Last updated on March 22nd, 2022 , 11:41 am

Covered call writing is an options trading strategy that consists of selling a call option while owning at least 100 shares of the stock. On a perfect 1:1 ratio, one call option can be sold for every 100 shares of stock that are owned.

By itself, selling a call option is a highly risky strategy with unlimited loss potential. However, when combined with a long stock position of 100 shares, selling a call option adds no additional risk, and creates a way to profit when the share price remains flat or even declines slightly.

Even more, the credit received for the call option provides downside protection against decreases in the stock price. The cost of this protection is that the long stock position’s potential profits are limited by selling the call.

In this post, you will learn the covered call strategy through in-depth examples and visualizations with real option data.

For those with smaller trading accounts, the poor man’s covered call is an alternative to covered calls that requires significantly less money to trade.

Jump To

TAKEAWAYS

- The covered call is an income generation strategy for equity owners who do not anticipate their stock will go higher in the future.

- In order for the position to be “covered”, 100 shares of stock must be long for every call that is sold.

- Most traders prefer selling “out-of-the-money” calls as these have a higher probability of expiring worthless.

- Covered calls can be profitable in bearish, neutral, and even slightly bullish markets.

- Maximum loss is high on this trade, as the stock still has downside risk.

Covered Call Writing - Strategy Characteristics

Let’s go over the strategy’s general characteristics:

➥Max Profit Potential: (Short Call Strike + Credit Received for Call – Share Purchase Price) x 100

➥Max Loss Potential: (Share Purchase Price – Credit Received for Call) x 100

➥Expiration Breakeven: Share Purchase Price – Credit Received for Call

➥Approximate Probability of Profit: Greater than 50%

To gain a better understanding of these concepts, let’s walk through a basic example.

Profit/Loss Potential at Expiration

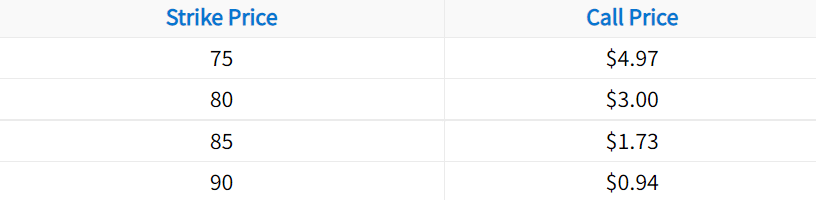

In the following example, we’ll construct a covered call position from the following option chain:

Trade Details

In this case, let’s assume the stock price is trading for $75 at the time of these option quotes. To construct a covered call, we’ll first buy 100 shares of stock at $75 per share. Next, we’ll sell one of the call options from above. For this example, we’ll sell the 80 call.

Share Purchase Price: $75

Short Call Strike Sold: $80

Premium Collected for the 80 Call: $3.00

Here are this particular position’s characteristics:

Max Profit Potential:

($80 short strike + $3 credit received – $75 share purchase price) x 100 = $800

Max Loss Potential:

($75 share purchase price – $3 credit received) x 100 = $7,200 (stock price goes to $0)

Expiration Breakeven Price (Effective Share Purchase Price):

$75 share purchase price – $3 credit received = $72

Probability of Profit: Greater than 50%

Position if Assigned:

If assigned on the short 80 call, then the covered call writer is obligated to sell 100 shares of stock at the strike price. Since the trader already owns 100 shares, the assignment leaves the trader with no position. However, the bright side is that a being assigned results in maximum profit for the covered call writer.

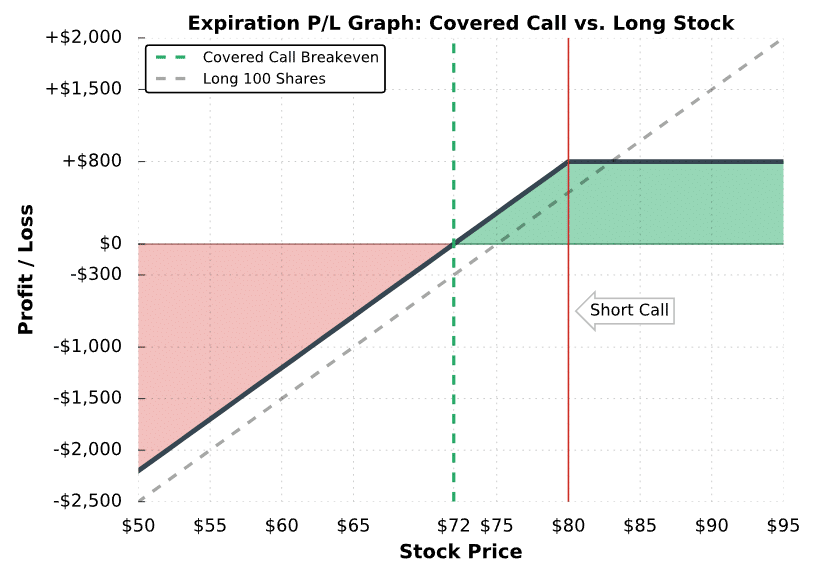

The following visual demonstrates the potential profits and losses for this particular position at expiration:

