Last updated on April 19th, 2022 , 03:34 pm

Table of Contents

One of the most difficult decisions investors can make in retirement planning is determining the bond/equity ratio they should have in their account and how that ratio should change as they age.

Unfortunately, there is no cut-and-dry answer to this question. In this article, projectfinace has compiled a list of 5 of the most popular asset allocation strategies in 2022 for retirement-minded investors. Although there may not be a methodology on this list that suits your particular risk profile, hopefully, we can give you some ideas and inspirations to create your own personal strategy.

Before we get started, I’d like to briefly touch upon the increasingly popular “target-date” retirement fund, offered by such companies as Fidelity and Vanguard.

TAKEAWAYS

- The standard asset allocation method for years has been “100-Age”. The product tells us what percentage of retirement funds should go into stocks.

- Warren Buffet recommends a “90/10” strategy, where 90% of assets are invested in stocks regardless of age.

- “120-Age” is an updated version of the old “100-Age” rule. This accounts for people living longer.

- A more modern idea, and perhaps the most popular, suggests investing 100% in equities until the age of 40, then gradually tapering off into fixed securities.

Target-Date Retirement Funds

Target-date retirement funds are exploding. Last year, their total assets under management surpassed one trillion dollars. The amount of inflows doesn’t appear to be slowing down. These funds have become, for many, a huge sigh of relief. Most of my friends don’t know the difference in risk between small-cap and mid-caps stocks; between emerging and international stocks. Target-date funds can be a godsend for those with little interest in a more hands-on approach to investing.

In the long run, target-date funds may very well be the best option. Fidgeting in retirement accounts is not recommended.

However, If you’re anything like myself, the idea of putting your entire IRA and 401k into a single target-date retirement fund makes you a little uncomfortable.

The “DIY” Approach

I prefer using mostly stock and bond exchange-traded funds (ETFs) in a hands-on approach. This gives me the ability to increase my retirement allocation in stocks during downturns, as well as make periodic adjustments to the various market-cap weights (mid-cap, small-cap, and large-caps) that I’m holding. If the market is constantly reaching all-time highs, I like having the option to take some profits. I rarely make a move, but I prefer being in charge of my diversification. There is also the distinct possibility I’m a control freak.

I am confident in my investment decisions and have the conviction to see them through. The one uncertainty I used to have was knowing whether or not my stock/equity to bonds ratio was what it should be. Over the years, I have read up on numerous methodologies and ultimately found the one that suited me best.

In this guide, we’re going to explore some of the more popular retirement allocation strategies. Hopefully, by the end, you’ll find a diversification class that suits your risk profile.

1) 100 Minus Age Rule

If you have any financially savvy seniors in your family, chances are you have heard the old “100 minus your age” adage before. This rule is very straightforward; simply subtract whatever your age is from 100 and voila! That is the percent of retirement funds you should have in stock. The rest go into bonds.

If you’re 30, this formula says you should have (100-30) 70% of your retirement fund in stocks. If you’re 60, you should therefore have 40% of your retirement in equities, and the remainder in bonds, money markets, and other investments deemed safer.

However, this formula no longer works. Why?

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Americans Are Living Longer

In 1950, life expectancy for the average American was 68 years. In 1975, that number rose to 72. The current American can expect to roam this blue sphere for 78.7 years, 270 days, two hours, and forty minutes. Mark your calendar.

So since the old formula no longer makes sense, why do we continue to use it?

There are two reasons, neither of which are legitimate.

- The formula is simple. Simple sayings have staying power. What is more simple than 100-age? It’s so easy and so obvious – how can it possibly be wrong?

- There will never be a “correct” formula. The 100-age rule will never be proven incorrect because there will never be a “correct” retirement allocation rule. Why? No two investors are going to retire at the same moment, just as no two investors are going to die at the same time (pardon my morbidity).

So if this formula is broken in 2021, what works?

2) 90/10 Strategy: Warren Buffet Says...

Warren Buffet has his own allocation suggestion, which is a 90/10 ratio of equities to bonds. This stock heavy ratio does not discriminate with age but stays true from the first day of your employment to the very last.

“It is a terrible mistake for investors with long-term horizons,” the Oracle of Omaha said in 2017, “to measure investment ‘risk’ by their portfolio’s ratio of bonds to stocks.”

He went on to say that the nature of high-grade bonds actually increases portfolio risk. What he doesn’t mention, however, is peace of mind; could you sleep well on the eve of your retirement with 90% of your savings in stocks?

Probably not. But that isn’t to say you are limited to these almost polar opposite approaches to risk when investing for retirement.

3) 120 minus your age

Perhaps the most widely accepted approach to retirement asset allocation in 2021 is a revamp of the old rule “100 minus Age”.

Instead of subtracting your age from 100, this new formula suggests subtracting your age from 110 or even 120. This takes into account the longer lifespans of Americans.

If I subtract my current age of 37 from 120, that number tells me I should have 83% of my retirement assets inequities. Given how long American’s are living, most investment professionals would agree this rule better suits modernity than the antiquated 100 minus age rule.

4) 100% Stocks Until You're 40

A modern idea gaining traction suggests investing 100% of your retirement fund in stocks until you reach the age of 40. This is assuming you plan on retiring around 70, give or take a few years. Does this seem reckless? Perhaps, but the numbers show otherwise.

Over time, the stock market recovers from recessions and depressions. Take the Great Depression for example. It took the US stock market 25 years to recover and breach new highs following this period. For The Great Recession of 2007-2008, the stock market only took 4 years to recover.

