Last updated on February 17th, 2022 , 05:58 am

With so many options trading strategies available, where might beginners want to start? In this post, we’ll cover our picks for the top 3 options trading strategies for beginners.

Strategy #1: Selling Put Spreads

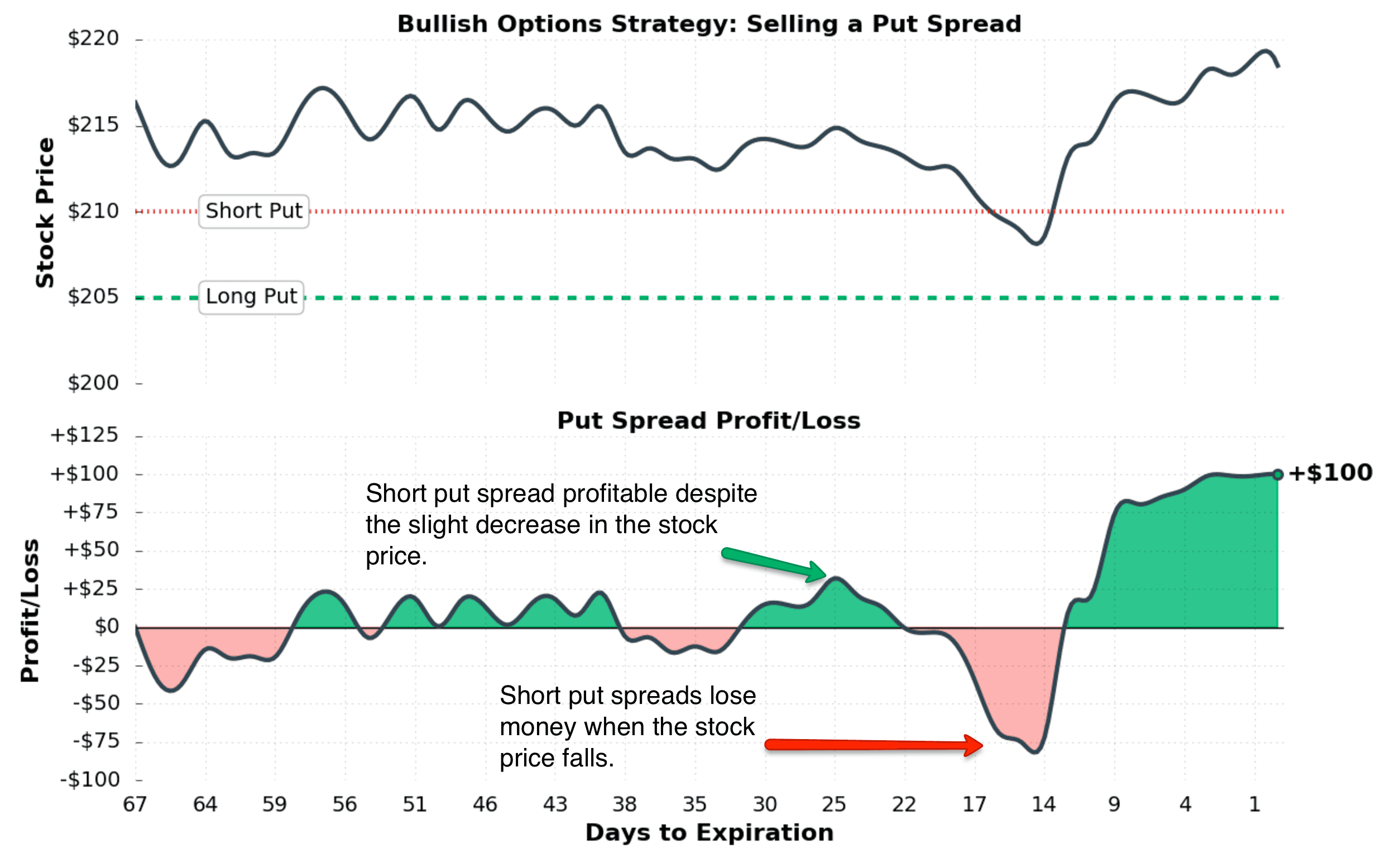

Our first options strategy for beginners is selling put spreads (short put spreads), as the strategy has bullish market exposure (which most investors want), has limited loss potential, and can be implemented in small trading accounts.

Setting Up the Trade

Here’s how a short put spread is constructed:

2. Buy another put option at a lower strike price than the sold put (same quantity and expiration cycle).

The position will be entered for a credit, which means you’ll be collecting money from selling the spread. This is because the put you sell will be more expensive than the put you buy.

How the Trade Makes Money

In the simplest explanation, a short put spread makes money as long as the stock price remains above the strike price of the short put as time passes:

As we can see, there’s a point in time where the stock price is below its price from the entry point of the short put spread. But, since time has passed, the put spread has lost value and is therefore profitable.

