Last updated on February 11th, 2022 , 12:40 pm

The prospect of a bitcoin exchange-traded fund (ETF) has been exciting retirement investors for years. After all, aren’t ETFs a great and easy way to provide exposure to a security?

Yes…and no.

The SEC has sure taken its time in approving a bitcoin ETF, and for good reasons.

In this article, projectfinance will explore these concerns. Hopefully, by the end, you’ll understand why a bitcoin ETF based on futures contracts probably shouldn’t exist.

Let’s start by understanding the difference between traditional ETFs, and those based on futures contracts (which would be the case for a bitcoin ETF).

Highlights

A bitcoin ETF will likely be based on futures contracts

Futures-based ETFs pose much greater risks than more traditional stock-based ETFs

In futures ETFs, contango occurs when the front-month futures contract is valued less than the next month futures contract

In addition to contango risks, trading halts on bitcoin futures could have devastating effects on a bitcoin ETF

Future Based ETFs vs Stock Based ETFs

Futures Based ETFs Definition: Exchange-traded funds that attempt to track the performance of an underlying security by investing in one or more futures contracts based on that security.

First off, let’s understand that not all ETFs are created equally.

The vast majority of listed ETFs attempt to mirror the performance of their respected index/sector by investing directly in the stocks (equity) that comprise that index.

Invesco’s QQQ and State Street’s SPY are two such funds.

QQQ invests directly in the 100 stocks which constitute the Nasdaq-100. SPY invests directly in the 500 stocks which constitute the S&P 500.

Together, SPY and QQQ represent two of the most widely traded stocks in the entire world. And for good reason; for very low expense ratios, the two ETFs provide direct equity exposure to two of the most highly sought-after indices in the world.

The keyword here is “equity”. When we invest in equity-based ETF, we know exactly what we are getting: stock. Unlike futures contracts (or options contracts), equity does not expire. Because of this, the correlation between equity ETFs is usually almost 1:1 with the index.

But this article isn’t focused on equity ETFs; we’re looking at futures ETFs. If you’re brand new to the ETF world, you will understand this material better if you have an understanding of more traditional ETFs first. Reading our article “ETFs Explained: Investing Basics” may be a good starting point for you!

So let’s assume you’re a savvy investor already familiar with the more basic ETFs that provide stock exposure; what if we wanted to invest in a sector that doesn’t have direct stock exposure, such as commodities or volatility?

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Futures ETFs Overview

There are numerous futures-based ETFs. In this example, we are going to study only one. If you know how a natural gas futures-based ETF works, the others should be easy to understand (such as a bitcoin futures ETF).

Natural gas prices are skyrocketing. If you wanted to go long on natural gas, there is no stock you could buy that gives you direct access. It isn’t a “company”, but a commodity.

You could buy a natural gas futures contract (/NG) of course, but you need a pretty strong stomach to trade futures, particularly on a commodity as volatile as natural gas.

Investors wanted a way to gain exposure to natural gas without trading futures contracts. To satisfy this demand, a company called USCF created the United States Natural Gas Fund (Ticker:UNG).

How Futures ETFs Work

So what does UNG invest in since it can’t purchase stock to mirror an index (such as QQQ and SPY)?

Futures! The below is taken from the “Fund Details” page of the UNG fund:

“The Benchmark is the futures contract on natural gas as traded on the NYMEX. If the near month contract is within two weeks of expiration, the Benchmark will be the next month contract to expire. The natural gas contract is natural gas delivered at the Henry Hub, Louisiana.”

USCF

The key to understanding the risks of futures ETFs (like those proposed on Bitcoin) lies in their constitution.

Like options contracts, futures contracts are constantly expiring. If you were running a futures ETF and your current contract was expiring, what would you do? You’d have to roll the expiring futures (front-month) to the next month.

Therefore, these types of funds must “roll” the futures that comprise their funds in order to stay alive.

But what if the futures price is different from the price of the actual underlying commodity? That leads to inefficiency.

Additionally, what about the difference in price between the front month and later month’s futures contract? Is there a difference in price? Yes! And we will likely have to pay in order to establish this roll. More inefficiency.

“Contango” and “Backwardation” in Futures ETFs

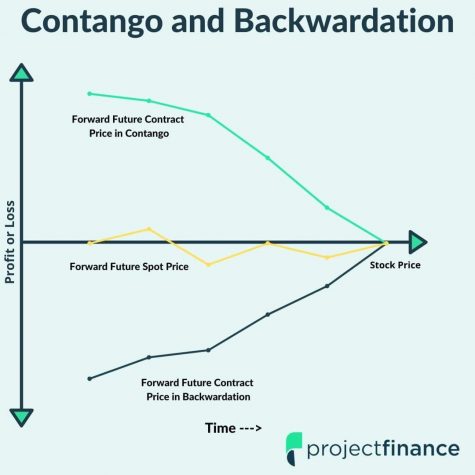

The methodology many futures ETFs employ introduces investors to a risk called “Contango” and “Backwardation” (CME Group) – the latter of which can be a benefit but happens less frequently!).

Contango Definition: Contango occurs when the futures price of a commodity/product is higher than the spot price. In regard to futures ETFs, contango occurs when the front-month futures contract is valued less than the next month futures contract

Backwardation Definition: Backwardation occurs when the futures price of a commodity/product is lower than the spot price. In regard to futures ETFs, backwardation occurs when the price of the later expiring future is trading at a value less than the front-month futures contract.

A little contango occurs naturally in most futures prices because of “the cost of carry”. This is not good for the health of an ETF. Things get really bad for futures ETFs when the contango spread widens.

