Last updated on March 1st, 2022 , 07:38 pm

How to Manage Covered Calls (And Make More Money)

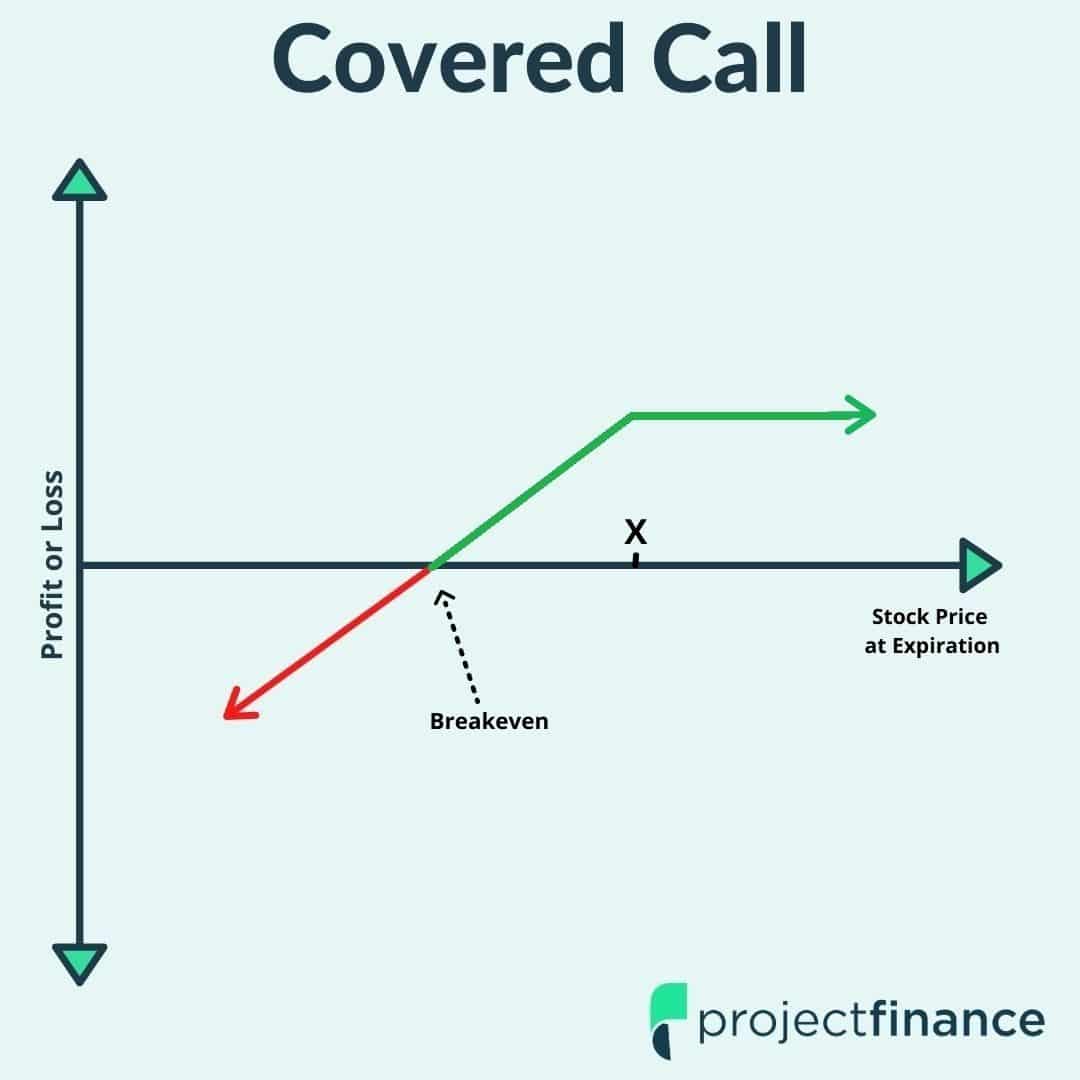

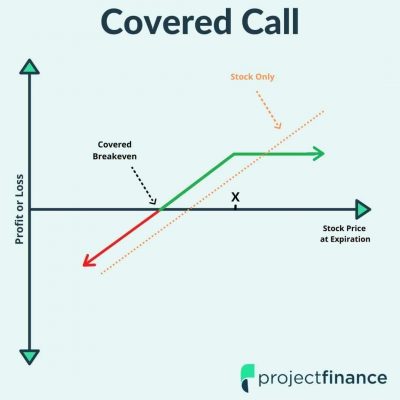

If you’re looking for a strategy that both generates income and hedges against a stock market decline, the covered call strategy may be for you. Because of its simplicity, the covered call is a great options trading strategy for amateur and seasoned options traders alike.

Covered Call Components:

- Long 100 Shares Stock

- Short 1 Out-Of-The-Money Call

Though this options strategy in itself is relatively easy to initiate, understanding how to manage the components of your covered call can be less intuitive. Terms like time decay (theta), extrinsic value, and the “Greeks” must all be in your toolbox in order to adequately manage the short call portion of your “buy-write”, which is another way of saying covered call.

In this article, projectfinance will closely examine how covered calls perform in numerous market cycles, as well as offer several ideas on how to manage your covered call position in these markets.

If you’d prefer to watch our video on this subject instead, please feel free to check it out below.

How to Manage Covered Calls (Improve Your Trade Results)

Highlights

- In a bearish market, the best practice is to buy back a short call for a profit.

- During a neutral market, do nothing and wait for the short call to “decay”. Then, buy the call back when (if) it later approaches zero.

- In a steady bullish market, buy back your short call for a loss early if you believe the stock will continue to rise.

- Assignment risk is all about understanding “Extrinsic” value.

- Extrinsic Value measures the difference between the market price of an option (premium), and its intrinsic value (how much the option is in the money by).

- The lower the extrinsic value, the higher the odds of assignment.

- An option with an extrinsic value of under 0.25 has a high chance of being assigned as expiration nears.

Covered Call #1: Bearish Stock Price

In our first example, we are going to look at how a covered call performs in a falling, or “bearish” market. This scenario will perhaps be the most intuitive for those new to covered calls to understand.

Let’s jump right into it by looking at the details of our trade:

Trade Inputs

Stock Position:

Buy 100 Shares @ $135/share

Option Position:

Short the 140 Call for $3.25

Time To Expiration:

39 Days

In summary, we are collecting $3.25 in premium for selling the 140 call. We can see that the stock is trading at $135 currently. As long as the stock closes under $140 at expiration (our strike price), in 39 days, we will collect the full premium of the option.

