Last updated on March 1st, 2022 , 06:11 am

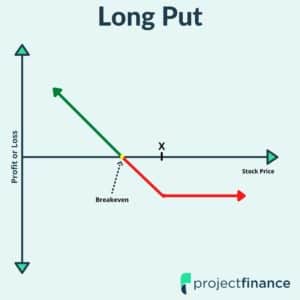

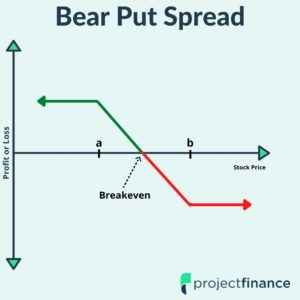

Buying put options (long put) and buying put spreads (long put spread) are both bearish options strategies with many similar characteristics.

However, both strategies have unique differences when it comes to profit/loss potential, exposure to changes in implied volatility, and probability of profit.

In the video below, you’ll learn the key differences between long puts and long put spreads as we compare the two strategies using real option contracts.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Next Lesson

Additional Resources

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.