Last updated on March 15th, 2022 , 02:01 pm

Selling put options (sometimes referred to as being “short put options”) is an options trading strategy that consists of selling a put option on a stock that a trader believes will increase in price. The risk in this strategy can be great, so it is important have a solid understanding of this options strategy before placing your first short put trade. Let’s get started!

TAKEAWAYS

- Selling puts is a high probability, high risk strategy for neutral to bullish traders.

- In the short put, profit is limited to the total credit received.

- Max loss in short puts is great and calculated by subtracting the credit received from the strike price.

- The short put is ideal for investors who are willing and ready to purchase a stock should it fall to the strike price sold.

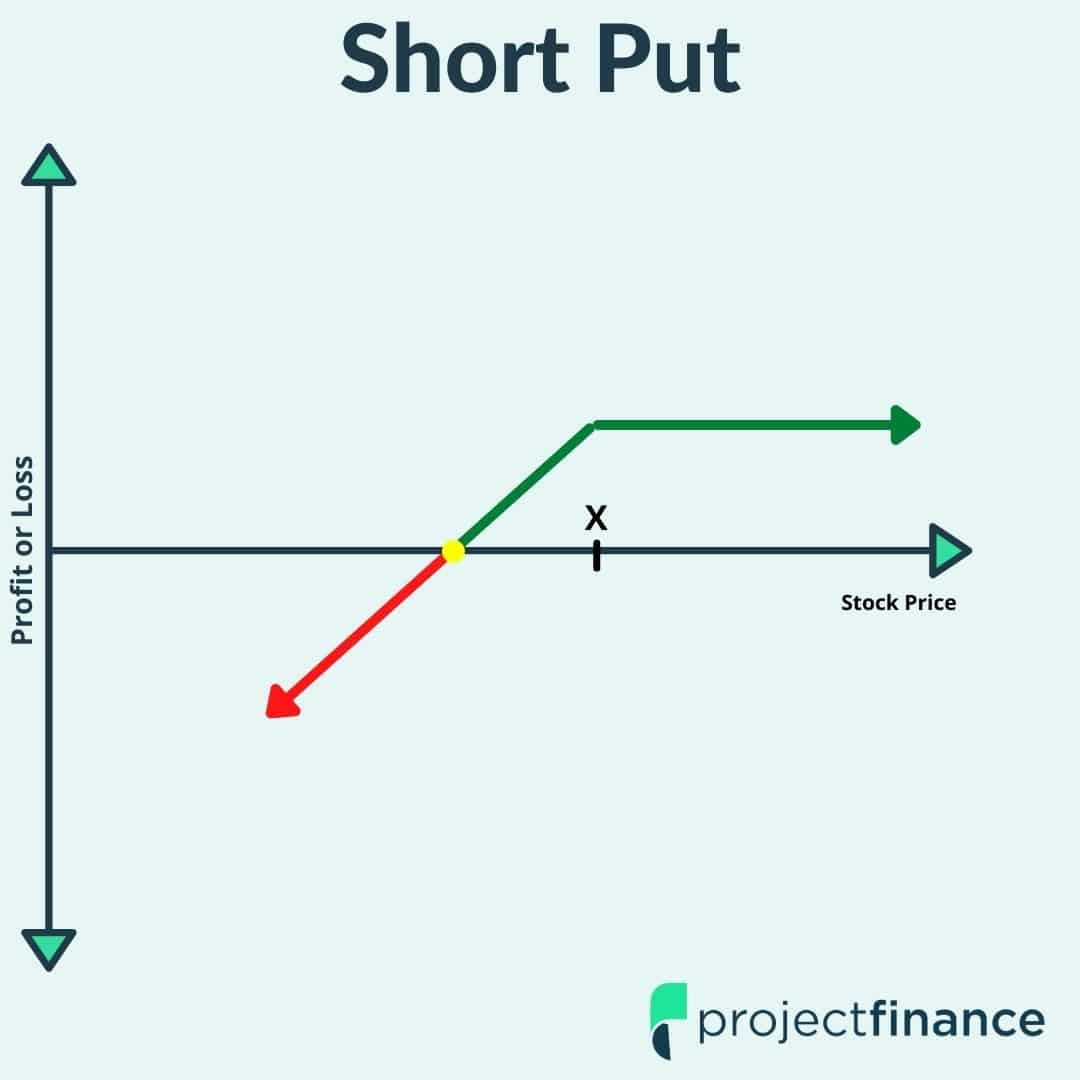

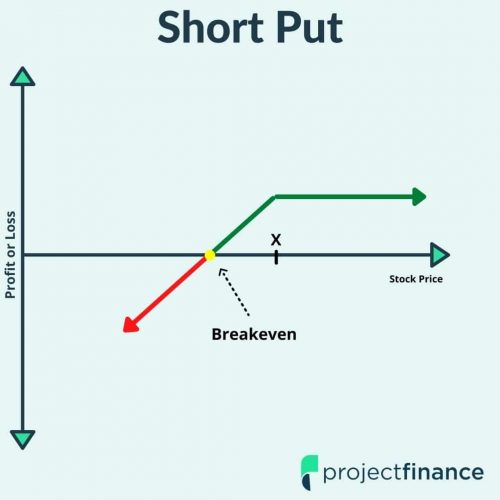

Short Put Strategy Characteristics

Let’s go over the strategy’s general characteristics:

•Max Profit Potential: Put Sale Price (Credit Received) x 100

•Max Loss Potential: (Put Strike Price – Credit Received) x 100

•Breakeven Price: Put Strike – Credit Received

To better understand these metrics, let’s go through a simple example.

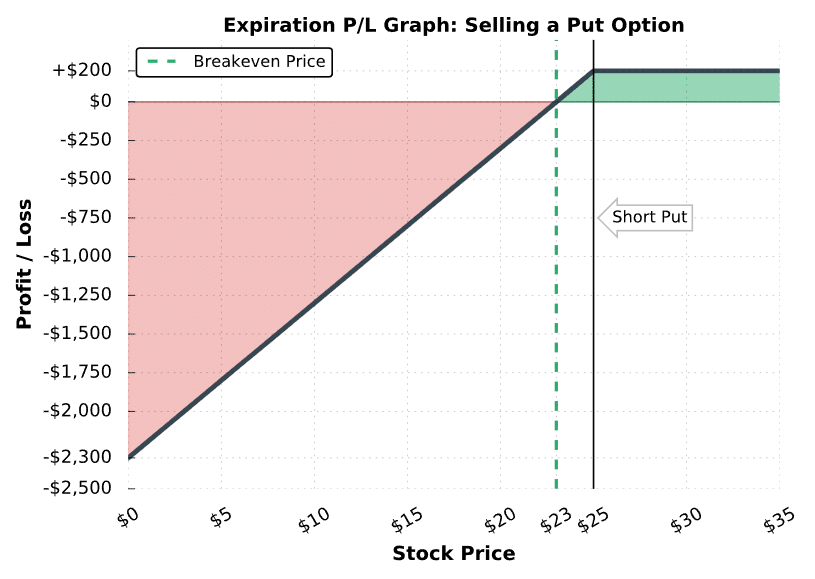

Profit/Loss Potential at Expiration

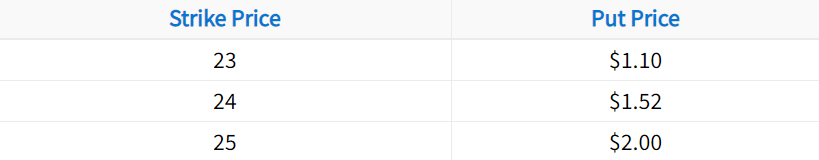

In the following example, we’ll construct a short put from the following option chain:

In this case, let’s assume the stock price is $25 when entering the put position. For this trade, we’ll sell the 25 put for $2.00.