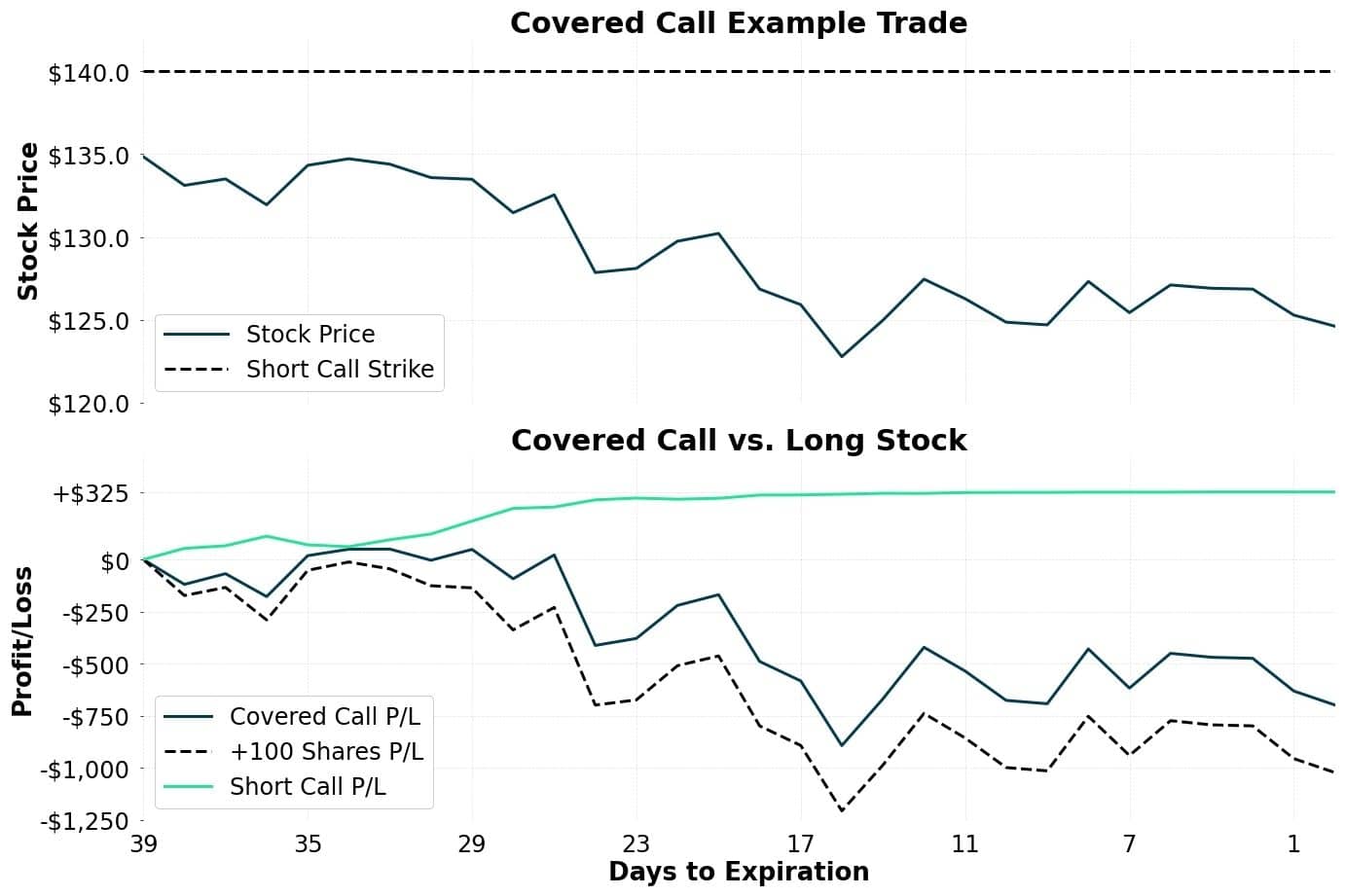

Chris Butler, founder of projectfinance, created a few visuals to help us better understand how covered calls work. Let’s take a look at the first one now:

If you were to only own the stock during this duration, the profit/loss of your position would look as the solid line in the top chart looks, where our short strike is illustrated by the dotted line.

We are going to be mostly concerned with the bottom graph as this illustrates how the different components of a covered call perform over time.

How a Short Call Loses Value Over Time

Let’s start off by looking at the green line in the lower graph. This line represents our short call. A short call position profits when the underlying security stays the same, or decreases over time. A short call will profit faster with a decline in stock price, which is what happens above.

It is because of this our short call (as seen in the green line) profits as the stock price falls.

Short Calls Offset Stock Losses

When comparing the dotted line on the lower graph (stock only) with the solid middle line (covered), we can see that we made more money by selling a call against that stock.

Take a look at the widening gap between these two lines.

Do you see how the profit/loss on a covered position is much milder than that of the shares alone?

We said before that a short call profits when the stock goes down. But at what pace does that option lose value?

Since our option expires in 39 days, it will take time for the option to approach zero in value. This is known as “theta”, or time value, and it on of the option “Greeks”. Since the stock could in theory jump back above our stock price with only a few days left, there will usually be some premium left in the weeks and days leading up to expiration.

In order to reap the full benefit from our short call here, we must wait until it expires (relatively) worthless.

But is the full benefit of the short call option what we’re looking for? Usually not. Why? Let’s take a look at how to manage a covered call in a declining market next to understand.

Managing a Covered Call in a Declining Market

Glancing again at the details of the above trade, we can see we sold this call for a net credit of $325. This is the most we can make on our call. As long as the call stays widely out of the money, it will approach zero as expiration nears.

So do we wait until expiration to close this position, where no action will be required on our end because the position will expire worthless?

Probably not. To understand why, let’s take a look at the profitability of our short call option, as seen below.

We can see that with 23 days to go until expiration, our short call position has nearly realized its maximum profit of $325 (the yellow arrow). Why take a chance in waiting 23 more days if we are almost at 100% profit today? Couldn’t the stock in theory still skyrocket higher? Yes!

Additionally, buying back the short call will return our long stock position to infinite profit, as it no longer has that short call tethering its maximum profit to strike price + premium.

This is why it is sometimes wise to buy back short options before expiration when the majority of the profit is already realized. Buying back (relatively) worthless options allows us to:

- 1. Lock in the profit on our short call.

- 2. Remove the risk of early assignment on the options.

- 3. Return our long stock position to infinite reward.

So what are the reasons to not buy our call back in this scenario? On a risk level, I can’t think of many.

Let’s next take a look at a more interesting scenario: a neutrally trending stock price with a twist at the end.

