Last updated on March 2nd, 2022 , 08:14 am

Jump To

Where do options go when they expire? If an option has no value, do you need to take any action? What will happen if you do not sell an in-the-money option by expiration?

Projectfinance has answers to all of your questions. In this article, we will explore the various outcomes of holding call and put options through expiration.

Highlights

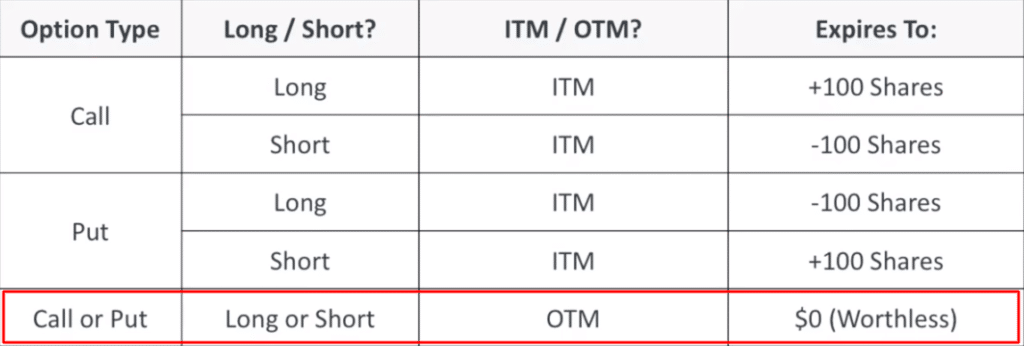

Out-of-the-money options “expire worthless” at expiration; no action is required

At-the-money options pose significant risks to traders in the time leading up to expiration. Best practice is to buy back short options before expiration to avoid the unnecessary stock risk

In-the-money options will be assigned/exercised at expiration

In-the-money long calls/puts will settle to long/short stock position. In-the-money short calls/puts will settle to short/long stock positions.

Holding certain options through expiration can introduce traders to unnecessary risks. Out-of-the-money options, however, pose no risk. Let’s start off with these types of options first!

Out-Of-The-Money Options at Expiration

If you are either long or short an options contract that is out-of-the money at expiration, you will generally have nothing to worry about. No action is required. Zip. Nada. Zilch.

Why? It makes zero financial sense for the owner of a long call or long put to exercise their right to buy/sell a stock (or ETF, or any security) if the current market price of that stock is more favorable than the strike price of your option.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Out-Of-The-Money Option at Expiration Example

For example, let’s say you own a 160 strike price call on AAPL. In the minutes leading up to expiration, AAPL is trading at $150 a share.

If you were to exercise your call contract, you would purchase 100 shares of AAPL at $160/share. Why on earth would you do this? You wouldn’t’. The best decision you can make is to do nothing.

Consequently, this means that if you are short an out-of-the-money option going into expiration, no action is required.

No long party in their right mind would exercise their call at this strike price. Therefore, your short position has no assignment risk.

But what if someone does exercise their option at this strike price? Rarely, this occurs.

Long option holders (of American-style options) have the right to exercise their option at any time. So let’s say they do this with an out-of-the-money option. This is a good thing for you! You’ll either buy (for short puts assigned) or sell (for short calls assigned) the underlying stock at a better price! Make sure to send them a thank-you note.

But 99.99% of the time, these options will “expire worthless”. The long party will lose the full premium; the short party will make the full premium.

Out-Of-The-Money Calls vs Puts at Expiration

In order to determine whether or not your option is “out-of-the-money”, understanding moneyness helps. A cheat is provided below. However, if you’d like to study up on moneyness, read our article, “Option Moneyness Explained.”

- Call options expire worthless when the strike price is higher than the price of the stock/security at expiration

- Put options expire worthless whe the strike price is lower than the price of the stock/security at expiration

Worthless Options Post Expiration

So what exactly happens to your out-of-the-money options at expiration? We said they “expire worthless”, but where do they go?

They simply cease to exist. They are no more. The contract has expired. They are yesterday’s news.

Ok. So out-of-the-money options are easy.

But what if, at the moments leading up to expiration, the stock price is hovering right around your strike price?

At-The-Money Options at Expiration

With at-the-money options, things aren’t so cut and dry. To better understand what could happen to these options at expiration, let’s return to our AAPL trade.

