Last updated on March 21st, 2022 , 03:38 am

Jump To

In-the-money options can pose a significant risk to traders going into expiration. This is unlike out-of-the-money options, which expire worthless post expiration and require no action.

It is almost always best to trade out of in-the-money options before the closing bell on the expiration day.

If no action is taken, both long options and short options are converted into 100 shares of stock. The cost and risk of this stock can be much greater than the cost and risk of the original option position.

However, not all in-the-money options are exercised and thus assigned into stock. Let’s first explore a few of the key differences between European and American Style Options.

TAKEAWAYS

- It rarely makes financial sense to let an in-the-money option be exercised or assigned.

- European style options (indices) are cash-settled; no transference of stock takes place.

- American style options (ETFs and equities) are settled via physical delivery; a transfer of stock takes place.

- Long in-the-money calls are exercised to +100 shares of stock; short calls are assigned -100 shares of short stock.

- Long in-the-money puts are exercised to -100 shares of stock; short puts are assigned +100 long shares of stock.

- If an option has intrinsic value at expiration, it will be assigned/exercised.

In-The-Money European Options at Expiration

Options that trade on indices such as SPX and NDX are styled in the European fashion. Here are a few characteristics of European Style Options:

- European Options Don’t Offer Stock

- European Options Can Not Be Exercised Early

- European Options are cash-settled.

Since no stock trades on European options, how can in-the-money European style options be settled in stock?

They can’t. A simple transfer of cash takes place at expiration between the long and short parties. Let’s look at an example:

European Style Option Example

SPX 4,300 Call

➥ Index Value at Expiration: $4,305

➥ Call Value at Expiration: $5

For the above trade, the long party owns an in-the-money call worth $5 post-expiration.

The short party must therefore deliver $500 cash to make good on the contract. If this were an American-style option, a transfer of 100 shares of stock would take place at the call strike price of 4,300. Let’s look at American style options next!

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

In-The-Money American Options at Expiration

All options are either European or American style. As we learned above, European-style options are generally indices.

American style options are everything else. This includes options on ETFs and equities. Here are a few characteristics of American style options:

- American Options Do Offer Stock

- American Options Can Be Exercised Early

- American Options Are Settled via Physical Delivery of Stock

Since American-style options are settled via an exchange of stock, traders both long and short in-the-money call and put options need to take action by expiration to avoid being assigned/exercised on the stock.

Let’s take a look at an example.

American Style Option Example

SPY ETF $430 Call

➥ ETF Value at Expiration: $432

➥ Call Value at Expiration: $2

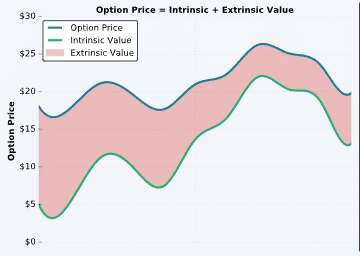

An expiration, only intrinsic value exists in options. Since both the risks of time (theta) and implied volatility no longer exist, extrinsic value is discounted completely from the options price.

Read! Intrinsic vs Extrinsic Value in Options Trading

Our SPY option is in-the-money by $2, therefore its (intrinsic) value is $2.

Now if you are long this call, wouldn’t it make sense to exercise it? The call gives you the right to purchase the stock at $430/share. This is a better price than the current SPY market price of $432.

In this scenario, the long would indeed exercise their right, and the short would be forced to deliver 100 shares:

- Long Call Ending Position: +100 shares at $430/share

- Short Call Ending Position: – 100 shares at $430/share

In-The-Money Options and Assignment/Exercise Cost

In the above example, we showed the net post-expiration position for both the long call and the short call.

The long call owner exercised his call (valued at $2, or $200 taking into account the multiplier effect) into 100 shares of stock. How much will this stock cost? $430 x 100 + $43,000.

That’s a lot of money. If a trader doesn’t have the funds to hold this position the next day when the stock appears in their account, their broker will put them in a margin call.

