Last updated on May 25th, 2022 , 02:30 pm

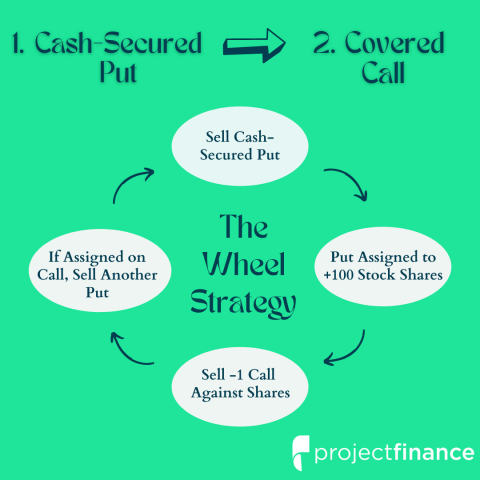

The Wheel Definition: In options trading, the “Wheel” is 4 step strategy that first involves selling a put option. If/when this put is assigned, you will be long stock. The next step is to sell a call option against this stock. If the underlying rises in prices, you will be “called out” on the stock, resulting in a flat position. Repeating this process creates “the wheel”.

The wheel strategy is a great, long-term options trading strategy best suited for traders looking to generate income. In this article, we will review step-by-step how this income strategy profits.

TAKEAWAYS

- The wheel strategy involves selling a cash-secured put, purchasing stock when/if the put is assigned and then selling a call against this long stock.

- Both the put and call sold are ideally out-of-the-money.

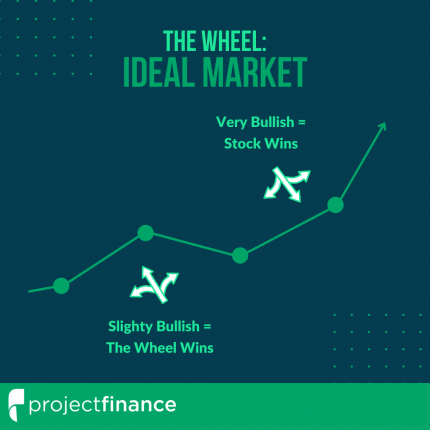

- The wheel options strategy works best in minorly bullish markets; in very bullish markets, owning the stock outright will be more advantageous.

Jump To

What Is the Options Wheel Strategy?

The wheel involves a multi-step, systemic process:

- Sell cash-secured puts on a stock you want to eventually own.

- When the stock falls below your short put strike price on the expiration date, your short put will be assigned and converted into long stock.

- Once in possession of the long stock, sell an out-of-the-money call on this stock.

- If/when the stock rallies to the short call strike price on expiration, you will be called out, or “assigned,” leaving you with a flat position.

- Re-enter the short put position on the same or another stock.

Let’s now go through the different components of this strategy step-by-step.

What Is A Cash-Secured Put?

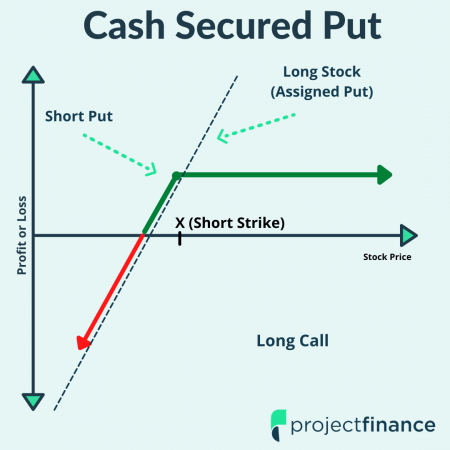

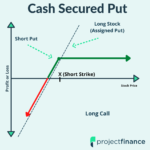

Cash-Secured Put Definition: In options trading, a “cash-secured put” is a short put option that is backed with the full cash amount needed to buy the shares at the strike price. This strategy is both neutral and bullish on the underlying.

Cash-Secured Put Maximum Profit: Premium received from selling put.

Cash-Secured Put Maximum loss: Strike price minus the premium received.

🎬 Watch on YouTube! Selling Put Options For Beginners

You can sell puts in both cash accounts (IRA accounts) and margin accounts. When you sell puts in cash accounts, you must front the entire capital required to purchase the stock should you be assigned.