Covered Call #2: Neutral Stock Price With a Surprise

Now that you understand how to manage a covered call with a simple outcome, let’s shake things up a bit. Let’s get right into it by looking at the details of our trade:

Trade Inputs

Stock Position:

Buy 100 Shares @ $121/share

Option Position:

Short the 130 Call for $3.08

Time To Expiration:

43 Days

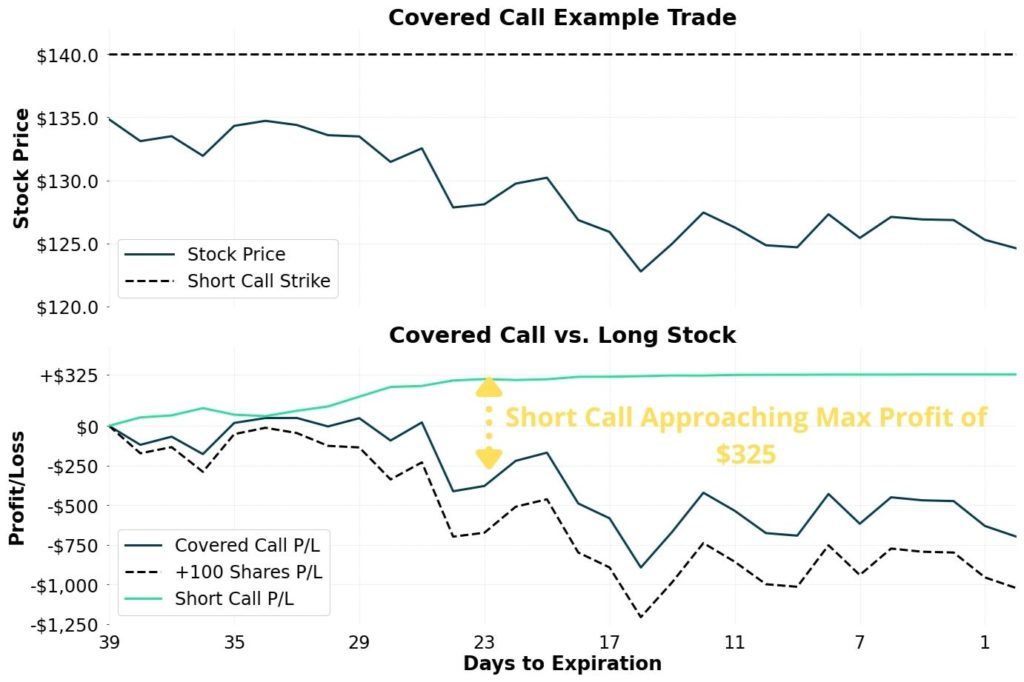

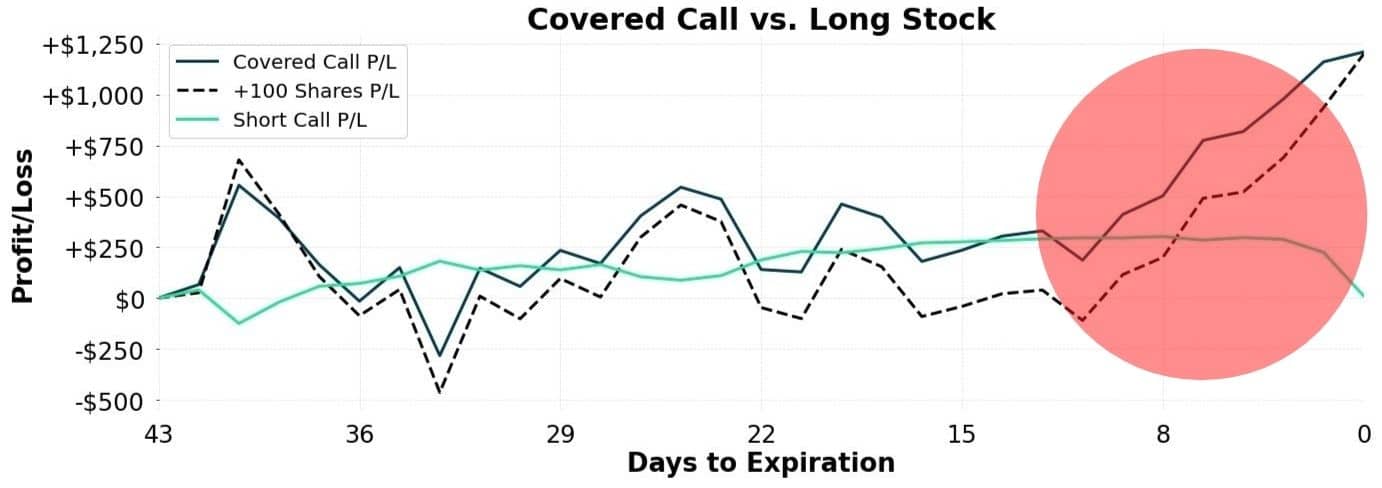

Key to note here is the premium we are receiving from selling our call, which is $3.08. Let’s take another look at one of Chris Butler’s visuals:

As we can see from the above image, our stock trades relatively neutral throughout the duration of the trade. Additionally, we can see that the short call steadily loses value, thus steadily generating profits on this component of the trade.

Remember, short call sellers want the price of their option to approach zero, which happens when the stock price remains below the strike price as time passes.

Recalling what we learned from the previous example, we can understand why our short call approaches maximum profitability before the option expires. In this instance, we approach that $308 maximum profit with about 15 days to go until expiration.

Now wouldn’t this be a good time to close the short call portion of this trade? It’s trading for a fraction of the price that we bought it for. Remember, closing a relatively worthless covered call allows us to:

- Lock in the profits on the call.

- Free up our stock to rise with the market.

- Eliminate early assignment risk.

The Risk of Not Closing a Worthless Short Call

Now let’s take a look at the right side of the lower graph from our trade.

During the last few days of trading, the stock skyrocketed in value from $120/share to $133/share, leaving our short call in the money at expiration.

Why? Perhaps the company adjusted their future earnings forecast, maybe a CEO stepped down, or perhaps the stock was boosted by a better than expected unemployment number. Whatever the case, we can see how not closing that short call when we had the chance hurt our overall position. That call went from almost 100% profit to 0% profit in only a few days!

This example perfectly illustrates the second reason why it is important to close worthless short calls early: to free up our stock to run with the market.

The maximum profit on covered calls is always strike price plus premium sold. In our trade, that price is $130 (stock price) + $3.08 (option premium) = $133.08. What if the stock went all the way up to $150? It wouldn’t matter one bit to us: we are always locked in to strike price + premium sold.

Do you see why it is important to close (relatively) worthless calls early now?

Let’s shake things up a little bit by looking at a scenario where the stock price steadily increases over the duration of our trade.

