Last updated on April 29th, 2022 , 10:06 am

The premium composition of all option contracts (derivatives) can be broken down into one of two values: intrinsic and/or extrinsic value.

Understanding the fundamental difference between these two values is vital for the success of any options trader. These values are the building blocks upon which other options trading narrative builds as they determine the price of an option.

Let’s get started!

Jump To

TAKEAWAYS

- An option’s value is comprised completely of intrinsic value and/or extrinsic value.

- Intrinsic value is simply the amount an option is in-the-money by.

- Extrinsic value represents all option premium that is not intrinsic value.

- Extrinsic value consists of 1) time value and 2) implied volatility.

- Because of time value, an options extrinsic value will diminish as expiration approaches.

- Options with high implied volatility will have greater extrinsic value than identical options with lower implied volatility.

An Option's Two Price Components

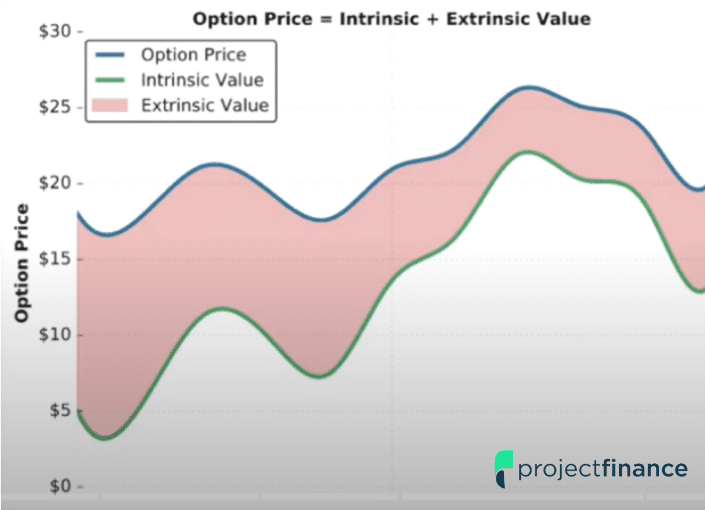

The value of any options contract – ETF options, equity options and index options – is the summation of its intrinsic and extrinsic value:

Option Price = Intrinsic + Extrinsic Value

The above image shows us how these values shift within an option as that contract progresses through time, reacting to changes in the price of the underlying security, the passing of time, and implied volatility.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

What is Intrinsic Value?

Intrinsic Value Definition: The value an option has in itself should that option be exercised immediately.

When compared to extrinsic value, intrinsic value is straightforward and easy to calculate.

The word “intrinsic” comes from the French word intrinsèque, which means “inwardly”. Intrinsic value is therefore the “inward” value of an option, discounting time and future volatility.

If an option were to be exercised at the moment of observation, would that option have value? If the option were in-the-money, yes. Therefore, in-the-money options have intrinsic value

Out-of-the-money (OTM) options, since they have no immediate value, have zero intrinsic value.

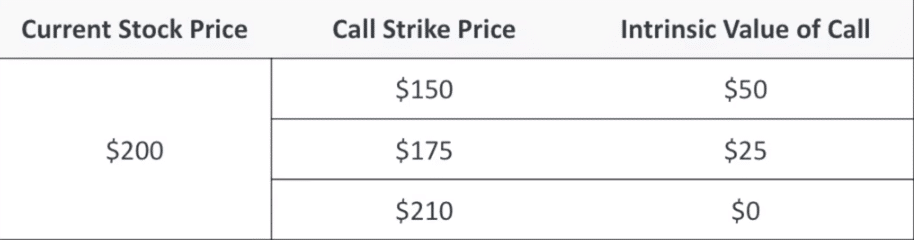

Let’s take a look at a few examples of intrinsic value and call options:

Calls and Intrinsic Value

The above table shows us three different call options. The first option listed has a strike price of $150. Since the current stock price is $200, this option has an intrinsic value of $50 ($200 – $150 = $50).

To determine the intrinsic value of any option, simply subtract the strike price from the stock price.

This calculation will tell us how much value that an option has should it be exercised immediately.

What about the above $210 strike price call? $200-$210 would give us -10. But extrinsic value can not be below zero, therefore the extrinsic value of this option is zero.

