Last updated on April 27th, 2022 , 07:46 am

Order Types

An introductory guide to option order types. Get started here!

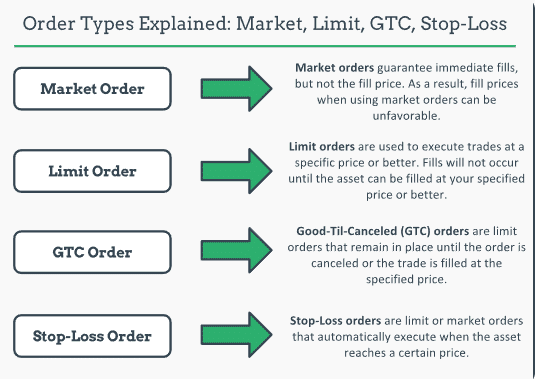

Market Order

Markets order are filled immediately regardless of price. In both illiquid stocks and options, market orders can lead to horrible fills.

Always avoid market orders on the market open/close!

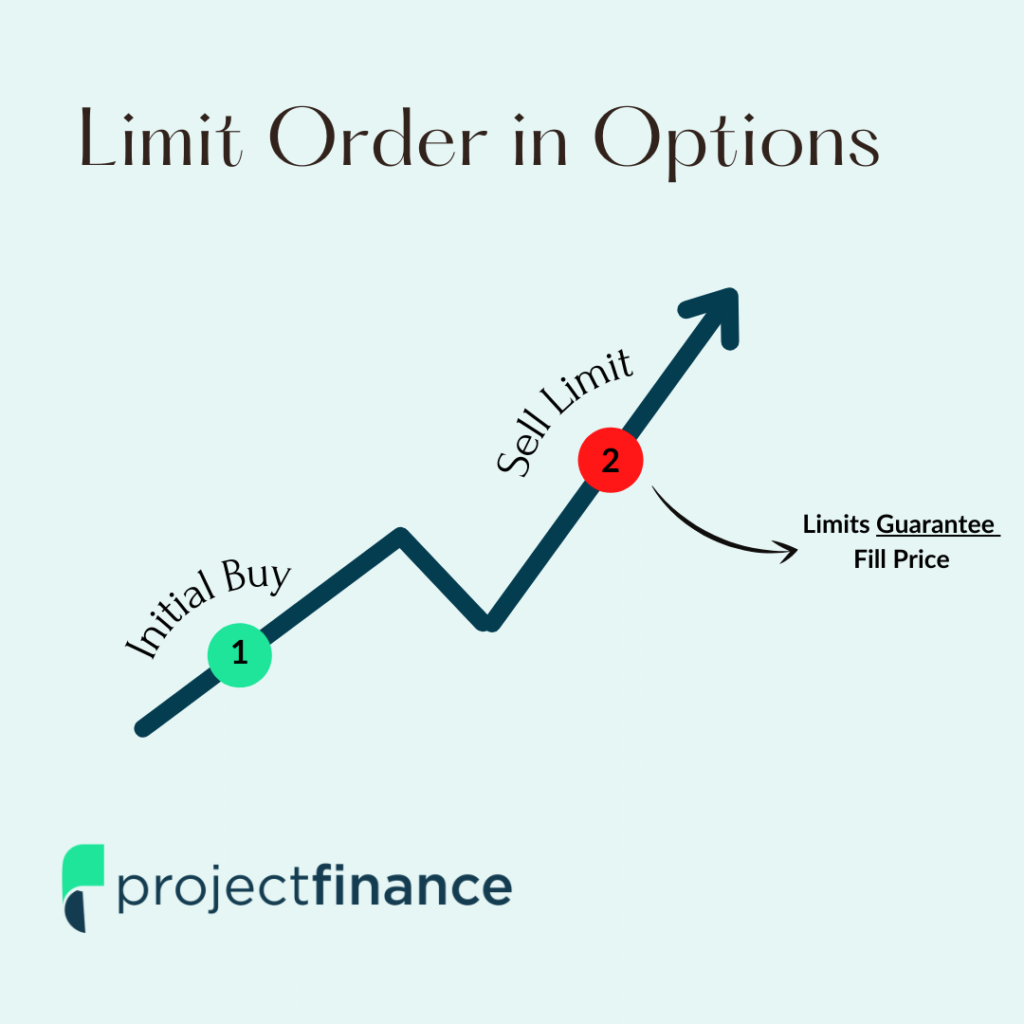

Limit Order

In options trading, limit orders are the only way to go. Why? They set an upper bound on the maximum debit you are willing to pay and a lower bound on the minimum credit you are willing to receive.

