Last updated on April 27th, 2022 , 04:59 am

Jump To

For sixteen years, Gary Gensler, (the Chairman of the SEC) had his heart set on improving the profits at Goldman Sachs. Today, it is set on the advocation of retail traders. He wants to do away with payment for order flow.

Payment for order flow (PFOF). Doesn’t it sound sinister? Like some kind of Faustian deal? The father of it may even be thought of like a modern-day Mephistopheles: none other than Bernie Madoff invented the system, whereby brokers receive compensation for routing their orders to market makers.

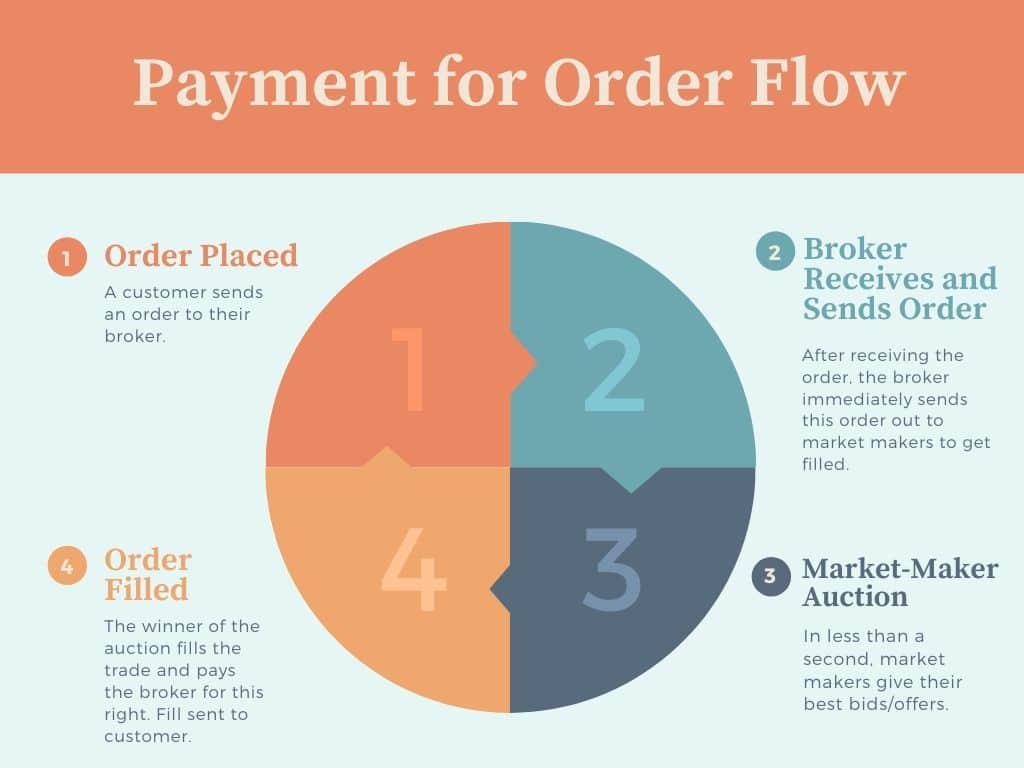

So how, exactly, does this system work?

Highlights

-

In payment for order flow (PFOF), market makers pay brokers for filling customer orders

-

In these flash-auctions, the best bid/offer wins; payment is sent from the market maker to the broker for filling the order, and the customer is filled

-

Outwardly, wholesale market makers welcome an end to PFOF as this means they’ll simply fill the same orders without having to pay

-

More transparency is needed in the system to assure investors they are indeed receiving the best fills possible

Payment for Order Flow Example

Let’s say your friend Fred wants to sell his apple. He hires you (the broker) to sell this apple for him. You then take the apple to market.

For a long time, there were only a few vendors in town. We will say three (market makers on public exchanges like the CBOE, NYSE, NASDAQ).

Now if you are selling an apple for a client, wouldn’t it be better if there was more competition? We want them to fight for the right to purchase our apple, thus making the spread tighter.

A few outsiders (wholesale market makers like Citadel and Virtu) got wind of the wide spreads in the apple market. One day, they are standing next to the major vendors, giving you their own markets.

Our apple auction begins. The newbies are aggressive and offer you the best fill, better than the old players. In fact, two of these best markets presented to you by the newcomers offer you the same price.

So who do you sell the apple to?

One vendor (market maker) says they’ll personally pay you a penny if you send him the order. This is money you can put in your pocket. This is NOT money for Fred.

You sell the apple to this party and then walk home, rolling that penny over in your pocket the entire time.

“Here’s your money.” you say to Fred, “Also, I got paid a penny, but I sold the apple at the best possible price.”

“Cool.” replies Fred.

“I am going to invest this penny in new pair of sneakers so I can get to the market faster.”

“I don’t care.” replies Fred.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Payment for Order Flow: A Benefit to Retail Traders?

Of course, in this situation, our apple is stock or options (most likely to be options) and the apple vendors are market makers. You are the broker here.

So what about that money you collected from the market maker? Instead of sneakers, you will use the funds to invest in technology and pay for the cost of your operations. After all, if you run an apple to the market for someone, shouldn’t you get paid? Capitalism isn’t charity.

In a nutshell, this is how PFOF works.

Markets Without Payment for Order Flow

So let’s say Gensler gets his way and PFOF is banned. What then?

For one, commissions may come back. There is a chance this may happen, but it’s unlikely. Too many large brokers can exist just fine without commissions.

Realistically, brokers may decide to “internalize” their order flow. These orders will never see competition. Technically, they must provide the best execution. However, the fills from internalization may be more nebulous than with PFOF!

In-house exchanges may be established, and investors may have to pay a fee to trade on these exchanges. Again, the markets here will not be as liquid nor as good as they are at present.

No matter how it plays out, investors will pay for a ban on PFOF, either through fees, commissions or in wider spreads and poorer liquidity.

PFOF Ban: Win-Win for Hedge Funds?

So what happens to the “villain” in this tale?

During an interview at The Economic Club of Chicago, the CEO of Citadel, Ken Griffin, said, “Payment for order flow is a cost to me.”

Mr. Griffin seems happy for a ban; after all, this will only mean Citadel can fill the same orders without paying!

But does Mr. Griffin truly want to do away with PFOF? What will actually happen at Citadel? We can’t say for certain. Perhaps his rhetoric is all strategy. All we do know is that a PFOF ban will most likely hurt the retail investor.

PFOF: What's the Solution ?

What’s the answer?

PFOF is built mostly on a system of trust. It assumes we trust our broker. Even though by law brokers most get us the best fill, we have no transparent way of knowing for certain whether or not they do.

Most Americans have an inherent distrust of Wall Street. This is in our blood. We will never take a Wall Street executive at their word. The only solution, that I can see, is to find a method of promulgation that removes the veil of ambiguity around PFOF.

Can they prove, clearly and on a regular basis, that they are indeed getting us the best fills?

But net-net, at the end of the day, empirical research has proved the system ain’t broken. Why fix it?