximum loss here, just subtract this credit from the spread width (50-11.38), which gives us a maximum potential loss of 38.62, or $3,862 when accounting for the multiplier effect.

Losses Limited to Either Calls or Puts

Now the stock can’t be both above and below our short strike prices at expiration. In the iron condor strategy, only one side has the potential of expiring in-the-money. Let’s explore these two various outcomes now:

- If the stock is below $400, the 450/400 put spread will be worth $50 at expiration while the 550/600 call spread will expire worthless. Iron Condor Value: $50

If the stock is above $600, the 550/600 call spread will be worth $50 at expiration while the 450/400 put spread will expire worthless. Iron Condor Value: $50

Maximum Loss > Maximum Profit: Why Trade?

So we have already determined that this trade has the potential to lose a lot more than it will ever make ($1,138 profit vs $3,862 loss). Why put this trade on then?

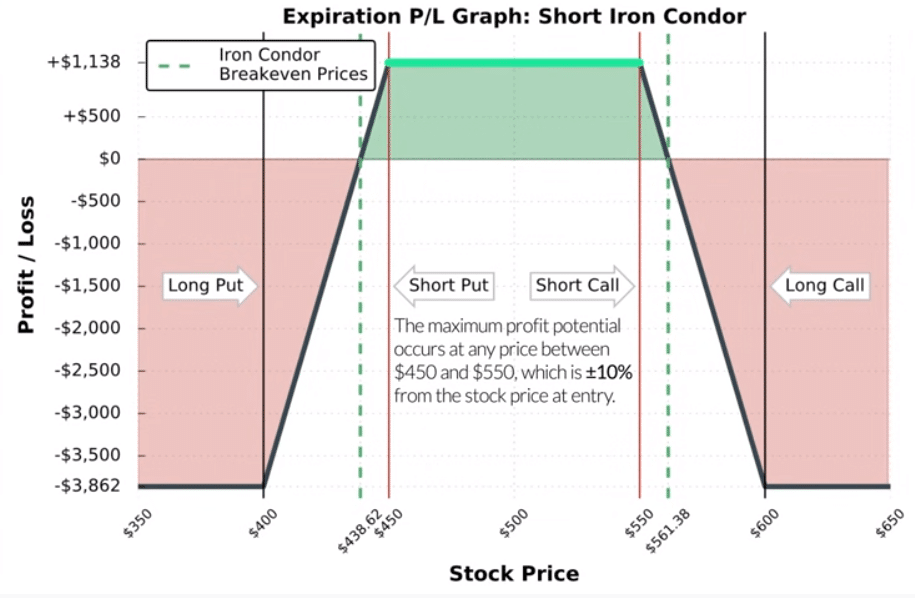

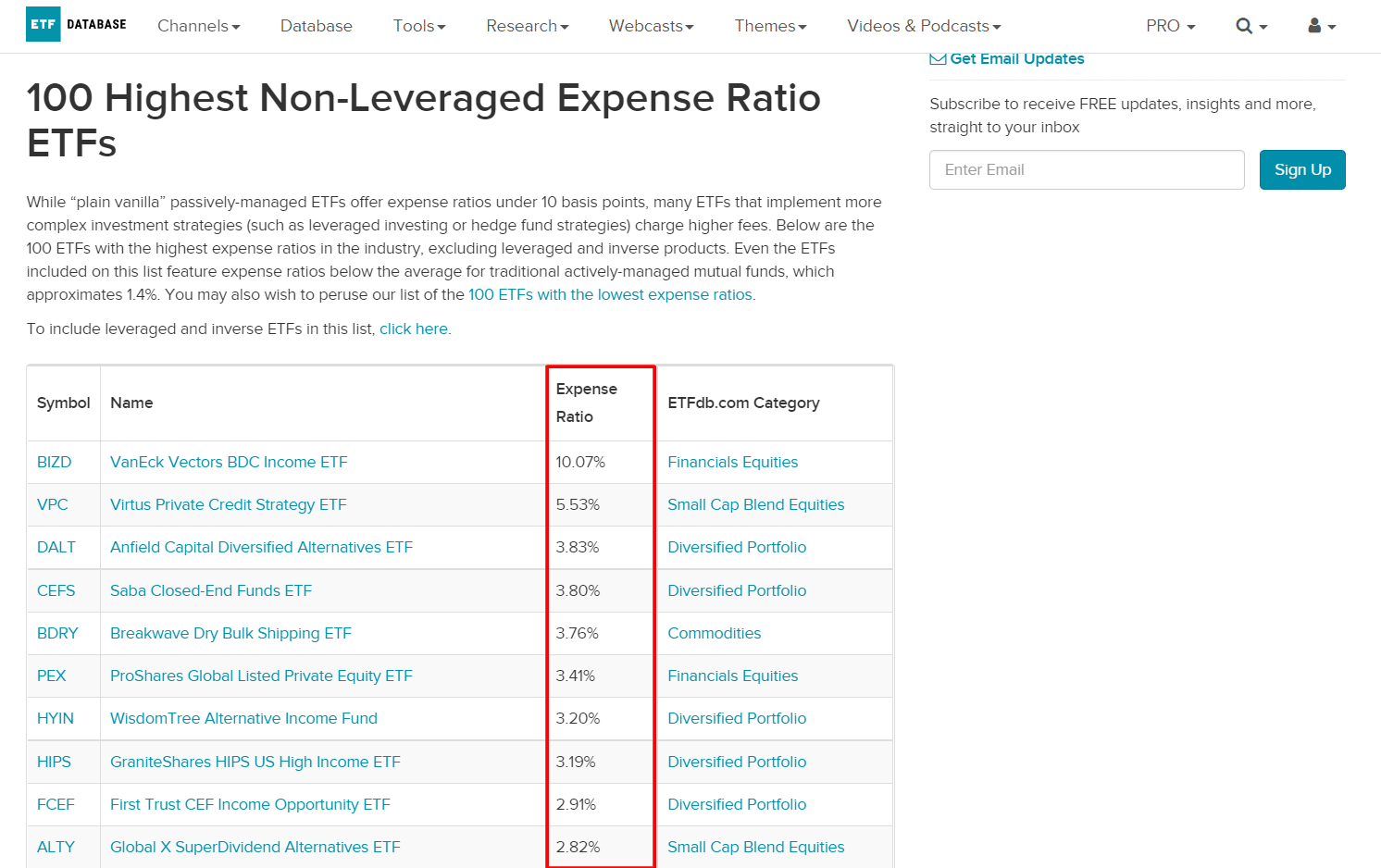

Because the odds are in your favor that the trade will expire worthless. Our maximum profit occurs when the stock is trading between $450 and $550 at expiration. That means the stock can move 10% up or down in the next 60 days (our time to expiration) and we will still achieve maximum profitability.

The below image shows this.

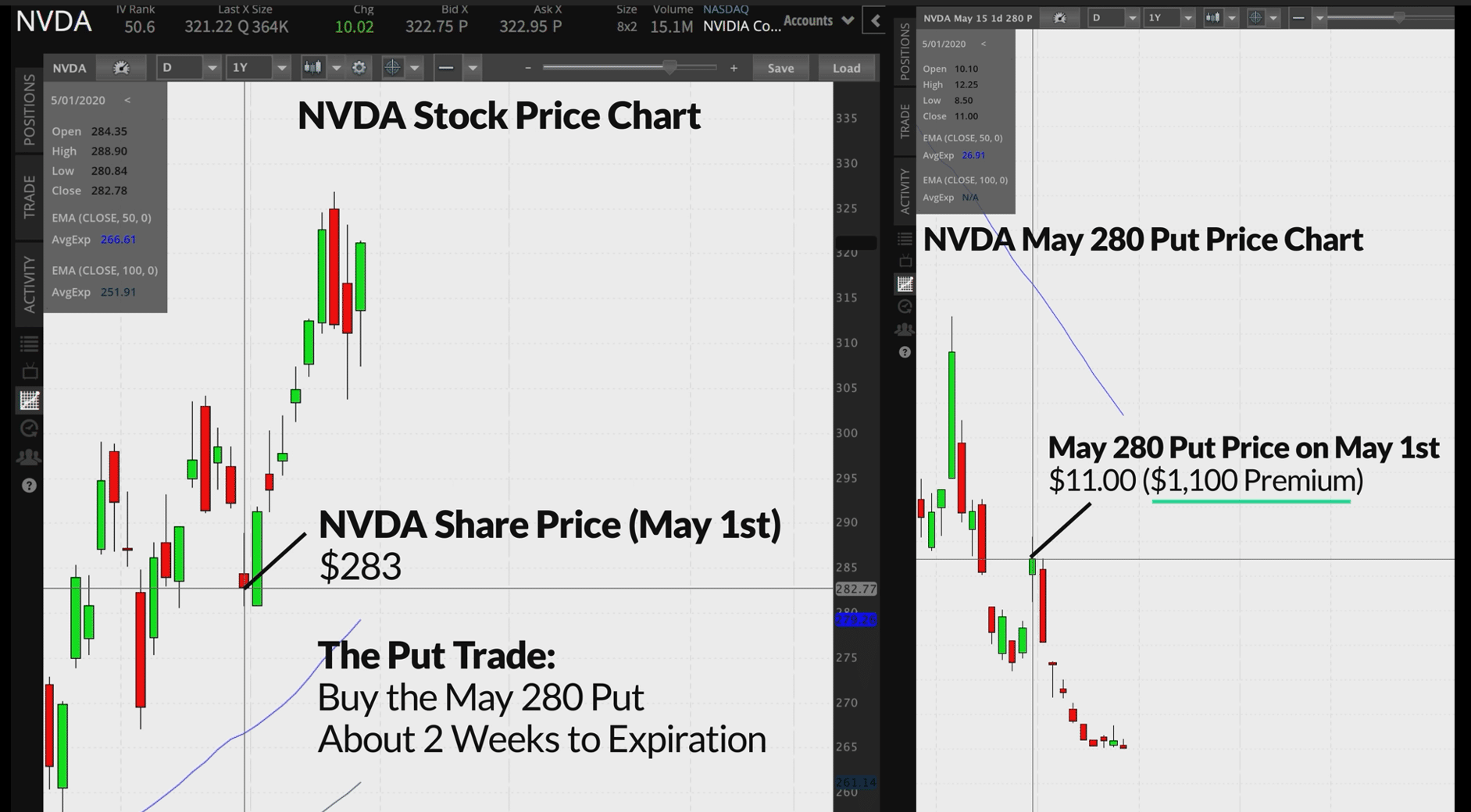

So will our maximum loss occur when the stock moves more than 10%? Not always. Remember, we took in a premium when we sold this trade. Taking into account this premium, the stock must move either up or down greater than 20% in order for us to have a maximum loss. When the stock breaches our short strike prices between 10% and 20%, our losses will fluctuate, but the trade will not be a maximum loss.

The below image shows this.

So we have looked at max profit and max loss; but at what prices do we breakeven?