Intrinsic value discounts time: it tells us what an option would be worth at any given moment assuming expiration is already here. If the expiration date were here, what value would a $210 call have with the stock at $200? Considering that we can buy the stock cheaper in the open market ($200), this option has zero intrinsic value.

What is Extrinsic Value?

Extrinsic Value Definition: The value of an option that exceeds its intrinsic value.

In short, extrinsic value is everything that is “leftover” from intrinsic value. This value is the “premium” associated with the potential for an option to become more valuable before it expires.

We remember that intrinsic value shows us the immediate value of an option should that option be exercised immediately.

But, if that option has time until it expires, shouldn’t that option’s value reflect what could happen to it during the duration of its life?

For this reason, extrinsic value is also known as “time value“.

Let’s take a look at an example:

Calls and Extrinsic Value

We mentioned above that an option’s extrinsic value is everything that is leftover from its intrinsic value. We can see the $150 strike price call is trading at $52. Since we know the intrinsic value to be $50, the extrinsic value must therefore be $2.

This $2 represents the options “time value“, or its premium to change as the option approaches expiration.

Notice how the $210 call has zero intrinsic value. Why is this? This option is out-of-the-money. These types of options have zero intrinsic value and therefore consist of 100% extrinsic value or time value.

Let’s do a quick recap of intrinsic value for calls.

Intrinsic Value for Calls

Call Intrinsic Value:

- The value of being able to buy shares at the call’s strike price.

Stock Price Above Call Strike Price:

- Call Intrinsic Value = Stock Price – Call Strike Price

- Example: 140 call on $150 stock = $10 Intrinsic Value

Stock Price Below Call Strike Price:

- Call Intrinsic Value = Zero

- Example: 225 call on $200 stock = $0 intrinsic Value

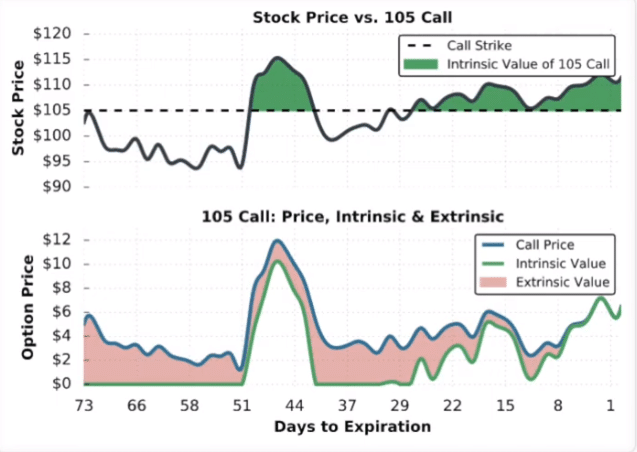

Intrinsic vs. Extrinsic: In-the-Money-Call

The above image illustrates how the intrinsic and extrinsic value of an option with a 105 strike price changes over time.

We learned before that only in-the-money options have intrinsic value. Therefore, this option will only have intrinsic value when the stock is trading above 105.

When the option is trading below this 105 strike price, its entire premium is comprised of extrinsic value.

- Stock > 105: Call Has Intrinsic Value

- Stock < 105: Call Is All Extrinsic Value

Notice how this option has its most extrinsic value at 73 days to expiration? Remembering that extrinsic value is synonymous with “time value”, this should make sense.

Notice too how the options extrinsic value falls when the option is “in-the-money” (ITM). During this period, a portion of an options value must be contributed to intrinsic value.

As time passes (and expiration nears), extrinsic value diminishes, leaving only intrinsic value.

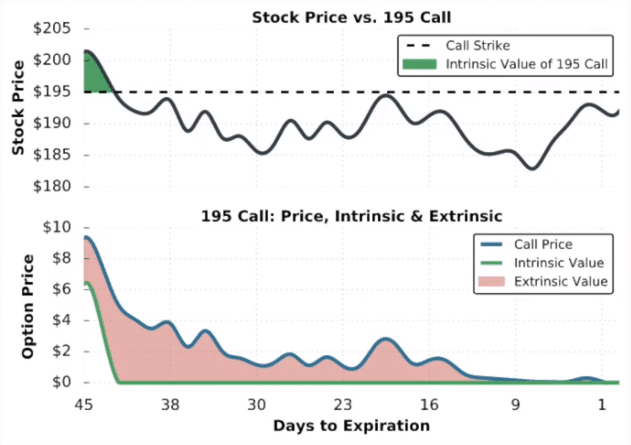

Intrinsic vs. Extrinsic: Out-of-the-Money-Call

The above image shows how the premium components of an out-of-the-money call shift over time as the underlying stock price changes.

