Last updated on February 10th, 2022 , 01:21 pm

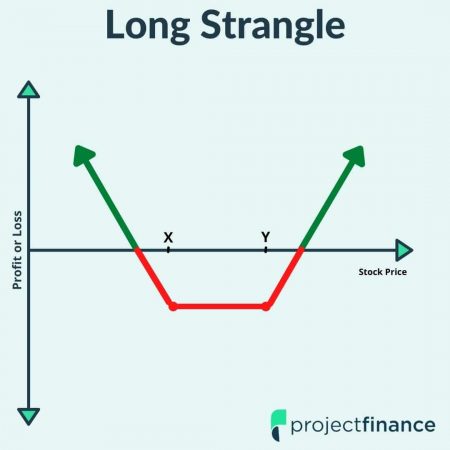

The long strangle is an options strategy that consists of buying an out-of-the-money call and put on a stock in the same expiration cycle.

Since the purchase of a call is a bullish strategy and buying a put is a bearish strategy, combining the two into a strangle results in a directionally neutral position.

However, even though a strangle is not directionally specific (bullish or bearish), the strategy requires a significant stock price change in either direction or an increase in implied volatility to profit. In other words, buying a strangle is bullish AND bearish.

If a large stock price movement or increase in implied volatility does not occur, the position’s value will slowly decrease, leading to losses for the strangle buyer.

Jump To

TAKEAWAYS

- The long strangle is a directional trade; it profits when the stock moves up or down by a significant amount.

- The strategy consists of buying both a call and put option at the same strike price and expiration.

- Maximum loss for the long strangle is the total debit paid.

- Maximum profit is unlimited as the long call has no cap.

Long Strangle Options Strategy Characteristics

Let’s look at the long strangle’s general characteristics:

Max Profit Potential: Unlimited

Max Loss Potential: Debit Paid x 100

Expiration Breakeven

Upper Breakeven = Call Strike Price + Total Debit Paid

Lower Breakeven = Put Strike Price – Total Debit Paid

Estimated Probability of Profit:

Less than 50% because a significant stock price change or an increase in implied volatility is required to profit.

To explain these characteristics further, let’s look at a basic example.

Long Strangle Profit/Loss Potential at Expiration

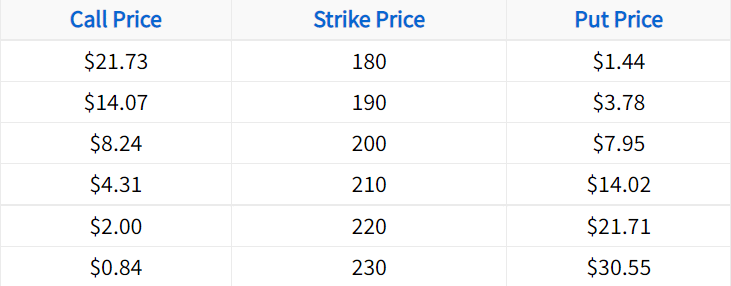

In the following example, we’ll construct a long strangle position using the following option chain:

In this case, we’ll buy the 190 put and the 210 call. Let’s also assume the stock price is trading for $200 when the strangle is purchased.

Initial Stock Price: $200

Long Strikes/Purchased Options Used: 190 put, 210 call

190 Put Purchase Price: $3.78

210 Call Purchase Price: $4.31

Total Debit Paid: $3.78 + $4.31 = $8.09

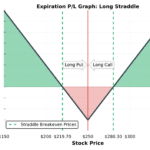

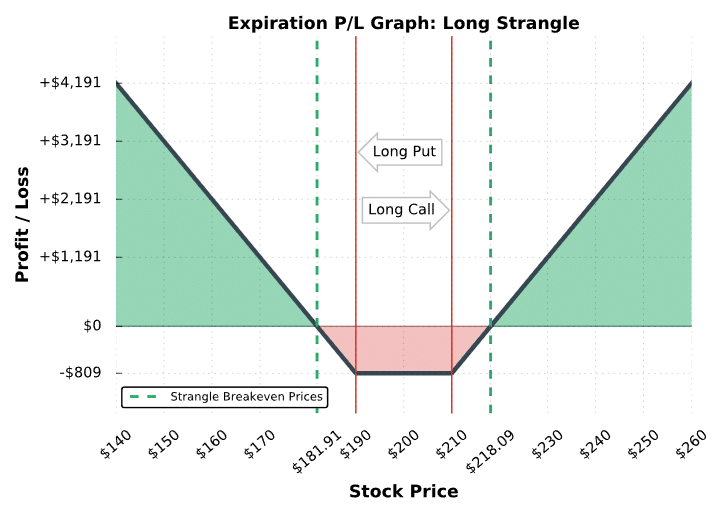

The following visual describes the potential profits and losses of this position at expiration:

Long Strangle at Expiration

As illustrated in this visual, a long strangle has significant profit potential when the stock price makes a large move in either direction. However, the low risk and high reward nature of a long strangle suggests that such a movement is not probable. In this particular example, the stock price must move ±18.09 for the position to break even at expiration, which represents nearly a 20% move in either direction.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Long Strangle Trade Examples

In this section, we’re going to visualize the performance of real long strangles that recently traded in the market. Note that we don’t specify the underlying, since the same concepts apply to long strangles on any stock. Additionally, each example demonstrates the performance of a single strangle position. When trading more contracts, the profits and losses in each case would be magnified by the number of strangles traded.

Let’s do it!