In margin accounts, the funds required to hold a “naked” put option are generally the greater of:

- 20% of the underlying price minus the out of money (OTM) amount plus the option premium

- 10% of the strike price plus the option premium

Since we anticipate purchasing the stock when the underlying stock price falls below our short put strike price, the wheel strategy must be “cash-secured”.

The Wheel: Cash-Secured Put Example

In this example, we are going to sell a put option of Ford (F).

Why Ford? Ford is currently trading at $15/share. When you sell cash-secured put options, you need to front the cash to purchase the stock at the strike price. Options are leveraged securities – one contract represents 100 shares of stock.

It will be very costly indeed to purchase 100 shares of Amazon (AMZN) for its current market price of $2,600/share! This is why I prefer selling puts on cheaper stocks, like Ford.

Here is our trade:

➥ Ford Stock Price: $15

➥ Put Option Strike Price: 14

➥ Put Option Expiration: 37 days away

➥ Put Option Premium (credit received): 0.60

Cash-Secured Put Trade Outcomes

When you sell a put option, there are two trade outcomes. The stock will either close above your short strike price on expiration or above your short strike price.

When the stock closes below your short strike price, you will be assigned on your short put. When the stock closes about your short strike price, your short put will expire worthless.

Ford Trade Outcome #1:

➥ Ford Stock Price: $15 –> $15.40

➥ Put Option Strike Price: 14

➥ Put Option Expiration: o days away

➥ Put Option Price: 0.60 –> 0.00

In this example, Ford closed above our short put strike. This means we collect the full premium of 0.60 ($60). Since we won’t be assigned stock, we can not initiate the wheel just yet. We’ll have to sell another put and wait for the stock to fall below the strike price. But we made some money in the process!

Ford Trade Outcome #2:

➥ Ford Stock Price: $15 –> $13

➥ Put Option Strike Price: 14

➥ Put Option Expiration: o days away

➥ Put Option Price: 0.60 –> 1.00

In the second outcome, Ford fell below our short strike price on expiration. This means we will purchase the stock at $14/share (the put’s strike). Since we collected $0.60 when selling the 14 put, our effective share purchase price is $14.00 – $0.60 = $13.40.

With the stock price at $13, we’re technically down $40, which is much better than being down $200 from purchasing the 100 shares at $15.

So what do we do now? To satisfy the wheel strategy, we must sell a call option against the assigned stock!

In order to better understand option premium and risk, read our guide: Implied Volatility for Beginners.

What Is A Covered Call?

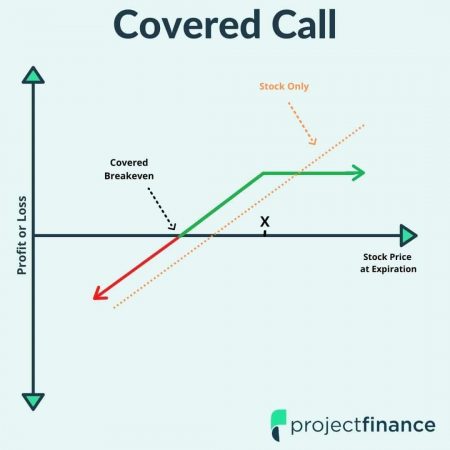

Covered Call Definition: In options trading, a covered call position is established when an out-of-the-money call option is sold against 100 shares of long stock.

Covered Call Maximum Profit: Strike price of the short call option minus the purchase price of the underlying stock plus the premium received.

Covered Call Maximum Loss: Stock price minus option premium received.

🎬 Watch on YouTube! Covered Calls For Beginners

Because of its low-risk nature, the covered call is a great strategy for beginners. It is also a great way for traders to collect income from a stagnating stock they own.

If you own the SPY ETF at $400/share, and don’t believe SPY will be trading above $410 in a month, you could sell a 410 strike price call option on SPY expiring in 30 days.

If SPY is trading below $410 on expiration, you will collect the full premium from the option. If SPY is trading above this price, your short call will be assigned, thereby forcing you to sell 100 shares. The net result? Your position is offset.

Since we already own the stock, risk is eliminated here from the option. Therefore, we do not need to use margin, or set funds on reserve, to hold a short call when it is sold against long stock.

The Wheel: Covered Call Example

Let’s now revisit Ford. Remember, in our second outcome, we were assigned on our short put option, leaving us long 100 shares of Ford. The first step of the wheel is complete.

Now, we must sell a call option against the long stock we own.

