Last updated on February 11th, 2022 , 09:19 am

The vast majority of options traders place trades that have a lifespan of 30-60 days. For this reason, those who utilize options are often referred to as “traders” rather than “investors”.

But not all options expire in this narrow window. Some options expire several months or even years in the future. These types of derivatives are known as long-term equity anticipation securities, or simply LEAPs.

According to the OIC (Options Industry Council), LEAP calls enable investors to “benefit from stock price rises while risking less capital than required to purchase stock.”

Although LEAPs do indeed offer less principal risk when compared to equities, the probability of success is less in LEAPs than stocks.

Because of their long lifespan, LEAPs (though still options) act more like investment vehicles than trades. Long-term options are best suited for long-term bullish (or bearish for puts) investors on an underlying stock or security.

Should LEAPs find a home in your portfolio? In this article, projectfinance will make an argument for (and against) LEAPs.

TAKEAWAYS

- LEAP options have expiration dates of more than one year in the future

- Long-term options are always less liquid than short-term options

- The wide bid-ask spread in LEAPs is attributed to low open interest and volume

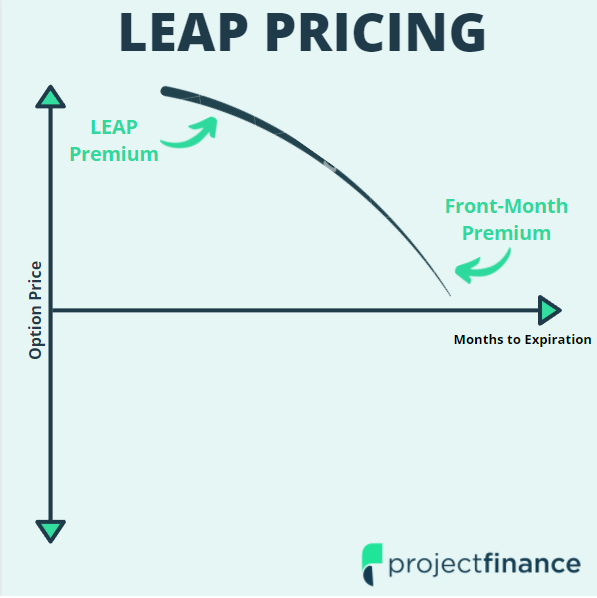

- When compared to short-term options (such as front-month options), LEAPs are less sensitive to time decay

- The leverage of LEAPs allows for magnified profits and losses when compared to buying the underlying stock/ETF

What are LEAPs in Options Trading?

Long-Term Equity Anticipation Securities (LEAPs) Definition: In options trading, LEAPs refer to call and put options which have expiration dates that are more than one year in the future.

There is no set time frame that defines a LEAP, but generally, options that have an expiration date that is greater than one year from the present are considered LEAPs.