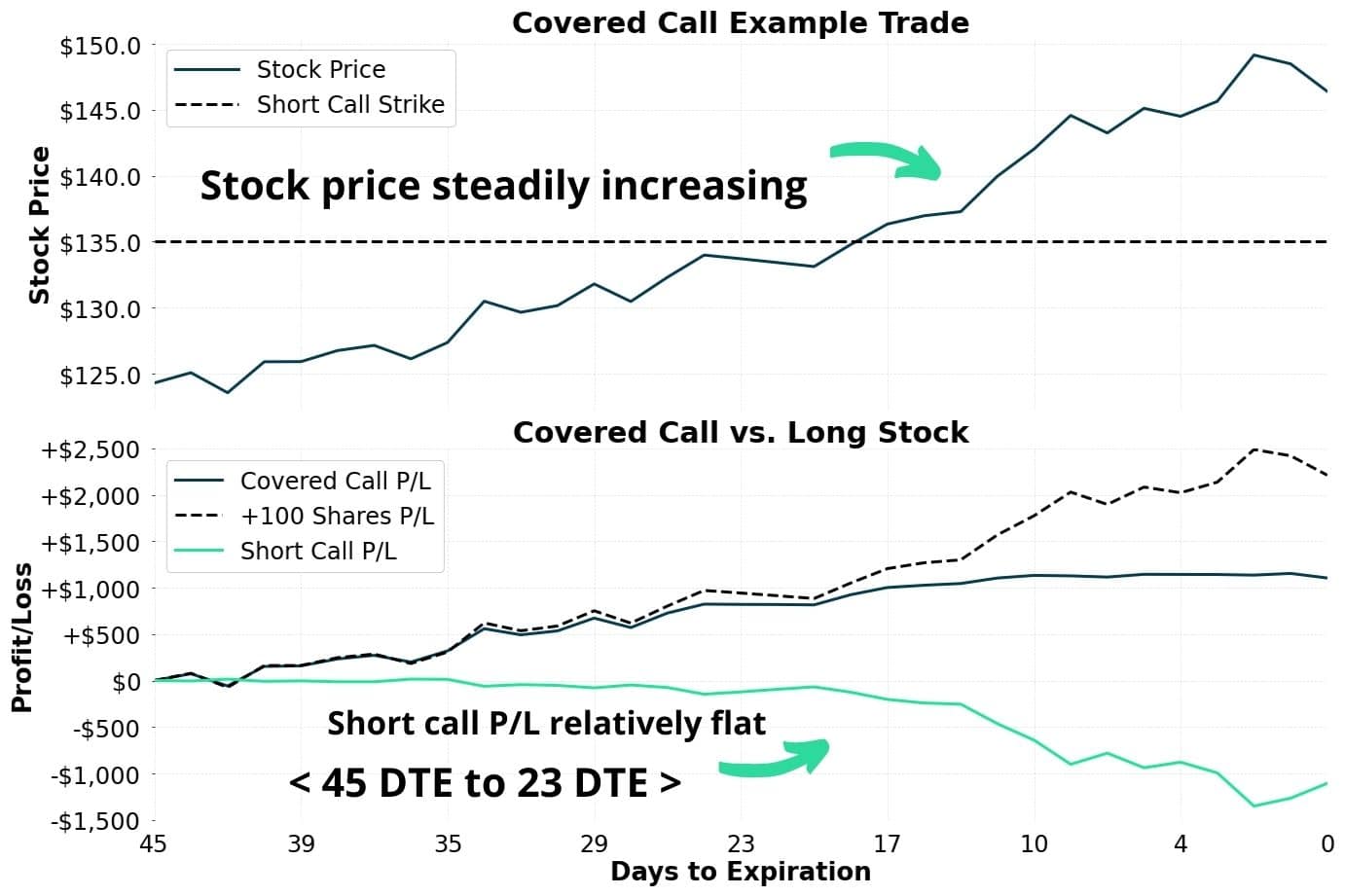

Covered Call #3: Bullish Stock Price

This third example of managing covered calls can be a bit frustrating for the holder of a covered call. Here, the underlying stock slowly appreciates in price over the duration of our trade.

Trade Inputs

Stock Position:

Buy 100 Shares @ $125/share

Option Position:

Short the 135 Call for $0.80

Time To Expiration:

45 Days

In this trade, we short the $135 call for 0.80 when the stock is trading at $125. As long as the stock stays below strike price + premium (135 + 0.80 = $135.80), we will make some money off of our covered strategy (and won’t miss profits on our long stock). If the stock rises above this price, we will still see a maximum profit, we just won’t realize any additional stock gain.