- Stock > 195: Call Has Intrinsic Value

- Stock < 195: Call Is All Extrinsic Value

With the exception of the very first few days, this option is widely out of the money for the duration of its life.

As expiration approaches, extrinsic value diminishes, leaving only intrinsic value. Since out-of-the-money options have no intrinsic value, this option is fated to expire worthless.

Just as in our previous example, extrinsic value (aka time value) sheds as expiration approaches.

Intrinsic Value for Puts

Hopefully, by now, you have a pretty good idea of that which comprises a call options value.

But what about put options?

Put Intrinsic Value:

- The value of being able to sell shares at the put option’s strike price as opposed to the current stock market price.

Stock Price Below Put Strike Price:

- Put Intrinsic Value = Put Strike Price – Stock Price

- Example: 165 Put on a $150 Stock = $15 of Intrinsic Value

Stock Price Above Put Strike Price:

- Put Intrinsic Value = Zero

- Example: 300 Put on a $325 Stock = $0 Intrinsic Value

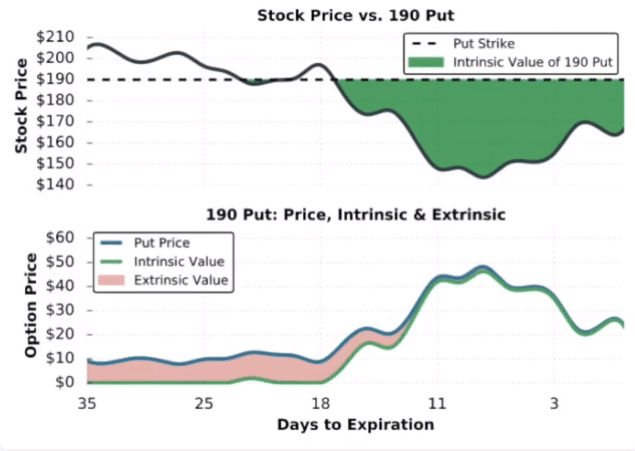

Intrinsic vs. Extrinsic: In-the-Money Put

In order to understand the pricing components of put options, we only need to take everything we learned about calls – then flip this information on its head.

- Stock > 190: Put is All Extrinsic

- Stock < 190: Put Has Intrinsic

Just as with call options, an option’s extrinsic value (aka time value) diminishes as time passes and expiration approaches.

At the moment of expiration, put options will consist of 100% intrinsic value or have “0” value if the option is out-of-the-money.

At the moment of expiration, the above stock price was trading at about $170. Since we are long the 190 put, that puts our option in the money by $20 (190-170). By looking at the lower chart, we can indeed see that this was the closing price of the option on the expiration day.

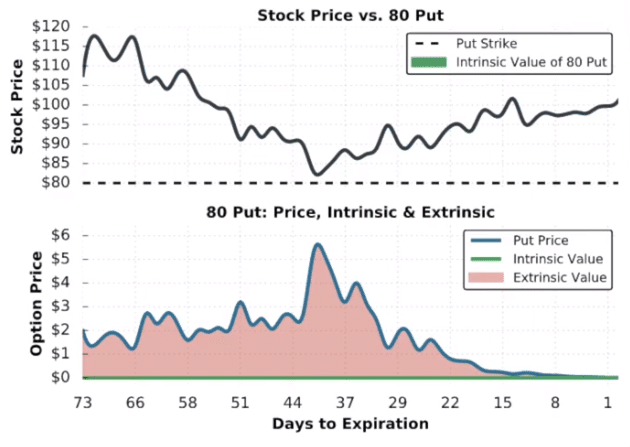

Intrinsic vs. Extrinsic: Out-of-the-Money Put

In this last example, we are going to look at the intrinsic and extrinsic value of a 80 strike price put that is out-of-the-money for its entire life.

- Stock > 80: Put is All Extrinsic

- Stock < 80: Put Has Intrinsic

Just as with our out-of-the-money call example, we can see this option shedding value as expiration nears.

