Last updated on February 14th, 2022 , 08:00 am

Let’s get this out of the way right off the bat: you will never be able to completely control your emotions in investing. It is an impossibility.

However, this is not a bad thing. Emotions play an integral part in both the cognitive and investing process. You are a better investor with them.

In this article, projectfinance takes a deep dive into the emotional investor. We will examine how science has proven emotion is not only necessary but desirable for investors.

Additionally, we will look at a few different coping strategies which may help trigger our emotions less.

Highlights

Finance professionals are just as emotional as the rest of us retail investors.

Pauline Yan tells us that working with your emotions is a better strategy than trying to ignore them.

“Ignorance is Bliss” can be the best strategy for both long-term investors as well as active traders.

Neuroscientist Antonio Damasio shows how emotions help the brain in filtering through vast data sets.

We like to believe that professionals have conquered their emotions. Politicians, doctors, retirement financial planners that handle our life savings; we like to think that emotionally charged thought plays little to no part in their thinking.

But the truth is, emotion plays an important factor in the decision-making of all human beings.

When I think of historical figures at the top of their game, Emerson’s “Representative Men” come to mind.

Montaigne, Napoleon, Goethe (amongst others); they all had their demons; they all struggled at points in their lives with crippling emotions.

Goethe experienced “psychic threats and polar tensions often to the limits of destruction”, Napoleon sought refuge from the jealousy of his adulterous wooden toothed wife in world domination, and Montaine fell into a melancholic depression following the sudden deaths of numerous loved ones.

The world’s greatest minds all suffered from intense emotional experiences.

So if these pillars of human thought can’t conquer their emotions, how are financial professionals any different?

In an interview with the Wall Street Journal, Richard Taffler, professor of Finance and Accounting at Warwick Business School, says they aren’t.

Investment Pros Are Just as Emotional as You

In reply to the Journal’s statement, “Some people think pros are more rational than individual investors”, Prof. Taffler responded:

Professor Taffler, also an authority on behavioral finance, later explains that this acquiescence to emotion is not only ubiquitous amongst fund managers, but outright inevitable.

It comes off as almost paradoxical. Taffler believes that an individual completely devoid of emotion would not be willing to take a risk-on position in the first place.

This makes sense, too. As humans, we must experience some degree of emotion. If our emotions were completely neutralized indeed, we’d derive as much pleasure from this life as a sedimentary rock.

So if we must experience emotion as humans (as though that’s a bad thing); if we are indeed destined to be Epicureans and not Stoics, how do we make the best out of it? Where do we start at self improvement if that perfect person we aspire to become is unreachable?

Work With Your Emotions

Instead of trying to change our emotional response to market events, perhaps a better strategy is to work with our emotions.

Pauline Yan, a portfolio manager in Toronto, Canada and founder of the Sunday Morning Brunch financial blog, recommends embracing negative emotions that pertain to investing, such as fear and greed.

As quoted by CNBC, Yan believes individuals should, “Feel the fear, feel the greed”.

In contrast to fighting our impulses, her theory suggests that swimming downstream (psychologically speaking) allows investors and traders a realistic and steady platform upon which investment decisions can be made. Here are a few ways to get started when working with your emotions.

- Identify what emotion exactly you are experiencing when confronted with an adverse market event.

- Accept that emotion. Go with the grain. The results from this new approach may surprise you!

- Meditate until it no longer bothers you and a more rational response appears.

Another option, and my personal strategy, is the “set it and forget it” mentality. Let’s take a look at that one next.

Ignorance is Bliss in Investing: Buy and Forget

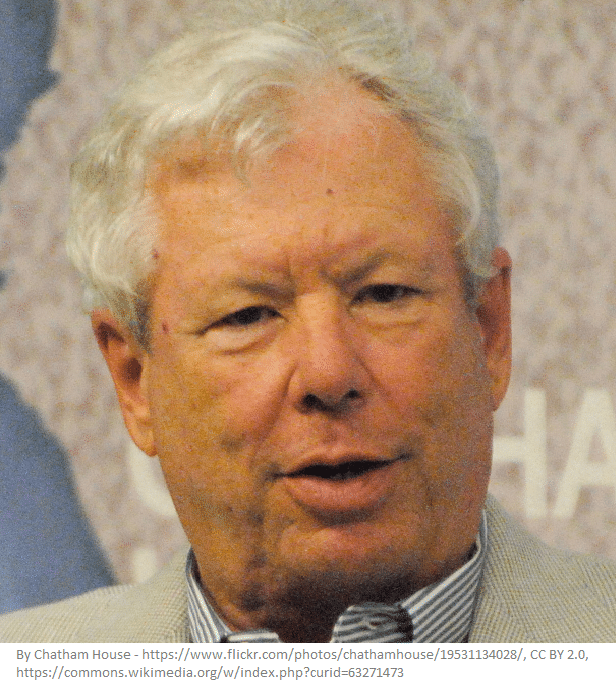

Richard Thaler, economist and Professor of Behavioral Science and Economics at the University of Chicago Booth School of Business, has his own strategy when it comes to managing emotion during volatile times.

