Last updated on March 1st, 2022 , 07:10 pm

5 Easy Ways to Start Investing Today

It’s never too early or too late to begin investing. Here are some tips to get started.

Jump to:

So you’re interested in getting started with investing. Congratulations! Investing can be a daunting subject, so kudos for making the first step.

First things first: the most important part of investing isn’t investing at all, but budgeting. After all, how can you invest if you don’t have any money to invest with?

Budget

If you’re a young, recent college graduate, chances are your expenses are high and your salary is low – not the ideal situation. Student debt, rent, groceries, phone bills, etc, etc; all cripplingly add up.

At this stage in your life, it’s easy to put investing in the back of your mind. In fact, that’s exactly what the majority of Americans do! It is estimated that as many as 64% of Americans aren’t ready for retirement.

That is a staggering and scary number. The worst part about procrastination is it gets easier with every passing year. But there’s still hope, even for the procrastinators. But you have to start today. Right now. This moment.

Investing is nothing more than mindful budgeting, and budgeting is nothing more than habit.

Examine Your Expenses

Examine every expense in your life; your transportation methods, your clothing, even your morning coffee. I bet that if you look hard enough, you’ll find at least two ways to reduce spending without impacting the quality of your life. It has been estimated that a tall coffee at Starbucks every day adds up to $1,221 annually!

Let’s say 10 years ago you decided to forgo your expensive Starbucks coffee and invested that money in the S&P 500 instead. Today, that $1,221 would be worth over $3,740.

If you’re like me, there’s little chance you’re giving up your morning cold brew ritual, but the point is small purchases here and there can add up very quickly. Remember, it’s not so much what that dollar means today, but more about what it could mean down the road.

For example, the average Chicagoan spends over $118 on ride sharing every month; that number rises to $138 in NYC. That’s over $1,600 per year. Simply making your coffee at home and jumping on the bus can add up to TONS of savings over the years.

So the first step is to determine what you can live without. Tighten the belt so you can feel it, but not so much that it hurts. You may even come to discover that living on a budget actually increases your enjoyment of life. After all, when you have less of something, its value increases.

Before we begin, I want to leave you with my two pillars of investing. If you take nothing away from this article, please remember this:

- Invest Early

- Invest Often

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

1. Retirement Accounts

Retirement accounts are listed number one on this list for a reason. Before you even think about investing in anything else, make sure you have contributed as much as possible into your retirement accounts. Why? Retirement accounts offer amazing tax advantages.

401(k) Plan

If you’re fortunate enough to have a 401k plan through your employer, those contributions go into your account before you pay taxes on them. This saves you money instantly.

Let’s say you make 50k/year and you decide to put 10k into your 401k plan. For that year, you’re only paying the government taxes on 40k. As my accountant once asked me, “Would you rather pay taxes on 50k or 40k?”

So 401k contributions go into your account tax-free, but what about when it comes time to withdraw? Withdrawals in 401k’s are taxed as ordinary income.

Generally, in retirement, you’ll be making less money than in your working years, so hopefully, you will be in a lower tax bracket when it comes time to withdraw. This is how it works for most people, but not all. If you stumble upon a windfall or adhere strictly to the F.I.R.E.(Financial Independence, Retire Early) mentality, maybe you’re expecting to have more income in retirement than you did when you worked. Wouldn’t it be nice if some of your withdrawals could be completely tax-free?

ROTH IRA

This is when the Roth IRA comes in handy. Roth IRA withdrawals are 100% tax-free. The contributions to them, however, are made with after-tax dollars.

There is one more advantage to having a Roth IRA. We have no idea what the country’s tax rates will be next year, let alone thirty or forty years down the road. During WW2, some individual tax rates climbed to over 90%!

Wouldn’t it be nice to have a chunk of savings immune to whatever political future is in store? Roth IRAs provide this shelter.

Another nice advantage of Roth IRAs is the flexibility they offer. Company-sponsored 401K plans typically are limited to a handful of mutual funds. If you open a Roth IRA, you can invest those funds any way you like.

For most people, keeping the vast majority of their savings in a 401k makes sense. At the very least, you should contribute enough to match that which your employer contributes (this average match being 4.3%).

Below are the 2021 contribution limits for both plans.

NOTE: These limits are separate, meaning you could in theory contribute a total of $25,500 in 2021. This is assuming your income threshold allows you to contribute to a Roth IRA.

- 2021 401k Contribution Limit: $19,500

- 2021 ROTH IRA Contribution Limit: $6,000

2. Brokerage Account

If you are satisfied with both your 401k and Roth IRA contributions for the year, another great and potentially lucrative way to invest in your future is through the stock market through a brokerage account. Again, this should be done only after you have contributed as much as possible to your 401k and ROTH IRA.