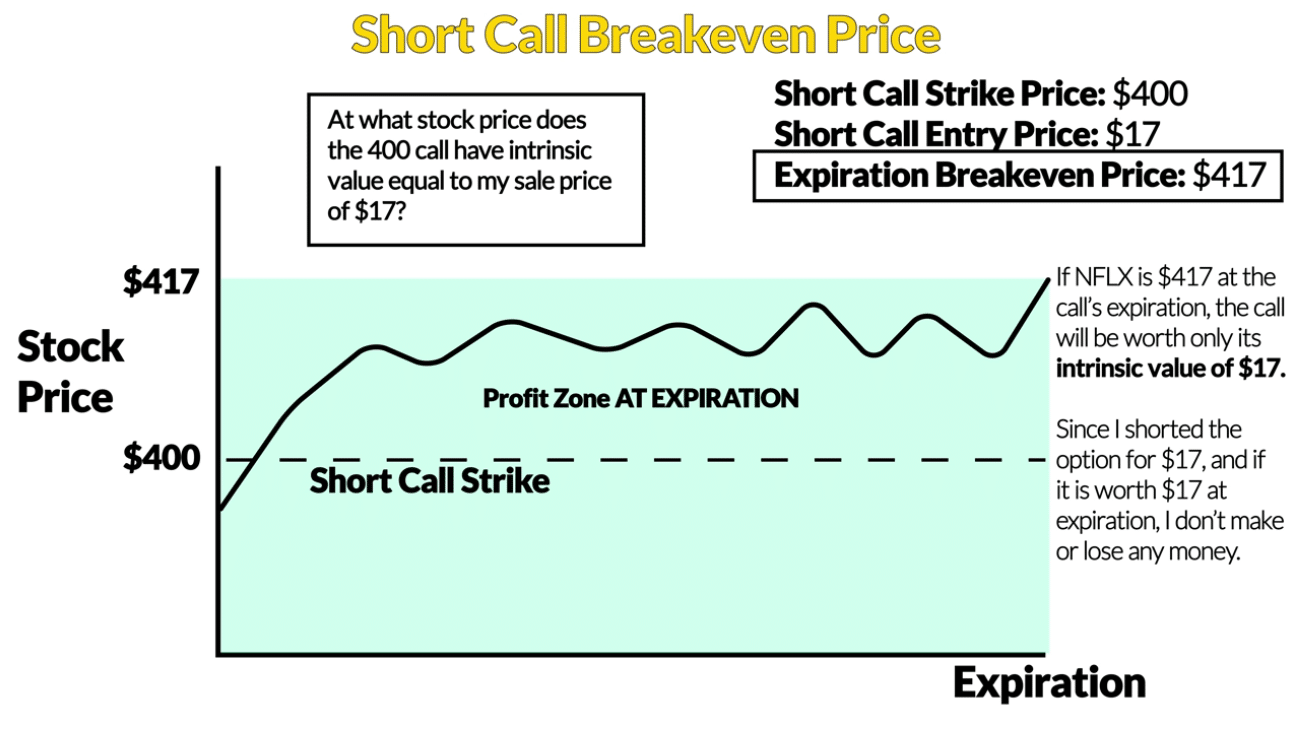

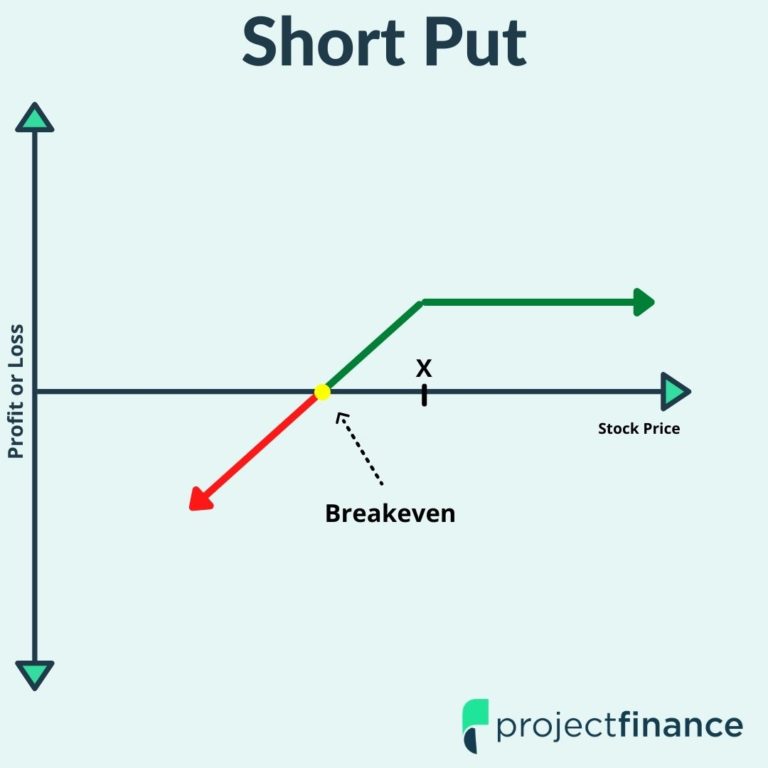

Iron Condor: Breakeven

Since we are selling two vertical spreads, we have two breakeven points.

To determine the two breakeven prices of an iron condor, we must:

- Subtract the net credit received from the short put strike

- Add the net credit received to the short call strike.

Let’s next break this down, starting with the put spread breakeven.

Lower Breakeven Price (Puts):

$450 – $11.38 = $438.62

When the stock is trading at $438.62 on expiration, the 450 put will be worth $11.38 while all the other options will expire worthless. This amount is also the credit we took in, so breakeven should make sense.

Higher Breakeven Price (Calls)

$550 + $11.38 = $561.38

When the stock is trading at $561.38 on expiration, our short call will be worth $11.38 while all the other options expire worthless. Again, this is the net credit we took in, so this scenario leads to a breakeven.

Selling Iron Condors and Probability

Generally speaking, iron condors have a greater than 50% chance of success. They are known as “High-Probability” trades because of this. Understanding now that the maximum loss on these trades is greater than the maximum profit, this should make sense.