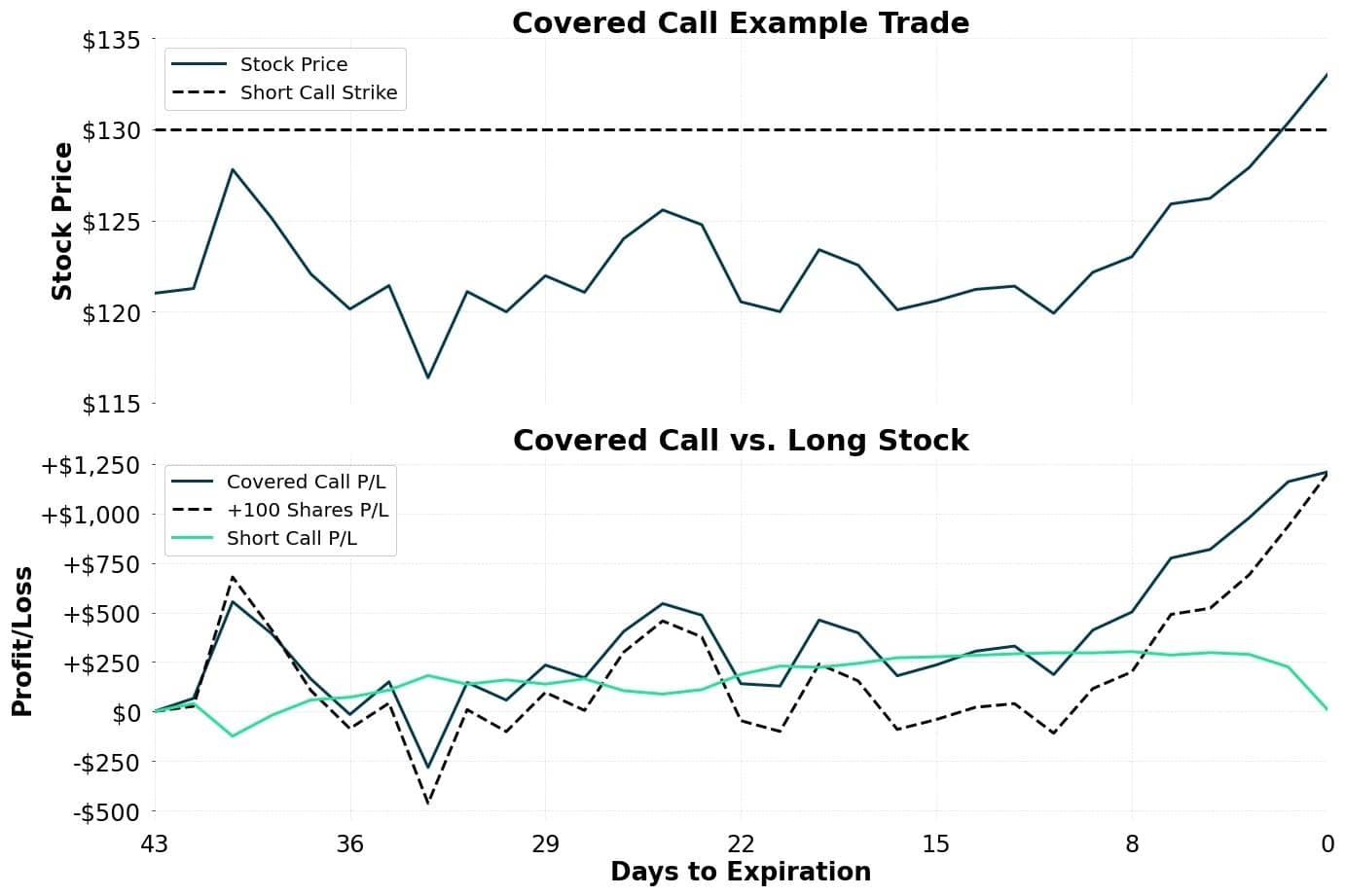

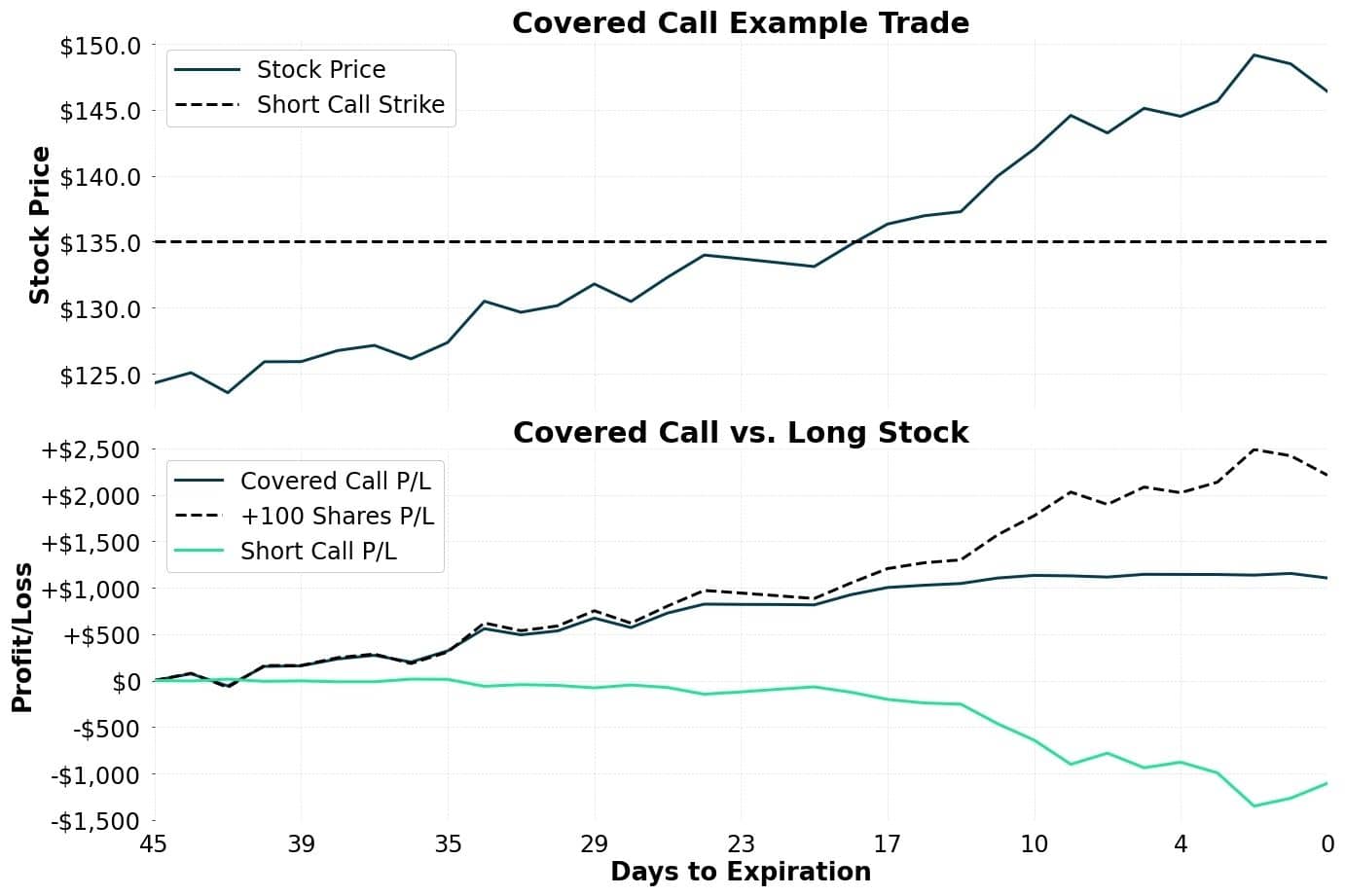

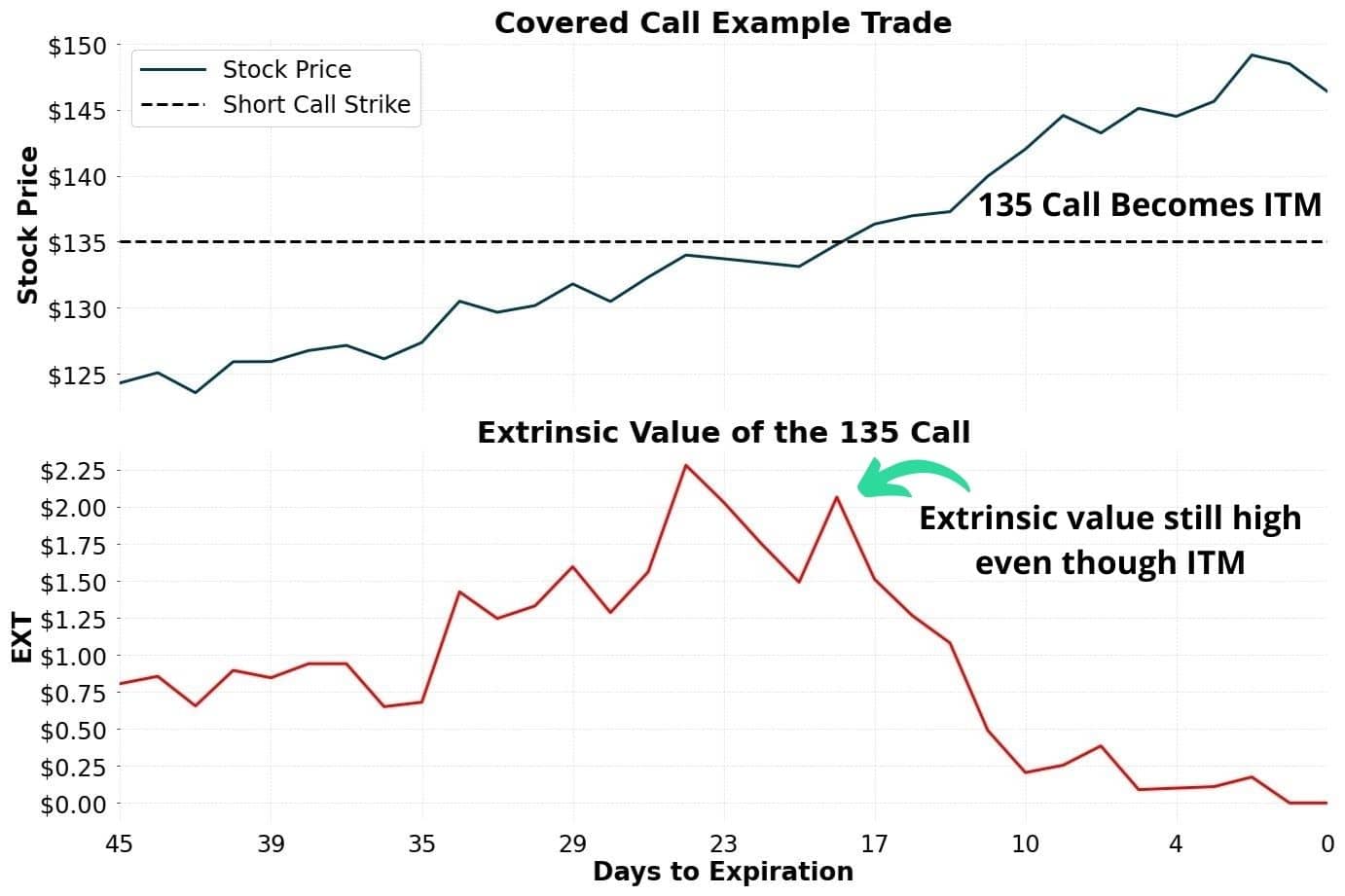

Compliments of Chris Butler, here is a graph of this bullish scenario.

As shown above, we can see that the stock price rises very steadily over the duration of the trade, rising from $125/share to $145/share at expiration.

By looking at the green line, we can see that our short call is losing money over the duration of this trade. This should make sense by now; short calls don’t like bullish markets, particularly when the underlying stock price blows through our short strike price, which does indeed happen.

By the end of this trade, our call has lost about $1,000. In other words, the price of the option increased in value by about $10. When compared to only owning the stock outright, the covered call position in this instance has vastly underperformed.

Managing A Covered Call in a Bullish Market

So how would we manage our covered call in this scenario? We have a few options:

- 1. Allow Our Short Call to Be Assigned.

If we let our short in-the-money call go into expiration, the option will be exercised. When a call is exercised, the seller of that call is forced to sell 100 shares of stock at the strike price of the option. In our trade, that price would be $130 since we are short the 130 call.

In this scenario, the maximum profit of our trade is realized (but you may miss the extra profit you could have received from only owning the shares!)

But what if we wanted to keep our shares in this situation?

- 2. Buy Back the Short 135 Call AT Expiration.

Simply buying back the short call is also an option here. However, if we bought back this short call the moment before it expires, we would realize a loss of $1,100 on the call. Not ideal. However, we still have another option when closing a losing short call in a bullish market. Let’s look at that one next.

- 3. Buy Back the Short 135 Call BEFORE Expiration.

Perhaps the best way to close a covered call in a bull market is to close it before expiration. Why? Let’s take another look at the graph to understand.