Short put spreads lose money when the stock price falls, but have limited loss potential. The maximum loss occurs when the stock price is below the purchased put’s strike price at expiration.

Watch me set up a real short put spread in Netflix (NFLX).

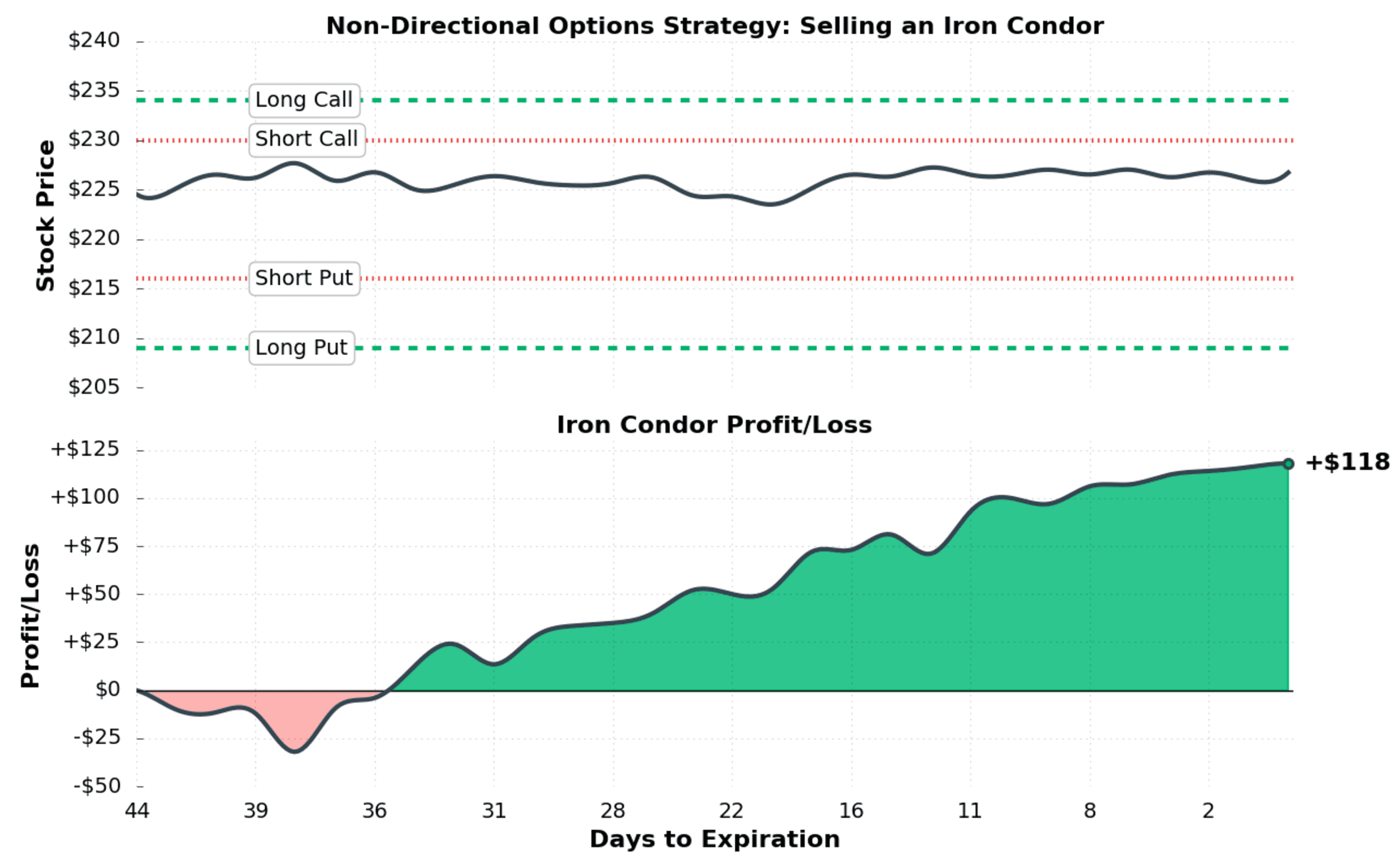

Strategy #2: Selling Iron Condors

Selling an iron condor (short iron condor) is a great options trading strategy for beginners because the position is non-directional, providing profit potential in range-bound stocks. The trade can be as conservative or aggressive as you’d like.

Setting Up the Trade

Here’s how to set up a short iron condor:

1. Sell a put spread (sell a put, buy another put at a lower strike price).

2. Sell a call spread (sell a call option, buy another call at a higher strike price).

The position will be entered for a credit, since the puts and calls you sell will be more expensive than the puts and calls you purchase.