The downside? Fills aren’t guaranteed!

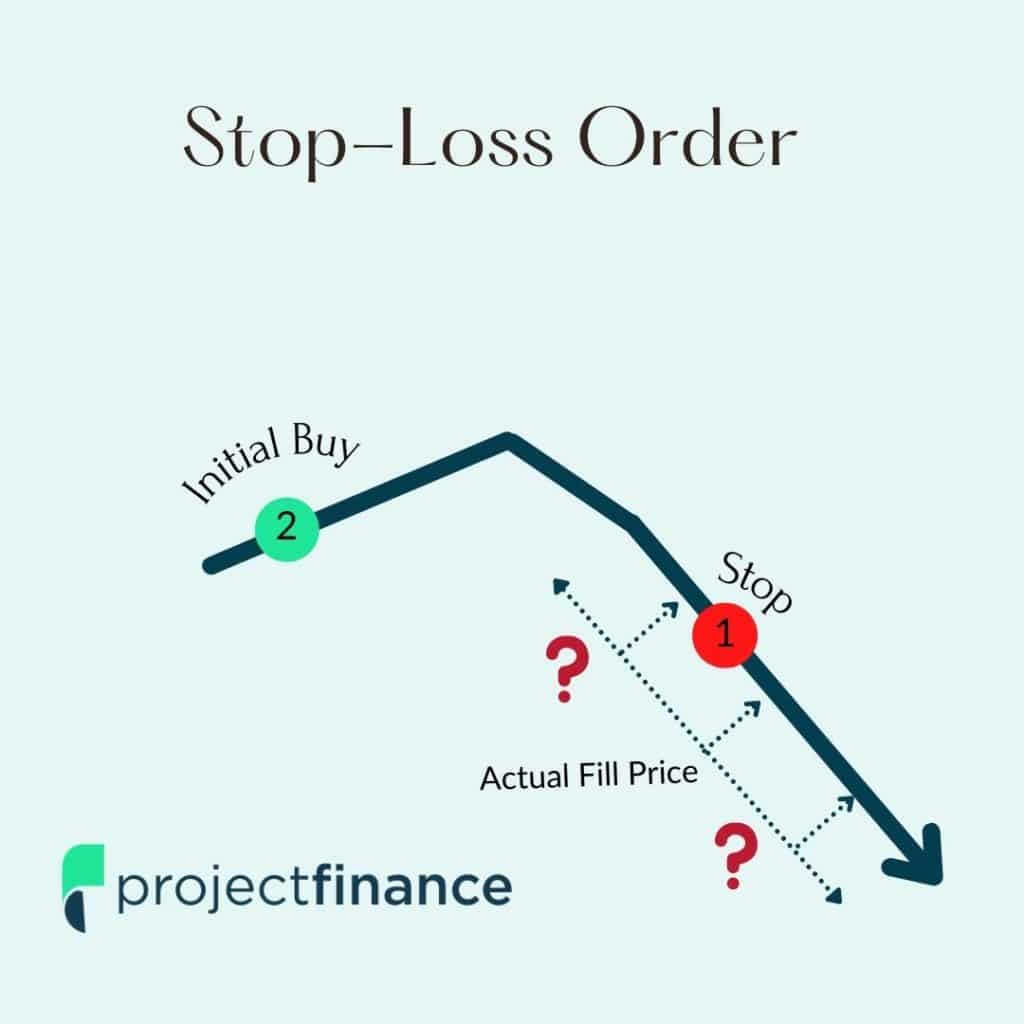

Stop-loss

A stop-loss order is simply a market order in disguise. Your broker holds these orders until the stop price is breached. They are then sent to the market makers. In the eyes of exchanges, stop-loss orders are the same as market orders.

Stop-Limit

A stop-limit order is a great alternative to the stop order. Unlike a stop-loss order, the stop-limit order triggers a limit order.

However, if the limit price is breached, stop-limit orders may never get filled.

TIF Orders

So now you know the order types. But for how long do you want that order working, and during what market period? Read all about time-in-force (TIF) order types here!

BTO vs BTC

The “position effect” box lets us choose whether our order is opening or closing. Which is right for your trade?

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.