Stock Price: $25

Put Strike Price: $25

Put Sale Price: $2.00

The following visual describes the potential profits and losses at expiration for this short put position:

Short Put Trade Results

Stock Price Above the Put’s Strike Price (Above $25)

The put has no intrinsic value, and therefore expires worthless. In this case, the put seller realizes the maximum profit of $200.

Stock Price Between the Breakeven Price and the Put’s Strike Price ($23 to $25)

The put option expires with intrinsic value, but not more than the $2 credit the trader collected when selling the put. Consequently, the short put position is profitable.

Stock Price Below the Put’s Breakeven Price (Below $22)

The put option’s intrinsic value is now greater than the premium the trader collected when selling the put, and therefore the short put position is not profitable.

Stock Price at Zero

The company has gone out of business. Any short put traders will realize the maximum loss potential. For the seller of the 25 put, the loss will be $2,300: ($2 Put Sale Price – $25 Put Expiration Value) x 100 = -$2,300.

Short Puts = High Probability/High Risk

The last thing we’ll point out about this graph is that the breakeven price is below the current stock price. Because of this, selling puts is a high probability strategy. However, this makes sense since the maximum potential loss is greater than the maximum potential reward.

So, you know how the outcomes at expiration when selling puts, but what about before expiration? Understanding how profits and losses occur when selling put options can be explained by the position’s option Greeks (if you want to improve your understanding of the risks of your option positions, read our ultimate guides on the option Greeks).

Nice job! You’ve learned the general characteristics of the put selling strategy. Now, let’s go through some visual examples to solidify your knowledge of how short puts work.

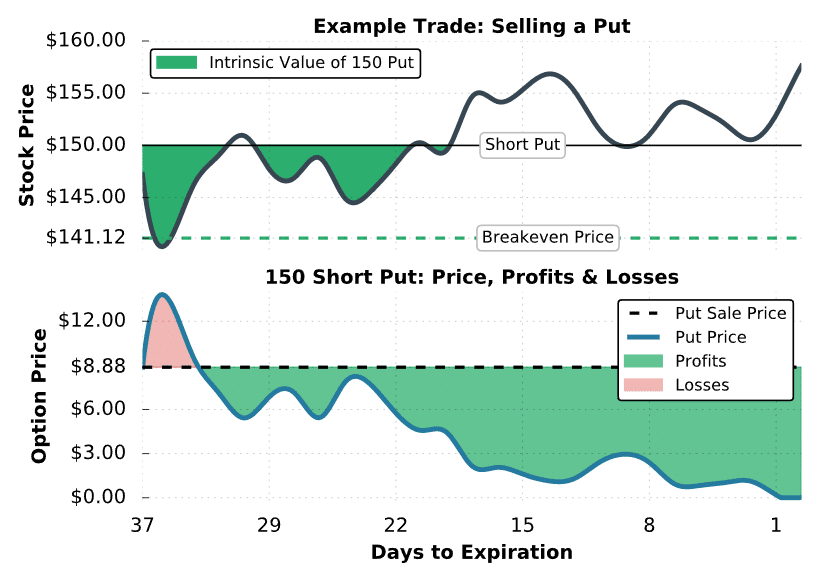

Maximum Profit Short Put - Trade Example #1

To visualize the performance of selling put options, let’s look at a few examples of real puts that recently traded. Note that we don’t specify the underlying, since the same concepts apply to all stocks in the market.

The first example we’ll look at is a situation where a trader sells an at-the-money put option (strike price near the stock price). Here are the specifics:

Initial Stock Price: $147.23

Initial Implied Volatility: 43%

Put Strike and DTE: 150 put expiring in 37 days

Put Sale Price: $8.88

Put Breakeven Price: $150 short put strike – $8.88 credit received = $141.12

Maximum Profit Potential: $8.88 net credit x 100 = $888

Maximum Loss Potential: $141.12 breakeven price x 100 = $14,112 (stock price at $0)

Let’s see what happens!