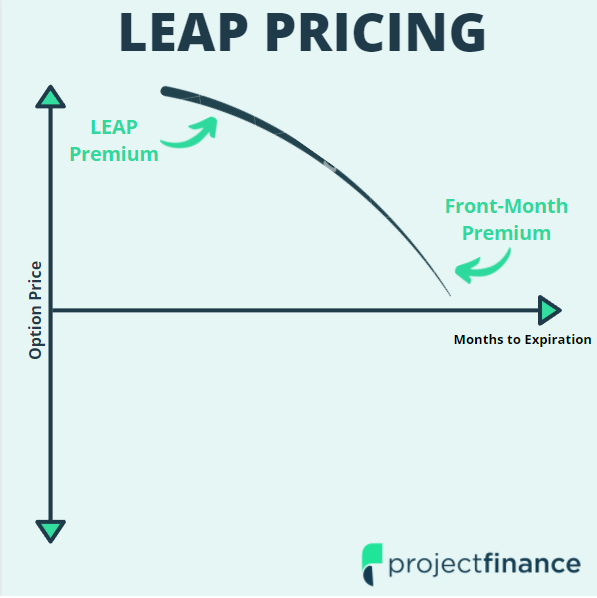

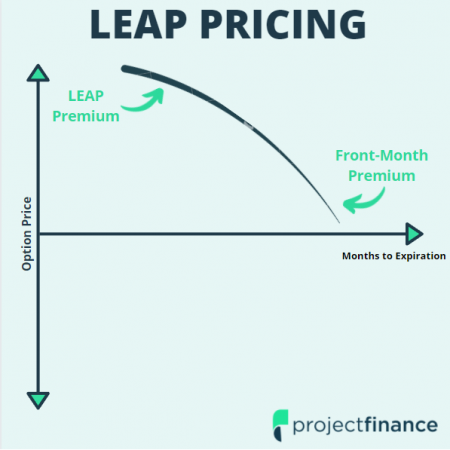

Iron Condors: Choosing an Expiration Date

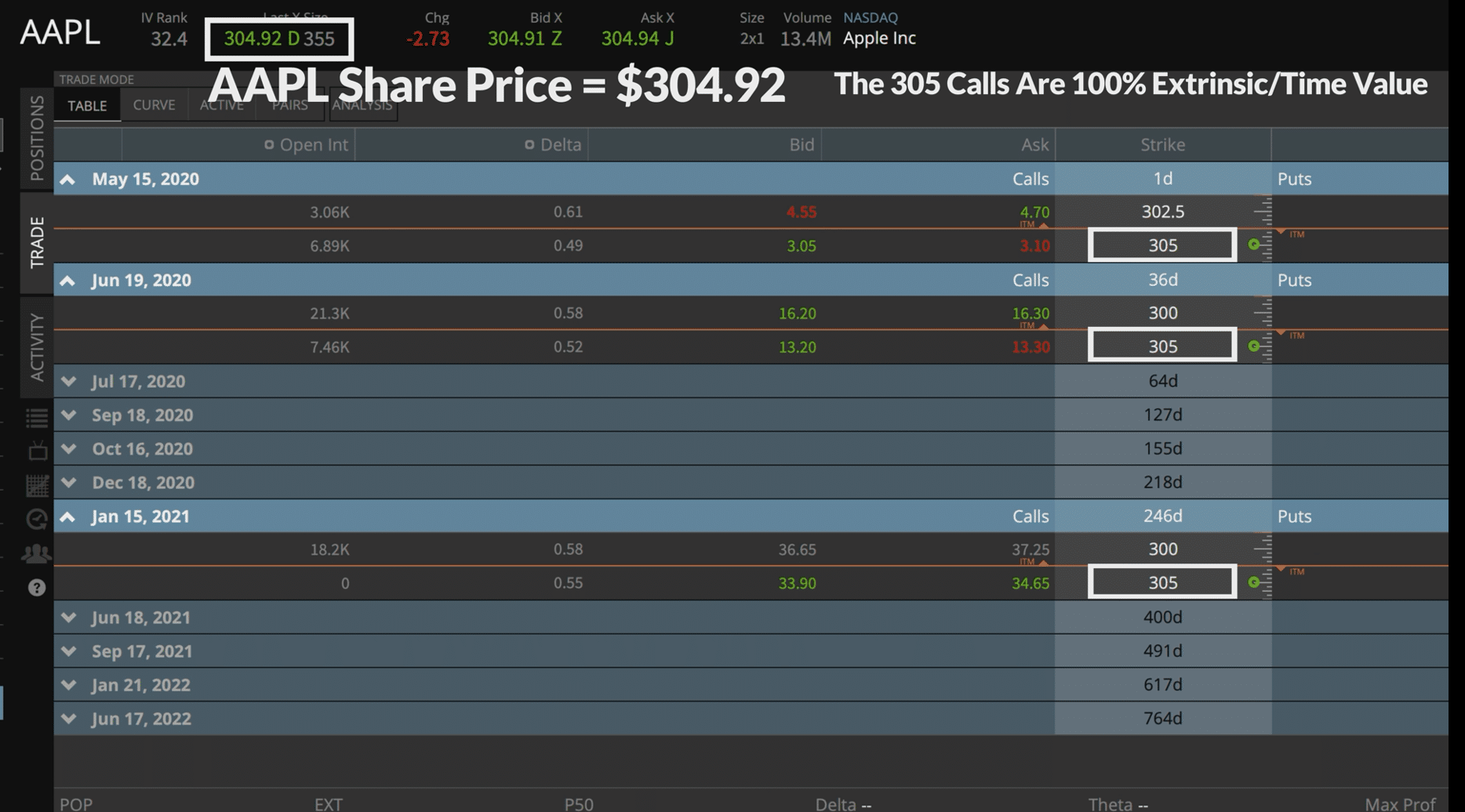

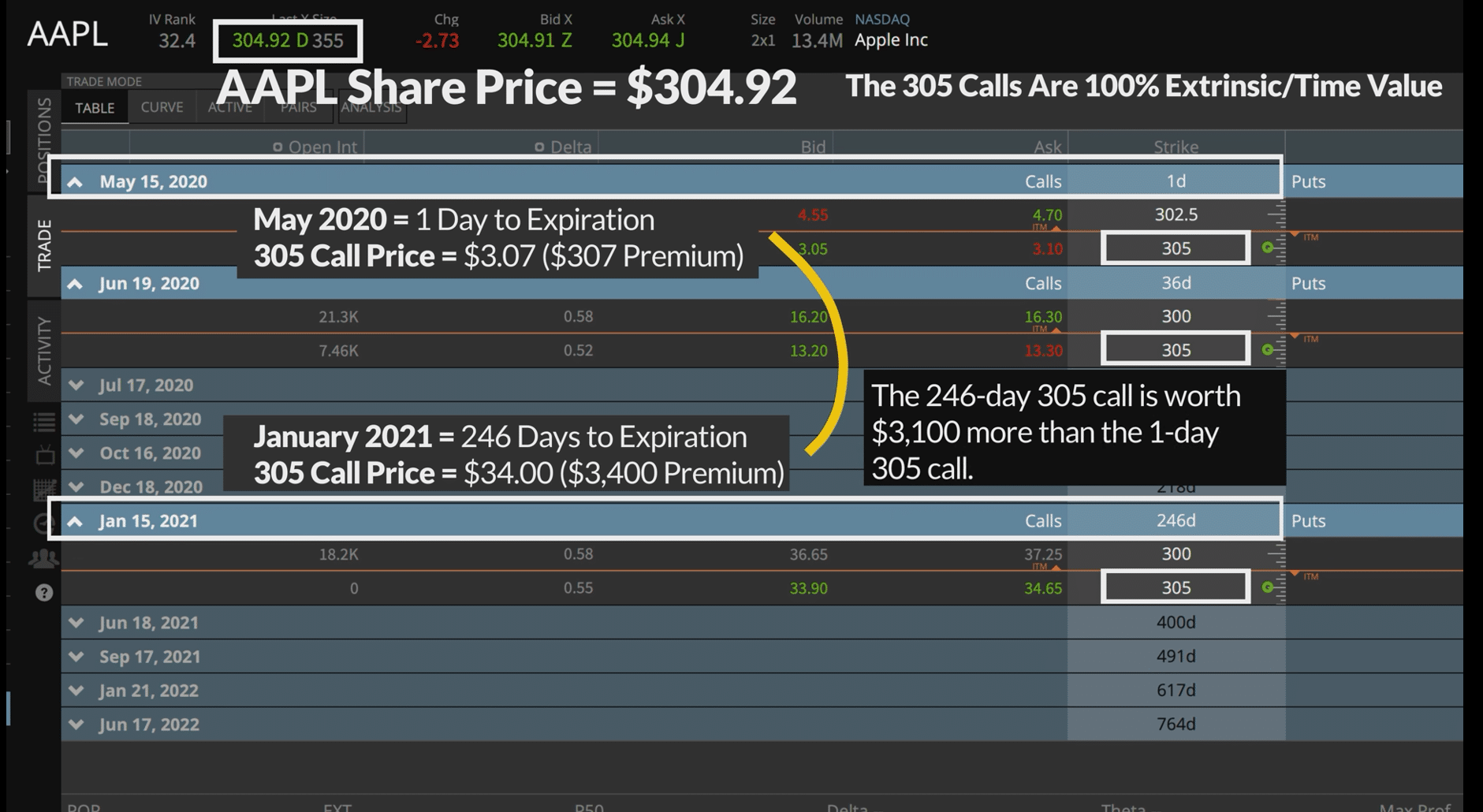

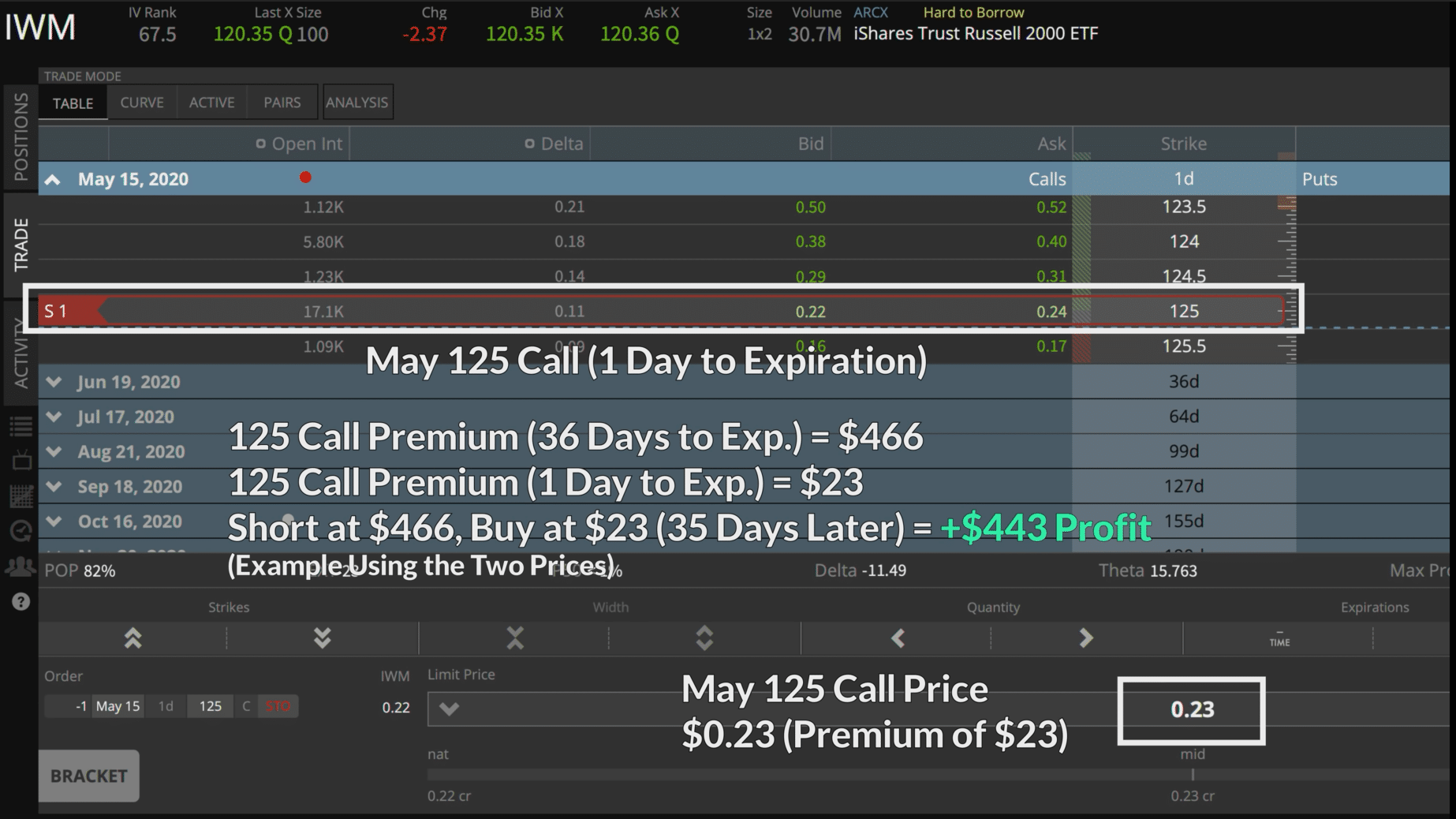

Our example looked at options that had 60 days to expiration. Many iron condors that are placed have a duration of between 30-60 days. Why?

As time passes, time decay, or “theta” sets in. Option sellers love theta. The 30-60 day range allows traders to collect quite a bit more time premium than options that expire in 7 days.

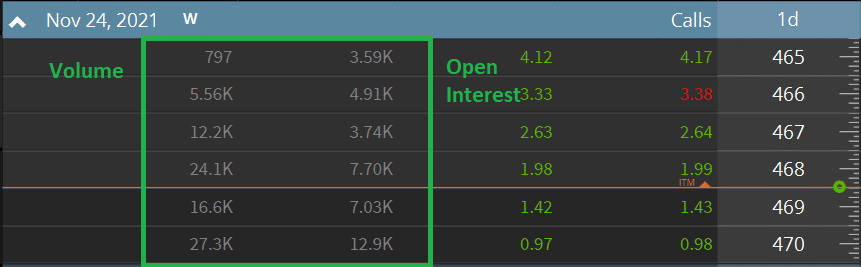

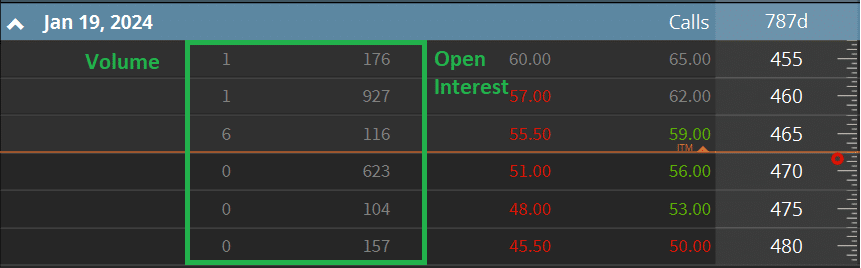

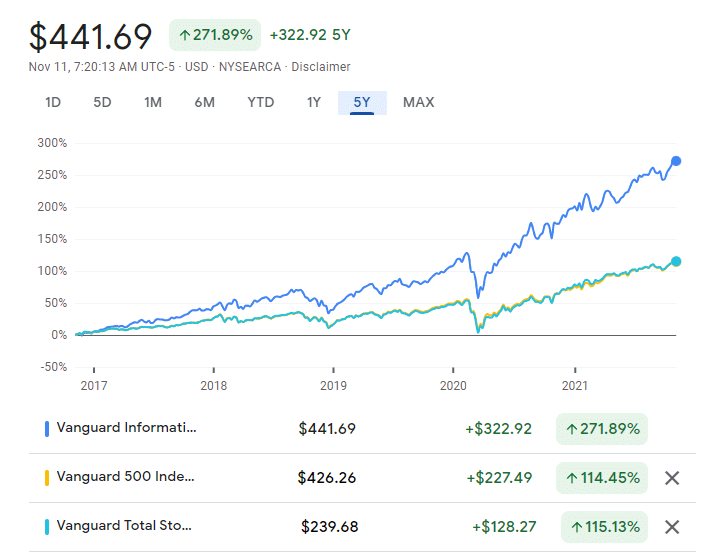

For example, a one-point SPY Iron Condor expiring in 3 days is currently bid at 0.13. That same spread expiring in 17 days is bid at .39, triple the premium!

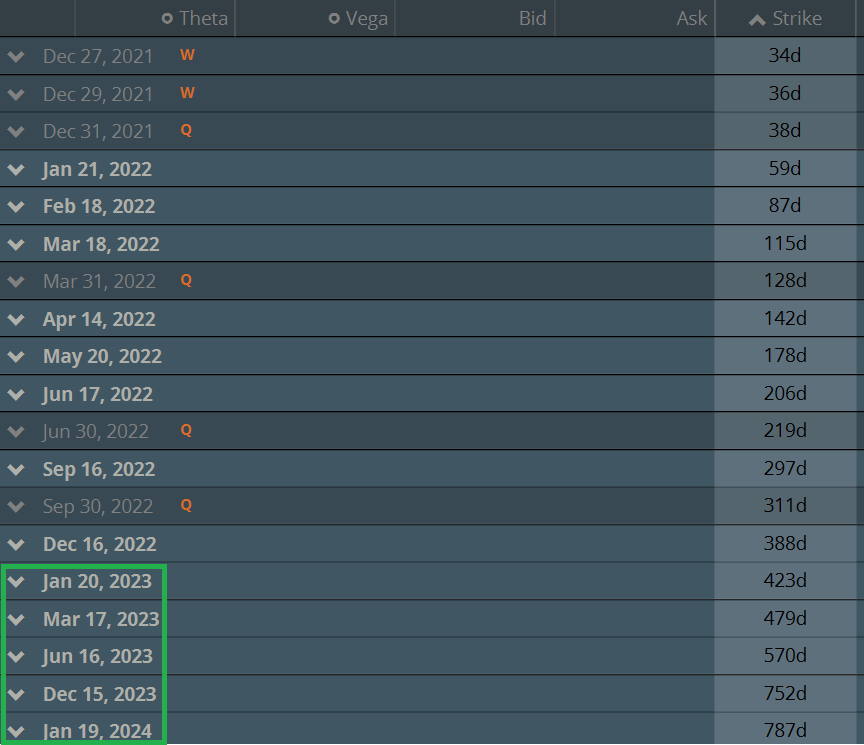

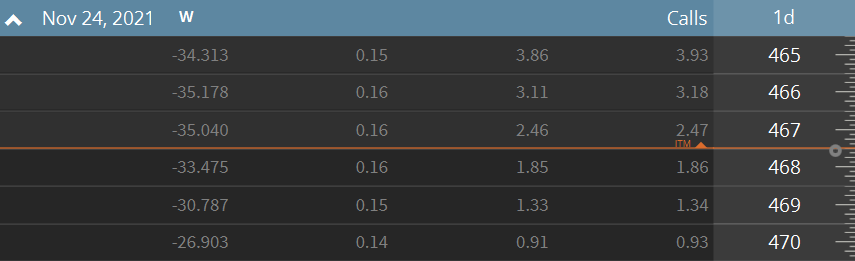

Iron Condors: Choosing Strike Prices

Deciding which strike prices you want to sell is a two-step process.

- Select the call and put option you want to short

- Select the corresponding options you want to buy

The width of these spreads (or the distance between the strike prices) must be the same if the trade is to be considered an iron condor.

So which options do you choose?

