Last updated on February 11th, 2022 , 07:13 am

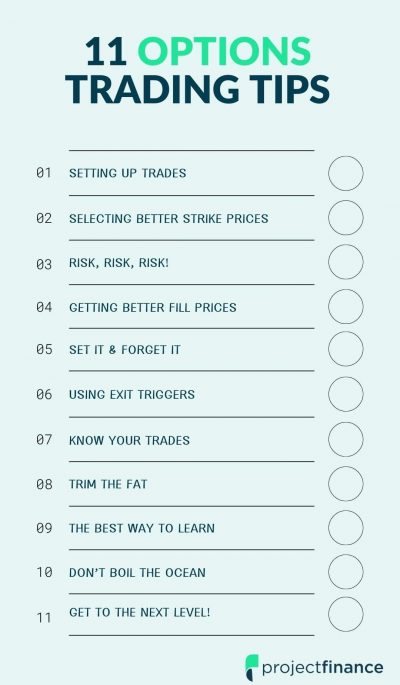

If you want to become a successful options trader, you need a game plan. It’s that simple.

In this article, projectfinance aims to aid in this process by providing a checklist of useful tips. Be sure to read through the entire article, as many of our tips build upon the other ones.

The first four options trading tips of our list pertains to setting up and entering trades. Let’s get started!

Jump To

TAKEAWAYS

- Both technical analysis and “delta” can be used to determine strike prices for a trade.

- Always check an option’s “liquidity” before trading it.

- High probability trades = high risk.

- Low probability trades = low risk.

- Always try to fill a trade at its “mid-price” first.

- Keep a logbook containing your complete trading history.

- Don’t trade overlapping strike prices within a security.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

1. Setting Up Your Trade

There are two popular methods of choosing the strike prices of options trades.

- Use Technical Metrics

- Use the Greek “delta”

Let’s take a look at each of these individually.

Using Technical Visuals to Setup Trades

Many inexperienced traders simply choose their strike prices after studying the historical trading activity of a security.

Though this can indeed work sometimes, it is important to know that past performance is not always indicative of future results.

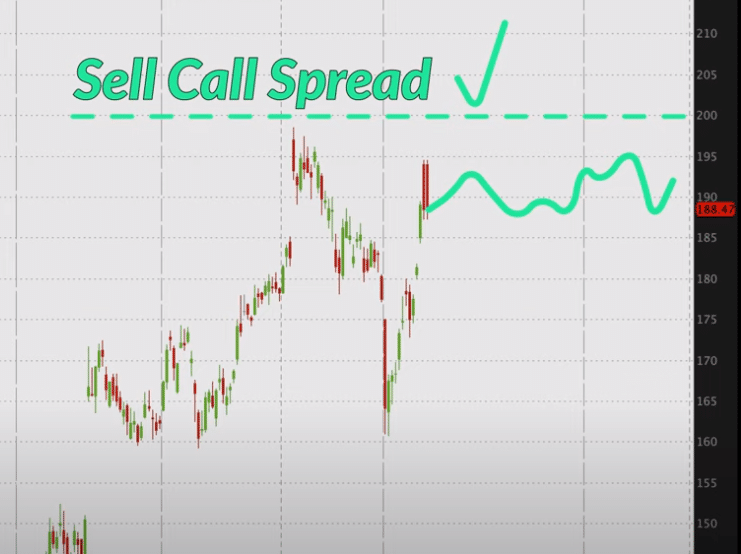

Let’s take a look at an example of this approach on Facebook (FB) stock.

After studying the above chart, we can see that FB has experienced resistance at the 200 level. A trader using technical analysis may, in this scenario, sell a call spread with the short strike price being at this 200 level.

A better (and more mathematically sound) approach to choosing your strike prices is through the delta approach.

Using Delta to Setup Trades

Using delta to choose your strike prices is a quantifiable system that both simplifies and streamlines the process of choosing strike prices.

This article assumes you have a basic familiarity of delta. If the Greeks are Greek to you, check our article, Option Greeks Explained: Delta, Gamma, Theta & Vega.

So how does this process work? Let’s jump into an example.