Remember, in retirement accounts, you have huge tax benefits that will weigh big time on your future returns, I’m talking potentially hundreds of thousands of dollars over the years. In a brokerage account, you deposit funds with after-tax money and then have to pay capital gains on any proceeds.

The first step is to open a brokerage account. We have decided to work with Tastyworks as they are the best in the business on most fronts. Not only do they actually answer the phone when you call, but you’ll speak with somebody who didn’t get their Series 7 last Monday.

Approaching the stock market for the first time can be a nerve-racking experience. This need not be the case. If you’ve been paying attention, you probably have picked up on my minor obsession with diversification. I stress this in the stock market more than anywhere.

ETFs (Exchange Traded Funds)

The best part about exchange-traded funds (ETFs) are they do the work of diversification for you. As a matter of fact, in order to have a fully diversified portfolio of US stocks, you only need to buy one ETF – VTI (Vanguard Total Stock Market Index Fund ETF Share).

Buying one share of this ETF will expose you to over 3,500 companies in the US. Today, VTI is trading around $219/share. Can you imagine how much it would cost you to buy each of these 3,500 stocks individually?

"Buying one share of this ETF will expose you to over 3,500 companies in the US."

Within this impressive basket, you’ll have exposure to large-cap, mid-cap, and small-cap stocks as well as the numerous growth and value stocks within these categories.

Adding VXUS (Vanguard Total International

Stock Index Fund ETF) in addition to VTI will give you exposure to a well-diversified blend of over 7,500 international stocks as well.

Combined together, these two low-fee ETFs will give you exposure to over 11,000 stocks, and all you need to do is buy two!

I can tell you the power of these two stocks by comparing their YTD returns to one of my retirement accounts. I spent countless hours crafting this portfolio, making sure all the ETFs were at least 4 stars on Morningstar, with most outperforming the underlying index. There are dozens of ETFs within it.

ETFs vs Mutual Funds

I compared my results to that of VTI and VXUS last week. And you know what? VTI and VXUS beat my returns on the year. Not by much, but they still performed better. Going forward, I’m going to let the folks at Vanguard do the work for me.

Both VTI and VXUS are index funds, meaning their aim is to match the index representing them. This leaves little room for subjective minds. I like this because I know as many as 85% of fund managers (stock pickers) underperform the market.

In my experience in the retail trading world, the biggest mistake investors make is thinking they can do it all on their own. If Albert Einstein can’t beat the stock market, I don’t believe fund managers, or myself, stand a chance.

3. Real Estate

Homeownership

Perhaps the best (yet most difficult) way to invest in real estate is to buy the physical property yourself. With today’s mortgage rates lingering around 3%, mortgage loans are as attractive as ever. Compare today’s thirty-year mortgage rate of 3% to the 1980s, when it climbed as high as 18%!

One of the most attractive and overlooked components of homeownership is the tax benefits that come with selling. If you can sell your property for a profit, (assuming you have lived in the property for 2 years) the first $250,000 in gains is completely tax-free. This number goes up to $500,000 for a married couple.

Homeownership could potentially save you money too. Sum up the total of all of your rental expenses and compare this number to the complete costs of a mortgage (make sure to include taxes, insurance, and HOA dues). If the numbers are comparable, and the prices in your neighborhood aren’t too elevated, why not purchase a home/condo?

Mortgage Advantages

Having a mortgage reduces your taxable income, too. Part of every mortgage payment is interest, and you can write-off mortgage interest payments on your taxes. As an example, if you paid $10,000 in mortgage interest in a given year, you can deduct that $10,000 from your taxable income earned in that same year. If you’re paying rent and don’t own a home, you can’t enjoy that benefit.

Lastly, mortgage payments are mostly payments to yourself. When you are renting an apartment, 100% of that payment is an expense. Money burned. When you have a mortgage, your mortgage payments will consist of principal and interest.

Principal payments simply represent repayment of the loan (mortgage) given to you by the bank, while interest payments represent the fee or cost of borrowing that money. Principal payments can be thought of as payments to yourself, as you’re building equity (ownership) in your home by slowly paying off the loan issued to you by the bank. Since a mortgage is a loan to you from a bank to buy a home, the bank essentially owns that portion of the home. If you make a $100,000 down-payment to buy a $500,000 home, then your mortgage is $400,000. The bank effectively owns 80% of your home ($400,000 / $500,000). You own the other 20%, or $100,000, which is your equity.

As you make mortgage payments, your loan balance decreases and your home equity grows.

Mortgage Example

As an example, let’s say your monthly mortgage payment is $2,000, with $1,300 being principal and the remaining $700 being interest.