When asked on an early morning financial news TV program what an investor should do when they wake up and see the market down 3 percent, Thaler recommended, “Change channels. Turn the show off.”

Richard Thaler

Investing is Preparation, Not Work

In investing and trading, the vast majority of your work should be in preparation. Once a position is established, as long as the fundamentals haven’t changed, the best course of action is to stay the course.

I can’t tell you how many times I messed with positions because of either boredom or desultory second-guessing. Whenever I fidget, I almost always end up donating cash to the market-makers.

Investing is not work. I know of several extraordinarily successful options traders who worked on the floor of the Chicago Board Options Exchange (CBOE) traders who would pass the time by putting on a green in their office above the trading floor, far away from the “madding crowd”.

Perhaps they did this because being on the floor may make them second guess themselves. Not paying any attention to the “noise” helped them maintain their initial convictions when they put their positions on.

When I look at where these traders are at today, I can tell their methods were obviously very successful. Here are a few steps to better become an “ignorant” trader.

- Before placing a trade or investment, forecast how you will react emotionally in an adverse market.

- Check the position only when it breaches your pre-establish parameters by setting alerts.

- If the position goes against you, recall how you planned on reacting when you were less emotional.

- Understand the risk, and meditate the daily ebbs and flows out of your mind.

In closing, we are going to look at a case study involving a man who had an operation on the part of the brain responsible for emotion. It is a profoundly sad case but also proves the crucial connection between the brain and emotion. One can not operate successfully without the other.

Be Careful What you Wish For: The Tragedy of “Elliot”

The ideal investor/trader, as seen through the eyes of most people, will not incorporate emotion into their financial decision-making. So what would happen if this ideal was actually met? What would happen if an individual could put their frontal lobe on permanent pause? Would this create a super investor? No. Quite the opposite, actually.

The patient’s name was known throughout the medical community as “Elliot”. Elliot was an educated and successful businessman, a good husband, and had a solid grip on his wealth and finances.

In the 1980s, Elliot experienced numerous headaches. It was discovered that Elliot had a brain tumor on his frontal lobe, that part of the brain which is responsible for higher cognitive function, including emotion.

An operation was done; the tumor was removed. But Eliot was never the same again.

Following the operation (which damaged his frontal lobe) Elliot lost his job, got divorced, and experienced numerous problems managing money. This led Elliot to declare bankruptcy.

The Portuguese-American neuroscientist Antonio Damasio wrote a book on this particular tragedy called Descartes’ Error: Reason, Emotion and the Human Brain. The main case study in this book was that of Elliot.

Neuroscientist António Damásio

Rational Thought Incorporates Emotion

Outwardly, Damasio discovered Elliot to be very pleasant and capable. Elliot even tested surprisingly well on numerous cognitive tests.

“He was always controlled,” wrote Damasio, “always describing scenes as a dispassionate, uninvolved spectator.”

But on the inside, Elliot’s personal and financial life was in disarray. Planning had become incredibly difficult. What was going on? These problems, which seemed subtle, took over Elliot’s life.

Damasio proceeded to test Elliot with pictures that would evoke intense emotional responses from most people. But Elliot’s reactions were indifferent. Damasio was astounded, and wrote of his reaction in his book:

Damasio asked Elliot whether or not he would buy more or sell stock that he owned over a previous month if he knew the performance. Elliot answered as reasonably as any other rational investor would. This was a perplexing case, given that Elliot’s personal finances were in disarray.

The question about this stock was very specific, and there were only a few outcomes presented to Elliot.

Emotion Assists the Brain When the Choices Are Vast

The problems with Elliot arose, Damasio discovered, when the potential list of outcomes was manifold rather than binary. He simply couldn’t contemplate an outcome where there were many possible choices, as there are in the stock market.

So what does the human brain rely upon when the potential outcomes for a scenario are too vast for it to comprehend?

Emotion. The frontal lobe, or that part of the brain in Elliot which was not working correctly, is responsible for emotion. In Damasio’s words:

Final Word

We are emotional creatures. Period. So how can an emotional person invest successfully?

One course of action, as recommended by Pauline Yan, is to work with our emotions.

Additionally, we can alter our patterns so emotion plays less of a role, like those CBOE traders putting upstairs when the market was open.

Emotions are completely subjective, and finding a custom coping strategy for yourself will likely take time. Perhaps more important than psychology in trading is philosophy. Check out our article on The Philosophy of Trading here.

At the end of the day, just know that “eliminating” emotion from your investment decisions is both impossible and undesirable. Even if you were able to take emotion out of your life, what fun would that be?!