Covered Call Outcomes

As you can see, buying 100 shares of stock at $75 and selling the 80 call for $3 reduces the risk of the position compared to just buying and holding stock. Since a credit is collected for selling the call, the purchase price of the shares is effectively reduced by the amount of the call price. Therefore, the breakeven price of a covered call position is essentially the reduced purchase price of the shares. However, for this purchase price reduction, the position’s potential profits are capped when the stock price rises above the strike price of the short call.

We’ve also added the profits and losses for a long stock position as a comparison. Compared to the long stock position, the covered call has less loss potential and more profit potential at most of the prices. However, if the stock price rises significantly above the short call strike, then the long stock position without a short call against it performs better. Because of this, a covered call writer is usually not extremely bullish on the stock.

Great job! You know the potential outcomes of a covered call position at expiration, but what about before expiration? As a demonstration, we’re going to look at a few positions that recently traded in the market.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Covered Call Trade Examples

In the following examples, we’ll compare changes in the stock price to a covered call position on that stock. Note that we won’t discuss the specific stock the trade was on, as the same concepts apply to each stock.

Covered Call vs. Holding Shares - Trade Example #1

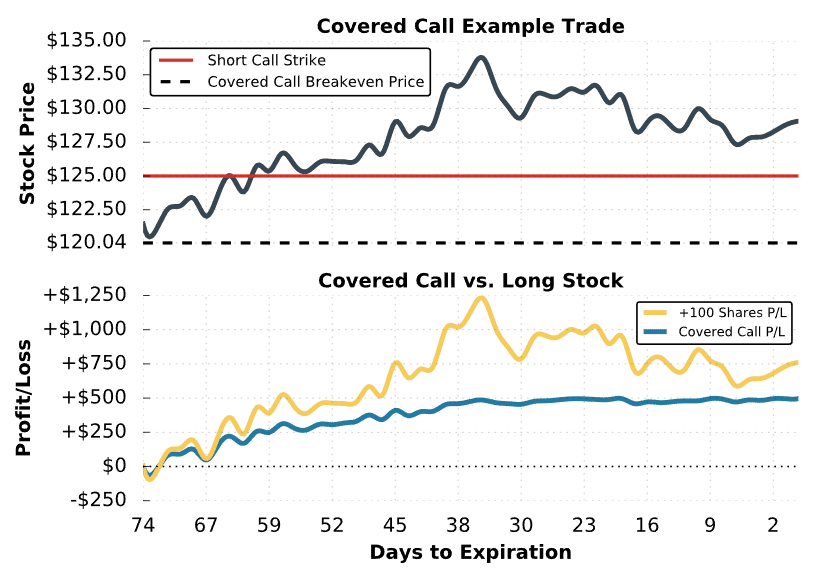

First, let’s examine a situation where covered call writing is less lucrative than just buying and holding shares of stock. Here’s the setup:

Initial Share Purchase Price: $121.45

Strike Price and Expiration: Short 125 call expiring in 74 days

125 Call Sale Price: $1.41

Breakeven Stock Price (Effective Share Purchase Price):

$121.45 share purchase price – $1.41 credit received from call = $120.04

Maximum Profit Potential:

($125 short call strike – $120.04 effective share purchase price) x 100 = $496

Maximum Loss Potential:

$120.04 effective share purchase price x 100 = $12,004 (stock price goes to $0)

Purchasing 100 shares of stock for $121.45 per share and selling one of the 125 calls for $1.41 results in a breakeven price of $120.04. Because of this, the stock price can fall, and the covered call can still profit. However, for that protection, the profit on the long shares is capped. At expiration, any stock price above the short call strike of $125 will result in the same gain for the covered call writer.

With that said, let’s see what happens!

Covered Call #1 Trade Results

As illustrated here, the stock price rising above $132.50 results in profits of $1,250 for an investor who just bought and held 100 shares of stock.

On the other hand, the profit potential is limited for an investor who sold the 125 call against their shares. It doesn’t matter if the stock price is $125 or $1,000 at expiration, the profit on a covered call position with a short 125 call will be the same.

