Last updated on April 29th, 2022 , 10:54 am

Though nearly identical in performance, there is an ocean of difference between the SPDR® S&P 500® ETF Trust (SPY) and S&P 500® Index Options (SPX). It is absolutely vital you understand the different nature of these two products before you place your first options trade.

Perhaps the most obvious difference between these two products is that, unlike SPY, no stock trades on SPX. But there are many more caveats investors must know when comparing the two.

Most professional options traders prefer to trade SPX over SPY. Let’s take a look at a few key differences between these two products to find out why.

Table of Contents

TAKEAWAYS

- SPX options are settled in the European style.

- SPY options are settled in the American style.

- European style options do not allow for early exercise.

- SPY is settled via an exchange of the underlying security.

- SPX is settled via a transfer of cash. This settlement type reduces pin risk.

- SPX options offer investors tax advantages.

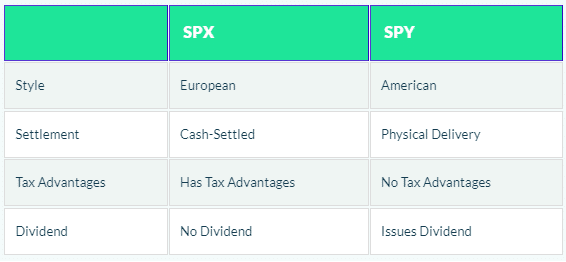

|

|

SPX

|

SPY

|

|---|---|---|

|

Style

|

European

|

American

|

|

Settlement

|

Cash-Settled

|

Physical Delivery

|

|

Tax Advantages

|

Has Tax Advantages

|

No Tax Advantages

|

|

Dividend

|

No Dividend

|

Issues Dividend

|

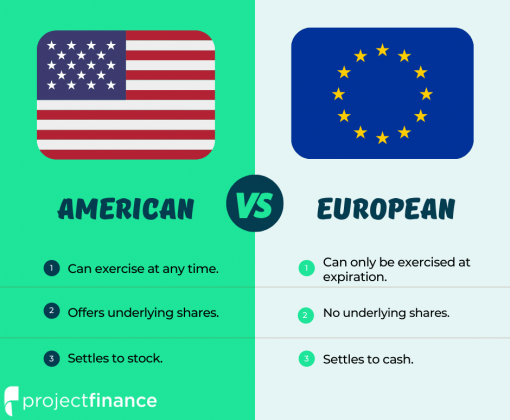

American Style (SPX) vs European Style (SPY)

American style options represent the vast majority of options contracts, including equities and Exchange-Traded Fund (ETF) ETFs such as SPY. This type of option can be exercised at any time prior to expiration. This often complicates matters for options sellers; sellers may in theory be assigned at any time. Option sellers are in particular danger of assignment if the option is in-the-money as the expiration date nears or when a dividend is issued.

European style options contracts, on the other hand, must only be exercised at expiry. SPX options are European styled, as are other indexes, such as Russell 2000 Index Options (RUT) and Nasdaq 100 Index Options (NDX).

But all in-the-money (ITM) options, regardless of how they are styled, will eventually be assigned and exercised. Let’s next take a look at the different ways in which SPX and SPY are settled.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

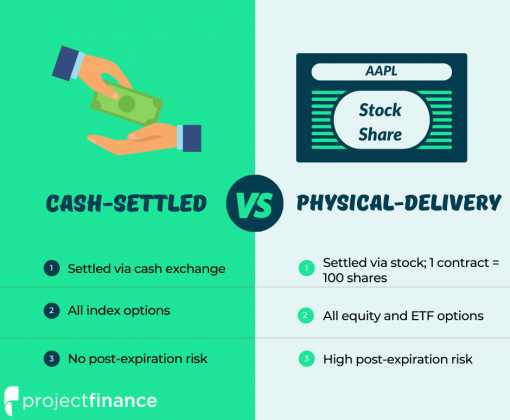

Cash Settled (SPX) vs Physical Delivery (SPY)

Cash-Settlement occurs on European style index options like SPX. In this type of settlement, the actual delivery of the underlying is not required. This should make sense: since there is no underlying stock to trade on SPX, what product will you deliver? You do have to deliver something, however, and that something is a transference of cash.

When an in-the-money cash-settled option expires, the owner of that option (whether it be a long call or long put) will be credited cash. The amount of this cash credit will be the difference between the amount the contract is in the money and the strike price. The seller of this option must therefore pay a debit in cash to complete the transaction.

Physical Delivery occurs on American-style options, like those of SPY. This type of delivery requires the actual underlying asset to be delivered upon the specified delivery date. Because SPY is a stock, shares of SPY stock will be transferred at expiration for all in-the-money put and call contracts. How much? 100 shares per contract.

This type of delivery poses a significant risk, and it is just another reason why professional traders choose SPX over SPY. What happens if you’re short a GOOGLE (GOOGL) call that suddenly becomes in-the-money during the last seconds of trading? You’ll have to deliver 100 short shares of GOOGL. Unless you have $240,000 laying around, you may be in trouble.