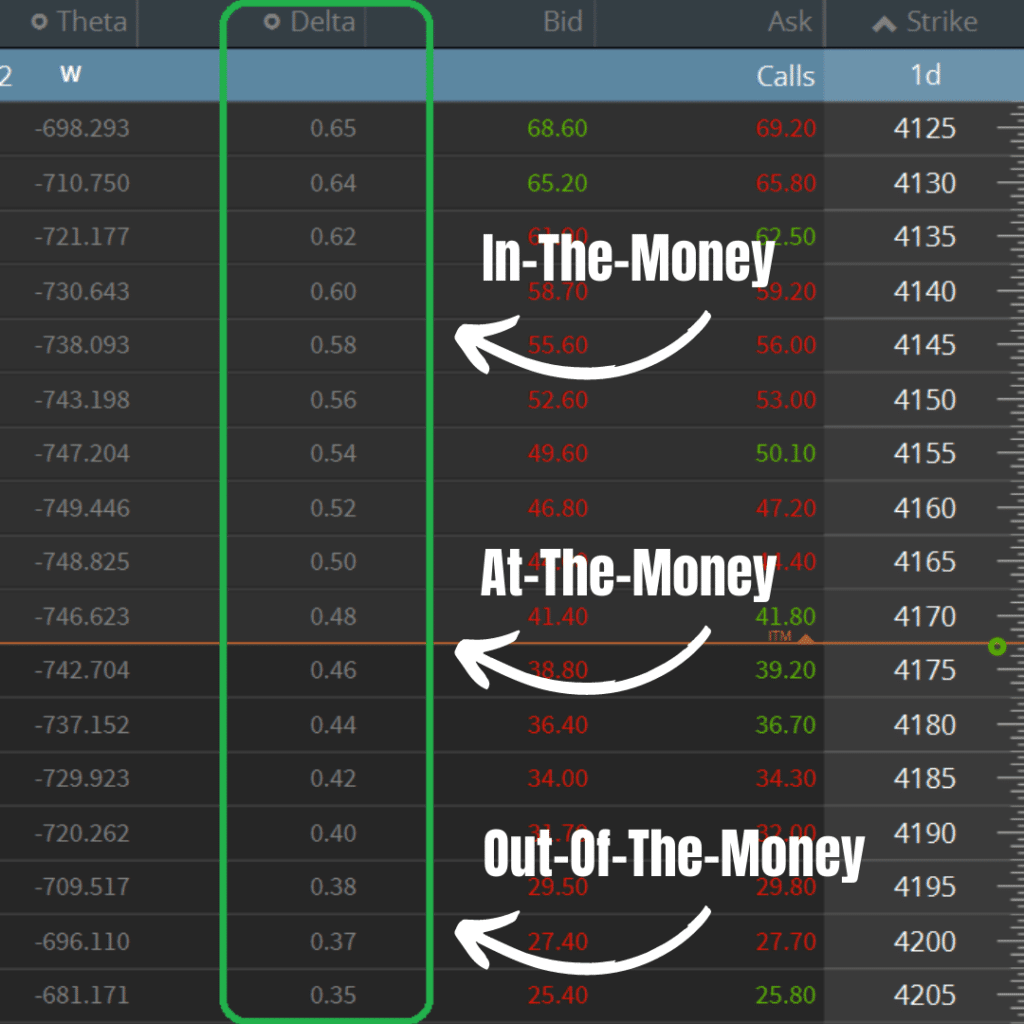

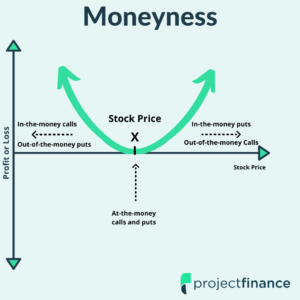

This call option must be “out-of-the-money.” I’ll provide a visual of option moneyness below.

Since Ford was trading at $13/share when we got assigned, the call we sell must be above this price to be out-of-the-money.

Let’s say we sell the $14 call option on Ford. Here is our trade!

➥ Ford Stock Price: $13

➥ Call Option Strike Price: 14

➥ Call Option Expiration: 30 days away

➥ Call Option Premium (credit received): 0.40

Covered Call Trade Outcomes

Just as with our short put option, our short call has two possible outcomes:

- The short call will expire worthless if out-of-the-money on expiration.

- The short call will be assigned short stock if in-the-money on expiration.

Let’s see how our trade did!