So, by selling a call against shares of stock, an investor gains the ability to profit when the stock stays flat or declines slightly. However, that benefit comes at the cost of profit potential on the long shares.

In this example, the maximum profit potential is achieved fairly early in the trade because the stock price traded significantly higher than the short call strike price. When maximum profit is achieved before expiration, it’s likely that the trader will close the position to lock in the profits. To close a covered call position, the trader can simultaneously sell the shares of stock and buy back the short call.

After expiration, this particular covered call writer would lose their shares if they held the short 125 call through expiration. To keep the shares, the investor would have to buy back the 125 short call at a loss, though the overall covered call position was profitable. Lastly, it’s important to note that the trader in this scenario faces an early assignment on the short call because the option is deep-in-the-money for most of the trade.

Next, we’ll look at an example of when covered call writing works out perfectly.

Income-Generating Covered Call - Trade Example #2

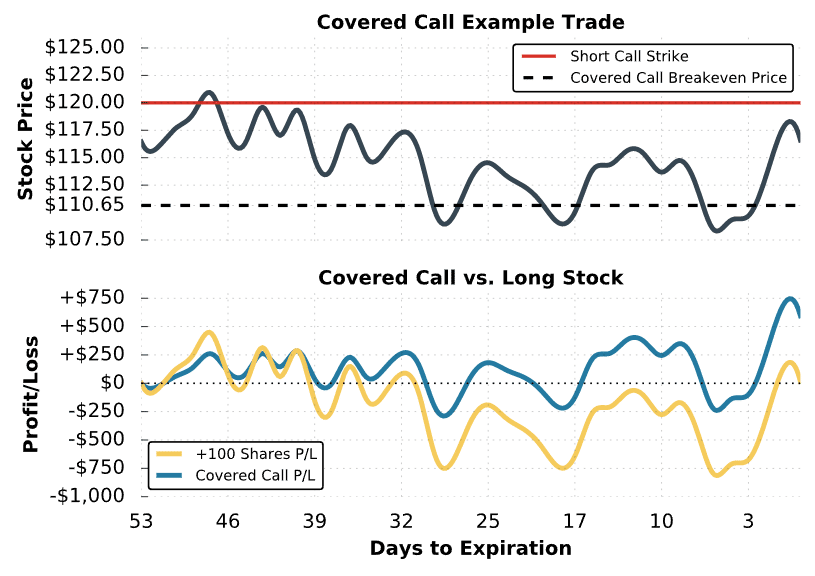

In the next example, we’ll look at a situation where the stock price remains in a particular range over 53 days. More specifically, the stock price is the same at the beginning and the end of the period. Over this time frame, we’ll compare a covered call position to a long stock position.

Here’s the setup:

Initial Share Purchase Price: $116.45

Strikes and Expiration: Short 120 call expiring in 53 days

120 Call Sale Price: $5.80

Breakeven Stock Price (Effective Share Purchase Price):

$116.45 share purchase price – $5.80 credit received from call = $110.65

Maximum Profit Potential:

($120 short call strike – $110.65 effective share purchase price) x 100 = $935

Maximum Loss Potential:

$110.65 effective share purchase price x 100 = $11,065 (stock price goes to $0)

This time around, we’re examining a covered call position where 100 shares of stock are purchased for $116.45 per share, and the 120 call is sold for $5.80. The breakeven price in this case is $110.65, which means the stock can fall $5.80 and the covered call writer will not lose money.

Let’s take a look at what happens:

Covered Call #2 Trade Results

The first thing to note about this trade is that the covered call position performs better than a long stock position when the shares remain below the short call’s strike price. This is because the profits from the short call offset losses (or add profits) when the stock price is below the short call’s strike price.

The second thing to note is that after expiration, this particular covered call writer would keep all the premium from selling the call, as the 120 call expires worthless. Since the 120 call was sold for $5.80, the covered call writer realizes a $580 profit when the call expires worthless (out-of-the-money). Additionally, when the short call expires out-of-the-money, a covered call writer keeps their long shares.

Lastly, you’ll notice that the long stock investor broke even on their position, as the stock price was the same at the beginning and the end of the period. However, the covered call writer made $580 from the premium collected on the call option. So, selling calls against long stock can be highly lucrative in a period of range-bound stock prices.

In the final example, we’ll look at a covered call position that is defensive in nature. While not profitable, we’ll see how the covered call compares to a long stock position.

