Last updated on February 16th, 2022 , 01:49 pm

Jump To

When starting out in trading, it’s entirely natural to focus on the profit side of the equation. However, losses in trading are inevitable, and keeping losses manageable is the key to long-term profitability.

In this post, we’re going to compare two trading approaches and see which one has performed the best. Since we’re an options trading website, we’re going to focus on a short premium (selling options) approach and compare two separate trade management plans when selling strangles:

1. Only exit trades if a pre-defined profit target is reached. Otherwise, hold to expiration.

2. Only close trades if a pre-defined loss limit is reached. Otherwise, hold to expiration.

We’ll also look at the combination of these two strategies.

Let’s briefly discuss the methodology we’ll use for this analysis.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Study Methodology

1. All positions entered on the first trading day of each month from 2007 to present.

2. Select standard options expiration cycle in the following month (43-52 days to expiration).

3. Sell a strangle with a 16-delta call and 16-delta put.

Now, for each strangle position we tested two separate management approaches:

1. Close profitable strangles for 50% of the maximum profit potential. For example, if a strangle was sold for $1.50, the trade was only closed if the strangle’s price fell to $0.75 (a 50% profit). If the profit target is never hit, hold the position until expiration and let any losses run.

2. Close unprofitable strangles for -100% of the maximum profit potential. For example, if a strangle is sold for $2.00, the position was only closed if the strangle’s price reached $4.00 (a loss equal to 100% of the maximum $2.00 profit potential). If the stop-loss is never hit, hold the position until expiration and let any profits run.

We also added the combination of these two strategies for comparison.

Study Results: Taking Profits vs. Taking Losses

After running the study, we rounded up the cumulative profit/loss of each management approach. Here’s what we found:

As we can see here, only taking losses at the pre-determined loss limit resulted in an end profit 76% higher than the approach in which only profits were taken.

Let’s look at some of the profitability metrics related to each management approach:

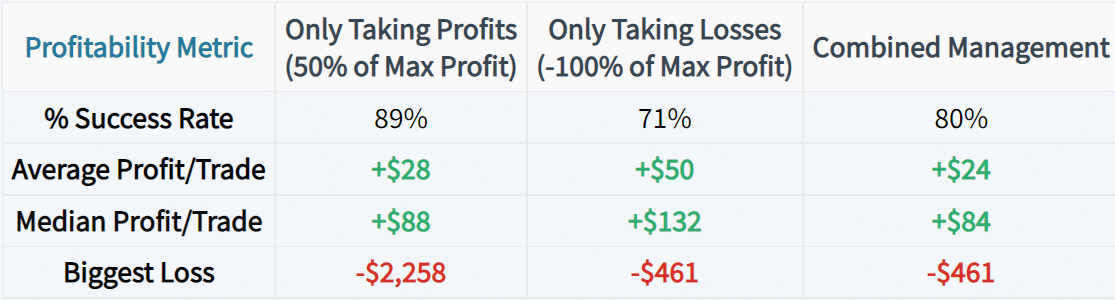

While the loss-taking approach had a 17% lower success rate, the strategy significantly outperformed in the profit expectancy and worst drawdown categories.

By taking losses, you get stopped out of some losing trades that end up being profitable, which leads to a lower success rate. However, when the losing trades don’t come back, taking the loss results in keeping a larger portion of the profits from previous trades.

By taking profits and losses, the combined management strategy got the best of all worlds: high success rate, small drawdowns, and similar profitability to the trades that were closed for a profit or held to expiration.

When implementing any short premium approach, profits are typically small and frequent. However, the losses are infrequent and substantial. The key to any options trading approach (especially a short premium approach that utilizes undefined-risk strategies) is minimizing drawdowns and keeping most of the small, frequent profits.

In this post, we covered a very basic management approach applied to short strangles. The small study we presented is only one test using one specific strategy, but the notion of avoiding large losses is the most important takeaway.

Summary of Main Concepts

Here are the main concepts to take away from this post:

- Many traders focus on the profit side of the equation, though focusing on losses can be more beneficial.

- When selling 16-delta strangles in the S&P 500 over the past 10 years, closing only losing trades performed significantly better than only closing profitable trades.

- Though the loss-taking approach to selling strangles had an 18% lower success rate, the strategy made up for it by keeping the losses small (the minimum drawdown was 80% lower than simply taking profits and holding losing trades).

- When implementing an option-selling strategy with significant loss potential, profits will typically be small and frequent, but the infrequent losses can be substantial. Avoiding catastrophic drawdowns when selling options is the key to long-term profitability.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.