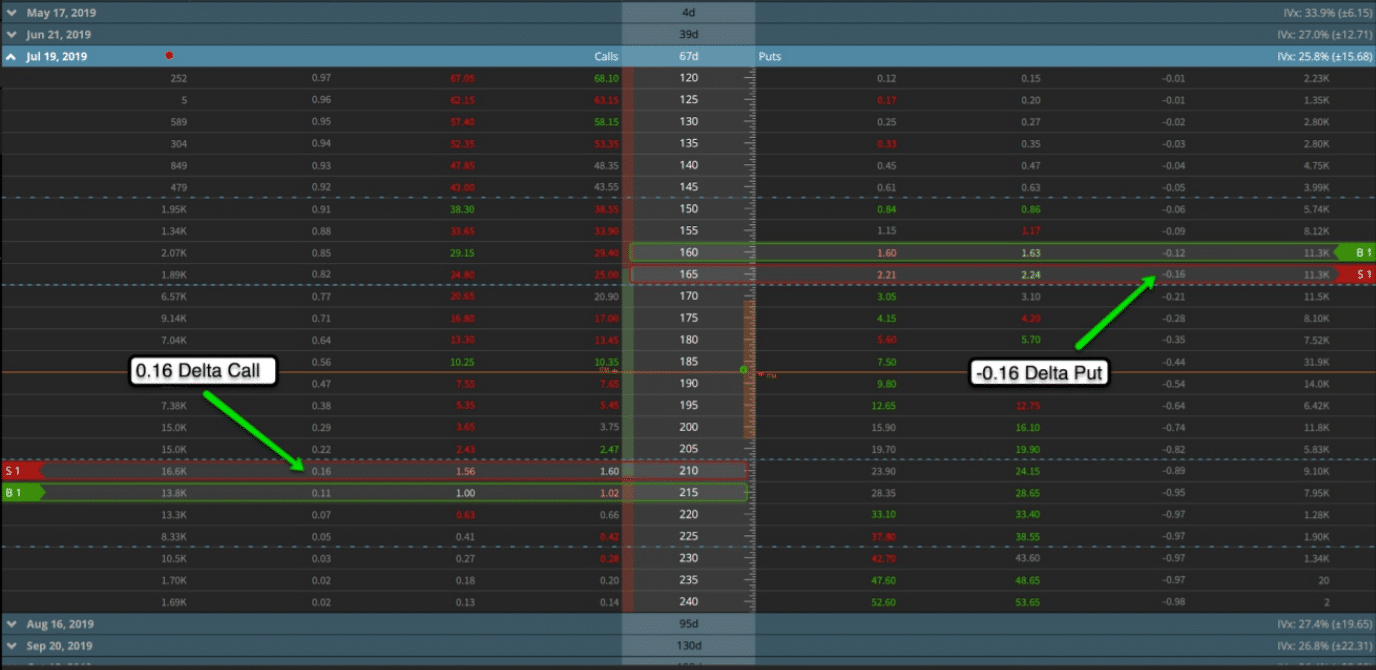

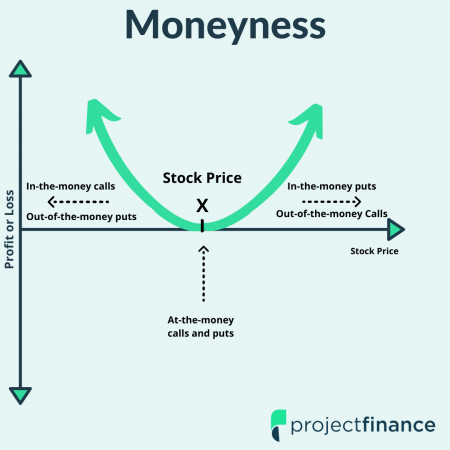

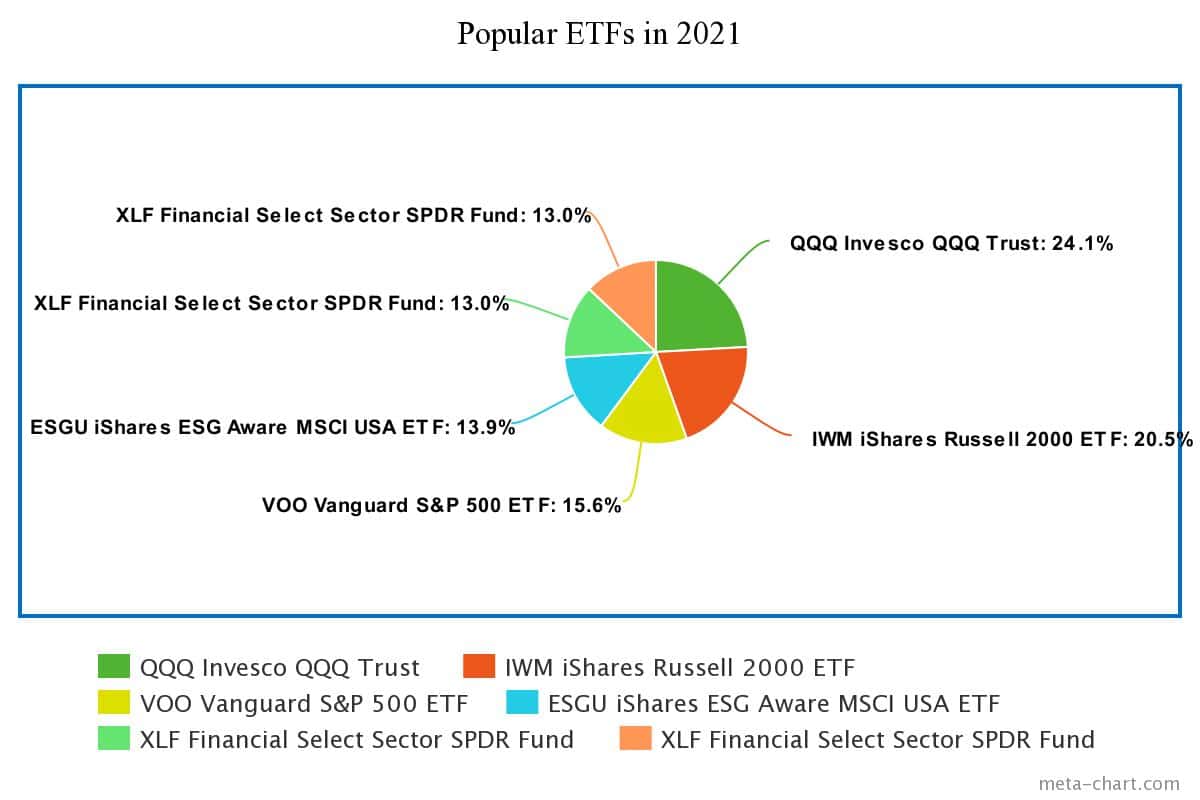

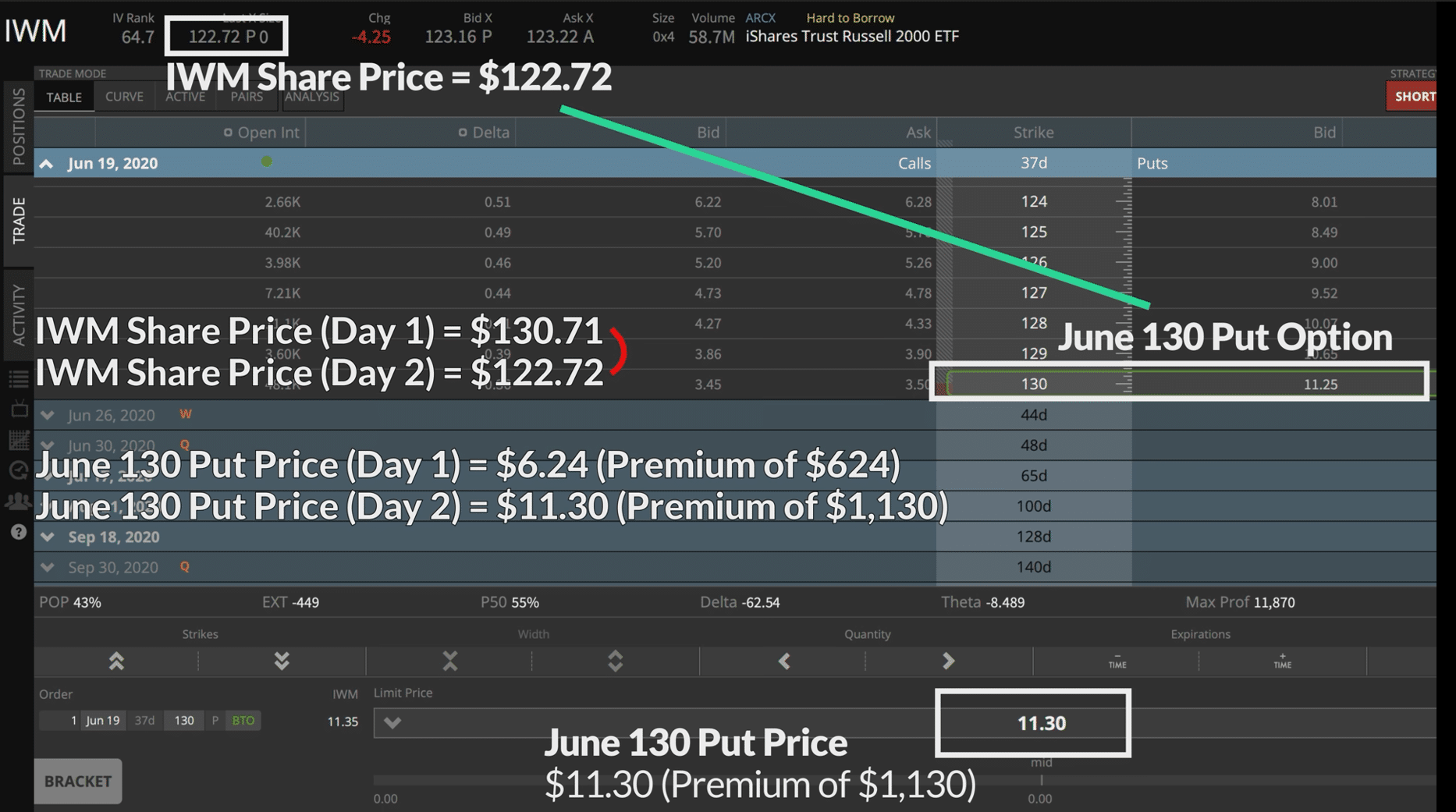

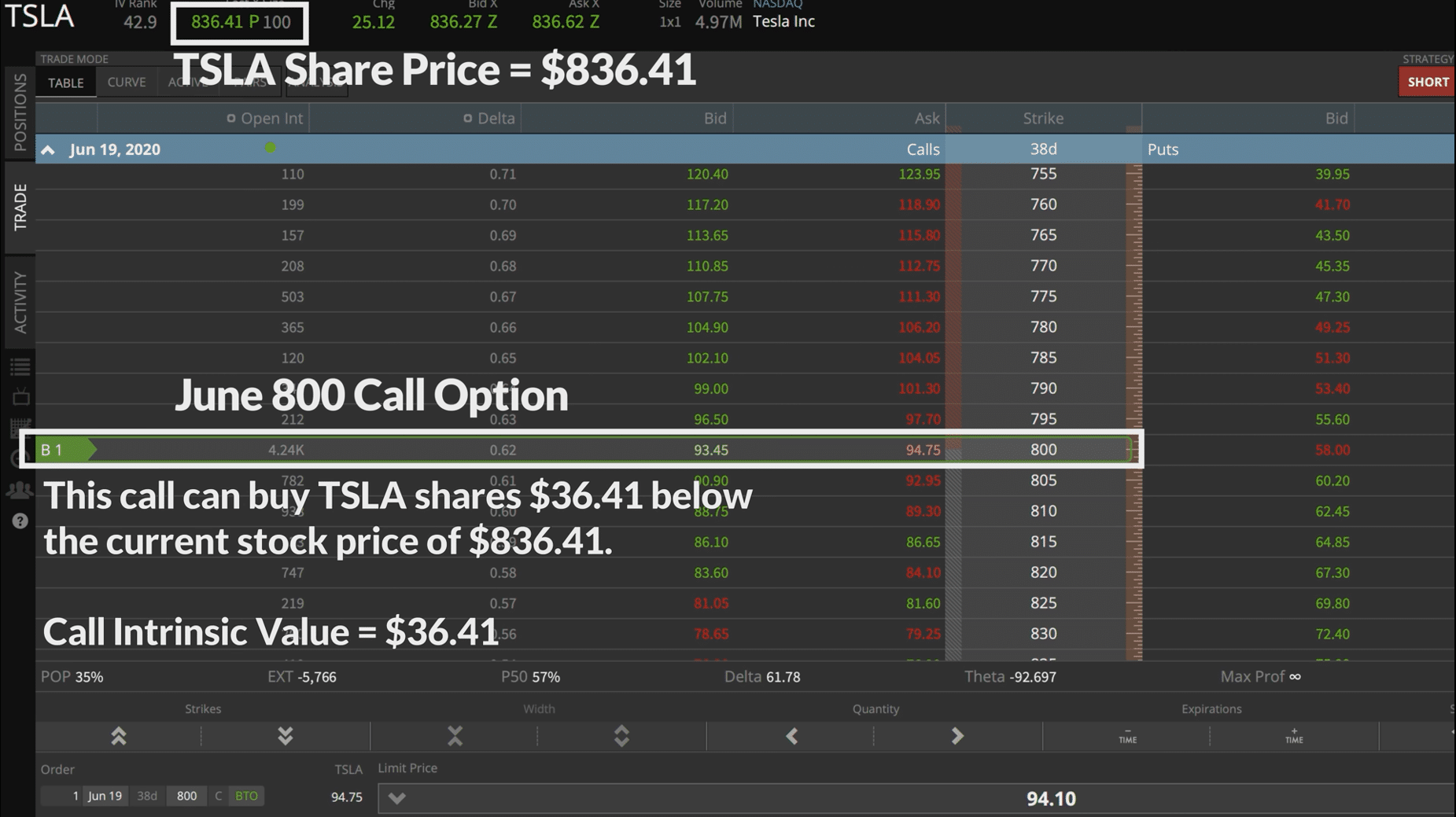

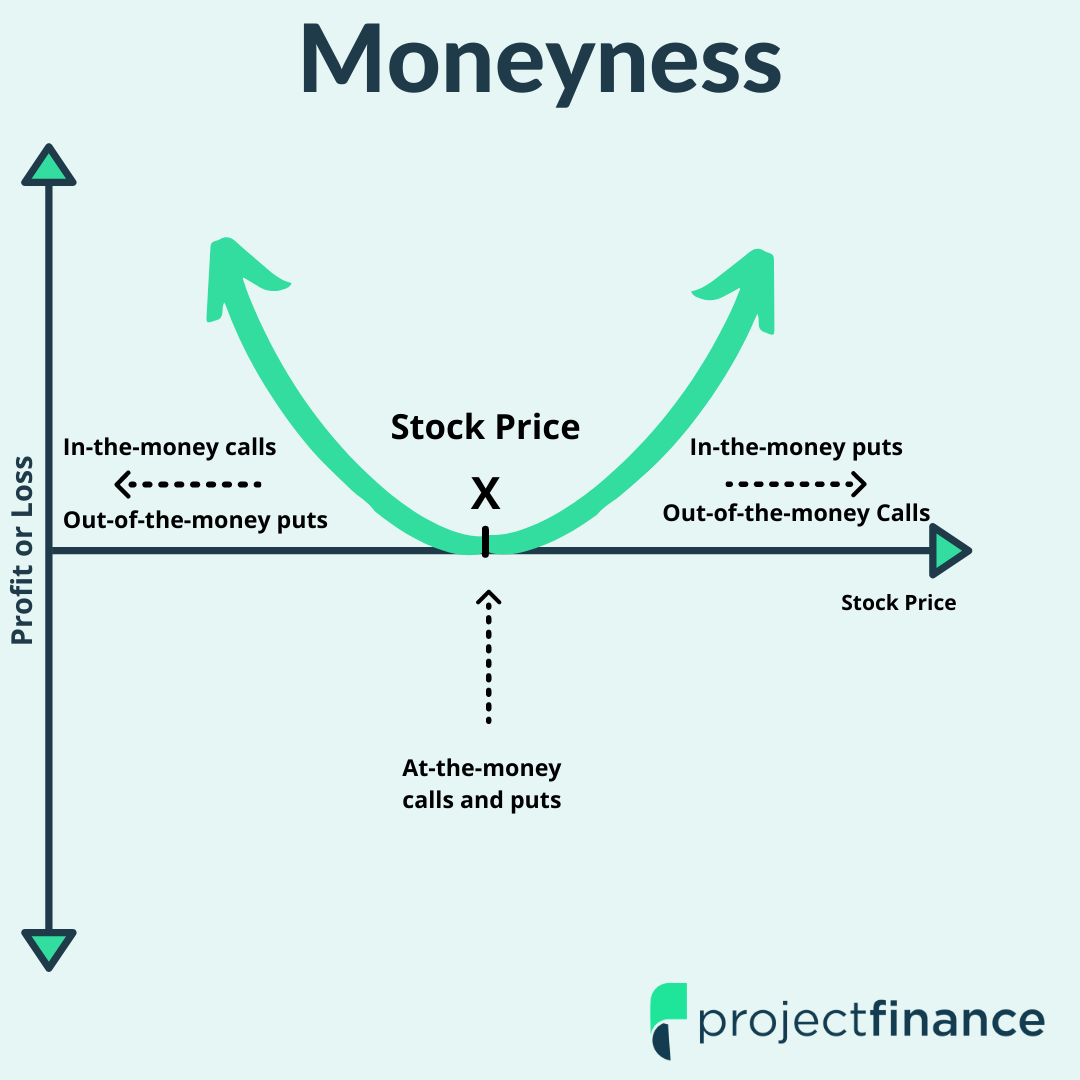

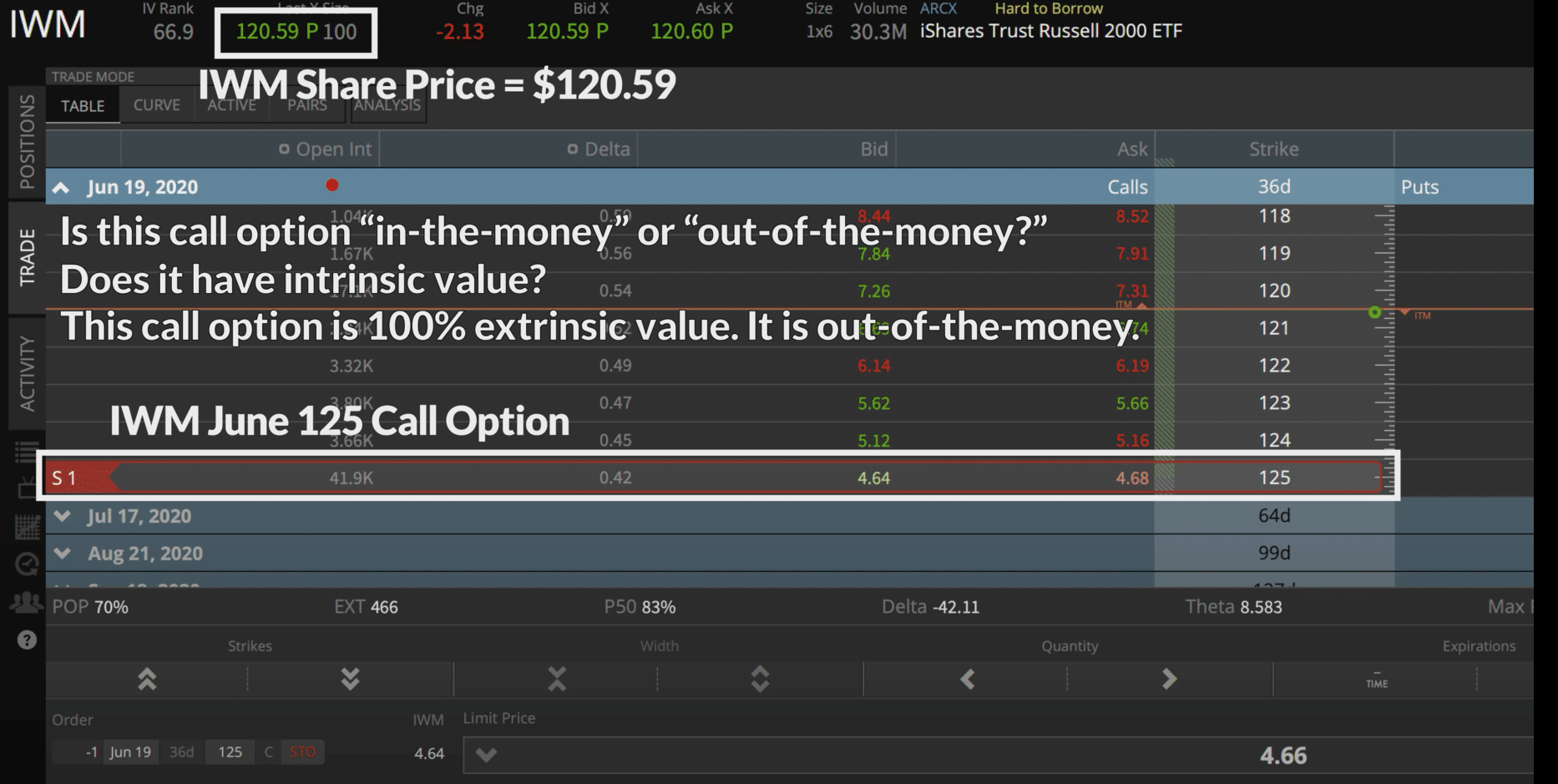

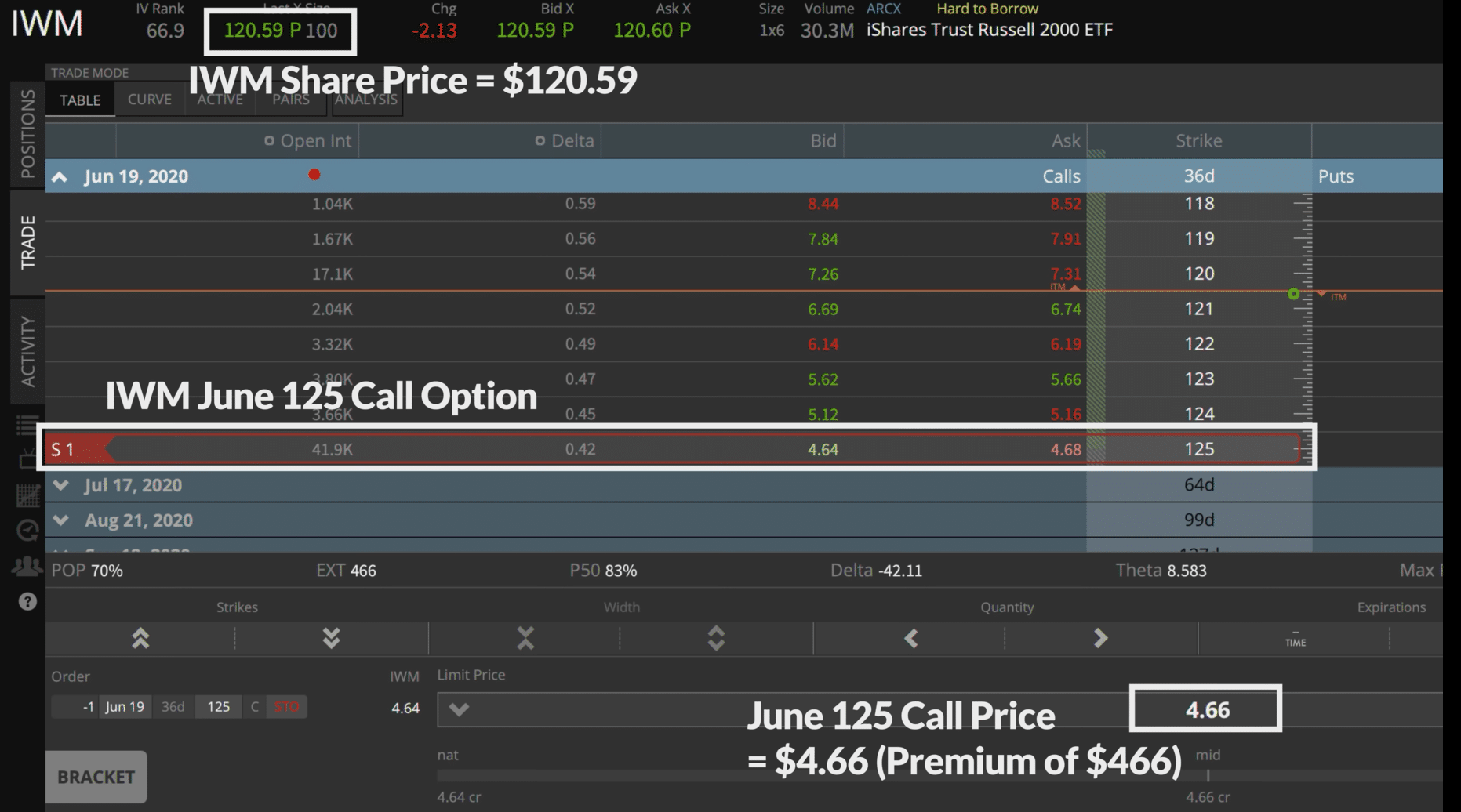

