Last updated on February 14th, 2022 , 08:06 am

Jump To

Without understanding the key roles that psychology and philosophy play in investing and trading, your monetary ambitions are doomed to fail.

You may get lucky here and there, but unless you have conviction and mastery over the myriad of emotions the stock market awakens in most humans, failure is an inevitability.

Let’s jump right into it by comparing psychology and philosophy.

Highlights

- Trader Psychology teaches us how our individual mind reacts to market conditions.

- Trader Philosophy gives us the tools to overcome our psychological shortcomings.

- The best teacher is personal experience.

- Without a solid philosophical bedrock, psychology on its own helps traders little.

- Most successful investors have their own personal philosophy on life.

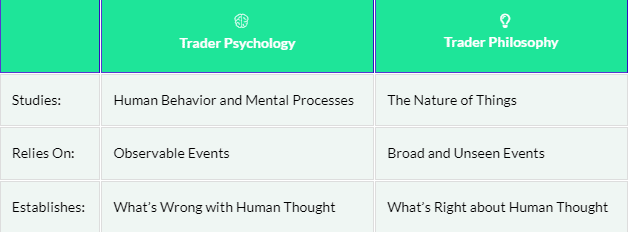

Psychology vs Philosophy

|

|

Trader Psychology

|

Trader Philosophy

|

|---|---|---|

|

Studies:

|

Human Behavior and Mental Processes

|

The Nature of Things

|

|

Relies On:

|

Observable Events

|

Broad and Unseen Events

|

|

Establishes:

|

What’s Wrong with Human Thought

|

What’s Right about Human Thought

|

Trader Psychology teaches us how our individual mind reacts to market conditions. Without an intuitive understanding of how our individual brains work, successful investing will be difficult and trading impossible. Being tuned into one’s own psychological makeup helps us better control our emotional response. This can help us become more disciplined and agile traders.

Trader Philosophy gives us the tools to overcome our psychological shortcomings. Incorporating philosophy into the trading process can help put a game plan into our trading and investing decisions. The result of trading philosophy is a firm grasp on and acceptant of risk tolerance, goals and market expectations.

The world’s best traders are both psychologically aware and philosophically minded. When these two colors of thought get together, the resulting color is more often than not green.

In this article, projectfinance takes a look at the link between psychology and philosophy in trading.

I believe trading to be more of an art than a science. Since philosophy is more artful than psychology, this article will focus primarily on how incorporating philosophy into our trading decisions (and life decisions) can make us more successful.

Since we will be looking at trading philosophy as an art, we will not get into cut-and-dry topics of investment philosophy (risk-management, diversification, algorithmic trading, etc.) and behavioral finance. Instead, we will focus more liberally on philosophy as a school of thought.

A Trader Fails Miserably: A Case Study About Myself.

About a decade ago, I put a small trade on in my account. It was a well-thought-out trade. The market was a bit overheated, and volatility was cheap. I placed an options trade that would allow me to capitalize should the market become bearish. It was a high-reward, low-risk trade that I had used successfully before.

I calculated there would be about a 50% chance the market would sell-off by the end of the week. Just a mild selloff would provide my long volatility position with a profit of over 100%. I was comfortable with losing it all.

If you have a 50% chance of making over 100%, isn’t that a good trade? I put a relatively small trade on Monday morning for options expiring on Friday.

It was a well-thought-out trade. Had I stuck to my original plan, I would have indeed turned a very nice profit.

But that’s not what happened. What actually did happen may very well be a great case study for a behavioral psychologist analyzing the irritation decisions of individual investors.

Doubling Down on a Losing Trade

By the end of the day Monday, the market sell-off did not come. I was in the red.

Great – double down, right?

Tuesday morning the market opened higher. That’s ok, right? Double down again!

Wednesday morning, the market opened higher yet again. With a little reluctance and less conviction, I doubled down again.

Guess what happened Thursday morning? The market opened higher, and I doubled down again.

My position was becoming massive, to the point I couldn’t take my eyes off the trading platform, which blinked green, only green, all day long.

And then came Friday. Guess what the market did on Friday? The bell went off, and S&P 500 futures opened up…higher.

I threw in the towel.

The market wasn’t going to sell-off. I was wrong. Had I only had my relatively small initial position on, I wouldn’t care. But the position had since grown to about 10 times its original size.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Panic Trading 101

So since I was indeed wrong, wasn’t there still a way to break even on the mounting losses? Didn’t one of those ex CBOE traders sitting all around me once say “don’t fight the trend”?

