Last updated on February 11th, 2022 , 12:59 pm

Highlights

ETF and Stock options can be exercised up until 5:30 PM ET on expiration day

Traders of short option positions may get assigned if the stock moves against them after the official close

To hedge short options that will be assigned, trader’s can exercise a long position if they are in a spread, or trade stock in the open market if the option position is naked

To avoid being assigned due to an after-hours move, trade out of all options while the markets are open

Just because the market is closed on expiration day does not necessarily mean your soon-to-be expired out-of-the-money short option position poses no risk. Why? Because options can be exercised up until 5:30 pm (4:30 Central)!

So as to better understand this risk, let’s jump right into an example.

AAPL Example: Getting Assigned After-Hours

Let’s assume you are bearish on AAPL. You decide to sell a vertical call spread on the stock that expires next week, the 140/145 call spread.

- Short 140 Call

- Long 145 Call

A week has passed, and the position has done well. It is expiration day and you check AAPL stock about 3 minutes before the close. The stock is trading at 137.50. You could just buy back your short option for 0.03 cents right now and be done with it, but isn’t that like throwing money away? Isn’t it a sure thing?

So you decide to just let the short portion of your spread expire worthless, saving you both commissions and a few cents in premium.

A few moments later, the bell rings and AAPL closes at 137.97. Great! The stock has settled, and since AAPL is trading under your short call strike price of 140, your position expired worthless, right?

99% of the time, the answer to this question would be yes. In this article, we’re concerned about the other 1%.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Dangers of Short Options Post-close on Expiration

Let’s say that some major news on AAPL was released at 4:09 ET after the market closed. AAPL announced a stock split. Whatever, this doesn’t matter. What matters is the stock immediately skyrockets $3 in value up to $140.50/share.

But this shouldn’t matter to us, right? The closing bell has rung; isn’t our position settled?

No!

Equity and exchange-traded fund (ETF) call options can be exercised up until 5:30 PM CT (4:30 ET). The below quote is from the OIC (Options Industry Council):

"Options exchanges have a cut-off time of 4:30 p.m. CT, for receiving an exercise notice. Be aware that most brokerage firms have an earlier cut-off time for submitting exercise instructions in order to meet exchange deadlines"

OIC

Option Can Be Exercised After the Close!

What we should be concerned about in this example is the opposite party that is long the 140 call that we are short.

Since the stock is trading higher than $140, and that party has the right to buy 100 shares at $140/share up until 5:30 ET if they exercise, what’s to stop them from exercising that right? Since the stock is trading at $140.50, why wouldn’t they immediately sell 100 shares in the open market at this price, and then exercise their call, buying 100 shares at $140?

When the stock arrives in their account, they will be flat and will have made $0.50 100x, or $50. This is a guaranteed $50! Wouldn’t you do it too?

So what does that mean to us, the short party?

A few hours after the long exercises, we may very well receive an email stating that we have been assigned on our short call. As a result, we will see 100 short shares of AAPL in our account. Since our long call expired worthless, we are unhedged

When Your Expiring Option Goes in the Money After-Hours

So what do we do in this situation? A lot of our response depends upon a trader paying attention and actually witness the after-hours rally. If you are aware, you can do one of three things:

- Exercise The Long Call. You can always offset the potential short stock position by exercising your long 145 call. You have until 5:30 ET to do this. But there are a lot of variables at play here. In our example, there is a high likelihood that we will get assigned. But what if the stock only rallied a few pennies beyond your short strike price in the after-hours market; are we guaranteed to get assigned? No. In a situation like this, call your trade desk. Bear in mind that if you have a large spread position, you can always exercise a portion of your long calls to hedge assignment risk as you may not get assigned on all of your calls. It’s really a guessing game!

Hedge with Stock. If you catch your mistake after the 5:30 ET deadline to exercise has passed, and your short position went deep in the money after-hours, you can always hedge the soon-to-be delivered stock by trading the opposite stock position in the extended market. For investors who are trading options naked and have no long position to exercise, this will be their only chance at hedging. Of course, you will deal with illiquid markets. You will have to weigh this risk against waiting until Monday to trade out; a lot can happen over the weekend.

Throw the Dice. The only other course of action is to wait and hope. If the underlying moves only a few pennies in the money in the after-hours market, you may not get assigned at all. When the stock moves a lot, you will likely get assigned. If you do indeed get assigned on a huge position that moves massively against you, beyond the value of your account, your broker can liquidate your account and put you in collections for the amount you owe. For trader’s with very large positions, this may be a good time to find religion!

So what should we have done here?

Trade Out of Short Options Before Expiration

Most brokers charge very little in commissions. tastyworks charges no commissions for exiting trades. Why not just pay a couple of pennies and be done with it? The risk isn’t worth the reward. Unless your short option is out of the money by more than 10%, I would recommend liquidating all short options before the closing bell.

A stock doesn’t have to move drastically in order for us to be concerned either. If the underlying ETF/stock rallies just a couple pennies above our short strike in the after hours, we are still at risk. This is called Pin Risk (Investopedia).

Pin Risk Definition: In finance, pin risk refers to the uncertainty as to whether or not a short call or put option will be assigned leading up to and immediately following the expiration of the contract.

Let’s now take a look at a case study in the real world.

A Cautionary Tale: Lost $30,000 on a $1-Wide Credit Spread

Chris Butler at Project Finance made a video on how this financial tragedy played out. Feel free to check it out below.

What happened with this trader is a horror story for other options traders. It’s what CAN go wrong when you don’t trade out of short positions before expiration.

