Last updated on May 22nd, 2025 , 11:53 am

7 guides to help you master topics related to implied volatility (option prices).

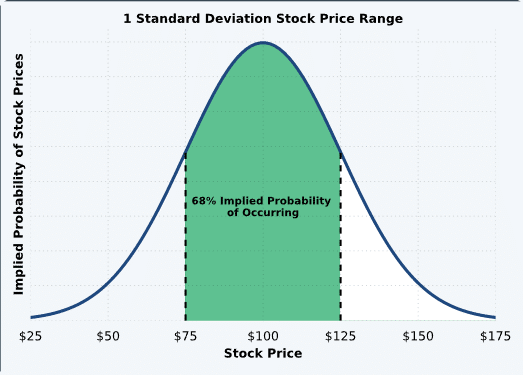

Implied Volatility Basics

Implied volatility represents a stock’s option prices, and is one of the most important options trading concepts to master.

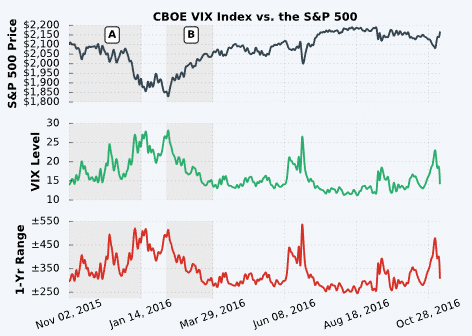

What is the VIX Index?

The VIX Index is a commonly watched indicator, as it measures option prices on the S&P 500 Index.

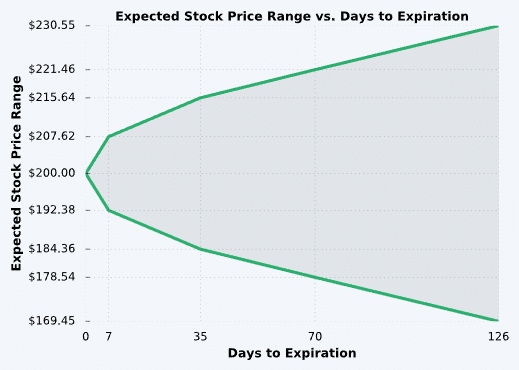

The Expected Move

The “expected move” represents a probabilistic forecast for a stock’s price in the future.

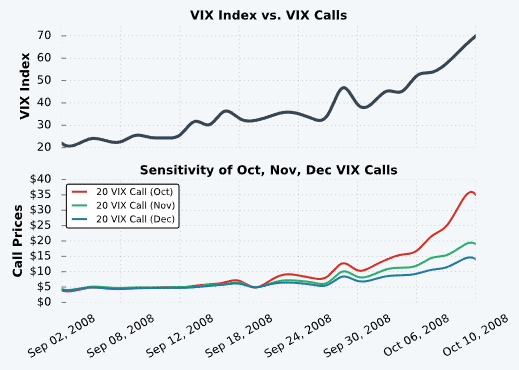

Trading VIX Options

Want to trade VIX options? Be sure to understand common misconceptions.

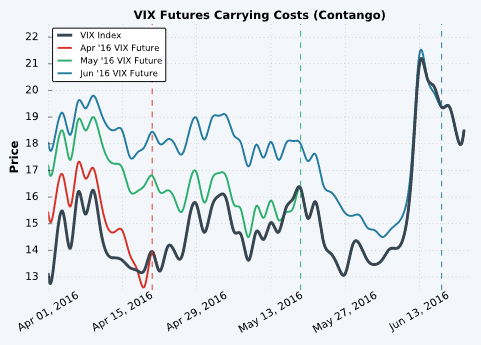

Trading VIX Futures

VIX futures can be used to trade expectations related to changes in the VIX Index.

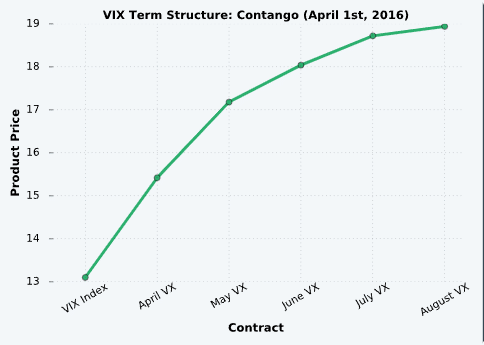

The VIX Term Structure

The VIX term structure represents the relationship between near-term and long-term VIX futures contracts.

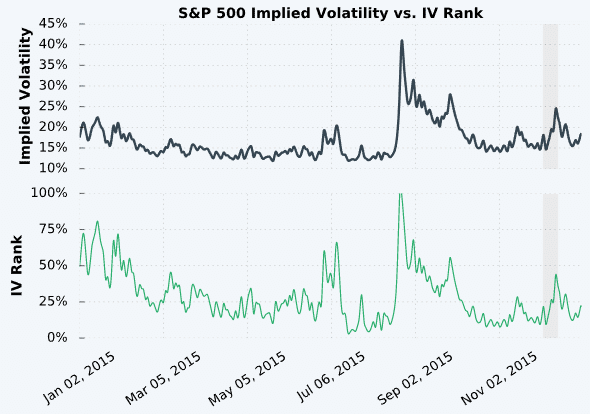

IV Rank vs. IV Percentile

How do you know if a stock’s current implied volatility is high or low relative to its historical levels? IV rank and percentile can help.

Mastered implied volatility? Move on to the Greeks next!

Next Lesson

Additional Resources

projectfinance Options Tutorials

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.