Last updated on April 27th, 2022 , 07:42 am

In options trading, there are five primary types of orders:

- Market Order

- Limit Order

- Stop Order

- Stop Limit Order

- Trailing Stop Order

In this article, we are going to focus on the stop-limit order.

The stop-limit order combines two of the above option order types: 1. the limit order and 2. the stop order.

Before we conquer the stop-limit order, we must first have a comprehensive understanding of how stop-loss orders and limit orders work. Since a stop-loss is essentially a market order, we must master that concept too.

Let’s get started with market orders!

Jump To

TAKEAWAYS

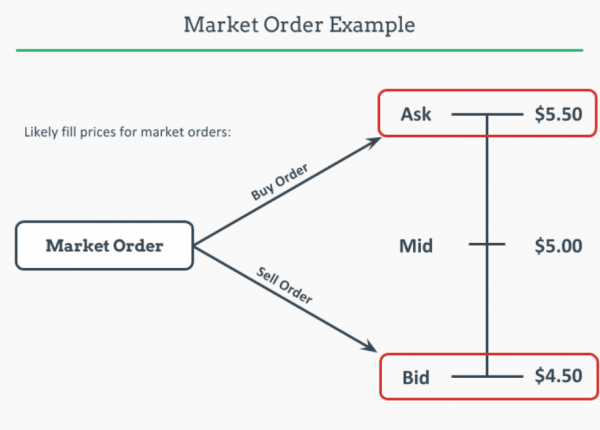

- A “market” order instructs your broker to send the order to the market makers to get filled immediately, regardless of price.

- A “limit” order places either an upper bound (buy order) or lower bound (sell order) on the fill price you are willing to receive.

- A “stop-limit” order combines the above options orders types and has two components. The “stop” price triggers the order, while the “limit” price tells your broker you will not accept a fill above (buy orders) or below (sell orders) the specified limit price.

What Is a Market Order in Options?

Market Order Definition: An order placed with your broker with instructions to get filled immediately, regardless of price.

In options trading, a “market order” instructs your broker that you want to receive a fill on your option contract(s) immediately.

After your broker receives your order, that trade will get sent out to market makers to get filled (as long as they do not internalize order flow).

In liquid stocks, market orders generally receive decent fills (though I never use market orders myself).

In options trading, market orders can very frequently result in poor fills.

Why?

Liquidity in options can be horrible. If you’re trading AAPL stock, there’s only one equity product, so volume is high. There are, however, thousands of options markets on AAPL. This is because of the innumerable strike prices and expiration cycles.

There are two components of liquidity: Volume/Open Interest and the Bid-Ask Spread:

1. Volume and Open Interest

The volume and open interest of an option tells us how many contracts:

1. Have traded so far that day (volume)

2. Are currently in existence (open interest)

If you send a buy market order on an option that has traded 3 contracts all day and has a total open interest of 10, you’re going to get a bad fill.

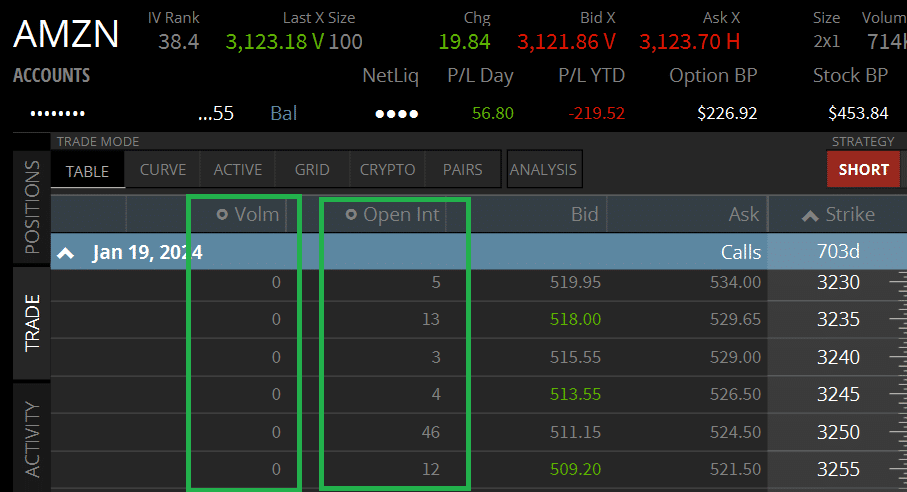

Amazon (AMZN) is known for good liquidity. However, when you look at the markets on options expiring years down the road (LEAP Options), you’ll see how poor the volume and open interest is. Stay away! Or work the order slowly, starting at the “mid-price”.