Ok. It’s not too late.

I panicked and soon found a solution. Everybody at the trading desk around me was long and making money; why wasn’t I? Why can’t I just flip the position on its head and go long?

So that’s what I did. And I felt good about it.

“The stock market is a device for transferring money from the impatient to the patient."

Warren Buffet

I was working at a trading desk at the time and decided to give my eyes a break and take a stroll around the office.

Ten minutes later, I saw from a coworker’s monitor a chart of the S&P 500. It appeared to be going down. I passed another screen on my walk; whatever chart he was looking at, it was going down too. I went to the restroom, splashed some water on my face then returned to my desk.

We had about 100 TVs in the office, all playing CNBC. There was a “Breaking News” alert on all of these TVs:

“Breaking news!!! Markets Reverse gains in the last hour of trading; DOW down on the week.”

When the bell rang that Friday, I stared at my monitor with a white face and an open mouth:

“What the hell just happened?”

I was right! My original trade made a huge return! Where did that trade go? What happened? Mommy?

And that concludes the story of one of the worst trade management strategies in history.

The Philosophy of Trading (and Living)

I have personally found philosophy to be a panacea for my (mostly) benign psychological shortcomings.

Shortly after moving to Chicago (and before the above trade happened), I had to take numerous FINRA exams. I snuck into a university library to study for these tests.

During these long nights, I would sometimes take breaks and roam the philosophy section, taking a particular interest in the old Greek and Roman Stoics. It awoke something in me – it was vague but real.

These authors were introduced to me by a college professor I once had. He was an old and eccentric man who was so in love with the old Greeks philosophers we couldn’t say the word “Greek” without getting misty-eyed. Truly! We as students, not having been through what he had been through, used to poke fun at him outside of class.

I returned to that library the Saturday morning after I lost my ass, but this time I was thirsty. I devoured the material that I could care less about in college, looking for some connection and solid ground; searching for the cure to my numerous psychological ailments.

That was about 15 years ago, and on the other side of the monitor I write these words on is a small library of all those books of eternal wisdom I perused so long ago. From all the words of those old sages, I was able to create my own philosophy. Never have I since that day put on such a bad trade. I have had bad trades of course, but never that bad.

Philosophy is Greater than Psychology in Trading

You can analyze behavioral finance and trading psychology all day long, but without conviction and inspiration, your toolbox will be very prosaic and thin.

There are innumerable psychological quirks that new and seasoned investors alike can experience. They are limited only by the infintestitude of the human mind. Let’s look at three trading sins I committed when I had that horrible week.

- Fear of Missing Out (F.O.M.O.) Trading

- Fear that a trader feels when missing out on a potentially winning investment.

- Revenge Trading

- When an investor forces trades to make up for a previous loss.

- Gambler’s Fallacy

- Occurs when an investor believes an event is more or less likely to occur based on previous events. E.g., the belief a coin will land on heads if it landed on tails the past 5 times.

Now, what are these but mere helpful words to describe trading psychology? Sure to be forgotten. They tell you what is wrong with living, but not how to correct oneself. If you have the roots of a personal philosophy deeply planted, however, you will never have to worry about falling victim to any of the swaying branches of the innumerable psychological quirks and fallacies that plague the human condition.

Trading Psychology Interpreted Through Philosophy

Shakespeare

"...full of sound and fury, Signifying nothing."

Machiavelli

"Never was anything great achieved without danger."

Epictetus

"No man is free who is not master of himself."

Now let’s look at these fallacies through the lens of a few of my favorite philosophical minds

Machiavelli gives me the courage to place risk-on trades. Epictetus challenges me to not become a slave to my emotions. Shakespeare persuades me to avoid the noise of the events around me.

In other words, their advice is actionable rather than just vague definitions.

With all that said, I believe one-off quotes are in themselves quite worthless. They are the equivalent of a cheat sheet. They have the soulful nourishment of a small fry from McDonald’s.

Becoming adept at anything takes innumerable hours of patience and commitment. You have to work for it. None of the 49ers struck gold the first time they swung their pickaxe; they all had to dig through layers of barely penetrable strata.

Where Trading Philosophy Comes From

I know millionaire traders who are honestly not that bright, and I have worked with surgeon day traders who lost boatloads of cash speculating on the markets. The differentiator of these two people is not that one understands the Gambler’s Fallacy and one does not; the difference is the former has their own personal brand of philosophy in life and the latter has none.

“Look for three things in a person. Intelligence, energy, and integrity. If they don't have the last one, don't even bother with the first two."

