Last updated on April 13th, 2022 , 02:30 pm

The humble 401(k) is among the most popular forms of retirement account. It is typically employer-sponsored and often includes employer matching (to a point), allowing retirement funds to ramp up faster than other investment vehicles simply due to the additional influx of cash.

“Before 1974, a few U.S. employers had been giving their staff the option of receiving cash in lieu of an employer-paid contribution to their tax-qualified retirement plan accounts. The U.S. Congress banned new plans of this type in 1974, pending further study. After that study was completed, Congress reauthorized such plans, provided they satisfied certain special requirements. Congress did this by enacting Internal Revenue Code Section 401(k) as part of the Revenue Act. This occurred on November 6, 1978.” – Wikipedia.

Though this form of retirement plan didn’t become popular until the 80s, it is now one of the most common plans available due to its benefits for employers and employees. Most companies that offer retirement benefits do so through a 401(k) plan today.

In the past, careers were stable. You could get a job and reasonably expect to work for that company for decades and possibly keep that same career to your retirement. Retirement parties were a common sight.

Today, company loyalty is at an all-time low, with many people job-hopping every 2-3 years. Companies often fail to provide avenues for advancement or raises, even to counteract the cost of living, so changing companies is often seen as the only way to progress in a career.

There are a ton of repercussions to this shift in employment culture, but one that many people overlook is the retirement plan. If you’re hired on to a company that offers a 401(k), and you work for them for three years, great! You have three years of contributions to your retirement account.

What happens if you leave the company and go to another that also offers a 401(k) plan? Chances are they’re with various brokerages or use different asset distributions. They open a new 401(k) for you, but your old one still exists.

Can you have two 401(k) plans legally? Can you contribute to both of them? Are there any salient details you should know?

Let’s dig in and find out.

Jump To

Are There Legal Restrictions on Multiple 401(k)s?

First of all, there’s no legal restriction against having multiple 401(k) accounts. You can have multiple 401(k) accounts from W-2 employers, or you can have both an employer-sponsored 401(k) and an individual 401(k) as suits your needs.

It’s pretty typical for people to have more than one 401(k). There are no laws or regulations against it. If you change jobs, you can keep your old 401(k), roll it over into your new account, consolidate it, or even take a payout.

However, there is one restriction: your old 401(k) needs to have at least $5,000 in it to maintain it. If it has less than that amount of money, the employer is entitled to shuffle that money around, often rolling it into an IRA. If your old 401(k) has less than $1,000, they will cash it out and send you a check.

The other limitation is that you cannot contribute to an old 401(k) from an employer you no longer work with. You can’t tell your new employer to contribute to your old account, nor can you contribute to it; after all, your old employer has no real incentive to help you with your retirement; they’re not allowed to do anything with those funds other than continue to manage them.

How to Contribute to More Than One 401(k)

So, wait. If you can’t contribute to an old employer’s 401(k), how can you contribute to more than one 401(k)? There are two options.

The first is having an employer 401(k) and an individual 401(k).

Individual 401(k)s are only available to people who have their own companies or are self-employed. Individuals with self-employment income and people who have C corps, S corps, or LLCs and no employees can create their 401(k) plans.

The individual 401(k) is unique in that the contribution limits are higher because you can “match” your contributions as both the employee and the business owner; you can “match” your contributions. This strategy isn’t “free” money the way an actual employer match is – since you’re contributing both sides, rather than one side coming from a company – but it effectively allows you to have a much higher contribution limit than a standard 401(k).

The second option is to have more than one job.

If you work two jobs, and both of them offer 401(k) plans to their employees, you are free to have both. In some cases, this can be a good idea because it allows you to access different asset mixes and funds and accrue more employer matching above the contribution limits.

What are The 401(k) Contribution Limits?

There are two relevant 401(k) contribution limits you need to know.

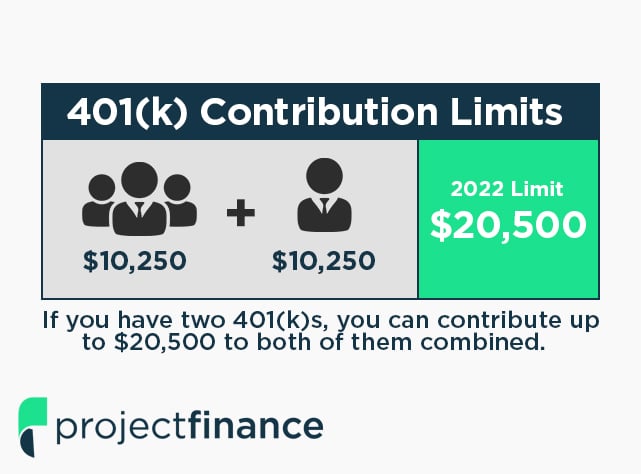

The first is the individual contribution limit. This contribution limit is a limitation that applies to all 401(k)s. In 2022, that limit is $20,500.

A 50/50 split means each 401(k) would support up to $10,250 and not a penny more. So, if you have one 401(k), you can contribute up to $20,500 to it. If you have two 401(k)s, you can contribute up to $20,500 to all accounts combined.

The distribution can vary. If you want to put $20,000 in one 401(k) and $500 in the other, you can do so. It would be best if you simply made sure neither employer over-funds your accounts through automatic contributions. If you over-contribute, you may be subject to additional taxes on the excess, and you’ll be required to remove the extra contributions, paying the 10% early withdrawal penalty. In general, over-contributing is penalized and isn’t worth trying to do.

There’s a second contribution limit, though, and it’s the most exciting. It’s the employer contribution limit. This limit, as of 2022, is $61,000.

There’s one quirk, however. This limitation is calculated per employer rather than per employee.