At-The-Money Option at Expiration Example

We are long the 150 AAPL call. In the minutes leading up to expiration, AAPL is trading at $149.89.

Our option is technically “out-of-the-money”, but what happens if AAPL shoots up by a quarter in the last second of trading?

If you’re long this option, your broker will automatically exercise your call if it is in-the-money post expiration (the same thing would happen for puts). However, you can contact your broker and request your long not be exercised. You need a lot more money to hold 100 shares of AAPL stock (15k right now) than your call option.

Now, what about if instead of being long, you were short this AAPL call option? Well, you’d be in a tight spot. There is no guarantee that an option only slightly in-the-money will be exercised, so offsetting the soon-to-be stock with stock now isn’t a sure hedge.

At-The-Money Options and Pin Rsk

What do you do? Nothing. This is called “Pin Risk” (Investopedia) and it’s very real.

Pin Risk Definition: In options trading, pin risk occurs when the strike price of an option is trading in a close range with the underlying stock/security price as expiration approaches.

I’ve been here before. It sucks. If you have a large position, it could wipe you out.

It’s always best practice to buy back short positions that have even the remotest chance of being assigned before expiration. It’ll cost you pennies, and could save you thousands.

On Wall Street, bears make money, bulls make money, but pigs get slaughtered!

So what happens if your long does indeed get exercised or your short gets assigned?

In-The-Money Options at Expiration

If your option is in-the-money at expiration, you may be in trouble.

Again, in order to understand whether or not your options position is in danger of being assigned, understanding moneyness is imperative. It’s simple stuff, truly. American-options that are in-the-money at expiration will be exercised/assigned.

So what does this mean? It depends on the type of option.

In-The-Money Call Options at Expiration

- Long call options that are in-the-money at expiration will be exercised, and (usually) 100 long shares of the stock/security per option contract will appear in your account, usually within one day.

- Short call options that are in-the-money at expiration will be assigned, and (usually) 100 short shares of the stock/security per option contract will appear in your account, usually within one day

In-The Money Put Options at Expiration

- Long put options that are in-the-money at expiration will be exercised, and (usually) 100 short shares of the stock/security per option contract will appear in your account, usually within one day.

- Short put options that are in-the-money at expiration will be assigned, and (usually) 100 long shares of the stock/security per option contract will appear in your account, usually within one day.

American vs European Style Options

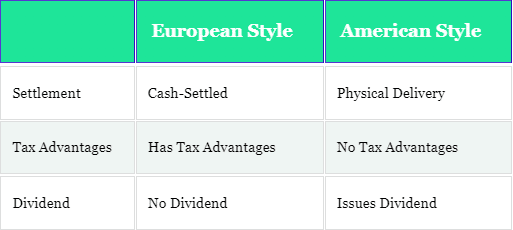

Most options on stock and ETF products are American-style. This means they are settled in stock. AAPL options, like most equities, are settled American-style.

But not all options are American Style. Some options are “European Style”. In addition to not allowing for early exercise/assignment, European options are settled in cash.

Index Options (like SPX, NDX and RUT) are European Style, and thus cash-settled.

Cash-Settled Definition: In cash-settled products, there is no physical delivery (stock) after expiration for in-the-money options. Instead, a transfer of cash occurs.

Check out the below table for a comparison of these two types of options. For a more in-depth review (like understanding the taxation difference), check out our article comparing SPX to SPY options (European style vs American style).

|

|

European Style

|

American Style

|

|---|---|---|

|

Settlement

|

Cash-Settled

|

Physical Delivery

|

|

Tax Advantages

|

Has Tax Advantages

|

No Tax Advantages

|

|

Dividend

|

No Dividend

|

Issues Dividend

|

European Style Options Explained

European style options (Investopedia) don’t have the huge stock risk that comes with American style options. If you’re trading SPX and your short call option is in the money by $1 at expiration, you’ll simply be required to transfer that cash difference to the long party at expiration.

Professional traders love trading index options for this reason. In addition to there being no dividend risk, European options shield short options traders from early assignment risk. Additionally, pin risk does not involve that huge monetary transfer of stock. A simple and relatively small transfer of cash settles these options. It doesn’t matter where SPX opens the next day, your position settles off the closing price at expiration.

Final Word

In order to understand the repercussions of expiration on your options, you must understand moneyness. In-the-money American-style options introduce investors to potentially huge monetary risks.

For a deeper understanding of options trading, please check out our articles below!