Warren Buffet

That isn’t to say that the successful traders I know spend their weekends in the philosophy department of libraries.

Maybe they learned their philosophical code through difficult times or even the advice of an old relative or coworkers. Maybe it was as large as an 8 year Oxford education, or perhaps it came from something overheard by a passerby on Michigan Avenue. Who knows where they picked it up, it works, and that’s all that matters.

I’m sure you know such people in your line of work. Think about one of these people you respect and admire for a moment.

What is it about them that inspires you? Chances are, it’s how they react to things. There’s also a good chance they were not always this way. Sage-like minds are not born, they’re made.

How Do You React Emotionally to the Stock Market?

How you react to an event is truly all that matters in investing and life. It’s the very definition of character. If I never had that horrific week of trading, I may have never developed my love for reading old philosophy, or any of the other literature I have enjoyed over the past 15 years. Nor would I have probably challenged me to become a successful trader. What’s the value of that?

Save death, it’s never what happens to you, but always how you react to the thing. Cliches exist for a reason; it’s generally because they work. If you squeeze hard enough you can almost always make lemonade out of lemons.

Sometimes, after I have a particularly bad week in investing/trading, I’ll try to get an equivalent (arbitrary) monetary amount of culture and education from my city. I’ll roam a museum, or get a cheap seat at the orchestra, or just wander 20 miles until my legs collapse, then hop on the Chicago “El” with a numb smile and return home.

“Walking is man's best medicine.”

Hippocrates

So next time some psychological quirk sends your trading account into a tailspin, try looking in the mirror to find out why, and make a plan as to what can be done.

Identifying Psychological and Philosophical Problems

I have three specific people on my mind as I write this article. They are friends, some close, some not, but each one is currently, or has been in the past, very successful at trading options.

All three of these individuals have one train in common: they are all incredibly steady.

It is very rare for any of them to get visibly angry under any circumstances. It is as though they all anticipated what was going to happen to them, no matter how positive or negative the outcome.

I was at an airport bar next to one of these individuals several years ago. I had heard earlier that day from other traders that he had had his best trading day ever. Retirement kind of money.

I fished to get something out of him, but my hook came back empty every time. He never showed his cards.

He had a contented look about him, but that was always there, no matter what the market was doing. What was he thinking? How can one not be celebrating in this situation? And who turns down a “Baby Guinness” shot!

Perhaps we can get a window into his mind by reading a quote from Paul Tudor Jones, one of the most successful traders the world has seen.

"Don’t ever feel that you are very good. The second you do you are dead. "

Paul Tudor Jones

This is easier said than done. I’m still working at it, but I’ve made progress. I can only gauge this progress by comparing my current self to the emotionally volatile trader I once was.

A violent emotional reaction to an undesirable market event is a sure sign of psychological instability and philosophical bankruptcy.

If this sounds familiar to how you react to a losing trade, you may need to do some introspection to turn things around. Turn your phone off from the insatiable noise of modernity. Take the time to get to know yourself. Do some walking; do some reading. It’s really that simple.

Final Word

To be a better trader, you need to learn to be a better thinker. This requires hard work. Mastering your emotions is easier said than done, and the only advice I can give with absolute certainty is that the answer won’t be found in a 2,000-word article on the internet.

Trading and investing in the markets can be thought of as a war. If you have the right army (philosophy) you can conquer all the battles (psychology).

Building the army is the hard part. You’ll know it only when you have it. If you rush it and dive into the markets without a mastery of yourself, you’ll get burnt. The vast majority of retail traders lose money, with 85% underperforming the benchmark.

Only when you have created a rock-solid philosophy on life and trading should you think about actively trading and investing. If you jumped the gun (like me), the process may be easier, as you have some empirical pain to build off of.

In the stock market, we must “know thy enemy”. The enemy is not a poor earnings report, faulty technical analysis, nor is it volatility; it’s ourselves.

If you’re looking for inspirational reads on how to master the art of life and trading (they are synonymous), here are a few books that have helped me tremendously in life. If you have a kindle, they should all be free. All books published before 1924 are in the public domain now. If you dig a little, you should be able to find any books published before this date for free!

If you’d like to dive deeper into trading psychology, please check out our article, “Emotional Investing is Inevitable. Learn how to Cope.”

Book Recommendations

- The Golden Sayings of Epictetus

- By: Epictetus

- Group Psychology and The Analysis of The Ego

- By: Sigmund Freud

- The Art of War

- By: Sun Tzu

Additional Resources

Mike Martin

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.