How the Trade Makes Money

Short iron condor positions make money when the stock price remains between the strike prices of the call and put that are sold:

You’ll lose money when selling iron condors if the stock price moves too much in either direction. The maximum loss potential occurs when the stock price is above the purchased call option’s strike price or below the purchased put option’s strike price at expiration.

Watch me set up a real iron condor position in the Russell 2000 ETF (IWM).

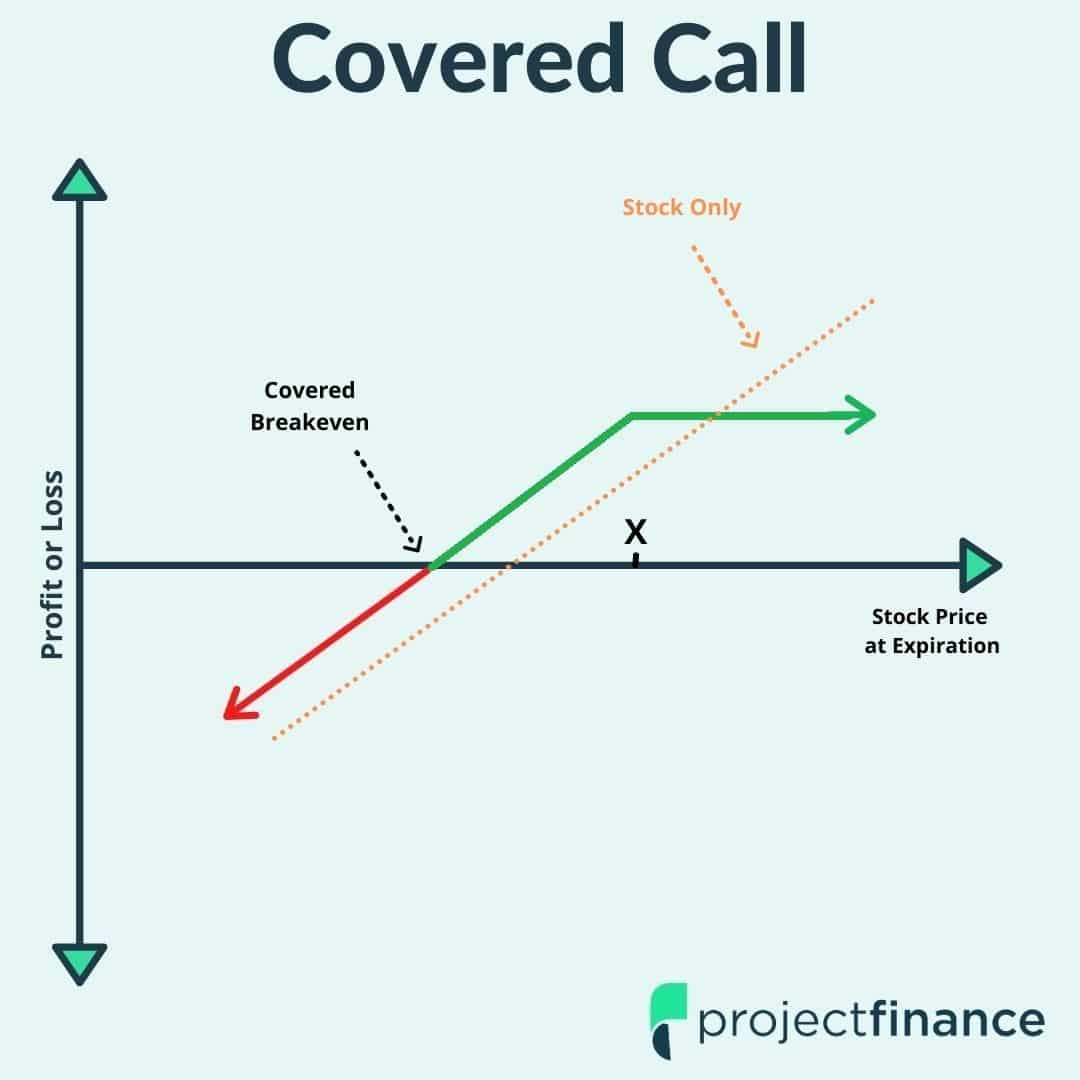

Strategy #3: Covered Calls

Our third options strategy for beginners is the covered call, which is great strategy to start with because those with stock investments can easily implement the strategy.

Covered calls require the ownership of 100 shares of stock, so the strategy requires more money to get started, making it less accessible to those with small trading accounts. However, for those with at least 100 shares of stock in their investment portfolios, covered calls can provide downside protection if the stock price falls, and profit potential when the stock remains flat.