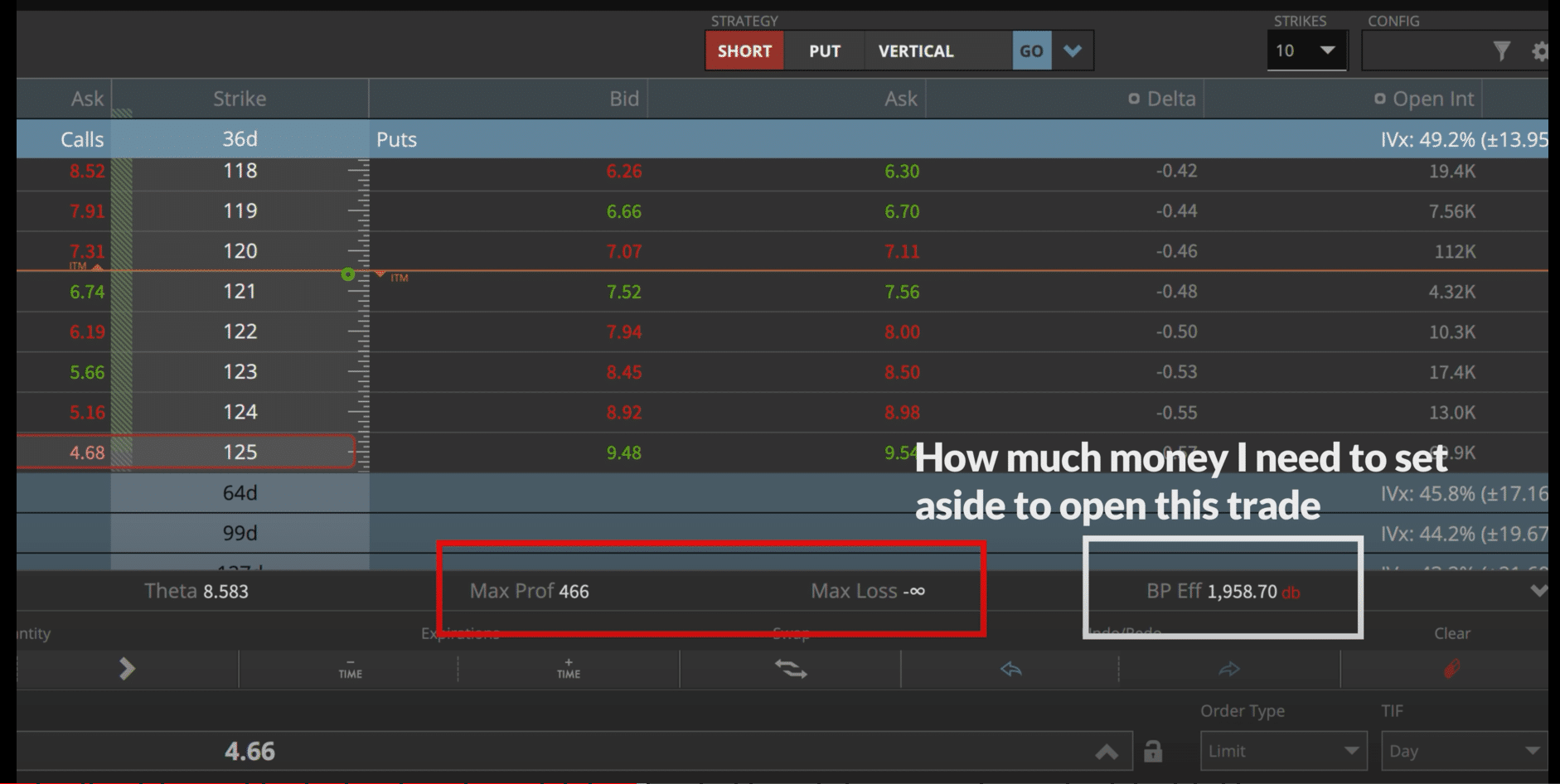

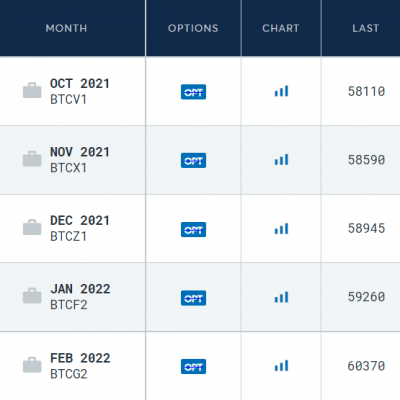

Start by looking at the Greek “delta”. Amongst other uses, the delta of an option tells us the odds that option has of expiring in-the-money. If an option has a delta of 0.16, it has a 16% chance of expiring in-the-money.