Covered Call as Expiration Approaches

Take particular notice on the lower chart of how slowly the profit/loss of the covered call (blue line) gaps away from the profit/loss on the outright shares (dotted line). They separate from each other very slowly, with the covered call losing most as expiration approaches.

Wouldn’t it make sense then to close the short call before these two lines really begin to deviate?

Absolutely. If you see a stock trending away from you, it’s better to act sooner than later (assuming you are OK with the risk of owning the stock outright).

So why does this gap in profitability happen so subtly?

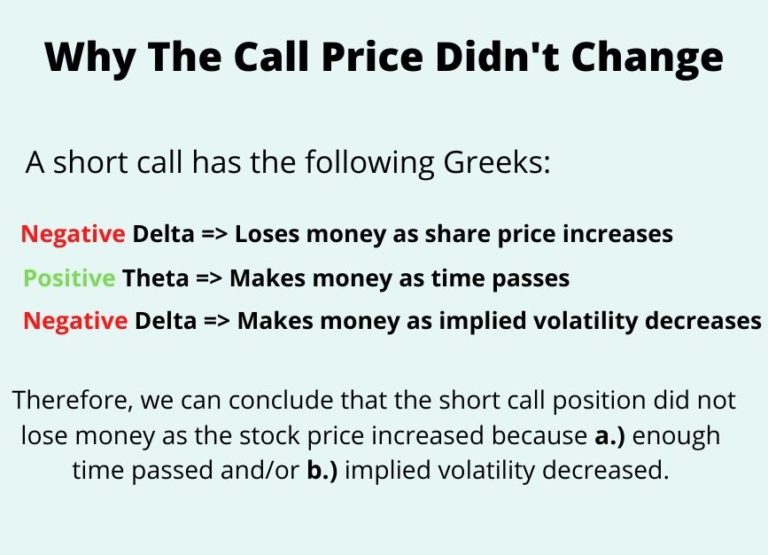

Understanding the “Greeks” in Covered Calls

In the above trade example, the options extrinsic value offsets the losses from the increase in the stock price. In terms of option “Greeks”, what we mean here is that the short calls positive theta, or “time decay”, was enough to offset the negative delta over the first 20 days. This results in a small change in the options price.

Confused? Don’t worry, this is complicated stuff. Basically, a negative delta means our short call will lose money as the stock price increases. The theta, however, is positive, which means our short call will make money from the passage of time. They even each other out.

Because of this, in the early stages, we’re not really seeing any losses on our short call. Therefore, it is an opportune time to buy back the option.

The below image may help you to better understand this:

Keep in mind that this closing strategy works best when the market is rising slowly yet steadily.

For more volatile markets, the profitability gap between the outright stock and covered will widen very rapidly. Let’s take a look at this scenario next, where the stock rockets upward.

Covered Call #4: Up & Down Stock Price

In our last example (you’re almost there!) we’re going to look at a few different ways to manage covered calls in an “up and down” market.