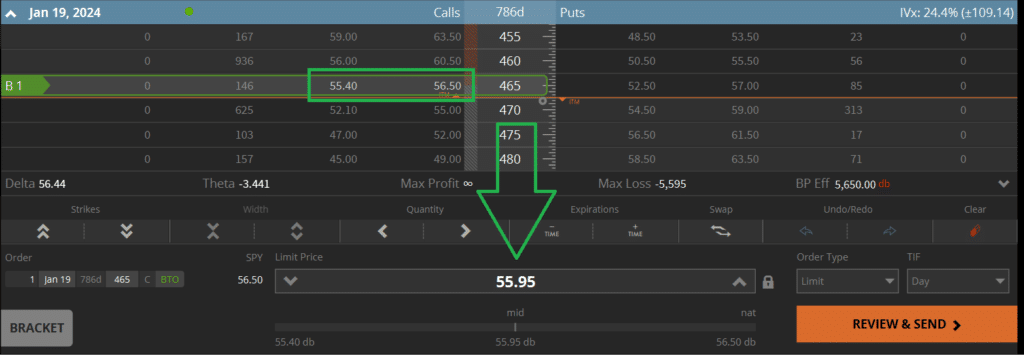

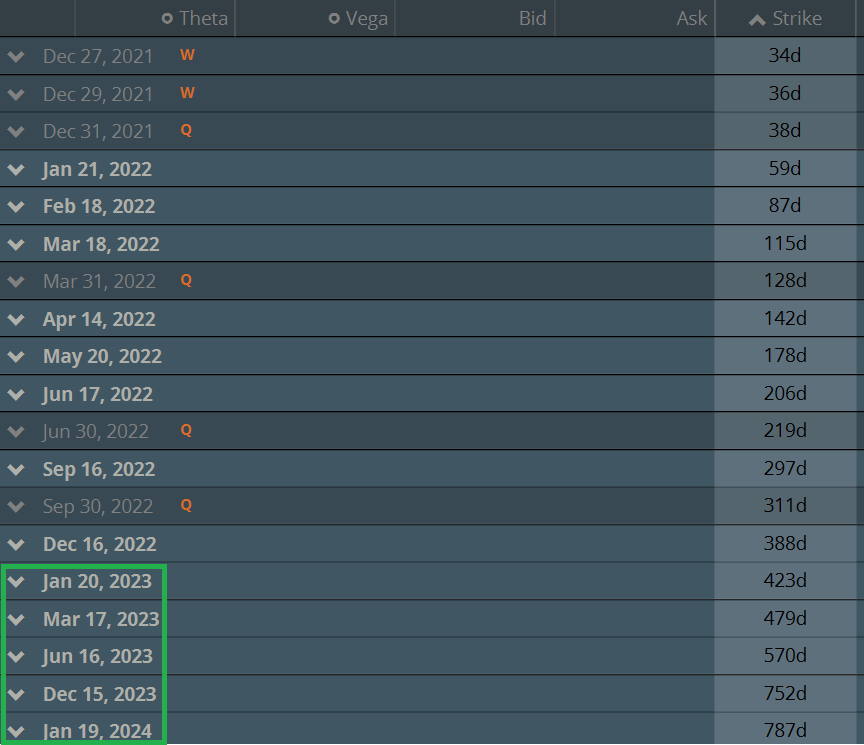

Let’s take a look at how SPY (S&P 500 ETF) LEAPs appear on the tastyworks trading platform.

SPY Options Chain

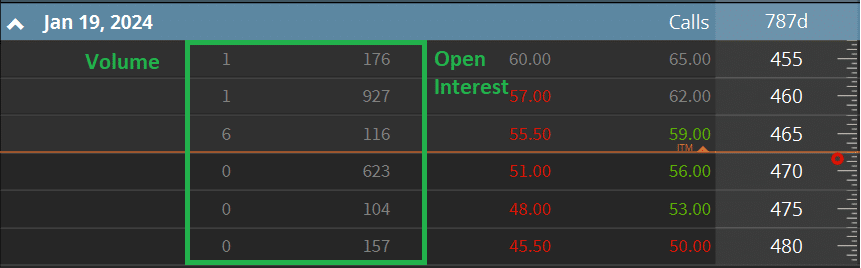

We’re going to focus on the bottom portion of the above image, where LEAPs are circled in green.

Today is November 23, 2021. Some of these options don’t expire until January of 2024! We can see to the right of the month that these options expire in 787 days. That’s a lot of time!

These options are known as long-term equity anticipation securities.

We assume in this article that you have already mastered the basics of options trading. If options are new to you, check our free, comprehensive guide on the subject below!

- Options Trading for Beginners: The ULTIMATE Guide

The best way to understand LEAPs in both calls and puts is by comparing them to more popular, short-term options. Let’s get started!

Short-Term vs Long-Term Options: The "Spread"

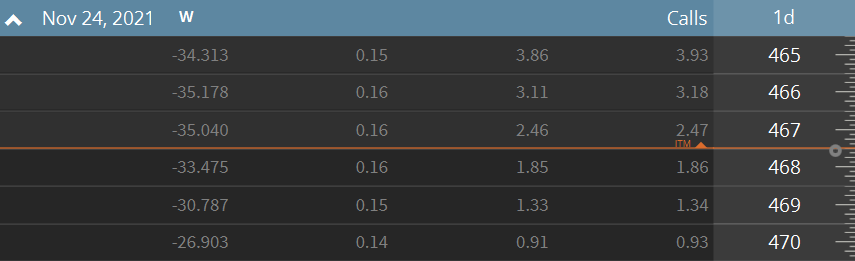

Generally speaking, the closer an options series is to expiration, the more popular those options are. “Front-Month” (or week) options are the next to expire, and listed first on an options chain. Take a look at the below image, which shows call options on SPY set to expire tomorrow.