2. The Bid-Ask Spread

For call and put markets, the Bid-Ask Spread is simply the width of the market.

In options trading, you want tight markets. Generally, poor volume/open interest goes hand in hand with wide markets.

Take a look at the Bid-Ask from the AMZN options in the above example. For the 3250 calls, the offer is 524.50 and the bid is 511.15. If we were to buy at the offer and immediately sell at the the bid, we would have lost 13.35 (or $1,335 taking into account the multiplier effect and option leverage). That’s a lot of money!

Because of the above reasons, we can now understand why market orders on options (whether they be placed on a single option, spread, or iron condor) is probably a bad idea.

If you’re in a situation where you can’t be around to monitor your positions, don’t trade risky options strategies, or don’t trade at all. Market orders are not the solution. After working as an options broker for 15 years, I have seen too many donations to market makers.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

What Is a Stop-Loss Order in Options?

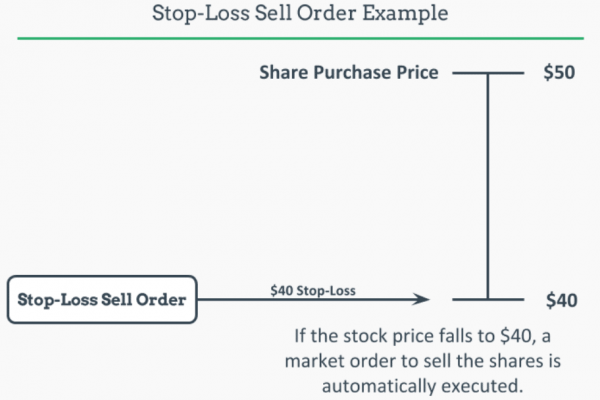

Stop-Loss Order Definition: An order placed with your broker which activates a market order to either buy or sell an option when that option trades at a certain price.

If you know how market orders work, you already know how stop-loss orders work.

A stop-loss order in simply a market order in disguise. The price you set your stop-loss at is the point at which that order gets changed to a market order.

Once your trigger gets hit, your broker sends that order get filled. Market makers only ever see a market order. On illiquid options, avoid stop-loss orders at all costs!

The stop-limit order, on the other hand, is a different story. We’ll get to that after we go over the limit order.

What Is a Limit Order in Options?

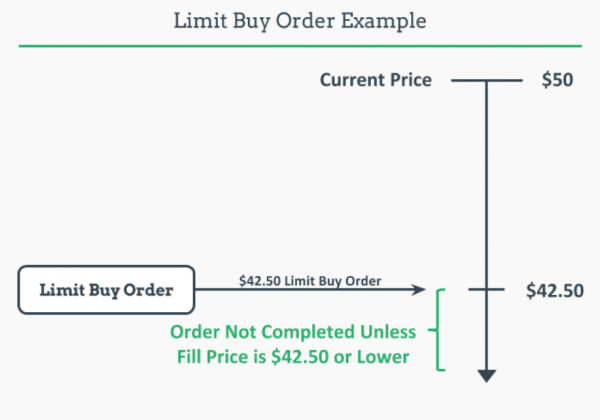

Limit Order Definition: An order placed with your broker to either buy or sell an option at or better than the predetermined “limit” price you choose.

When I trade options (and I have traded a lot!), I only ever use limit orders. With limit orders, you don’t have to worry about liquidity – you’re going to get filled at or better than your limit price, no matter what.

Of course the downside here is you may never get filled. I, however, would rather not get filled than get filled poorly.

If I place an order to buy an AAPL option at 3.10, I will get filled at 3.10 or better. Period.

What Is a Stop-Limit Order in Options?

Stop-Limit Order Definition: An order placed with your broker to either buy or sell an option at or better than the “limit” price set. Unlike traditional limit orders, the stop-limit order is only triggered when the stop price is breached.

So we have learned all of that to get to this: the stop-limit order. Like all option order types, you can use the stop-limit to buy or sell.

Let’s break down the sell stop-limit first.

Sell Stop Limit Example

Let’s look at this order type through the lens of a trade on tastyworks.