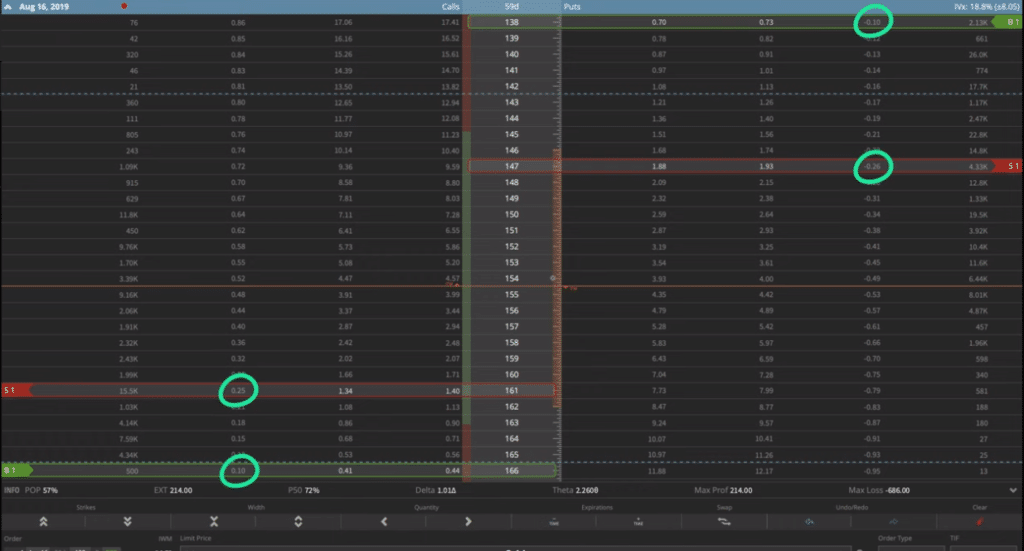

The above screenshot (taken from the tastyworks trading platform) has four deltas circled. These four options will comprise an “iron condor” trade strategy.

- Short Call Delta: 0.25

- Long Call Delta: 0.10

- Short Put Delta: -0.26

- Long Put Delta: -0.10

An option’s delta estimates the options price change with a $1 movement in stock price. Delta also represents an options probability of expiring in-the-money.

Our short options, therefore have a ~25% chance of expiring in-the-money, which implies a 75% chance of expiring out-of-the-money, which is our goal since we are selling this iron condor.

Using delta incorporates probability into our trading. When we only look at charts, our decisions are often arbitrary.

2. Trade Liquid Strike Prices

Liquidity is very important in options trading. To determine the liquidity of an option, three metric must be checked:

- Volume (total number of contracts traded on a given day)

- Open Interest (total options outstanding)

- Spread (difference between the bid and ask)

Liquidity issues should not be a problem for more popular, front-month options. More exotic stocks, however, tend to have wide spreads and very low volume/open interest.

It is, therefore, best to avoid these options. If a call is bid at $1, and offered at $1.90, that means (assuming you are filled at these prices) you will already have a 50% loss the moment you trade the option.

Additionally, longer-term options (LEAPS) tend to have less liquid options than shoter-term options.