In other words, both of your employers can potentially contribute up to $61,000 to your 401(k)s. If you work two jobs and have two employers, and all three of you max out your contributions, that’s $20,500 + $61,000 + $61,000.

Employer contributions are usually based on a percentage of the employee’s salary and contributions, carefully calculated to be as minimal as possible while still compelling to the employee. Very few companies will max out contributions for most of their employees. However, that’s a more social and political discussion than a legal one.

If you’re using an individual 401(k) as a self-employed person with a day job, you can contribute to both the employer and employee side of your individual 401(k).

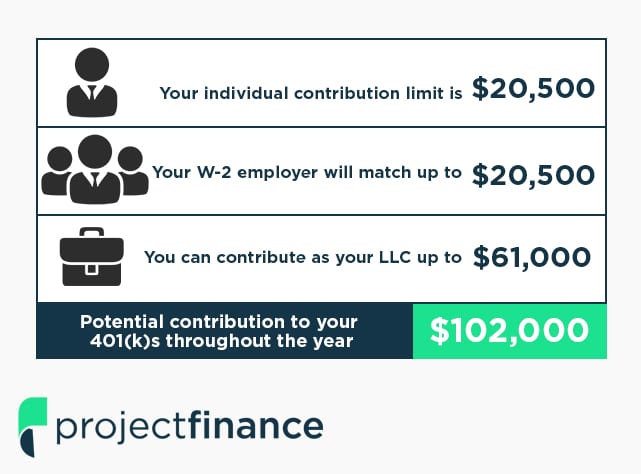

Imagine a scenario such as this:

- You work a W-2 job with 401(k) matching, dollar for dollar, up to your contribution limit.

- You have a lucrative LLC on the side.

You have three relevant values here:

- You can contribute as your LLC by up to $61,000.

- Your individual contribution limit is $20,500.

- Your W-2 employer will match up to $20,500.

That means you can potentially have $102,000 added to your 401(k)s throughout the year.

If your W-2 employer wanted, they could even contribute more, up to that $61,000 amount, though it’s relatively unlikely to happen.

This practice is perfectly legal; you simply need the funds to supply the account from your LLC.

Remember, too: if you’re over 49 years old, you can add “catch-up contributions” on top of your other contributions; the limits are higher for older people to better take advantage of a limited number of years of compounding interest.

Before we continue, there’s one more quirk you should be aware of: employee vesting. When you sign up for a retirement plan with an employer, they will usually have a clause about “vesting” in the employer contributions.

Vesting is partial ownership of the money the employer invests in your account. If an employer has, say, 20% per year vesting, it will take five years for you to be entitled to the total amount the employer has contributed.

This contribution limit is essentially a way for an employer to avoid paying into an employee’s account, only to have that employee leave after 1-2 years and take the money with them. While most of the time, this wouldn’t be valuable to do anyway, some specific businesses and industries have excellent retirement benefits. Thus, vesting rules prevent it. It would be beneficial to do so.

In practice, what this means is that if you leave an employer before you are fully vested in their 401(k) contributions, they can keep some percentage of the money – the percentage you weren’t invested in. This limitation can be a rude awakening if you roll over an old 401(k), only to find that some portion of the value doesn’t come with you.

What to Do with Multiple 401(k)s

Suppose you find yourself in a situation where you have more than one 401(k). What should you do? What’s the correct move financially?

The truth is, there’s no one correct answer. Your best bet is to talk to a financial advisor directly. However, we can offer some general advice and scenarios.

If you left a job with a 401(k) and you started a new career with a 401(k), you generally want to do something with the old 401(k). There are several reasons for this.

- If the value is too low, under $1,000, the employer will cash out the old 401(k) in your name, and you will be subject to a penalty for early withdrawal.

- If your old 401(k) value is under $5,000, the employer is not required to keep a handle on it and can force you to roll it over or otherwise claim it.

- Since IRAs and 401(k)s are different accounts, they are subject to additional rules, asset mixes, and management practices. If you leave the retirement account alone, your employer will likely roll it over into an IRA for you to manage on your own. After all, the employer doesn’t want to manage your money when you no longer work for them.

- If the old employer goes bankrupt or collapses, it can be challenging to track down and claim the money in the old account, especially years after the fact. Of course, you’re entitled to it, but getting ahold of it can be challenging and frustrating.

Generally, the best option is to roll over your old 401(k) into your new one, so your interest keeps compounding. There are occasionally good reasons to leave your old 401(k) in place, such as taking advantage of limited investment vehicles. Again, though, talk to a financial advisor about your specific situation.

Remember that you can’t contribute to a 401(k) managed by an employer you no longer work for. While they may be required to keep managing the money if it’s over $5,000, they are not required to allow you to pay into the account.

On the other hand, if you have two 401(k)s because you’re self-employed, you can use the contributions from the employer site to invest more than you “should” be able to invest. Careful management of employer matching with your W-2 job, plus maximizing your contributions as an LLC, can be a compelling way to save more for retirement.

Summing Up

To sum things up in brief:

- Yes, you can have more than one 401(k) account.

- Yes, you can contribute to more than one 401(k) account if you actively work for two employers (even if one of those employers is yourself).

- Your individual contribution limit is shared across all 401(k) accounts, and you will be subject to taxes and penalties if you over-contribute.

Depending on your specific situation, there are a few potential benefits to having more than one 401(k). Still, you would do best to talk to a financial advisor directly about your particular circumstances to get the best advice.

Do you have multiple 401k accounts, or are you thinking of opening one? Are you worried about hitting contribution limits? Have you had trouble rolling over your 401ks, or are you worried you’re doing something incorrectly? Please share with us in the comments below, and we’ll do our best to point you in the right direction!