If you still aren’t worried about assignment risk, just watch the clip below from tastyworks (17:00) and learn how a single retail investor almost wiped out thinkorswim in its early days. But just know: options contracts are rarely assigned.

A Lesson on the Dangers of Assignment

For settlement type, SPX appears to be the clear winner in the eyes of most traders.

Tax Advantages of SPX over SPY

For most investors, trading index options (SPX) over ETFs (SPY) makes sense when it comes to taxation. Why?

In 2021 (and beyond presumably), the IRS gives index options preferential treatment. Listed under section 1256 of the tax code, the gains and losses on certain exchange-traded options (like SPX) are entitled to a tax rate equal to 60% long-term and 40% short-term capital gain or loss.

The profits and losses on ETF options (like SPY) are typically treated completely as short-term capital gains. Here’s what the Chicago Board Options Exchange (CBOE) says about these taxes:

"Many traders use a variety of ETF options products, such as SPY, to gain exposure to the S&P 500. What they may not realize is that capital gains from ETF options may be considered short-term gains and taxed at the ordinary income rate, which in 2019 ranged from 10-37%. Depending on individual trading and your tax bracket, that could be a big hit to your income."

The added tax-benefit of index options will of course depend on an investor’s tax profile, but, generally speaking, index options are more monetarily beneficial when it comes to tax time than equity and ETF options. Another win for SPX!

SPY vs SPY: Notional Value and Flexibility

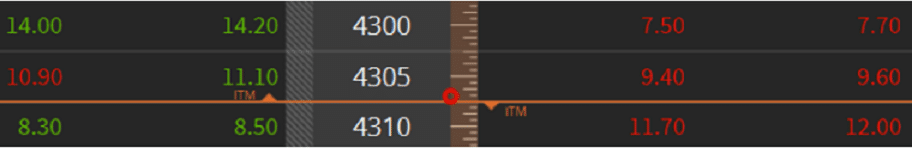

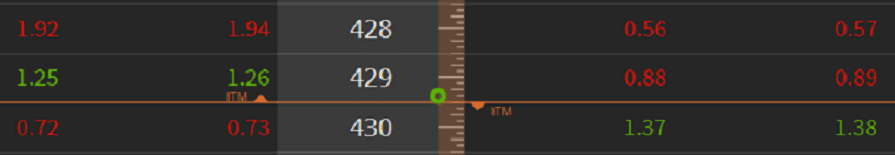

The notional value of SPX is 10 times greater than that of SPY. Because of this lofty price, trading certain strategies on SPX vs SPY can cost a lot of money. Take a look below at the cost of buying an at-the-money call option on SPX (left) vs buying an at-the-money call on SPY (right) on the tastyworks platform.

Luckily for us, most successful traders don’t simply buy or sell single options; they create spreads. When you’re trading spreads (verticals, iron condors, calendars, etc) we don’t care what the value of the underlying is. Selling a ten-point spread for $1 is going to cost us $9, no matter what the price of the underlying is.

A potential downside for SPX involves the width of its strike prices. SPX strike prices generally are separated by a width of $5 (you can see this in the above image), making it impossible to do a one-point spread.

Spy, on the other hand, typically lists its strike prices $1 apart. Sometimes, SPY even lists its strike prices in half-point intervals. This means that in theory, you could do a half-point spread! For small traders, the generous strike structure of SPY has added benefits.

Liquidity

SPY is the most liquid equity-based trading product in the world. This means options volume is high and the bid ask spread is tight. Stock on SPY trades over 80 million shares per day. So far today, at midday, the volume of options trading on SPY is about 600k million contracts. This liquidity almost guarantees great fills.

SPX, on the other hand, isn’t as liquid. That isn’t to say the product is not liquid – it just isn’t as liquid as SPY. Options contracts on SPX have traded at a volume of 245k contracts so far today. If that doesn’t seem like a lot, compare that number to Johnson & Johnson (JNJ), which has traded only 2,500 option contracts all day.

Generally speaking, liquidity in SPX is not a problem.

Conclusion

Every trader has their own style. Most savvy traders, however, from the numerous reasons listed above, prefer to trade SPX when given a choice.

Remember, trading options is very risky. To learn more about these risks, please read the Characteristics and Risks of Standardized Options from The OCC.

Happy trading!

SPX vs SPY: FAQs

For tax reasons, SPX offers many benefits over SPY. Additionally, SPX is cash-settled, so there is no assignment risk. Most professional traders prefer to trade SPX for these reasons. SPY, however, offers tighter strike prices and more liquid markets.

Though SPX and SPY both track an mirror the S&P 500 stock market index, they are two different products. SPX is an index and SPY is an ETF. SPX does not offer shares while SPY does.

2 thoughts on “SPX vs SPY Options: Here’s How They Differ”

Thanks for the article! Quick question – is SPX or SPY more suitable for beginner option traders with (relatively) small accounts? Thanks!

-Cindy

Thanks for the question Cindy!

That’s a tough one. As far as cost goes, SPY options offer tighter strike prices, and therefore trading SPY options are generally cheaper than SPX options (which are also 10x more expensive).

On the flip side, SPX options are cash-settled and have no early assignment risk. Both big pros!

I would say, because of its tax advantages, SPX is the better choice.

Mike