After one year, you’ll have paid $24,000 in mortgage payments, with $15,600 of that amount representing principal payments, and the remaining $8,400 representing interest payments.

The result? Your home equity grows to $115,600 after the first year, meaning you own more of the home and the bank owns less of the home. In essence, mortgage payments are basically investments into your home. So instead of paying rent and losing 100% of that money, having a mortgage results in payments to yourself, with only the interest portion of payments being lost. But as we mentioned earlier, you can deduct mortgage interest from your taxes.

In short, buying a home can be a win-win situation in terms of 1) paying yourself instead of a 100% rental expense, and 2) reducing taxable income by deducting mortgage interest payments.

If it makes sense but you’re still hesitant, just ask yourself one question: would you rather be adding to your own equity every month, or somebody else’s?

If and when you decide to move and don’t want to sell, you can always rent the property out. Rental properties provide for stable and mostly market immune income. Renting also comes with tax advantages as well.

If that all sounds like too much of a headache for you, there are many other ways to invest in real estate, many of which require just a few clicks of your mouse.

Real Estate ETFs

The simplest and most liquid of all ways to invest in real estate is to do so through an ETF (exchange-traded fund). ETFs trade just like stocks. One particularly attractive fund for today’s skyrocketing residential housing market is REZ, the Residential and Multisector Real Estate fund, brought to you by iShares.

Below are a few more popular real estate ETFs. Check them out on Morningstar for unbiased reviews as to their historic and latest performance.

- VNQ

- IYR

- SCHH

- INDS

Another passive real estate option would be investing directly in a real estate investment trust (REIT). To learn more about the different kinds of REITs, checkout out our article, Equity REITS vs. Mortgage REITs

Fundrise

Fundrise is a burgeoning real estate crowdfunding platform. It is a great way for those looking for a more hands-on approach to real estate investing. Unlike simply buying an ETF, investing through Fundrise allows you to see what you’re investing in and how each of your real estate investments is coming along.

Fundrise segments their investors by account level. $500 will get you set up with their lowest “Starter” account. These levels go all the way up to 100k+, which is called their “Premium” account level.

The downside of Fundrise is, compared to ETFs, the liquidity is not great. You’re only able to sell your shares four times a year (at the end of each quarter). If you have a long time horizon, that may suit your needs. For those of us that have lived through the housing bubble, this lack of liquidity brings cause for concern.

The fees at Fundrise could also eat into your profits over time. They charge an asset management fee of .85% in addition to an advisory fee of .15%, the total of which is more than double the fees of the very liquid REZ ETF.

With competition growing in the real estate crowdfunding space, these fees are almost certain to go down in the future. I’ll think more seriously about investing in them when this time comes.

4. Cryptocurrency

A friend of mine asked me 3 years ago what I thought of Bitcoin. I told him I thought it was too risky at 15k. I was invested in three different cryptocurrencies at the time, but I couldn’t believe their meteoric rise would continue much longer.

That very same friend asked me last week the very same question, but I had a different answer. I told him all investment portfolios should have some (very small) exposure to cryptos. I told him this because, in the past 3 years, I believe the crypto space has graduated from being a casino to becoming a widely accepted asset class.

A well-diversified portfolio has exposure to as many assets as possible, regardless of risk. I can’t think of any better hedge to the innumerable black swans that await this world than bitcoin.

"I can’t think of any better hedge to the innumerable black swans that await this world than bitcoin."

Dangers of Investing in Crypto Stocks

Just like in real estate, you can invest in Cryptocurrency through stocks, but, at the moment, these stocks are a poor substitution for the real thing.

GBTC is just one example. It is a bitcoin trust (Grayscale Bitcoin Trust), designed to track the actual coin. The shares of a trust however, are very different from ETFs, as a trust can trade at a discount/premium to its actual holdings. Net Asset Value (NAV) represents the per-share equivalency of its holdings. Shares of an ETF will trade very closely to their NAV as Authorized Participants buy/sell shares of the ETF and its actual components to keep the ETFs shares close to NAV.

With a trust like GBTC, supply and demand dictate the price of the shares, whereas the price of ETFs is generally dictated by the underlying holdings.

Until cryptocurrency ETFs become approved in the United States, your best chance at crypto exposure is to buy it directly through an exchange platform like Coinbase. You will pay high fees, but at the moment, there is no better option for the amateur crypto investor.

Even better, you can take the Warren Buffett approach and set up a recurring purchase plan for bitcoin with a platform like Swan Bitcoin. Swan’s platform is the easiest way to start buying bitcoin as a beginner. Generally, you can get approved at Swan within a matter of minutes, and they are available globally. Compared to cryptocurrency exchanges like Coinbase or Gemini, you will save 23-80% in fees on recurring purchases by using Swan.