Here’s our trade:

Trade Inputs

Stock Position:

Buy 100 Shares @ $130/share

Option Position:

Short the 140 Call for $3.50

Time To Expiration:

46 Days

So here we are short the 140 call for $3.50 while the stock is trading at $130/share.

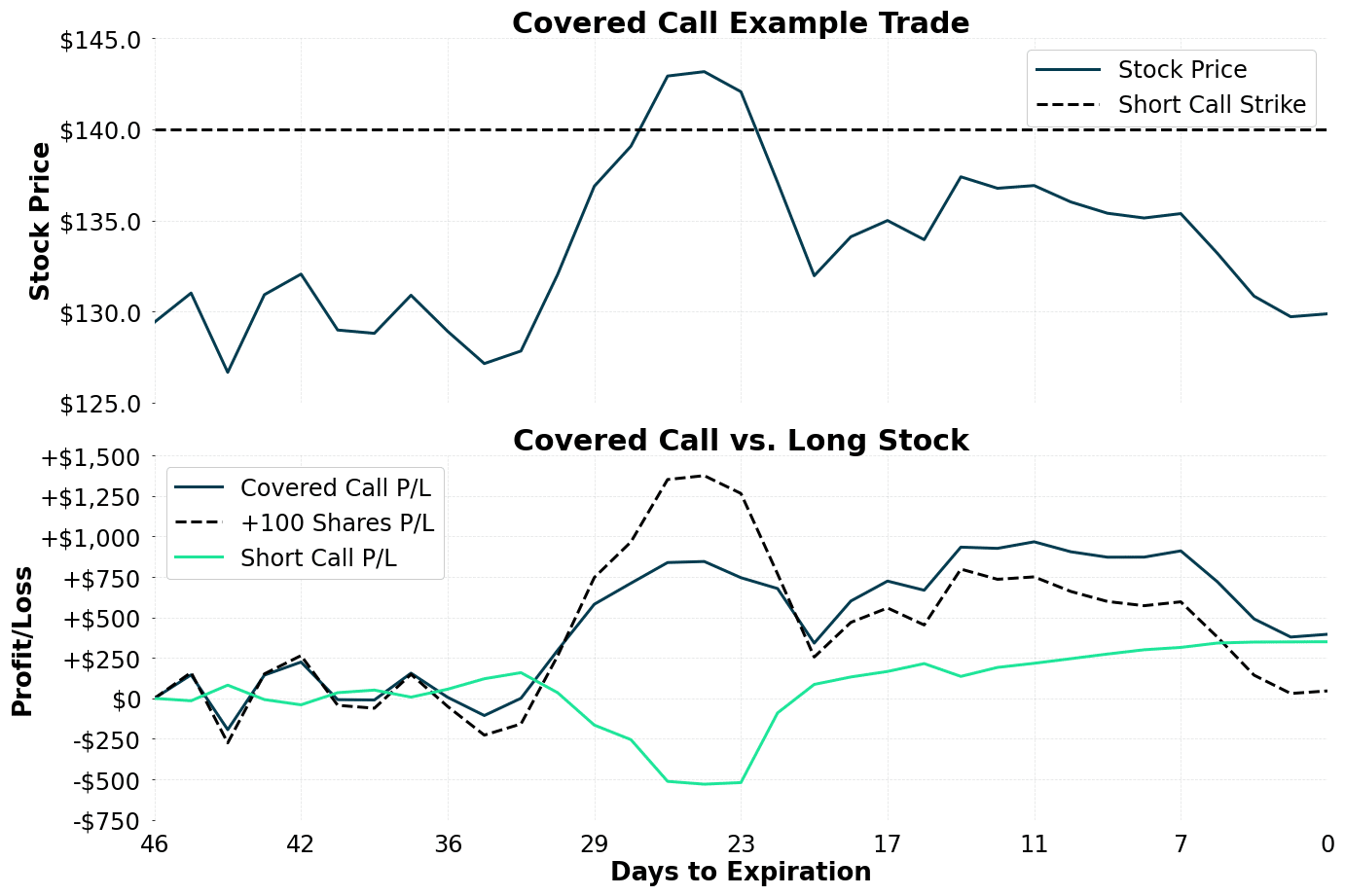

Here’s a visual of our trade:

What concerns us in this graph is the abrupt rise, and subsequent fall in stock price during the middle of the covered calls life.

Remember in our last example how subtle the deviation in profitability was between the covered and the stock outright? That was because the stock rose steadily.

In this example, the stock explodes upward. This results in immediate and deep losses on our short call.

Subsequently, our covered call position underperforms the outright stock dramatically. Buying our short call back during this market will not be so advantageous because of its very elevated price.

So what should you do in this scenario?

Managing A Covered Call in A Volatile Market

Personally, I would wait to see how the trade plays out here. Volatile markets tend to swing back and forth quite a bit.

That is exactly what happened here (how convenient!).

At around 15 days to expiration, we can see the short call profit was approaching $250. This represents the majority of the maximum $350 that we can collect from our option. As we said before, the more profitable a short call becomes, the more logical it is to buy the option back.

Understanding the recent volatility of this stock, I personally would close the short call position while it was in my favor.

Was that the right move?

We can see that if I would have held the option to expiration, I would have indeed received the full profit of $350. Whoops!

But I’m a risk-averse investor. What would you have done?

Assessing Early Assignment Risk

If you’re trading a covered call and the stock prices rise above your strike price, most newbie investors panic. But you shouldn’t worry about assignment. Here’s why.

First off, if you are indeed assigned on your short call, you will realize the maximum profit of your covered call. That’s a good thing. The only situation in which this wouldn’t be desirable is if you wanted to continue holding your shares.

That being said, it is always wise for an investor to know their assignment risk. Nobody likes being blindsided.

Extrinsic Value and Assignment

The key to understanding whether an option is at risk for assignment or not is all about understanding the option’s extrinsic value.

If you want to take a deep dive into extrinsic value (which you should understand if you’re a serious options trader) feel free to check out our video below.

Why Options Are Rarely Assigned

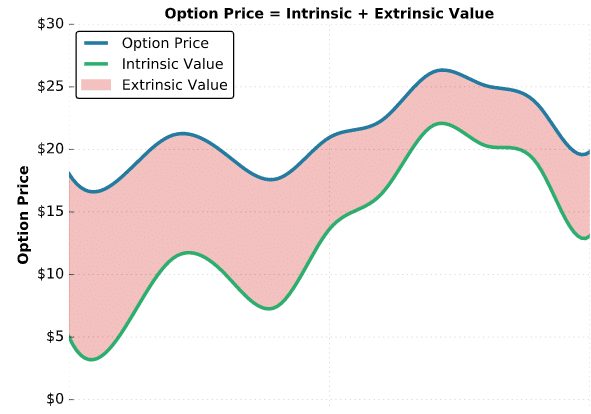

Extrinsic value measures the difference between the market price of an option (premium), and its intrinsic value. Intrinsic value is simply the amount an option is in-the-money by. Therefore, out-of-the-money options are all extrinsic value.