Short Put Trade Results

As you can see, selling puts is profitable as long as the stock price doesn’t fall quickly and violently. You’ll notice that around 21 days to expiration, the stock price is trading right at the put’s strike price of $150, but the put is worth half of its initial value. Three factors contribute to the put’s price decrease:

1) 15 days have passed, resulting in the decay of the put’s extrinsic value

2) Implied volatility has fallen from 43% to 31% (not visualized by the graph), which indicates a broad decrease in the stock’s option prices.

3) The stock price has risen by $3, which results in lower put prices compared to before. Why? When the stock price increases, put options at every strike price become less valuable because they have a lower probability of expiring in-the-money.

Since short put positions have positive theta, negative vega and positive delta, they profit from the passage of time, decreasing implied volatility, and increasing stock prices. All three of these occurred in this trade example.

Regarding closing this position early, the trader in this example had many opportunities to close the put before expiration to lock in profits. To close a short put, a trader can buy back the put at its current price. As an example, if the trader in this example bought the put back when it was worth $3.00, they would lock in $588 in profits: ($8.88 initial sale price – $3.00 purchase price) x 100 = +$588. If held to expiration, the profit would have been $888 because the put expired worthless.

Next, we’ll look at an example of a short put trade where the stock price is below the put’s strike price at expiration.

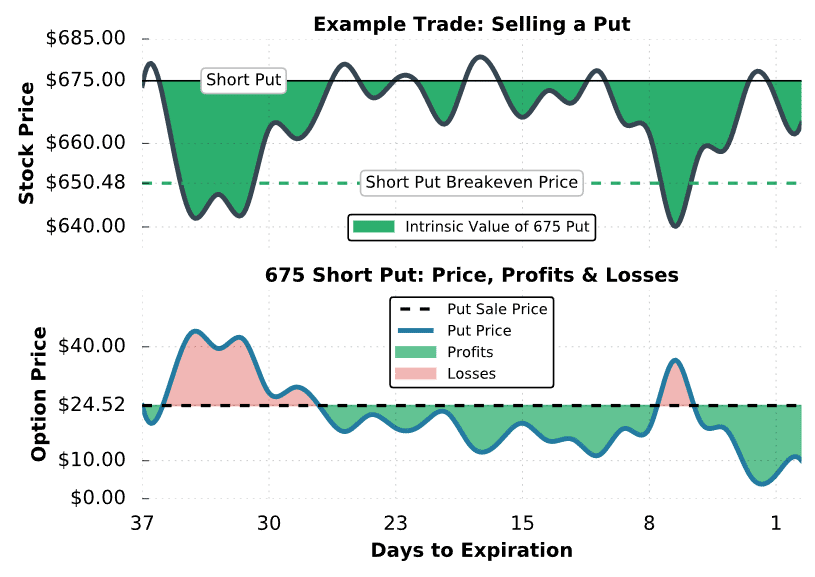

Partially Profitable Short Put - Trade Example #2

When the stock price is below a short put’s strike price at expiration, the put seller will not make the full profit potential. However, it is still possible that the trade could work out. To demonstrate this, let’s look at an example where the stock price is trading below the short put’s strike price at expiration.

Here are the specifics:

Initial Stock Price: $673.86

Initial Implied Volatility: 30%

Strike and Expiration: 675 put expiring in 37 days

Put Sale Price: $24.52

Put Breakeven Price: $675 short put strike – $24.52 credit received = $650.48

Maximum Profit Potential: $24.52 credit received x 100 = $2,452

Maximum Loss Potential: $650.48 breakeven price x 100 = $65,048 (stock price at $0)

Let’s take a look at the trade’s performance:

Short Put #2 Trade Results

In this trade, the initial sale price of the 675 put was $24.52, resulting in a breakeven price of $650.48. Initially, the stock price crashed to nearly $640, which is well below the put’s breakeven price. As a result, the price of the 675 put surged to $42, which represents a $1,700 loss for the put seller.

However, the stock regained its losses and was trading around $665 at expiration. With the stock price $10 below the put’s strike price at expiration, the put was worth its intrinsic value of $10. Since the initial sale price was $24.52, the final profit is $1,452 per contract for the put seller: ($24.52 sale price – $10 expiration price) x 100 = +$1,452.