What do both of these black swans have in common? Both recovery times were under 30 years, which is the time horizon most investors would until retirement when they invest all of their retirement funds into stocks before reaching 40 years of age.

Looking at the Numbers

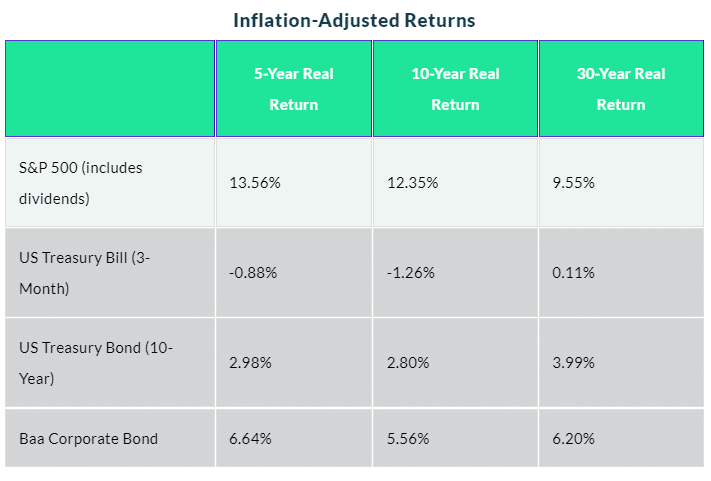

If you’re like me, you would prefer to see the numbers rather than the narrative. Let’s next take a look at the historical performance of stocks, Treasury Bills, Treasury Bonds, and corporate bonds (rated Bbb).

The NYU Stern School of Business provided a phenomenal data table comparing the historical returns of these various categories. I went through the list and compiled my own table on the performance of these different categories, adjusted for inflation, over different time periods. Take a look below.

Clearly, investing in broad-based stock indexes such as the S&P 500 has proven the better option for long-term investors. This includes all of the volatility of the past 30 years, not limited to the Early 2000s Recession, the Financial Crisis, and the pandemic.

But that said, who knows what the future has in store? History does not always repeat itself.

5) Vanguard's Target Date Allocations

We mentioned earlier in this article a great alternative to DIY investing: Target Date Funds.

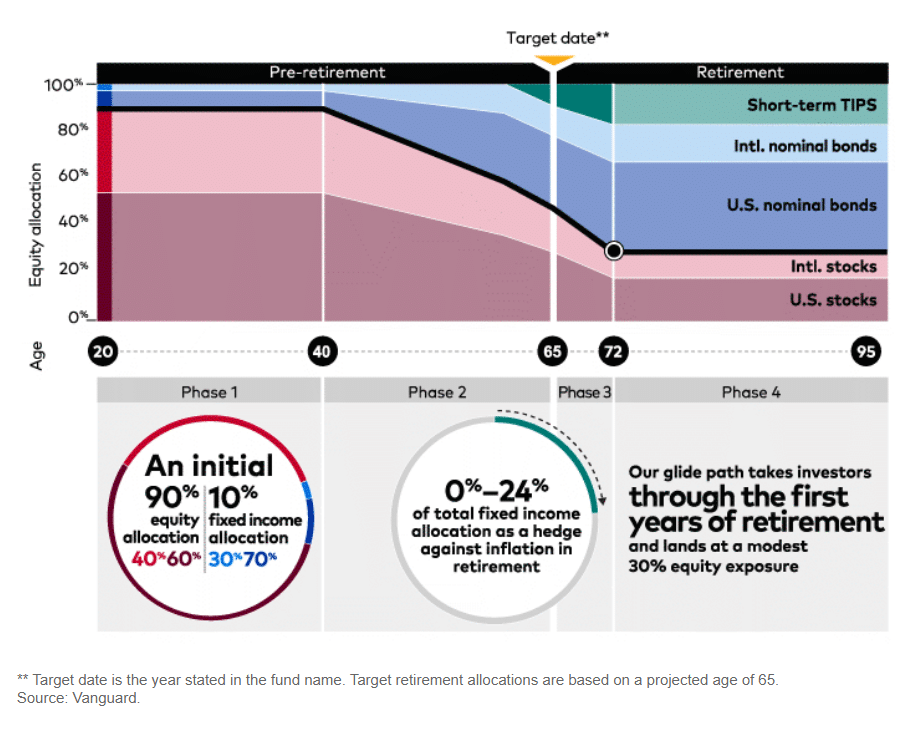

Vanguard is one of the most popular companies in this arena. So what equity allocation do they choose?

From the image above, we can see that Vanguard’s “Phase 1”, which includes investors up to the age of forty, has an equity (stock) allocation of 90%. Up until that age, Vanguard appears to mirror Warren Buffet’s approach.

I bet that high stock allocation number would surprise a lot of 401k employees participating in this fund.

If we were to go off of the “100 minus age” rule, the equity allocation for an investor 40 years of age would be only 60% invested in stocks. When you’re talking dozens of years, that 30% difference could easily add up to millions of dollars.

If we look at “Phase 4” of Vanguard’s investment strategy, we see that investors aged 72-92 still have a considerable equity exposure of 30%.

Following that age, Vanguard very reasonably begins to curtail the risk.

Final Word

So which retirement asset allocation strategy is best for you? This decision would be a whole lot easier if we had a crystal ball.

I will say this – risk-averse investors rarely add into their calculations the cost of not participating in the equity market.

Remember the negative performance of Treasury Bills from the above graph? With inflation factored in, it’s very possible for investors to actually lose money on a yearly basis when they forego stocks.

The post-pandemic recovery has proven this, and should be enough motivation for stock-market-jittery investors to take on more risk.