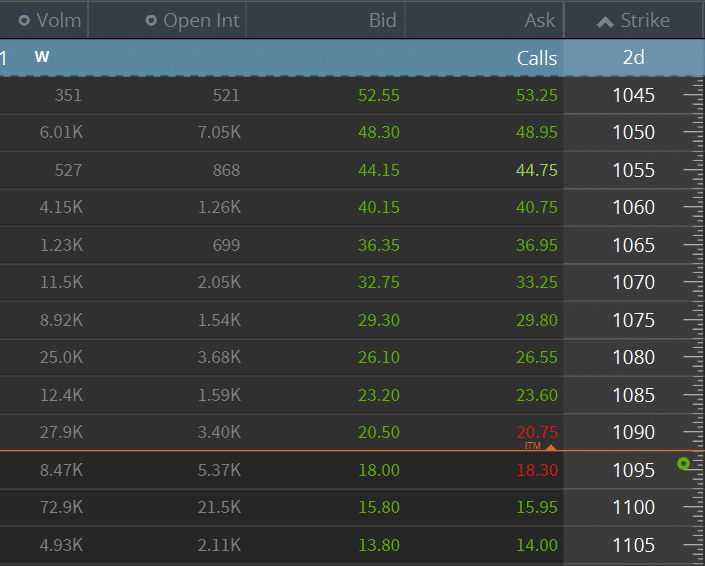

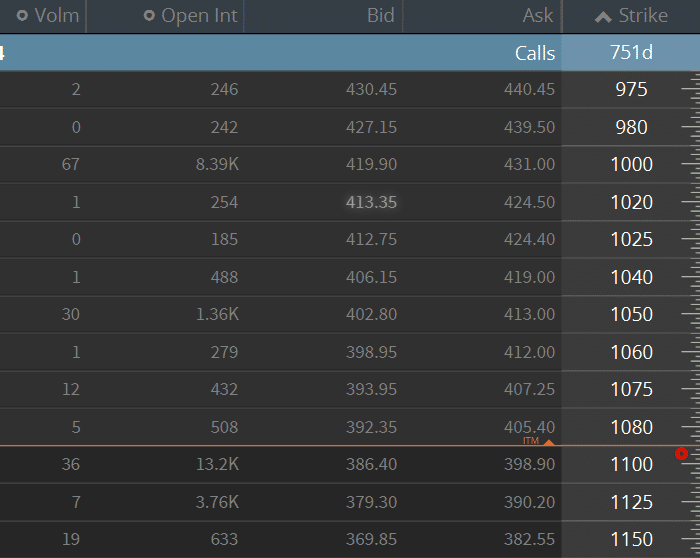

Take a look at the below two option chain for Tesla (TSLA). The first image shows front-month options. The second image shows options that expire 3 years into the future.

TSLA: Front Month Options

TSLA: 2024 LEAP Options

Do you see how the volume and open interest plummets on the LEAP options? Additionally, you could park a truck between those wide markets!

3. Mind Your Risk!

When I began trading options, I only saw the upside. I fast learned to shift this mentality to focus on risk.

Whenever you place a trade, always examine the maximum loss potential. Losses will occur in options trading. That’s inevitable. Developing your own trading philosophy is vital to your success.

Just because a trade has a high probability of making money does not necessarily mean it is a good trade. Options trading is all about risk AND reward.

- High probability trades generally have little profit potential and a lot of risk.

- Low probability trades, on the other hand, generally have a high-profit potential and little risk.

4. Try to Fill at the Mid-Price

This is perhaps one of the more important tips on our list.

When trading stocks, it is common practice to send “market” orders. These are essentially stop-loss orders in disguise.

What does this mean? It communicates to the market maker that you want to get filled immediately, regardless of price.

DO NOT USE MARKET ORDERS FOR OPTIONS. EVER.

When I was working on a trade desk, I have seen market orders filled for 0.05, only to see that option trade at $1.00 seconds later. We used to call these order types “donations to the market-makers holiday fund.”

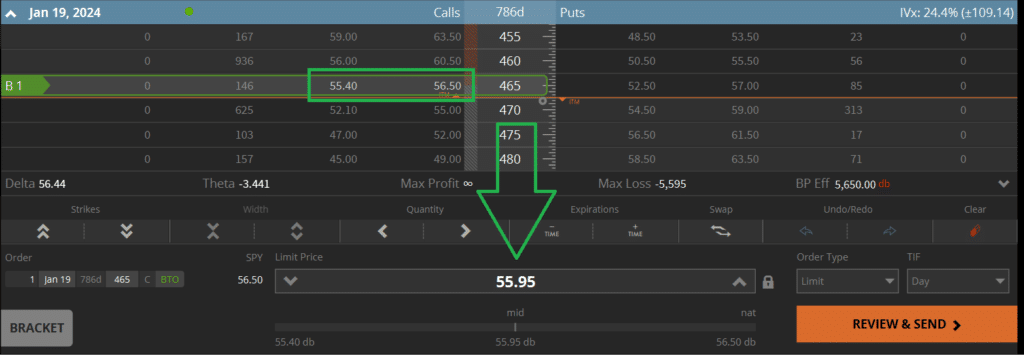

So what do you do? Always, always, always try and get filled at the “Mid-Price”. This price is between the bid and ask price. Whether you are trading single options or complicated options spreads, always start at the mid-point, then work your way down or up.

Getting Filled at the Mid-Price

5. Set a GTC Order at Your Profit Target

The old Wall Street saying goes, “Bears make money, bulls make money, but pigs always lose.”

Perhaps it’s a bit harsh, but how true it is! Whenever you place a trade, always have a profit-taking plan in place.