The same is true with the short party. If they can’t hold -100 shares of SPY stock (valued at 43k) their broker will liquidate the account.

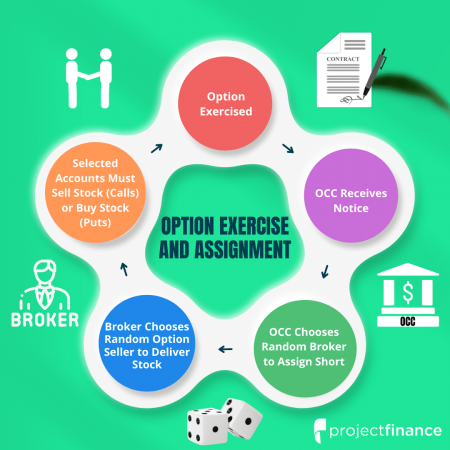

Let’s next go through the process of what happens to in-the-money American style options at expiration.

In The Money Long Call at Expiration

- Long call options that are in the money by 0.01 or more on expiration will be automatically exercised by a broker, resulting in +100 shares of long stock.

In The Money Short Call at Expiration

- Short Call options that are in the money by 0.01 or more on expiration will be automatically assigned by a broker, resulting in -100 shares of short stock.

In The Money Long Put at Expiration

- Long put options that are in the money by 0.01 or more on expiration will be automatically exercised by a broker, resulting in -100 shares of short stock.

In The Money Short Put at Expiration

- Short put options that are in the money by 0.01 or more on expiration will be automatically assigned by a broker, resulting in +100 shares of short stock.

Check Out Our Video On Option Expiration Here!

Should I Exercise My In The Money Option at Expiration?

The vast, vast majority of the time, it does not make sense to allow long in-the-money options to be exercised or assigned.

Personally, I have never done this. Why?

Risk! As we said before, long options generally have less net risk than long stock. We have no idea where a stock is going to be trading on the day it opens post-expiration.

Let’s say you are long an AMZN call going into expiration. Right before the bell, it’s trading at $2. Your downside risk here is $200.

But if you choose to exercise that option, you must buy 100 shares of AMZN. The current cost of 100 shares of AMZN? About $300,000!

That’s a lot of risk! There is hardly ever a reason to exercise an option.

Sometimes, covered call positions allow their short call to be assigned, but they already have 100 long shares of stock, so the risk is offset.

It rarely, if ever, makes sense to exercise (or be assigned) on naked call and put options going into expiration. In addition to the market risk, there are also additional exercise assignment fees that go along with holding in-the-money options through expiration.

Simply trade out of the position before the bell and you’ll sleep much better. Trust me!

Is My Option In The Money?

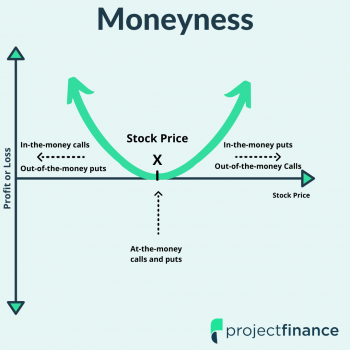

Determining moneyness is quite simple.

- Call options are in the money when the strike price is below the stock price.

- Put options are in the money when the strike price is above the stock price.

In-The-Money Options at Expiration FAQ's

You can sell an option at any time before the closing bell on expiration day. This includes expiration day itself. It is best to not wait until the final seconds of trading to trade out of options. If technology fails, you may find yourself in a bit of trouble.

Yes, you can exercise options on expiration day. You can even choose to exercise options (or not exercise them) after the market closes on expiration day. The cutoff time for exercising an option is 4:40pm CT.

Brokers automatically exercise in-the-money options at expiration. You can, however, communicate to your broker that you do not want to exercise an option. If your broker is not informed, you will be automatically exercised on your long call/put options that are in the money by 0.01 or more.

When a long call expires in-the-money (ITM), a broker will automatically exercise the option. This will ultimately result in +100 shares of long stock.