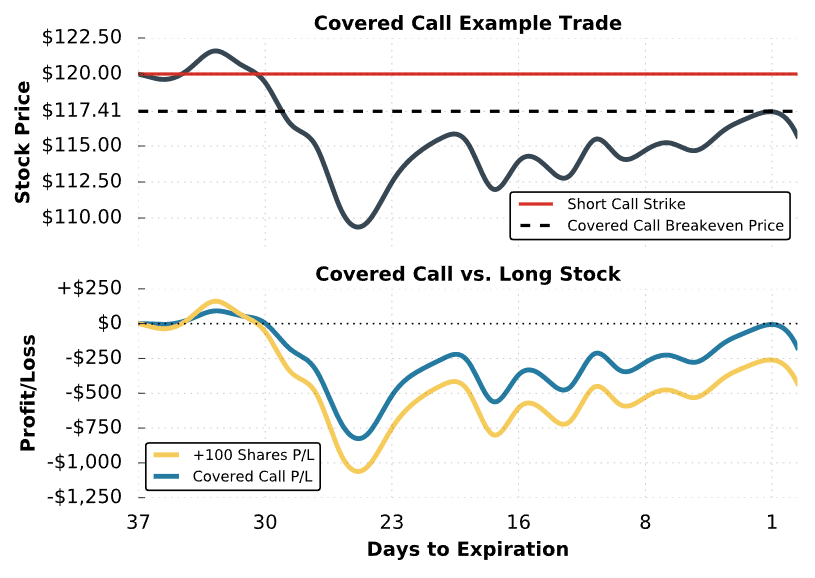

A Defensive Covered Call - Trade Example #3

As mentioned throughout this guide, covered call writing provides protection against declines in the stock price. Because of this, covered calls can be used defensively. So, in the final example, we’ll look at a scenario where a covered call position is unprofitable but better off than just buying and holding stock.

Here are the specifics of the final example:

Initial Share Purchase Price: $119.99

Strikes and Expiration: Short 120 call expiring in 37 days

120 Call Sale Price: $2.58

Breakeven Stock Price (Effective Share Purchase Price):

$119.99 share purchase price – $2.58 credit received from call = $117.41

Maximum Profit Potential:

($120 short call strike – $117.41 effective share purchase price) x 100 = $259

Maximum Loss Potential:

$117.41 effective share purchase price x 100 = $11,741 (stock price goes to $0)

Let’s see what happens!

Covered Call #3 Trade Results

In this particular trade, the stock price fell sharply, resulting in losses for the covered call writer and the long stock investor. However, since the covered call writer collected $2.58 in premium, their loss was $258 less than the long stock investor at the expiration of the short call, demonstrating how a covered call can be used defensively.

Congratulations! You now know how the covered call strategy works! In the next section, we’ll discuss how to select which call to sell.

How to Select a Covered Call Strike Price

At this point, you know how covered calls work, as well as when you might use the strategy. However, with so many different call strikes available, how do you choose which one to sell? We’ve put together a simple guide that may help the strike price selection process easier.

Strike Price Selection: Determine Your Stock Price Outlook

Before selecting a call strike to sell, it’s crucial to determine an outlook for the shares of stock that you own. Here is a quick guide that demonstrates how to select a call strike based on various outlooks:

You Believe the Share Price Will Increase Significantly:

With such a bullish outlook, selling calls to limit the profit potential on the long shares might not make sense. Additionally, selling far-out-of-the-money calls doesn’t provide much profit potential or downside protection since far-out-of-the-money options are cheap.

You Believe the Share Price Will Increase Moderately:

Selling a call option with a delta between 0.20 – 0.30 may be logical, as those options only have a 20-30% probability of being in-the-money at expiration (in theory).

You Believe the Share Price Will Remain Flat/Decrease Slightly:

With a neutral outlook, selling calls with strike prices closer to the stock price (.40 to .50 delta calls) may be logical. Selling at-the-money calls provides the greatest profit potential from the decay of the call’s extrinsic value.

You Believe the Share Price Will Fall:

With such a bearish outlook, owning shares of stock or trading covered calls is likely not the appropriate strategy.

The table above serves as a guideline for selecting a call to sell. When trading covered calls, there isn’t a “one-size-fits-all” approach. The call that is sold depends on the investor’s outlook for the stock price in the future.

Final Word

Awesome! You’ve reached the end of the guide. Hopefully, you’re much more confident in your understanding of the covered call options strategy.

In a nutshell, we have learned:

- Covered calls can help equity owners generate income in sideways markets.

- The covered strategy only mildly reduces downside stock risk.

- Before determining your strike price, it is important to determine the outlook for a stock.

Next Lesson

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.