Additionally, our 80 strike price put was never in-the-money. Therefore, it never had intrinsic value.

On expiration day, the stock was trading at about $100 – not even close to our $80 strike price. Therefore, the option will expire worthless.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

What Determines the Amount of Extrinsic Value?

The extrinsic value of any option is comprised of two components.

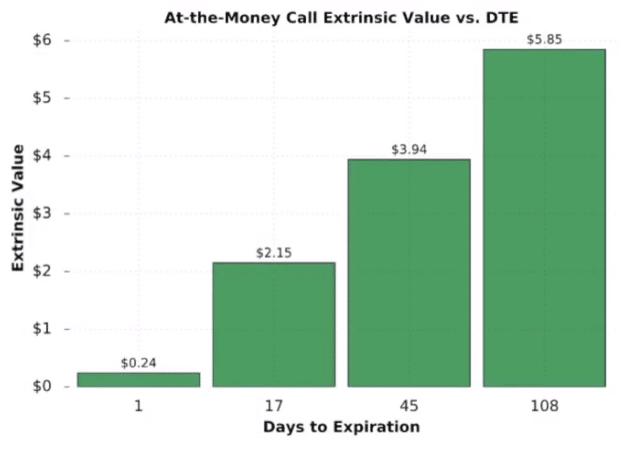

#1: Time to Expiration

An options days to expiration (DTE) is the first factor that determines an option’s extrinsic value.

Longer-Term Options = Greater Extrinsic Value

As a rule, extrinsic value increases with greater DTE. These options are more expensive than front-month options because there is more time for the stock to reach or exceed the strike price.

If a stock is trading at $100, and you own a $110 call going into expiration day, there is little chance the stock has the time to reach this level. If you own a $110 strike price call that expires in 6 months, however, the stock still has sufficient time to reach these levels, and will therefore have considerably more extrinsic value.

The above image illustrates how the extrinsic value of an at-the-money (ATM) call diminishes as expiration approaches. Remember, at-the-money calls are not in-the-money, so are therefore comprised of 100% extrinsic value.

#1: Implied Volatility

In options trading, implied volatility is the market’s prediction of the future movement in a security.

Higher Implied Volatility = Greater Extrinsic Value

The more an underlying asset is expected to move, the greater the premium the options on that underlying will be.

The above image shows us how implied volatility impacts the prices of an at-the-money call option experiencing various implied volatility levels.

With implied volatility (IV) of 15%, the option is only trading at $1.71. Increase that IV to 50%, and the options jacks up to over $5 in value.

This should make sense. Think about Tesla (TSLA) stock vs. Johnson & Johnson (JNJ).

Tesla is known for its volatile swings. It, therefore, has a greater chance of reaching distant strike prices than that of JNJ. To reflect this probability, TSLA has higher implied volatility than JNJ.

Intrinsic vs Extrinsic Value: FAQs

Options have extrinsic value to account for time value and the implied volatility of the underlying. Intrinsic value tells us how much value an option has in itself; extrinsic value tells us how much value an option has taking into account the unknown. Understanding these two values is very important when trading options.

Intrinsic value tells us how much value in option has if it were to be exercised at this moment of observation. Therefore, only in-the-money options have intrinsic value. This value ignores “time” and “implied volatility”.

Final Word

- The entirety of an option’s premium consists of intrinsic and/or extrinsic value.

- Intrinsic for Calls: Stock Price – Call Strike Price

- Intrinsic for Puts: Put Strike Price – Stock Price

- Extrinsic value is everything left over after accounting for intrinsic value.

- Extrinsic value consists of 1) time decay and 2) implied volatility.

- Extrinsic values declines as expiration approaches.

2 thoughts on “Intrinsic and Extrinsic Value in Options Trading Explained”

Great read! Just one question – why do at-the-money options have the highest extrinsic value?

Thanks for the question J!

At-the-money options always have the highest extrinsic value. Why? When/if the underlying stock moves, the value of these options will be impacted the most.

Think of it this way, if you’re long a 150 call on AAPL and the stock jumps from $150 to $155, wouldn’t you expect your 150 call to move more than a 160 call? At-the-money options are full of potential, and this is represented in “extrinsic value”.

Mike