What we are interested in here is the “bid-ask” spread (the two columns to the left of the “days to expiration” column).

Let’s focus on the 467 call strike. This option can currently be sold at 2.46 and purchased at 2.47. This means we can enter and exit this position right now and only 0.01 would be lost.

How do these spreads look on longer-term options? Let’s take a look!

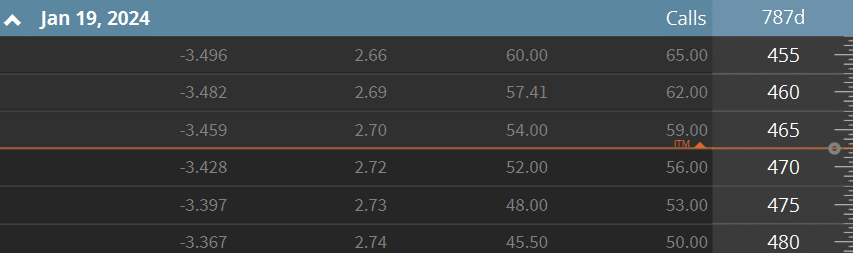

From the above LEAP options chain, we can see the spreads for the at-the-money call options have widened from being one penny wide to $4-$5 dollars wide!

Additionally, the premiums are quite a bit higher – the greater the time to expiration, the higher the premium will be.

So what do these wide spreads mean?

If we were to buy at the ask price, and immediately sell at the bid, we would lose about $4. When taking into account the multiplier effect, that’s a $400 loss on a one lot!

LEAPs, therefore, are considerably less liquid than their shorter-term counterparts.

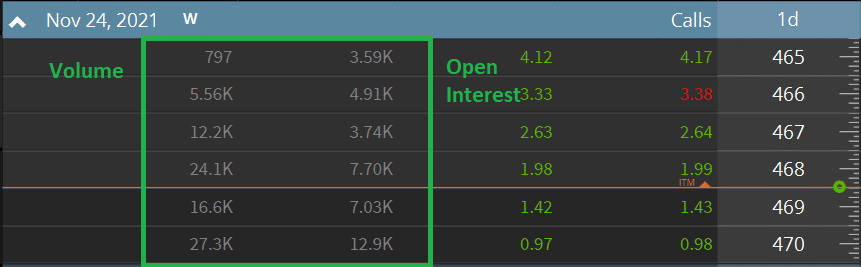

This liquidity problem is caused by two factors: volume and open interest.

Volume and Open Interest in LEAPs

- An options volume tells us how many contracts in that particular expiration and strike price have traded all day.

- An options open interest tells us how many contracts are currently in existence for a particular option.

Both of these play a huge factor in determining the bid/ask spread that we talked about earlier. The more volume and open interest an option has, the tighter its spread will be.

If you take a moment to look at these metrics in both short-term and long-term options below, you will understand why LEAPs have such wide spreads.

SPY Short-Term Options Volume and Open Interest

SPY Long-Term Options Volume and Open Interest

Let’s take a look at the 470 calls on the top options chain first.

These options will expire tomorrow; 27k contracts have traded so far today (and it’s only the morning!)

Additionally, we can see the open interest for the 470 call is 12.9k contracts.

Now, how do these metrics look on the LEAP options chain below?

Zero of the 470 strike price calls have traded today. And the open interest? 623. Compare these numbers to the ones above, and you’ll see why the markets for these two options expirations are so different.

Short-Term Options vs LEAPs: Time Decay

When you’re trading short-term options, you’re paying very close attention to time decay. Time decay is also known as “theta”, which is one of the option Greeks.

If you’re long an option that is set to expire in a few days and the underlying stock price has not been moving, your option will decrease in value.

This is bad news for long option traders. Short option traders, however, love time decay because it leads to the option falling in price.

LEAPs are not as sensitive to time decay, or theta, as short-term options. Since there is more time to expiration, the stock has a better chance of rising (for calls) or falling (for puts) to a set strike price.