Understanding an Options Premium

The closer an option’s extrinsic value is to zero, the greater the odds that option has of being assigned. Generally (dividend risk aside), an in-the-money option is not at risk of early assignment if its extrinsic value is between 0.25-0.50 cents. This is a broad guideline. But below these levels, watch out.

To see how the relationship between extrinsic value and assignment works in practice, let’s revisit our volatile market trade, where the stock rapidly breached our short call price. Was there assignment risk then?

Extrinsic Value Example #1 : Low Risk Assignment

So here’s that volatile market trade we went over earlier. Let’s now evaluate the assignment risk of the short call during the stock run-up.

So since the stock rallied past our short call price in this trade, was our short option at risk of assignment during this time? No!

Why? There is still a lot of extrinsic value left in that option.

If the holder of that option exercised their call, they would be giving this up. It is actually free money to us. How much money? By examining the chart, we can see the owner of this call would be forfeiting over $5!

If the owner of that call really wanted the stock, they would sell the option in the marketplace and simply buy 100 shares in a “synthetic” exercise.

Therefore, our chance of assignment was almost zero in this scenario.

Now let’s look at another trade where there is indeed assignment risk.

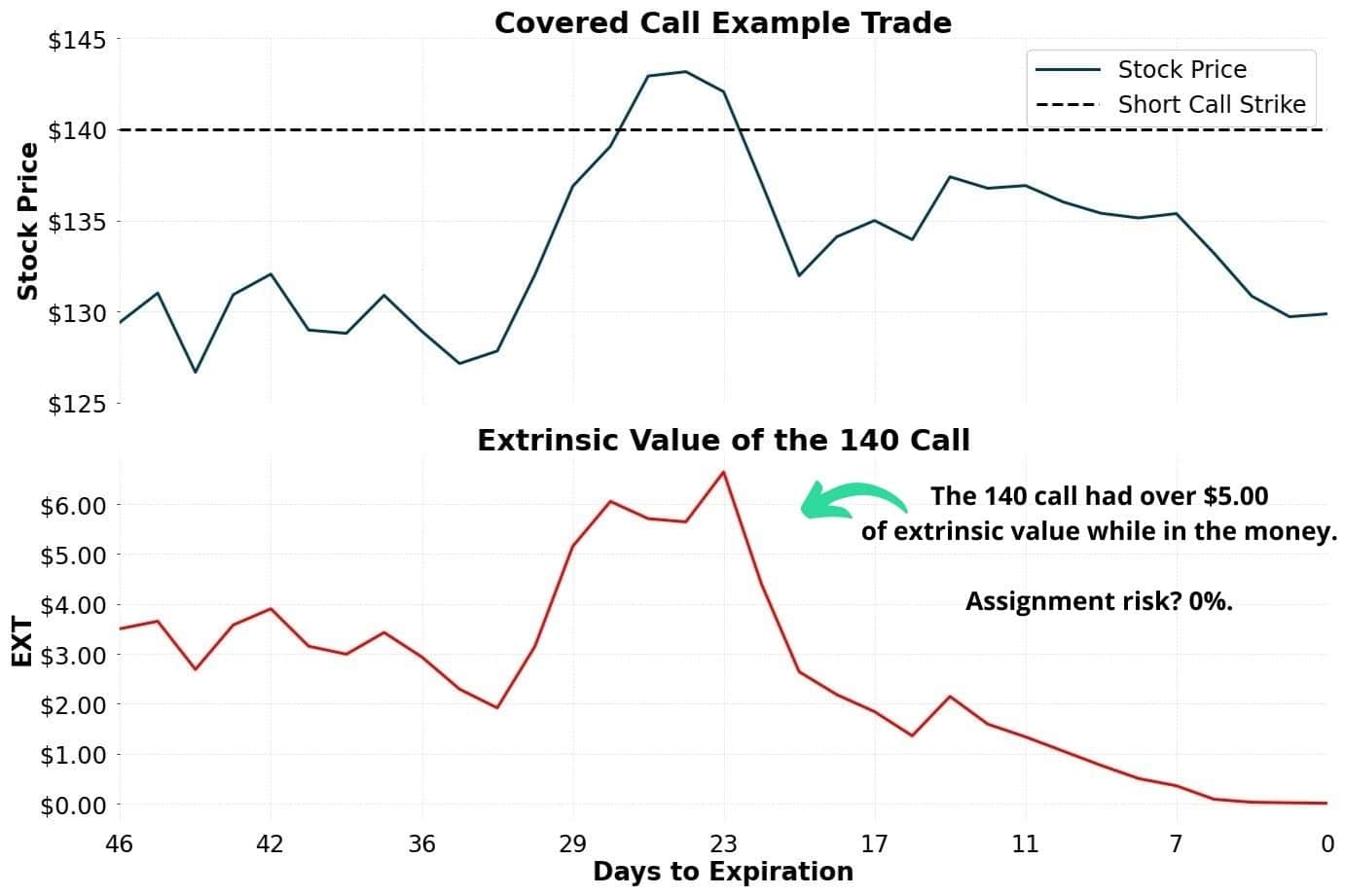

Extrinsic Value Example #2: High Risk Assignment

In this example, we are going to revisit that trade where the stock price trended steadily upward.

As illustrated by the lower red line, the extrinsic value of an option is in constant flux with the market. When this call was first sold, its extrinsic value was about 0.75 cent. This means it’s assignment risk was very low.

However, as that option became in the money, its extrinsic value rapidly declined. At expiration, the extrinsic value was zero. An option with an extrinsic value of zero at expiration has an almost 100% chance of being assigned.

So what causes the extrinsic value of an option to decrease in price?

Causes of Decreasing Extrinsic Value

There are three factors at play here.

- 1. Passage of Time

Options shed extrinsic value as time passes

- 2. Option Becomes Deeper ITM

The deeper in-the-money an option is, the less extrinsic value it has

- 3. Decreasing Implied Volatility.

Implied volatility = extrinsic value. They are synonymous. Decreased volatility leads to decreased extrinsic value

So remember when we said options with extrinsic values of between 0.25 and 0.50 need not worry about assignment risk?

In this last trade example, we can see that the extrinsic value of the option fell below this level with about 10 days to go. Therefore, assignment risk during this period is quite high.

Final Word

Hopefully, this article will help you to better understand how the various elements of a covered call may react to different market conditions.

It’s important to remember that there is no need to panic if your short-call strike price is breached. Early assignment with extrinsic value (which most all in-the-money options have) is rare.

With that being said, assignment is not a bad thing. Remember, an assignment on a covered call means max profit!

You should, however, always be prepared. In the long run, pleading ignorance rarely works in options trading.

Happy trading!