Ford Trade Outcome:

➥ Ford Stock Price: $13 –> $14.25

➥ Call Option Strike Price: 14

➥ Call Option Expiration: o days away

➥ Call Option Price: 0.40 –> 0.25

In this trade, Ford rallied from $13 to $14.25 at the time our short call expired. This means our call expired in-the-money. The final premium of the option was 0.25. Since we sold the option for 0.40, we made 0.15 ($15) on the trade!

However, since our option was in the money, we will be assigned on our short call. When assigned on a short call, you must deliver -100 shares of stock. But remember, we were already long 100 shares of stock.

Therefore, this short assignment will offset our long stock, leaving us with no position in Ford.

To sum up the entire wheel position:

1) Shorted the 14 put for $0.60.

2) Stock fell to $13 and we got assigned on the 14 put, purchasing 100 shares at $14/share. Effective purchase price = $14 put strike – $0.60 put premium collected = $13.40.

3) Shorted the 14 call for $0.40.

4) Stock rallied to $14.25 and we got assigned on the 14 call, selling our 100 shares for $14/share. Effective share sale price = $14 call strike + $0.40 call premium collected = $14.40.

Total Position P/L: ($14.40 effective sale price – $13.40 effective purchase price) x 100 shares = +$100.

Another way to consider this P/L is to calculate the account inflows and outflows.

1) Shorted the 14 put for $0.60: $60 inflow

2) Buy 100 shares @ $14/share via put assignment: $1,400 outflow

3) Shorted the 14 call for $0.40: $40 inflow

4) Sold 100 shares @ $14/share via call assignment: -$1,400 outflow

$100 option inflow – $0 stock outflow = $100 net inflow.

A different way to get to the same conclusion is to consider closing the options at expiration and buying/selling the shares at the current stock prices.

1) Short the 14 put for $0.60, stock drops to $13. Close 14 put for -$0.40 and buy 100 shares at $13.

2) Short the 14 call for $0.40. Stock climbs to $14.25. Close the 14 call for $0.15 profit and sell shares at $14.25.

Stock P/L: $14.25 sale price – $13 purchase price = +$1.25 x 100 shares = +$125

Option P/L: -$0.40 on short put + $0.15 on short call = -$0.25 x 100 = -$25.

Net P/L: $125 stock profit – $25 option loss = +$100.

Same result, different math.

And we’re back to where we started from!

To complete the cycle, sell another put option on Ford, and repeat!

The Wheel And Strike Prices: Which Options To Choose?

In order to be a successful options trader, you must understand the risks.

Having a fundamental understanding of “The Greeks” will help you accomplish this.

Delta is the option Greek that tells us how much an option price is expected to move based on a $1 change in the underlying stock.

This Greek also tells us the probability an option has of expiring in-the-money (ITM).

An options chain can be arranged by the Greeks. When choosing your option contract strike prices for both cash-secured puts and covered calls, it is therefore very important to take this metric into consideration when choosing your strike prices for the wheel.

The below options chain shows the deltas for SPX call options. The orange line represents the at-the-money options. We can see the following strike prices have the corresponding odds of expiring in-the-money:

- 4140 Call: 60%

- 4165 Call: 50%

- 4185 Call: 42%

Though the wheel strategy is a great way to collect passive income, it does indeed require quite a bit of maintenance.

Additionally, if you’re very bullish on a stock, your best bet is to buy it outright. The wheel takes time and money and underperforms in very bullish markets.

The Wheel Options Strategy FAQs

When choosing stocks for the wheel strategy, there are several factors to consider. If you have a limited amount of capital to work with, it may be wiser to stick with cheap stocks. Implied volatility is also important in this strategy. The higher the implied volatility, the higher the odds the stock will breach both the short put and short call strike price.

The wheel options trading strategy is most profitable (when compared to simply buying the stock) when the underlying stock is minorly bullish.

If the stock goes up too much, the wheel strategy will lose money when compared to owning the stock outright.

3 thoughts on “The Wheel Options Strategy: Collect Income From Options”

Thanks for the article! What’s a good expiration duration to use for the wheel? Is 3 months out too long?

Ira

Thanks for the comment Ira!

3 months out may be a little long for this strategy. Remember, our goal here is to collect income. Waiting 3 months to do so may make the strategy ineffective! I would say a good time-to-expiration for the wheel would ideally be 2-4 weeks.

Hope this helps!

Mike

2-4 weeks for both the cash-secured put and covered call strategy that is…