Setting Up the Trade

Covered calls are structured with the following positions:

1. Buy 100 shares of stock.

2. Sell 1 call option against the shares (typically expiring in 30-60 days).

How the Trade Makes Money

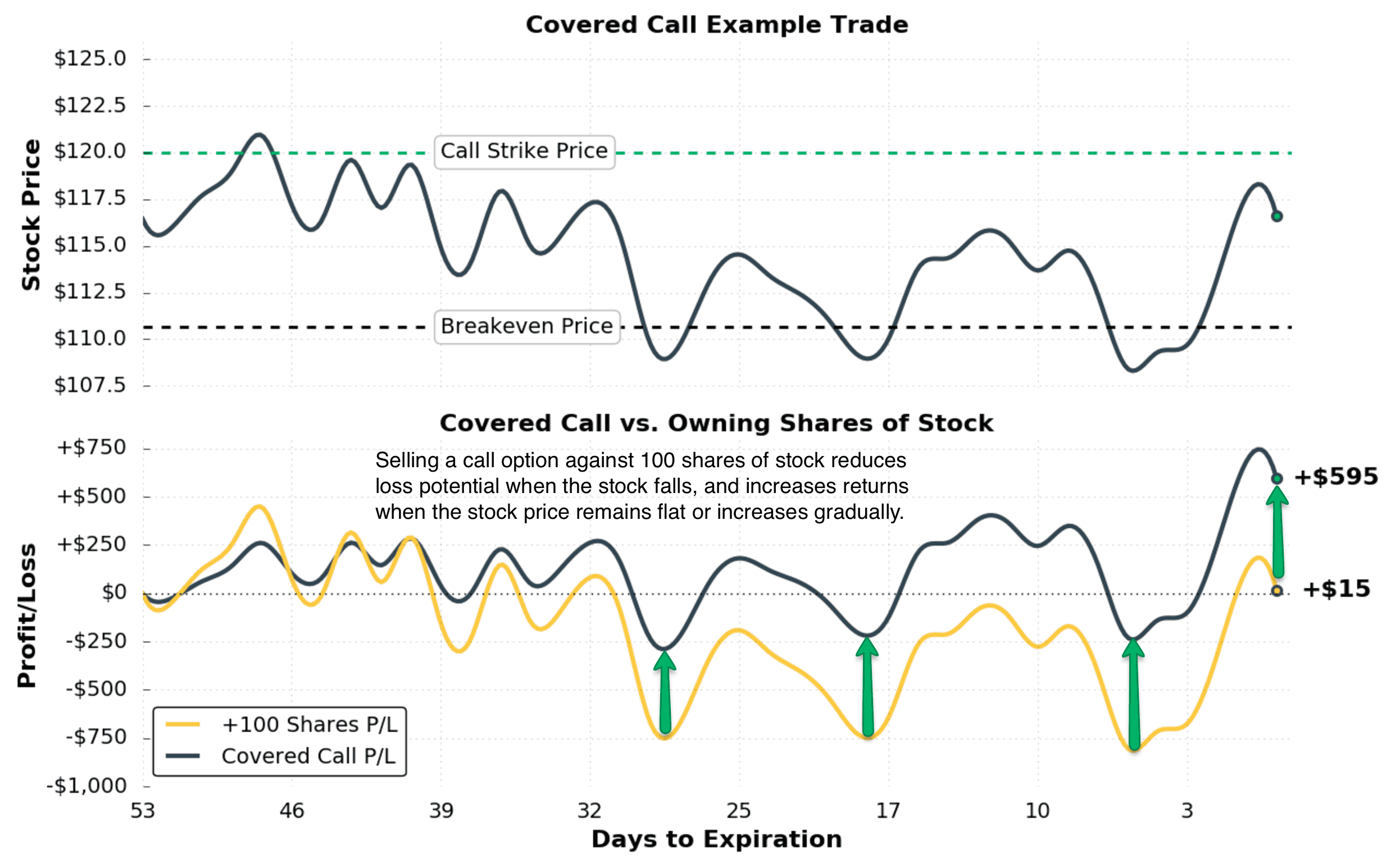

Covered call positions make money as long as the stock price doesn’t fall substantially:

As we can see, the covered call position outperforms the stock position over the entire period, as the premium received from selling the call option against shares provides downside protection when the shares fall. Additionally, when the share price remains flat or increases gradually over time, the covered call position will also outperform.

The only time a covered call position will underperform a long stock position is when the share price increases substantially.

Watch me set up a real covered call position in the Brazil ETF (EWZ).

Closing Thoughts

When starting out as an options trader, the number of strategies that can be used may be intimidating, especially the more complex strategies.

In my opinion, the simplest strategies are the most effective for options traders of all levels. The three strategies discussed in this post are my picks for the best options trading strategies for beginners to start with.

Lastly, please be sure to check out the complete strategy guides for the listed strategies to fully understand how each strategy works and the risks involved.

Thanks for reading!