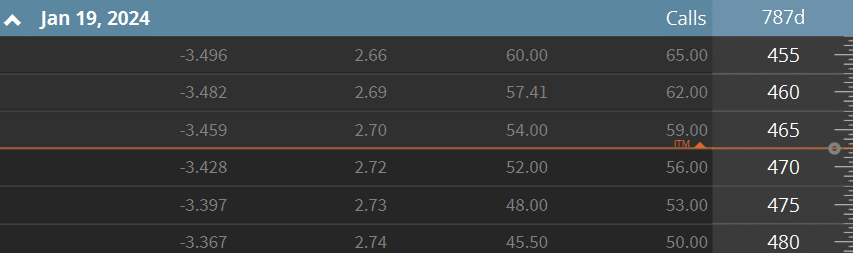

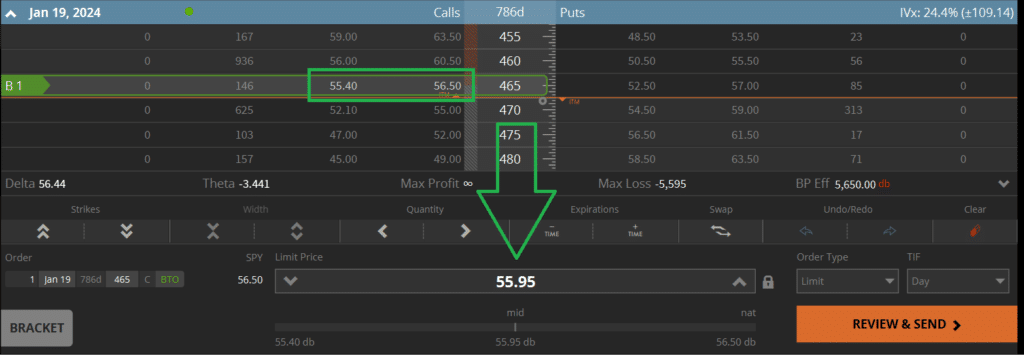

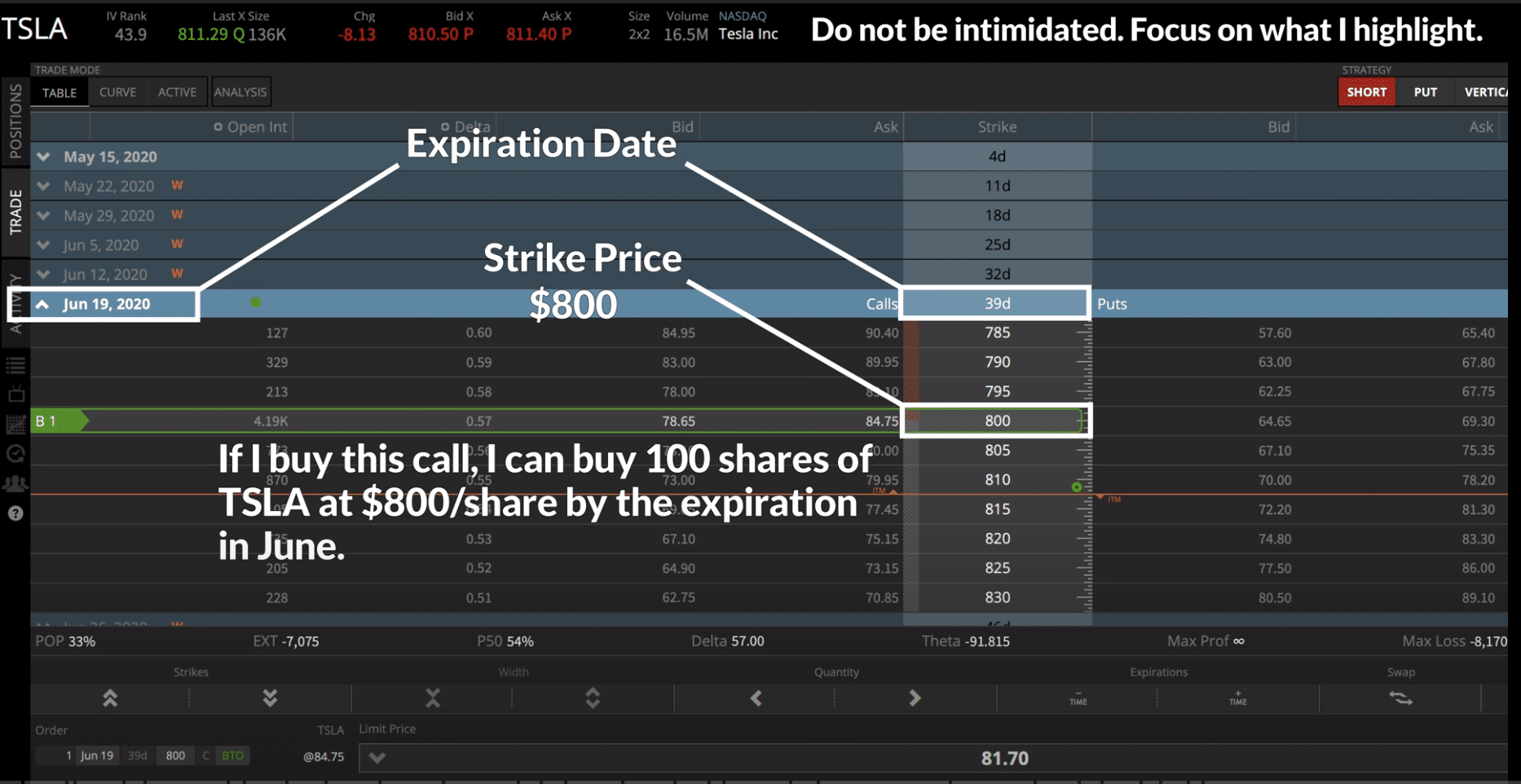

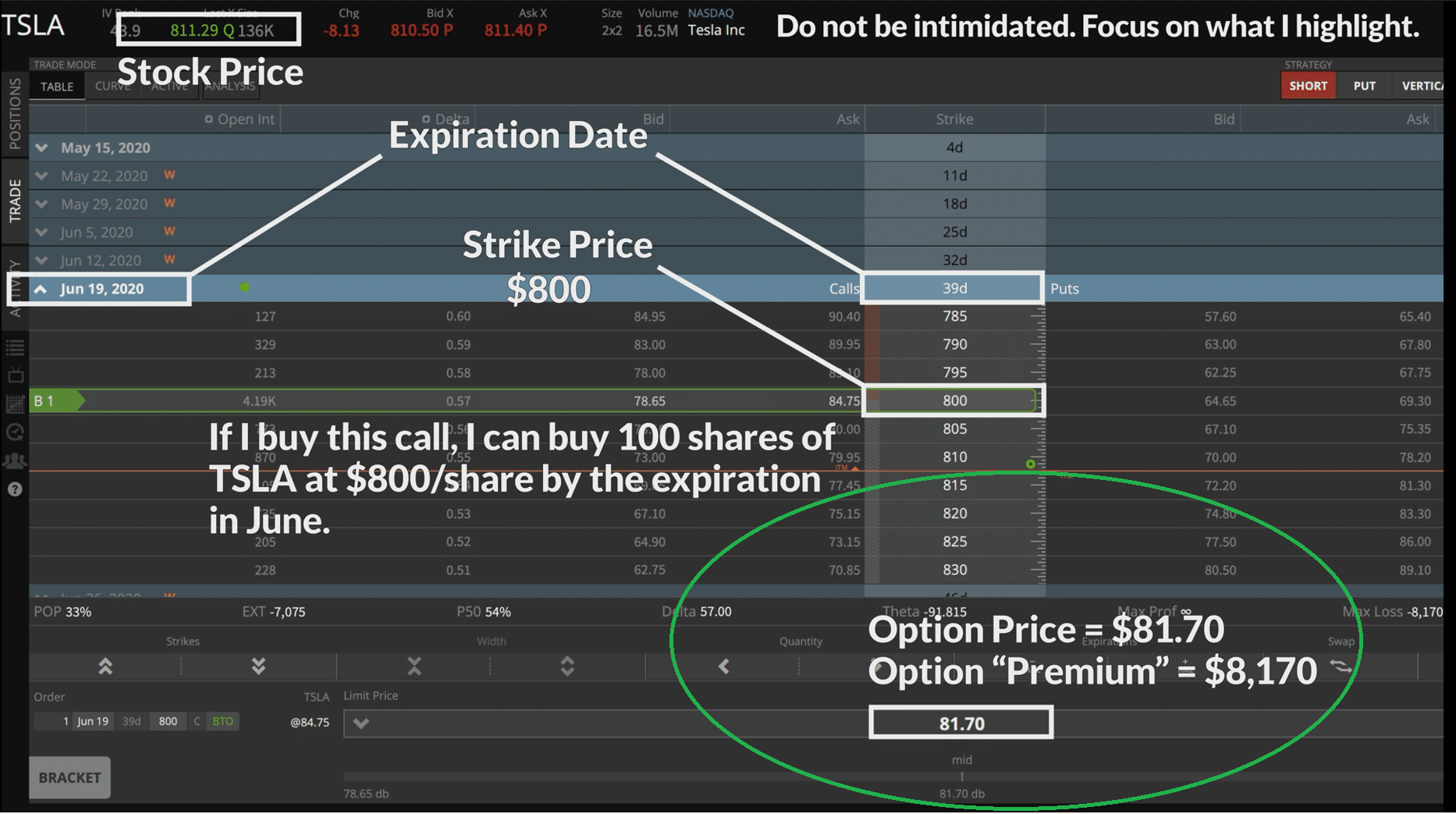

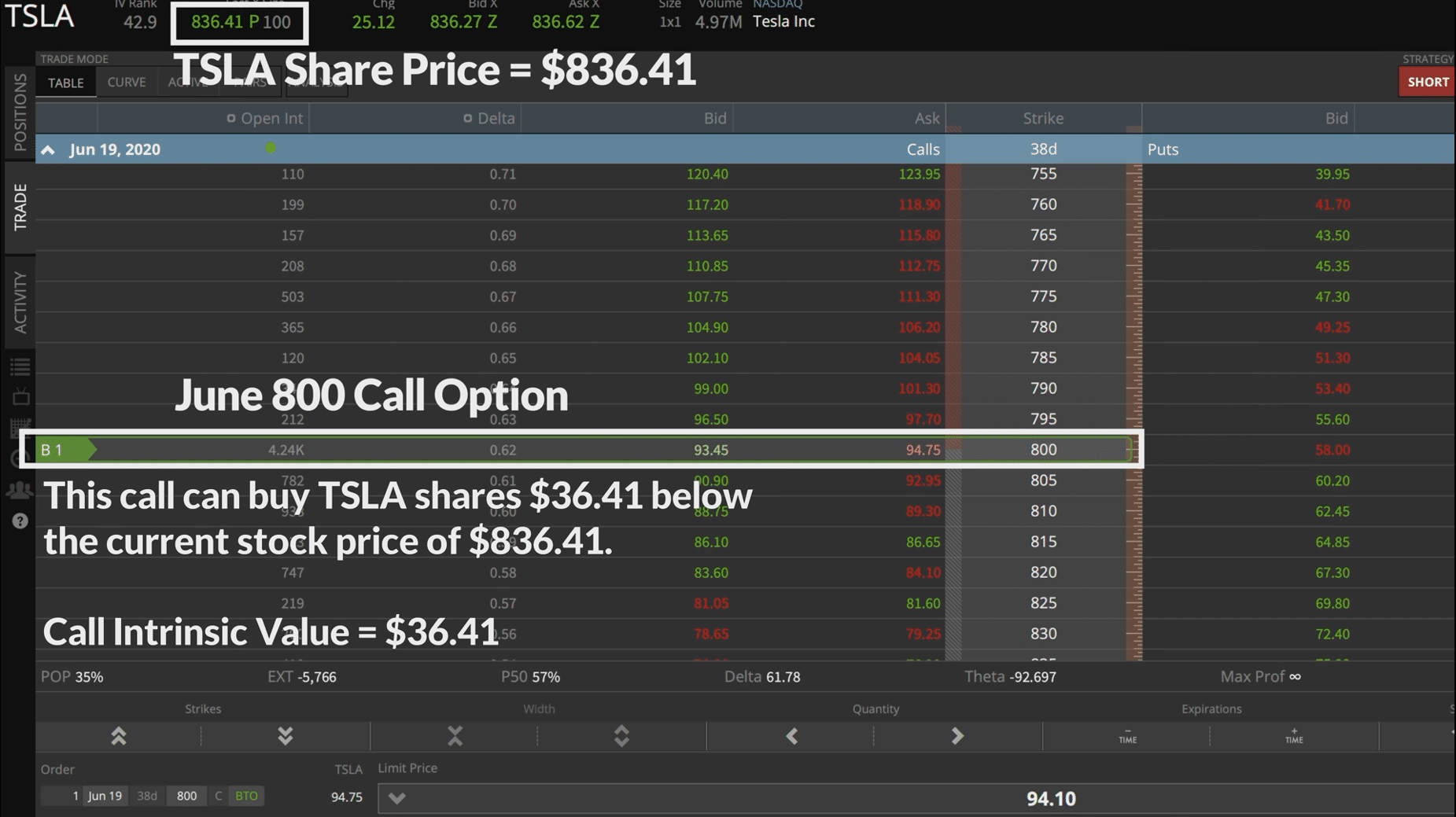

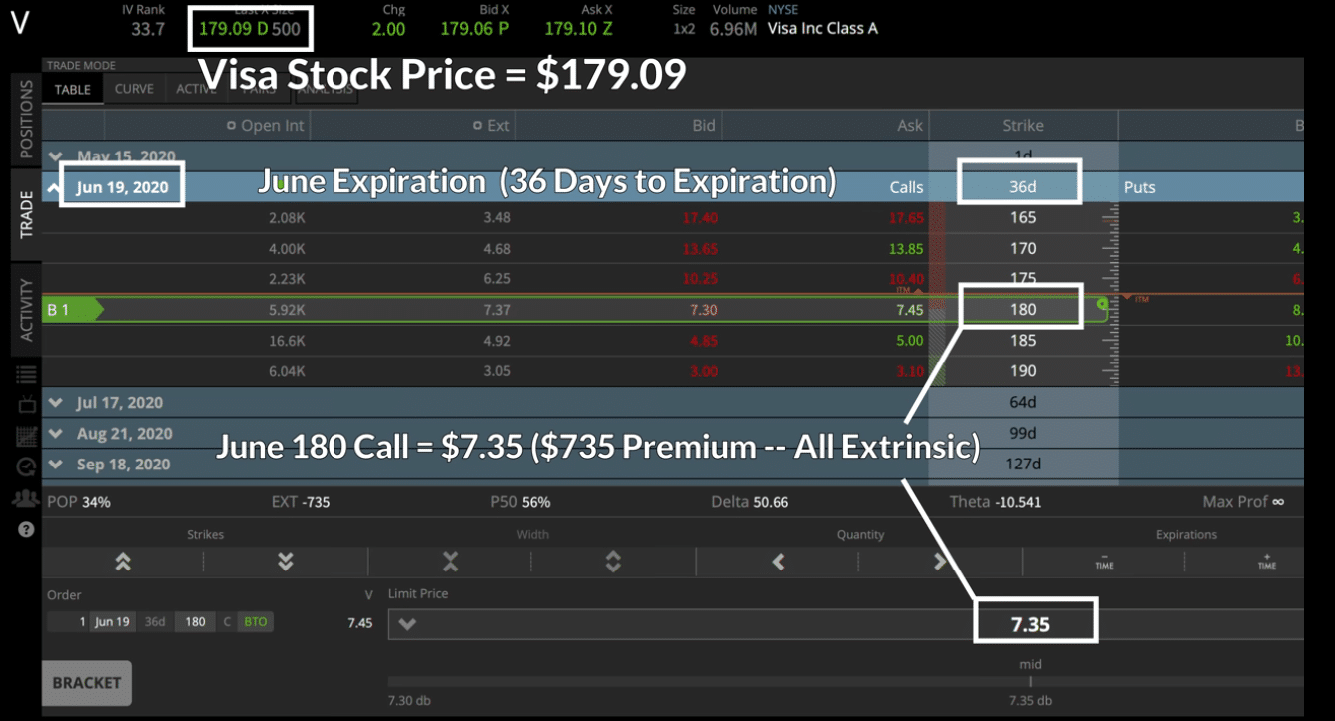

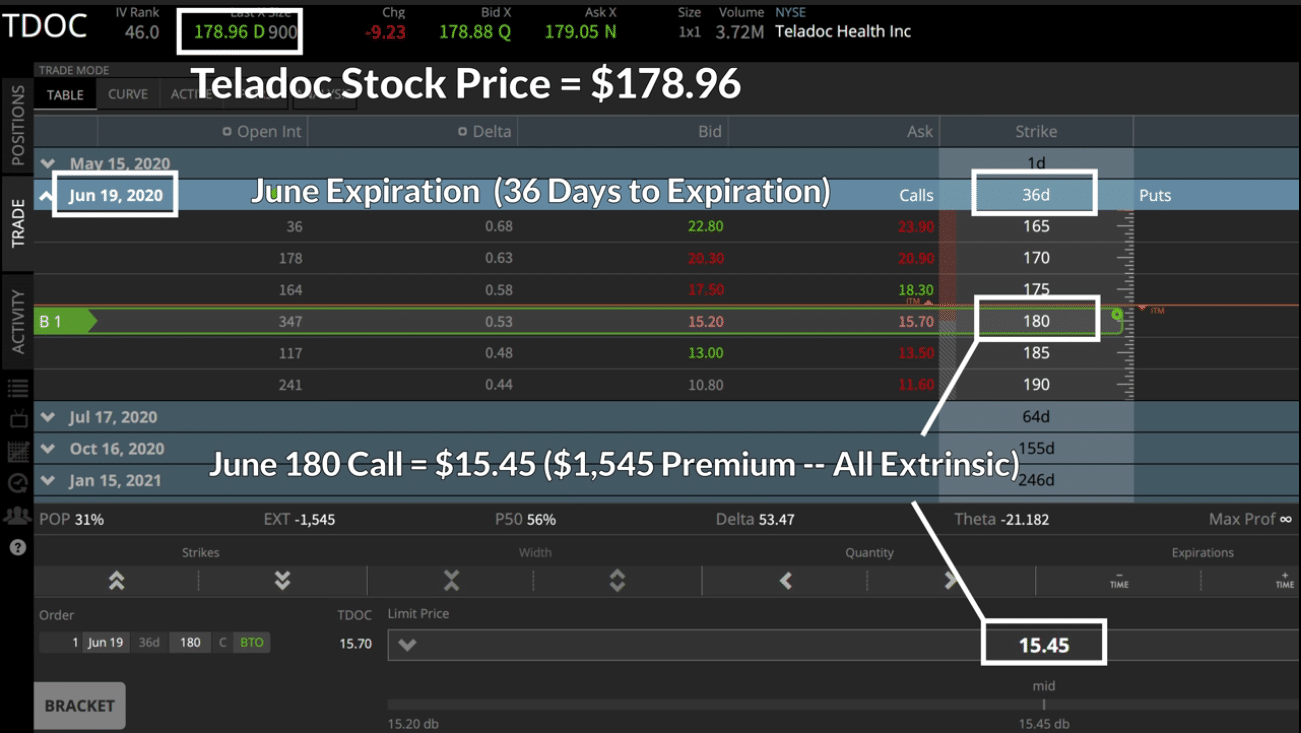

Now since we are selling both a call and a put, we must add these deltas together to determine the odds these options have of expiring in the money. If both of our options have a delta of 0.16, they will dually have a 32% (16%+16%) chance of expiring in-the-money. The below image shows these deltas on the tastyworks trading platform.

If the options together have a 32% chance of expiring in-the-money, they must therefore have a 68% chance (100%-32%) of expiring out-of-the-money, which is our goal being sellers!