Trade Example #1: Maximum Loss Strangle Purchase

The first example we’ll look at is a situation where a hypothetical trader buys a strangle with a call and put that have deltas near ±0.20. With a delta near ±0.20, the call and put both have an estimated 20% probability of expiring in-the-money, respectively.

Because of this, the strangle as a whole has an approximate 40% probability of expiring in-the-money, which translates to a 60% probability of expiring out-of-the-money (max loss for the strangle buyer).

Here are the trade details:

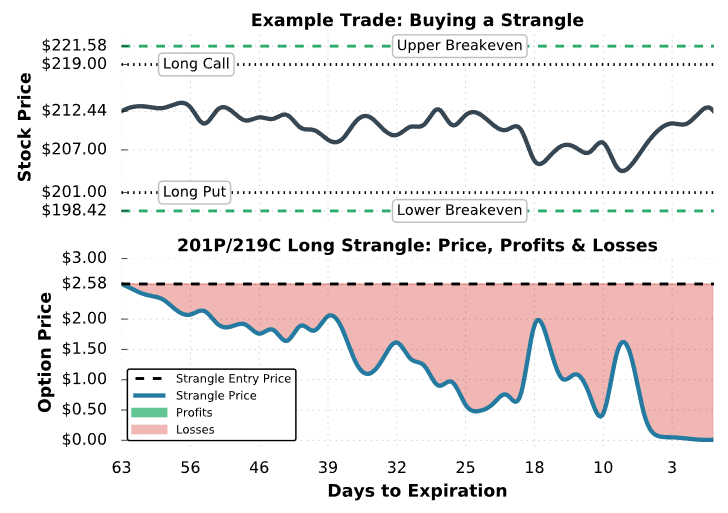

Initial Stock Price: $212.44

Initial Implied Volatility: 14%

Strikes and Expiration: 201 put and 219 call expiring in 63 days

Strangle Purchase Price: $1.75 for the put and $0.83 for the call = $2.58 total debit

Breakeven Prices: $198.42 and $221.58 ($201 – $2.58 and $219 + $2.58)

Maximum Profit Potential: Unlimited

Maximum Loss Potential: $2.58 net debit x 100 = $258

Let’s see how this trade performed:

Strangle #1 Trade Results

In this example, we can see that the price of the 201/219 strangle decays continously over time because the stock price remains between the long strikes. Additionally, implied volatility remained flat because the stock price did not move violently in either direction. At expiration, both options expire worthless, resulting in the maximum loss potential of $258 for the strangle buyer.

If the trader wanted to lock in losses at any point, they could have sold the strangle at its current price. For example, if the trader sold the strangle for $1.50, they would have locked in a loss of $108: ($1.50 sale price – $2.58 purchase price) x 100 = -$108.

Trade Example #2: Profitable Long Strangle

In this example, we’ll examine the performance of a long strangle when the stock price collapses through the long put strike.

Here are the trade details:

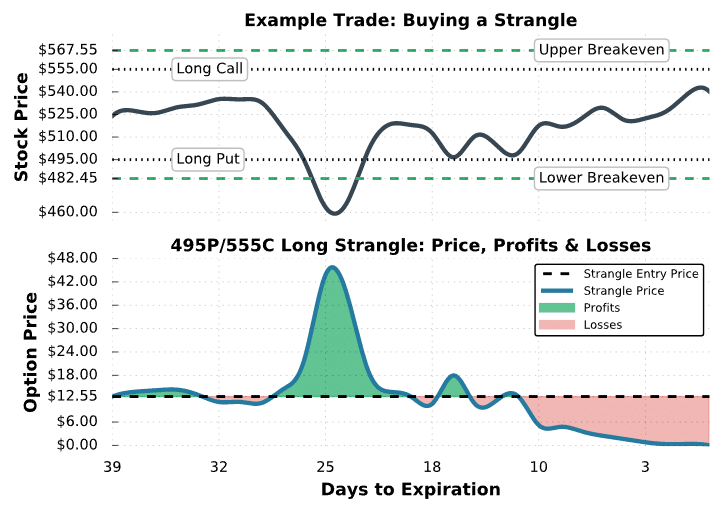

Initial Stock Price: $524

Initial Implied Volatility: 26%

Strikes and Expiration: 495 put and 555 call expiring in 39 days

Strangle Purchase Price: $6.35 for the put and $6.20 for the call = $12.55 total debit paid

Breakeven Prices: $482.45 and $567.55 ($495 – $12.55 and $555 + $12.55)

Maximum Profit Potential: Unlimited

Maximum Loss Potential: $12.55 net debit x 100 = $1,255

Let’s see how the trade performed:

Trade #2 Results

This time around, we can see that when the stock price falls significantly, the price of the strangle surges because the price of the long put explodes. Additionally, when the stock price falls significantly, implied volatility tends to spike, which indicates higher option prices across the board.

At the highest point, the 495/555 strangle is worth $43.85, which represents a profit of $3,130: ($43.85 strangle price – $12.55 purchase price) x 100 = +$3,130. Unfortunately, the stock price rallied back and the strangle ended up expiring worthless, but this example still demonstrates how a significant move in the stock price leads to profits for a strangle buyer.

Final Word

Congratulations! You should now be much more comfortable with how buying strangles works as an options trading strategy.

Let’s review what we have learned:

- To profit, the long strangle requires a strategy requires a significant stock price change in either direction or an increase in implied volatility to profit.

- If the underlying does not change in value, overtime the options will both decay.

- Max loss on the long strangle is the debit paid; max profit is unlimited

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.