Last updated on March 24th, 2022 , 08:03 am

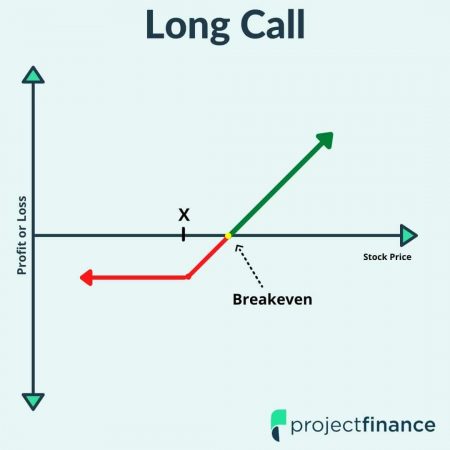

The above image represents the profit/loss of a long call position at expiration, where X represents the strike price of the call purchased.

Long Call Definition

In finance, a long call is an options strategy where a trader purchases a stand-alone call contract with the expectation that the underlying security (stock, ETF or index) will increase in value. Typically, a long call represents the right to purchase 100 shares of the underlying stock at the specified strike price on or before the expiration date.

Long Call Inputs

● Long call at strike price X

Maximum Profit

Unlimited

Maximum Loss

Complete debit paid for call contract X

Breakeven

Strike price X + premium paid

Assignment Risk

None

Best For

Extremely bullish investors

Long Call Option Video

Long Call Option Strategy for Beginners

In options trading, a long call gives the buyer the right to purchase (typically) 100 shares of a stock at the strike price of the call contract on or before the expiration of the option. There are many variables to this rule, but understanding this generality is a good starting point for beginners.

In order to determine the true dollar cost of an option, this “multiplier effect (leverage)” of 100 tells us we must multiply the options quoted cost by 100. For example, an option quoted at $1.37 will cost us $137 to purchase.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Long Call Option and Moneyness

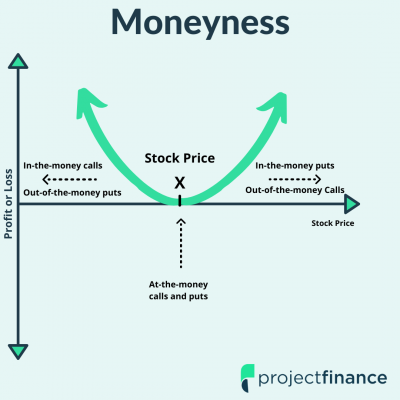

All options contracts trade in one of three “moneyness” states. This state represents the proximity of the options strikes price to the current stock price.

- Out-of-the-Money

- At-the-money

- In-the-Money

The most costly of the “moneyness options” are in-the-money. For call options, this state occurs when the underlying security price has surpassed the options strike price. It is for this reason beginner investors prefer trading out-of-the-money calls, as the premium required to purchase these contracts is much lower.

Time Decay and Long Calls

The greatest risk that comes with purchasing long call options (particularly when purchased out-of-the-money) is time decay or theta. Theta refers to the rate of decline in the value of the option as time passes.

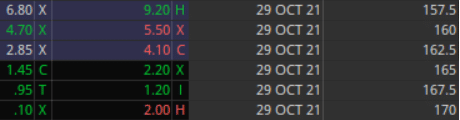

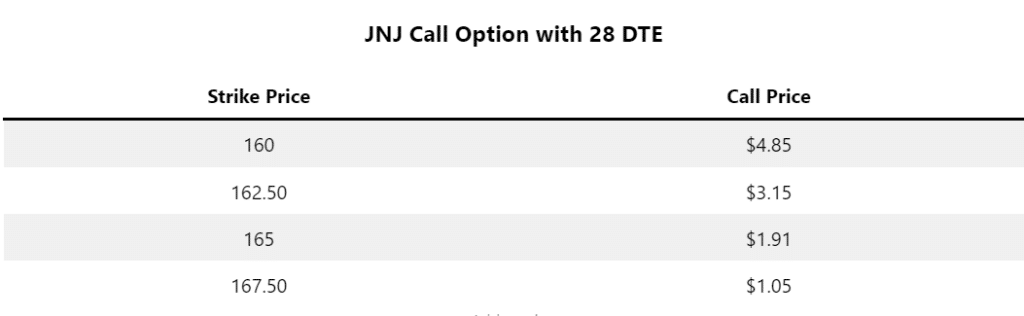

Take a look at the below options chain for Johnson and Johnson (JNJ) with 28 days to expiration (DTE). JNJ is trading at $163.50.

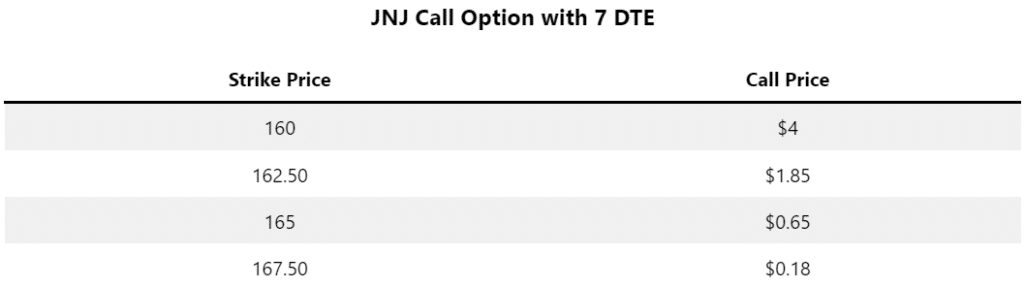

As time passes and the stock remains the same, the odds that JNJ stock will reach the strike price of the call diminishes for out-of-the-money options. This is reflected in the premium of the option. The below options chain is updated to reflect the passage of 21 days. Our model assumes the stock has remained unchanged during the elapsed time and still trades at $163.50/share.

Let’s explore next why, exactly, our options are priced at the levels they are.

Long Calls and Implied Volatility

Some options are more expensive than others.

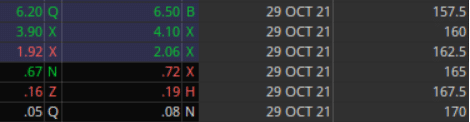

For example, options on JNJ are more expensive than options on PPG Industries (PPG). Both stocks are currently trading at the same exact price, but the October 29th, 2021 calls on JNJ cost more than the same calls on PPG.

This is due to something called “implied volatility”. In options trading, implied volatility tries to predict future price movements of the underlying security. How is this forecasted? By looking at the pricing of the derivatives (options) on the underlying security/stock.

Historic volatility, unlike implied volatility, looks at the past volatility of options. Historic volatility tells us that the price of PPG tends to undulate more wildly than that of JNJ. Therefore, the premium for options on PPG expiring at a future date must be greater than that of options of the same expiration for JNJ.

Closing a Long Call Position

There are three ways to exit a long call position. The vast majority of traders exit option positions by simply closing the position in the open market (choice #1). You can trade out of options at any time and do not need to wait until the expiration to do so.

- Sell the long call in the open market.

- If a call is in-the-money at expiration, your call will be exercised automatically, resulting in 100 long shares of stock per long call.

- If the call is out-of-the-money on expiration, it will expire worthless; no action required.

Final Word

Long calls are reserved for the incredibly bullish investor. Just because a stock goes up in value does not mean the value of a call will go up. In order for an out-of-the-money long call to be profitable, traders need the value of the underlying to go up a lot and fast.

Next Lesson

projectfinance Options Tutorials

Additional Resources

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.