Let’s start off by looking at the trader’s position:

Stock: TSLA

Expiration: Sept 4th,2021

Position: Short 410/409 Put Spread (Short 410, Long 409)

Quantity: 5 Spreads

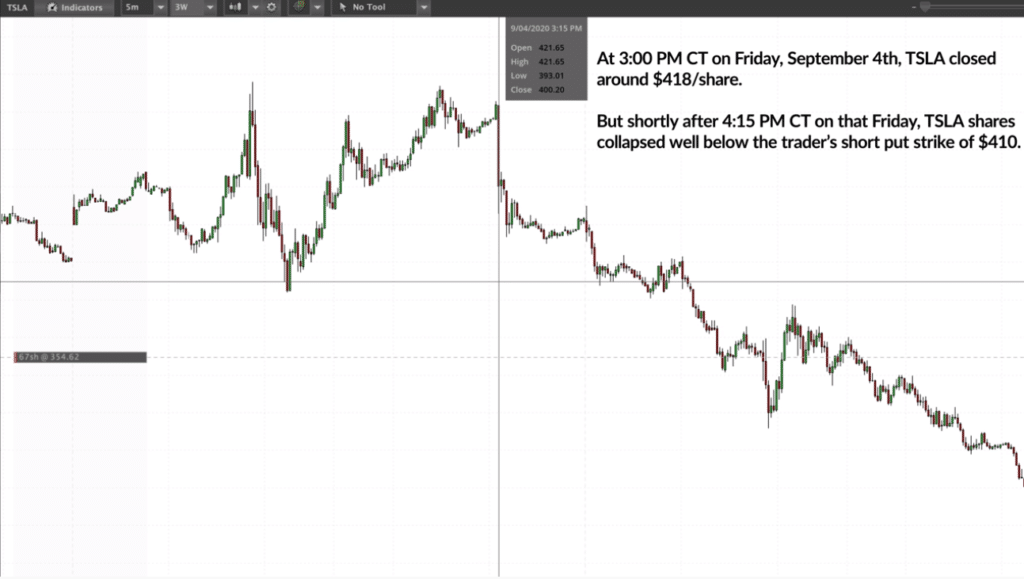

Let’s jump ahead to expiration day now. On the close of this day (at 4PM ET), TSLA stock was trading around $418/share. Now since we are short the 410 put, we should be safe here, right? If you were paying attention to what I said above, you probably can tell where this is going.

Take a look at the middle of the below chart, which illustrates TSLA’s price action about 15 minutes after the closing bell.

By looking at the above chart, we can see that TSLA tanked in the after-hours market. It fell well below the trader’s short put strike of $410.

A little over an hour later, the trader got assigned on all of the 5 short TSLA puts, leaving them with +500 shares of TSLA, worth 200k.

Huge Stock Risk with Assignment

But that’s ok; can’t the trader just exercise their long put to offset the stock position?

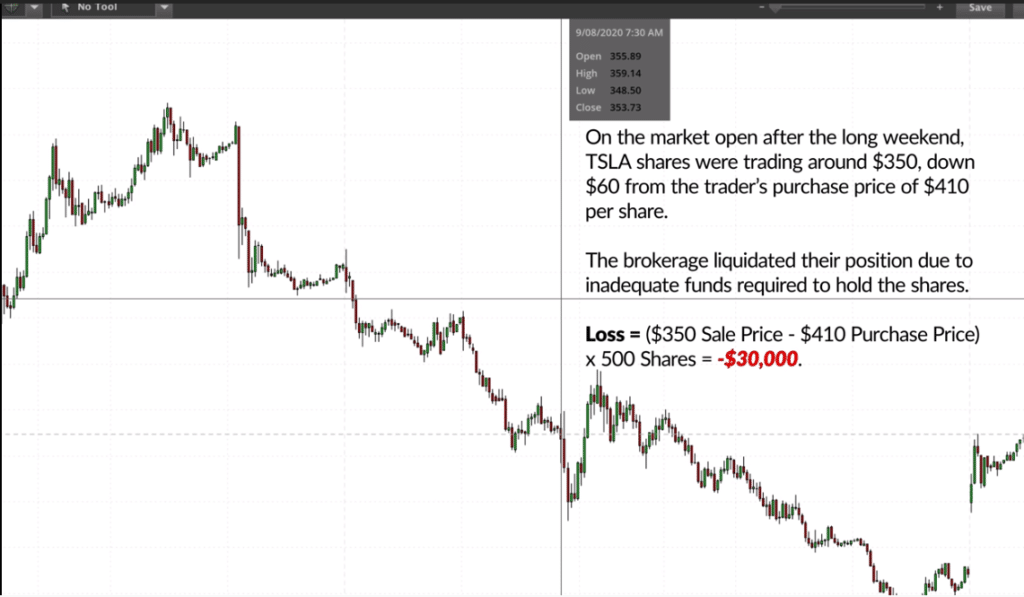

Sure, unless you’re broker waits until midnight to notify you, which is exactly what happened here. The trader was helpless, and since the stock wasn’t trading at midnight, they had to wait until Monday morning to trade out. What happened Monday morning? Take a look at the below chart to find out.

On Monday morning, the stock plummeted. Since the value of the stock was worth a lot more than the traders account, the broker stepped in and liquidated the account, selling the shares for around $350/share.

Remember, the trader bought 500 shares at $410 from the assignment, then sold 500 shares at $350/share Monday morning. The result? A $30,000 loss. This loss completely wiped out the trader’s account.

Final Word

The moral of the story? Close short options before the close! It’s that simple. Paying a couple of pennies to close a trade eradicates huge risk.

If you’d like to learn more on this subject, be sure to read our article, “Options That Trade Until 4:15 pm (3:15 Central)“.

Recommended Articles

projectfinance Options Tutorials

Additional Resources

Mike Martin

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.