This number should be determined before you enter the trade. A GTC (good-’til-cancelled) order will be working in your account until 1.) your target is met or 2.) the option expires.

6. Use Multiple Trade Exit Triggers

A “trade exit trigger” is an event that you use to determine when a trade is closed. Here are a few examples:

- Profit Targets

- Loss Limits

- Specific Stock Price Movements

- Amount of Time in a Trade

- Option Delta Breaching Level

Profit-Based Exit

A profit-based exit is simply closing a trade at a pre-determined profit level (as discussed above). I prefer to use percentages as opposed to dollar amounts.

Example:

Sell an Iron Condor for $5.00 with a 50% profit target

Profit Based Exit Rule:

Buy back the iron condor for $2.50 (50% profit)

Delta-Based Exit

A delta-based exit is closing a trade at a pre-determined delta breach level.

Example:

Sell an Iron Condor on SPY

(0.25 short call and put delta)

Profit Based Exit Rule:

Close the iron condor if the call OR put delta breach the 0.35 level.

Time-Based Exit

Another good rule-based strategy is to simply close a trade after a certain amount of time has elapsed.

Example:

Sell an Iron Condor with 60 DTE

Time-Based Exit Trigger:

Close the Iron Condor after 30 days, no matter what.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

7. Log Your Trades

This may not be the most popular of the tips on our list. It is easy to see how our current trades are performing, but keeping track of historical trades can be important as well.

Why?

Perhaps there is a certain security on which you only seem to lose money. Stocks can sometimes have their own personalities; some you get along with and others you don’t. If you are persistently losing money on certain trades, or certain stocks, why keep on doing the same thing?

If you trade a lot, sometimes it can be difficult to keep track of all of your trades. Having a sortable, online log will help you to keep track of every trade you ever placed.

If you don’t log your trades, you:

- Won’t be able to measure what’s working and what’s not.

- Won’t know the specific factors that may be influencing your success/failure rate

8. Trim the Fat

What do we mean by “trim the fat”? Eliminate what’s not working for you and focus on what is. Of course, this is where the above “trade log” comes in handy.

Becoming a successful trader is often accomplished by a process of elimination. If you have tried to make a certain strategy work time and time again only to keep losing money, it is probably best to avoid this strategy.

Personally, I don’t have the stomach to sell naked options. Whenever the option goes in the red, all I can see is the max loss scenario, and I close the option out. Since I let emotion get in the way of these trades, I simply no longer do them.

9. Experiment with Different Strategies

In options trading, there are dozens of default template trades. In addition to these, custom trades are only limited by your imagination.

New traders often only buy call and put options. New traders, therefore, often lose money. Try doing a “vertical spread” if the long game isn’t working for you.

After you’ve mastered this strategy, you can move on to more advanced trades like the “iron condor” and “straddle”.

When compared to stock trading, options trading can bet on literally any market direction movement.

But remember – start small! Experimentation can sometimes be costly!

10. Don't Overcomplicate Matters

When I used to work on a trading desk, I would often get calls from customers who had no idea what their actual options position in a certain underlying was.

They would have dozens of various strike prices listed, and they simply couldn’t understand why a certain leg of their “iron condor” had disappeared.

They usually, inadvertently, traded out of this leg while initiating another trade. This would often create some kind of funky ratio spread, or simply a flat position in that particular strike price.

These Gordian Knot like scenarios can be a real nightmare. The solution? Keep it simple! Simply don’t overlap strike prices.

Here are a few other ways traders overcomplicate matters:

- Trading too many positions with conflicting outlooks

- Looking at arbitrary metrics to determine PERFECT entry/exit points

- Pairs Trading

- Complex strategy construction

11. Develop a 100% Quant Backed PLan

The ultimate goal of a beginner options trader is to come up with a trading plan that leaves NOTHING to the imagination. i.e., your emotions are completely dormant.

This plan should incorporate:

- The Stock/Product

- The Strategy

- Specific Strategy Setup

- Exact Trade Size

Final Word

Success in options trading does not happen overnight. Mistakes will inevitably be made.

The best approach (and perhaps the most important tip from this article) is to trade small.

If you get emotionally excited about the upside prospects of a trade, you’ll probably lose in the long run. Success in options trading can often be linked to the psychology and philosophy of individual traders. This business isn’t for everyone.