If the put seller let the put expire in-the-money, the resulting position would be +100 shares of stock. Letting an option expire in-the-money is known as “taking assignment.” In the case that the trader doesn’t want a stock position, the short put can be purchased back before expiration. However, keep in mind that it’s always possible to be assigned 100 shares of stock on an in-the-money short put, but unlikely when the put has plenty of extrinsic value.

Alright, you know how well short puts can do. Let’s finish by investigating what can go wrong when selling puts.

Significant Loss from Selling Puts - Trade Example #3

So, what happens when the stock price falls through the strike price of a short put? To demonstrate this, we’ll look at a situation where a trader sells an at-the-money put before the stock price drops significantly.

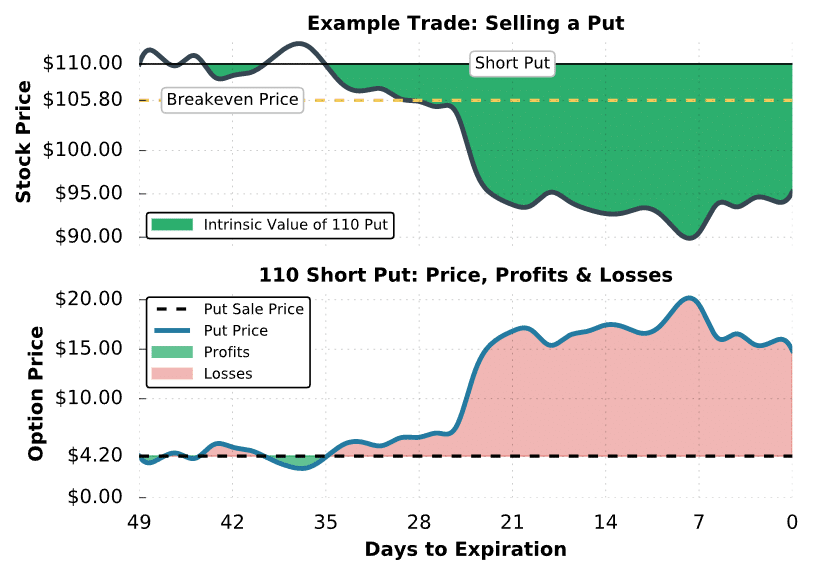

Here are the specifics of the next example:

Initial Stock Price: $109.99

Initial Implied Volatility: 27.5%

Strike and Expiration: 110 put expiring in 49 days

Put Sale Price: $4.20

Put Breakeven Price: $110 put strike price – $4.20 credit received = $105.80

Maximum Profit Potential: $4.20 credit received x 100 = $420

Maximum Loss Potential: $105.80 breakeven price x 100 = $10,580 (stock price at $0)

Let’s see what happens!

Short Put #3 Trade Results

In the first 14 days of this trade, the short put trader didn’t have significant profits or losses. However, things changed quickly when the stock price plummeted 10% after an earnings report.

With 21 days to expiration, the 110 put was worth $17, which is four times more than the initial sale price. At expiration, the stock price was $95, which meant the 110 put had $15 of intrinsic value. Unfortunately, this resulted in a loss of $1,080 per contract for the put seller: ($4.20 sale price – $15 expiration price) x 100 = -$1,080.

As mentioned earlier, it’s always possible to close the position early to lock in losses. For example, if this particular trader wanted to take their losses when the put traded $10, they could buy the put back and lock in $580 in losses: ($4.20 initial sale price – $10.00 purchase price) x 100 = -$580.

In summary, keep in mind that things don’t always work out when trading a high probability strategy such as selling puts. However, there’s always an exit opportunity if the losses get out of hand.

Final Word

Congratulations! You now know how selling put options works as a trading strategy. Be sure to revisit this guide often to solidify what you’ve learned.

In a nutshell, here is what we learned:

- Short puts have great downside risk.

- With decreasing extrinsic value, short puts have a greater chance of being assigned.

- The maximum profit on short puts is limited to the credit received.

- More premium can be collected from puts when the implied volatility is elevated