Undulations in the stock price do indeed affect the pricing of long-term options, just to a much smaller magnitude than options expiring a few days, or weeks, away.

Short-Term Options vs LEAPs: Implied Volatility

So we learned above that theta is not as detrimental to long-dated options when compared to short-dated options.

But what about implied volatility? What impact does implied volatility have on the pricing of LEAPs?

Generally speaking, the implied volatility of long-term options is greater than that of short-term options. This is part of the reason why LEAPs are so expensive.

Nobody has any idea what is going to happen a year or two down the road. Market-makers, therefore, charge a premium for this uncertainty in long-term options.

As a rule, the higher the implied volatility, the greater the premium for long-term options will be.

If you want to buy a LEAP, the best opportunity will probably be during a low-volatility environment.

LEAPs: Leveraged Return Potential

One options contract typically represents 100 shares of stock. Because of this immense leverage, options offer traders the potential for huge returns, as well as losses. For LEAPs, these profits (and losses!) can be magnified.

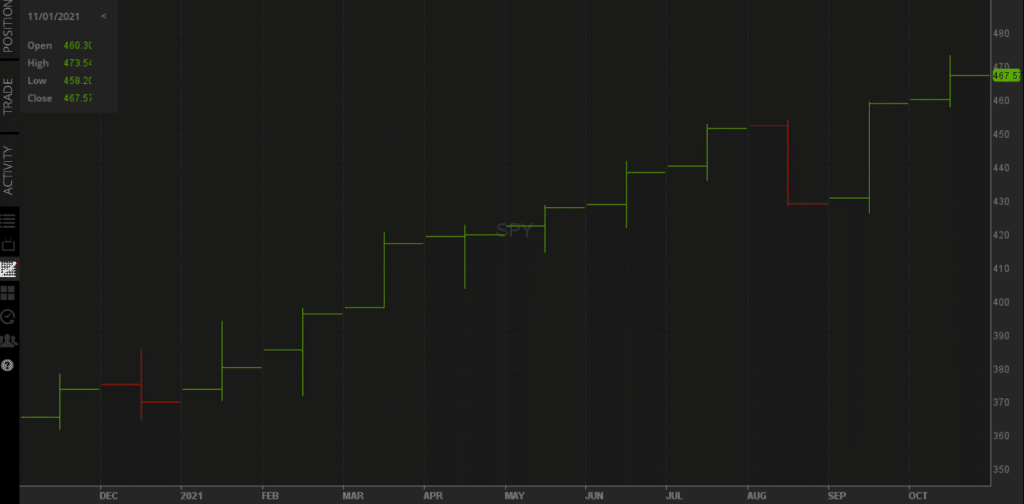

If you were bullish on SPY one year ago today, you would have made far more money if you decided to purchase a long-term call option when compared to the exchange-traded fund (ETF) itself.

Let’s say you decided to take this risk, and you purchased a SPY DEC 16, 2022 call option one year ago today.

The below image (from the tastywork platform) shows your return on this option (click to lighten and enlarge).

One year ago today, the above SPY option was trading around $5. Today, that option is trading at $40. You would have netted a 700% return!

Now what if we had purchased stock instead?

Over the past year, SPY stock increased from $365 to $467 per share. This makes for a very attractive return of 28%.

When compared to our LEAP, however, 28% suddenly doesn’t sound too great.

This example is rare; most of the time, over the long-run, stocks/ETFs outperform options. Our example does, however, give us an idea of the great leveraged returns that options offer.

Final Word

On top of all the other types of risks that come with options trading, LEAPs introduce yet one more: liquidity risk.

If you want to trade long-term options, it is vital that you try and get filled at the mid-point.

How do you do this?

If a LEAP option is bid at $55.40 and offered at $56.50, your best bet would be to place an order (either buy or sell) at the middle point. This point would be about $55.95 (as seen below).

If you don’t get filled here (and really want to be in the trade) start working that price up (if you’re buying) or down (if you’re selling) in 0.05 or 0.10 increments.

If you still aren’t getting filled, it is probably best to avoid that option.

In more liquid products (like SPY) you’ll have a better chance of getting a decent fill than more exotic stocks and ETFs.

Thanks for reading and happy trading!