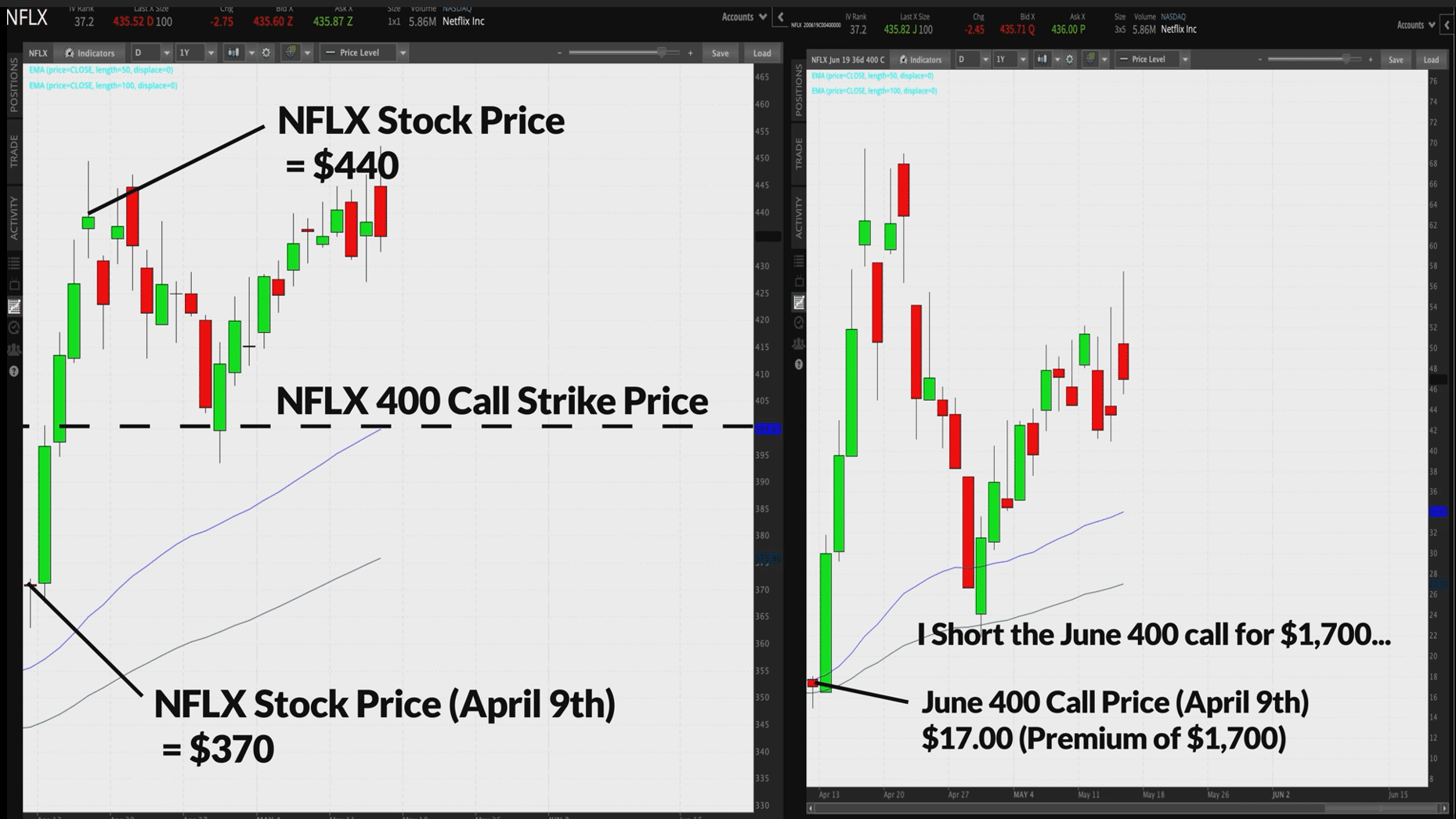

When To Sell Iron Condors

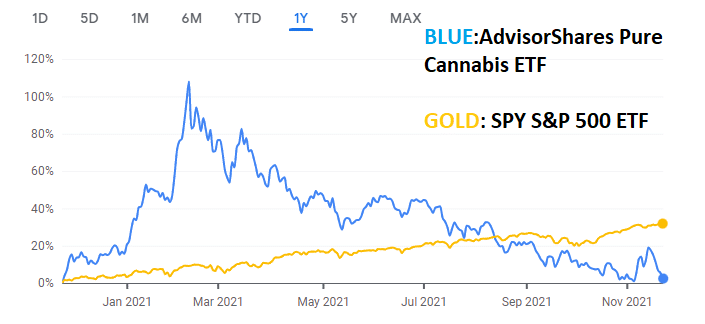

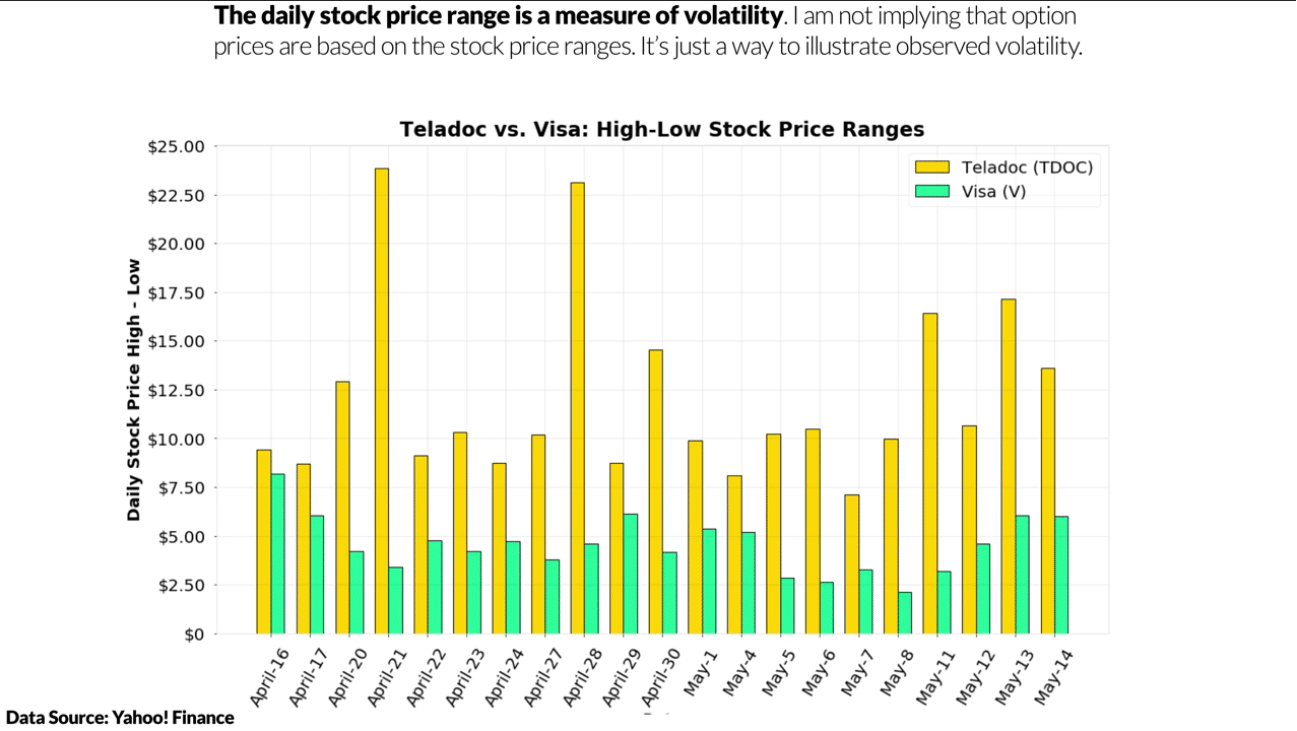

The best time to sell an iron condor is when volatility is high. Why? The higher the implied volatility, the greater the premium you will collect. Remember, when you are a net seller of options, you want to take in as much credit as possible. Ideally, the options you sell will expire worthless, and the full premium will be collected.

As a rule of thumb, sell iron condors when:

- Volatility is currently high

- You expect this volatility to decrease

Final Word

The iron condor is a great risk-defined strategy for market-neutral traders.

As mentioned before, the best time to sell an iron condor is when implied volatility is elevated. As long as this volatility settles, you will probably be in good shape. Many times, however, volatility can build upon itself.

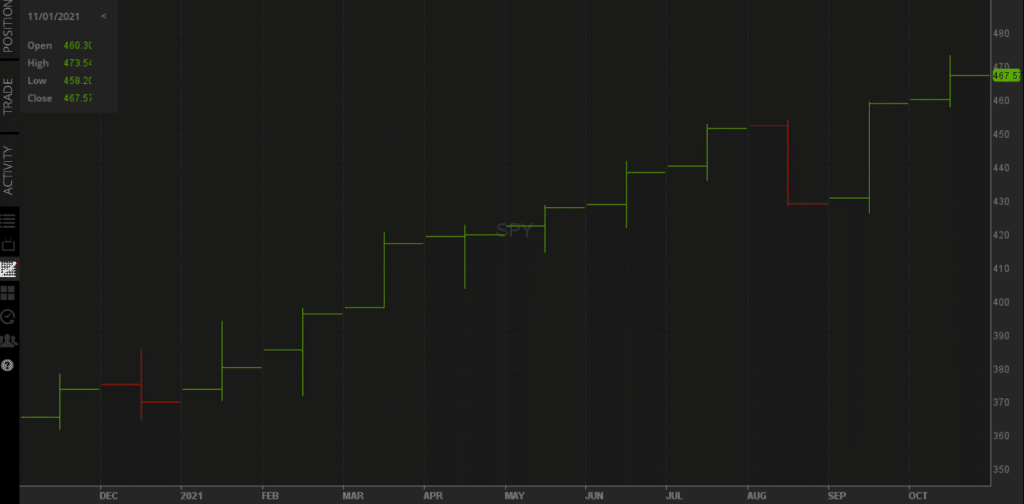

It is always wise to step back and take the general temperature of a stock (or ETF or index) before placing an iron condor. If you believe the volatility will be short-lived, you will have a high chance of success.

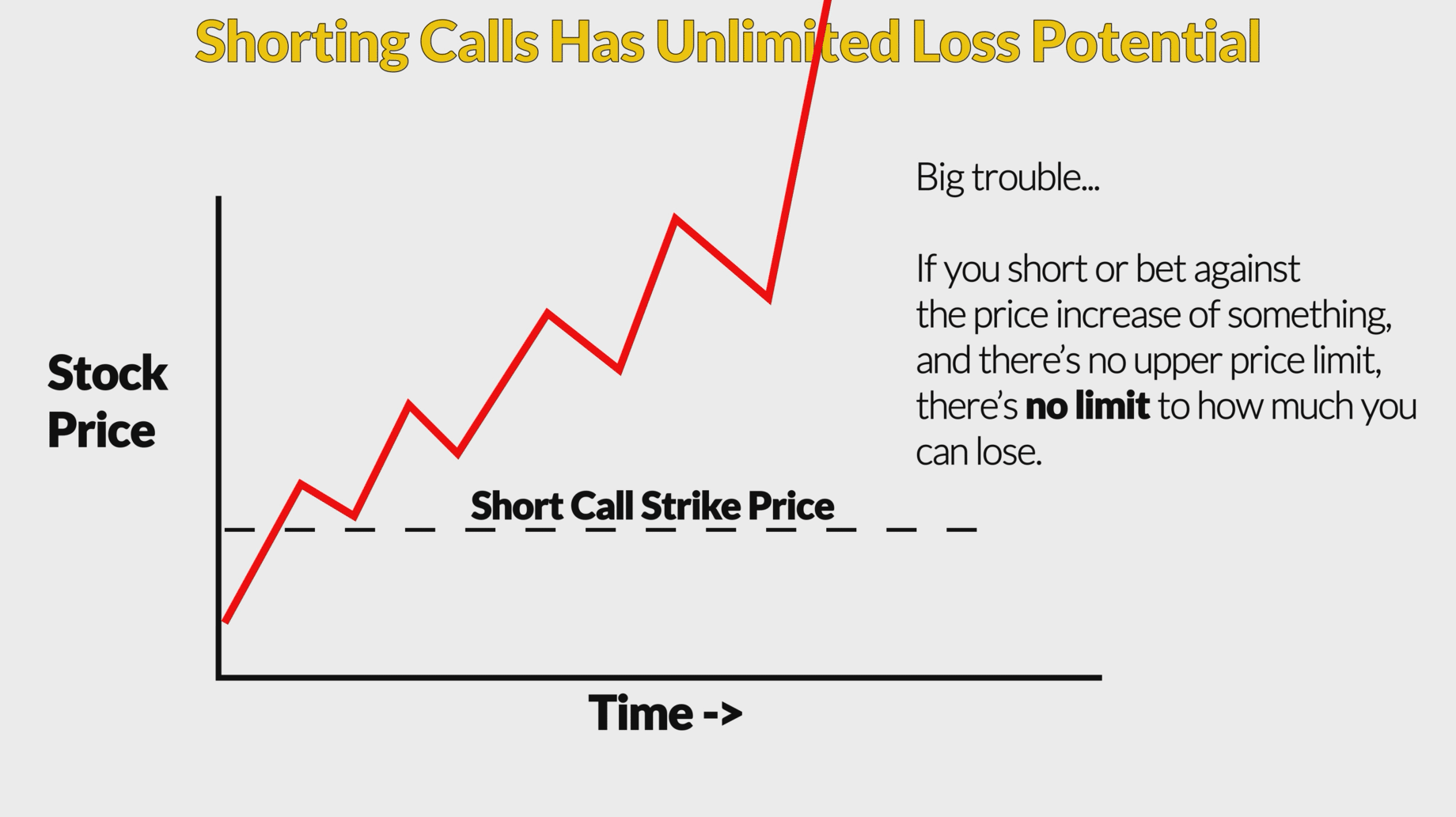

However, during volatile times (like the pandemic) shorts can be breached. But the best part of this strategy is its risk-defined nature. Unlike selling options naked, here, you know exactly how much you can lose.

As stated by the Options Industry Council, it is wise for traders to monitor short in-the-money options as they may be at risk of assignment.