Our Trade:

➥ Long SPY 445 Call at $2.60

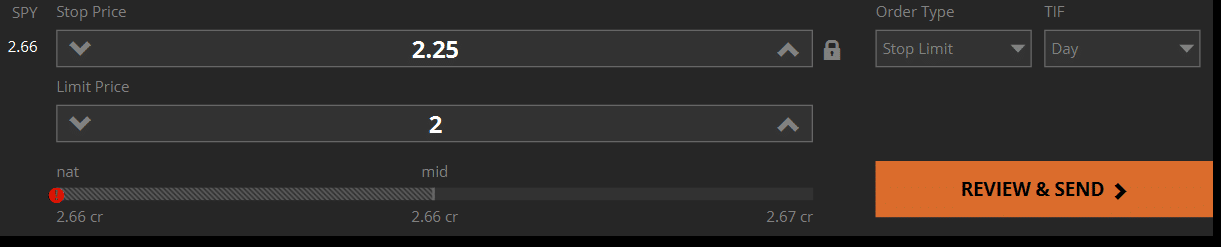

So let’s say we want to sell our long SPY ETF option if it falls below 2.25 in value. HOWEVER, we are not willing to accept a fill price worse than 2. Our sell stop-limit order, therefore, has 2 components:

➥Stop Price: 2.25

➥Limit Price: 2

So at what price can we expect to get filled? At $2 or better. The stop-limit order can even get filled better than our stop price!

And here’s how this trade looks on tastyworks:

Buy Stop Limit Example

In this example, we are short a call option on Meta Platforms (FB).

Our Trade:

➥ Short FB 215 Call at $2

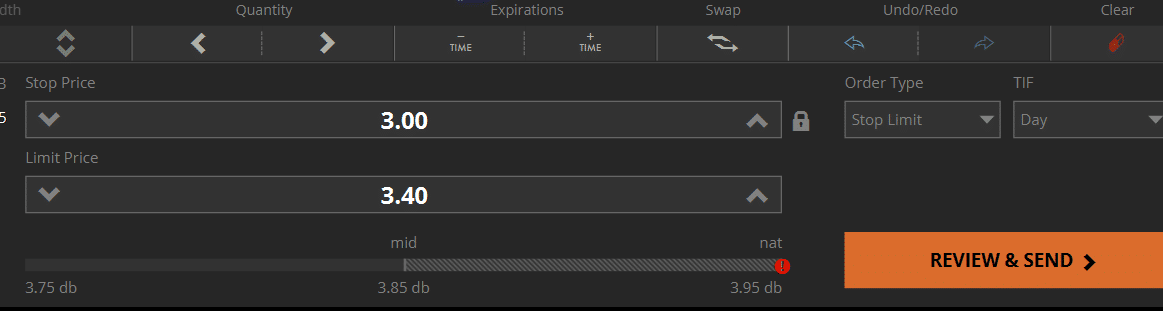

So let’s say we want to buy back our short option if the option moves against us and rises to $3 in value. However, we are unwilling to pay more than $3.40 for this equity option.

Just as in our previous example, this stop-limit order has two components::

➥Stop Price: 3

➥Limit Price: 3.40

So at what price can we expect to get filled? At $3.40 or better. The buy stop-limit order can also get filled better than our stop price! (think market open).

And here’s how this trade would look on tastyworks:

Stop-Limit Order Pros and Cons

Lastly, let’s fly over some advantages and disadvantages of the stop-limit order.

👍 Stop-Limit Order Pros

- Assures fill price.

- Traders are not constantly required to monitor their positions.

- Acts as a hedge against illiquid markets.

👎 Stop-Limit Order Cons

- If the market blows past your limit price, your position could move against you…fast!

- Erroneous fills could trigger the stop price portion of the stop-limit order, resulting in an undesirable and early exit.

TIF Order Types

In stop orders, you also need to consider the TIF designation. TIF (time-in-force) orders can be designated in numerous different ways. These communicate to a broker when and for how long a trade should remain working. Some of these include DAY, GTC, GTD, EXT, GTC-EXT, MOC, LOC. Read more about these order types in our article on TIF order types here!

Stop Limit Order FAQ's

A stop-loss order triggers a market order. In market orders, fill prices are unknown. Stop-limit orders guarantee execution price, but that doesn’t mean you’ll get filled!

This depends on whether or not you have tagged the order as “DAY” or “GTC”. DAY orders are only good for the day, GTC (Good Til Cancelled) orders stay working in your account until you cancel them.

Stop orders are NOT visible until they get triggered, at which point your broker sends them to the exchanges/market makers. Limit order ARE visible to market makers as they are in working status immediately.