In 2021, a bitcoin futures-based ETF was launched. This product, however, has many risks. Be sure to check out our article, “ProShares BITO ETF Explained” to be more informed on these risks before investing.

5. Savings Account, Money Market, Treasury Securities

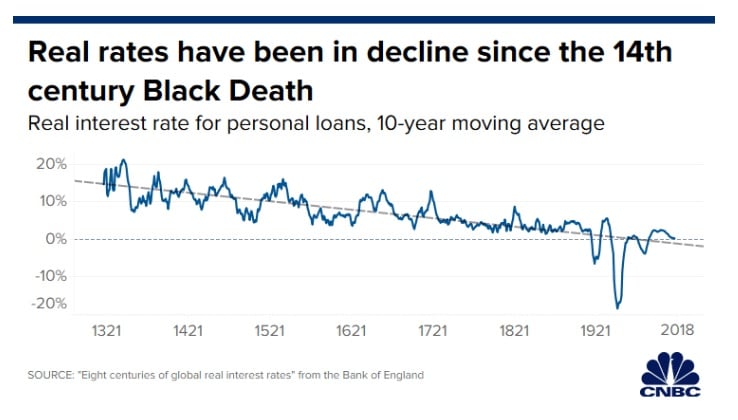

Next on our list, we have savings accounts, money market accounts, and Treasury securities (bonds). These traditional savings options are perhaps the least sexy right now on account of today’s historically low-interest-rate environment.

Interest rates are currently lower than inflation. This means that your money in the bank loses value every year. Why would anyone have their money in an investment that loses money?

Because it’s the only option we have to park cash (relatively) risk-free. Because a 0.07% interest rate is better than the 0.00% interest rate the money under your mattress accrues.

For the elderly and risk-averse, this is truly a financial nightmare. To make things worse, low rates appear to be the new normal. One famed economist has even made a convincing case that interest rates have been going down since the hyperinflation following the Black Death!

Considering the world is only just now recovering from yet another pandemic, the future of those seeking returns through more traditional savings accounts and government securities is bleaker than ever.

But that isn’t to say you shouldn’t have some money in the bank. It seems nothing is safe from the volatile swings occurring across today’s numerous asset classes. One rule of thumb is to keep three to six months of your salary tucked away in as risk-free of an environment as possible.

BlockFi's High Interest Rate

For those who are willing to take on more risk in a savings account, BlockFi is currently offering a remarkably high interest rate of over 7% on stablecoins. Stablecoins maintain a stable exchange rate with assets such as the US Dollar, and are far less volatile than regular cryptocurrencies, which is exactly why they are called stablecoins.

A cryptocurrency like bitcoin may be worth $30,000 today and $60,000 in a month, which means it has a variable or floating exchange rate. A USD-backed stablecoin such as USDC keeps a 1:1 exchange rate with the U.S. dollar. If you buy 1,000 units of USDC with $1,000, you can later convert your 1,000 units of USDC back into $1,000.

While the intention here isn’t to be a doomsayer, USD-backed stablecoins still represent the U.S. dollar, which means you do have currency-related risks. With the current rate of U.S. dollar money-printing right now, some fear that the U.S. dollar is in trouble. When the supply of something is rapidly increased, each unit loses value. So if you’re worried about the long-term value of the U.S. dollar, then buying a USD-backed stablecoin may not be the right choice for you.

The interest rate that can be earned on stablecoin deposits is subject to market conditions and may change over time, but for now, earning 7.5%+ interest on idle cash in a savings account may be well worth it for those willing to take some additional risk with that cash. I must mention that there is also a greater risk in BlockFi’s interest-bearing accounts as they are not FDIC insured.

To learn more about BlockFi, watch our YouTube video on the subject.

But remember, most of your rainy-day funds should be held in tried and tested banks.

Conclusion

There are innumerable ways to invest money. The key, from my experience, is to not get too creative. When I think of speculative investments, I always think of Mark Twain. America’s funniest man was also America’s worst investor. Everything he touched failed. His “Paige Typesetter” investment nearly destroyed both him and his family.

Perhaps the worst part of Twain’s story is what he wasn’t doing while he was worried about his investment in an over-complicated, 18,000 piece printing machine – and that is writing. I can’t help but wonder how many more works he would have produced had he simply invested his money in VTI and VXUS instead of impossibly complicated printing machines.

Do what you love, and let your money work for you. I promise you, if you invest with both diversification and intelligence, you won’t be disappointed in its work ethic.

After having put down one of my idols, I feel I must end this article with a quote by him.

“The lack of money is the root of all evil” – Mark Twain