Futures ETF in Contango Example

Let’s say the UNG fund is long 100 front-month futures in natural gas. That future is soon to expire. Therefore, to remain exposed to natural gas, the fund must “roll” the future contract to the next month.

However, futures that expire at a later date often trade at a premium (because of the cost of carry).

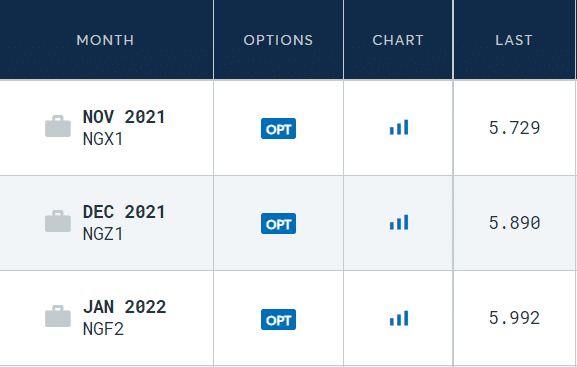

Take a moment to study the different prices of various natural gas futures contracts below from the CME Group’s website. Do you see how the further away from the present date we go, the more expensive the contracts get?

HENRY HUB NATURAL GAS FUTURES

Therefore, when UNG rolls the position from the front-month to the next month, they will incur a small loss. If they did this once, no big deal. But they do it every month! Will we pay more sometimes than other times? If so, the ETF price will decay with time.

Are you beginning to see why futures ETFs in bitcoin may spell trouble?

If you’d like to learn more about what could go wrong in a futures-based ETF, check out our video below, highlighting the rise (and decline) of a few volatilities exchange-traded notes (ETN), which use futures in their construction.

Bitcoin Futures ETF: A Grim Prospect

The more volatile a security is, the more risk an exchange-traded product has when “rolling” its position.

Last year, Bitcoin shed over 37% of its value in one single day. Bitcoin is volatile as hell, and this poses HUGE risks when it comes to futures ETFs.

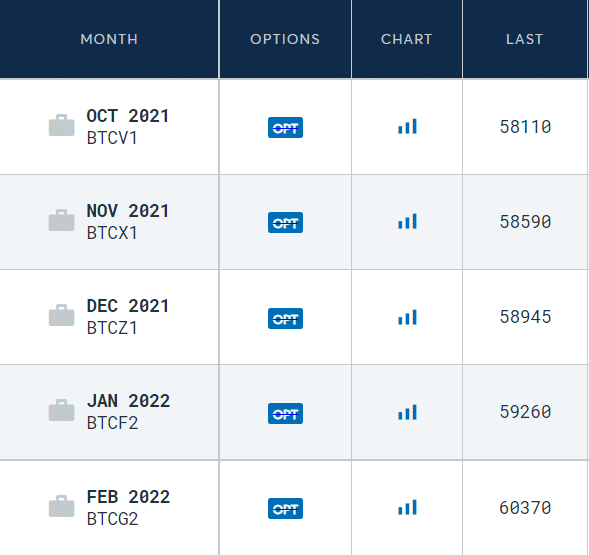

Take a look at the below screenshot from the CME Group, which shows us the various pricing for futures contracts on Bitcoin. Again, you’ll notice how the further out we go, the more expensive the contract becomes.

CME-Bitcoin Futures Quotes

What concerns us is what the premium paid to roll to the next month, and subsequently, the month after that. Will we pay more sometimes than other times? Remember, these quotes are in constant flux!

Contango therefore may indeed post a great risk to futures-based bitcoin ETFs.

But this isn’t the only risk for these types of funds.

Canadian Bitcoin ETFs: A Cautionary Tale

Canada has beaten America in the race to permit bitcoin ETFs; they have already released two.

The performance of these ETFs (issued by “Horizon’), however, can be a portent for what is to come for Americans should the SEC permit a futures-based ETF on bitcoin.

In May of 2021, the price of bitcoin tumbled. If you just owned the coin, that would be fine – there is nothing you need to do but wait (and pray!) for the price to go back up.

However, if you were trading futures on bitcoin during this time, you may have been in trouble. Why?

The price of bitcoin dropped so much, the Chicago Mercantile Exchange halted trading on the contract.

Horizon ETFs out of Canada use the CME futures to create their bitcoin ETFs. The problem?

According to the Financial Times, the company (which runs two bitcoin ETFs), sent an email to their market markets stating that, should Bitcoin remain halted, they would not be able to honor the days buy and sell orders.

Fortunately for them, the price of bitcoin recovered, and futures on bitcoin began trading again, which allowed them to honor all of the buy and sell orders of the day.

But what if Bitcoin continued to go down? What would happen to their ETFs? That’s a good question, and one surely the SEC is going over right now.

Final Word

At the end of the day, there are plenty of better alternatives to getting exposure to bitcoin than a futures ETF. Unfortunately, many of these are out of reach for retirement accounts. You can indeed open a bitcoin IRA, but, for most people, this is simply too much work.

Grayscales’ bitcoin ETF (GBTC) was once a great way for retirement investors to get access to bitcoin. For a while, it traded at a massive premium to bitcoin! However, for a long time since, it has been trading at a steep discount. It is very frustrating when bitcoin is up 1% on the day and your bitcoin trust is down 2%!

Perhaps someday there will be an ETF that directly invests in bitcoin rather than futures on bitcoin. Until then, getting exposure to cryptocurrencies via the stock market could very well end in disappointment.