Last updated on April 25th, 2022 , 12:20 pm

Saving for retirement is a big deal. Every one of us needs some way to survive when we age out of the workforce and retire. Some lucky few can start successful ventures and save more money than they can ever spend, but most of us need to be a little slower and more deliberate with it.

We rely on a 401(k), an IRA, or multiple accounts to fund retirement. The trouble is, it’s pretty challenging to determine just how much you’ll have to live on when you retire. There are many moving parts and different factors to consider.

Moreover, if you search online, much of what you’ll find is about saving for retirement, not how to calculate what you’ll have as a payout when you finally retire.

How can you estimate what your retirement paychecks will be?

Let’s get started.

Jump To

Age of Retirement

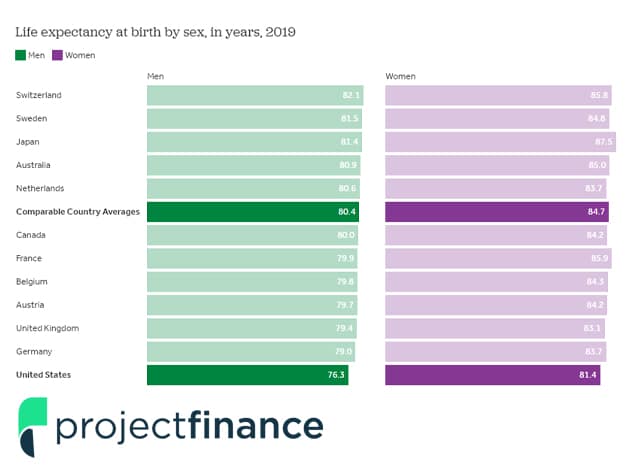

The average retirement age varies by location, culture, and income level. The one commonality is the age of 60. With an average life expectancy of about 78 in America today, this gives you a solid two decades to enjoy the twilight of your life. Of course, some people don’t retire until 65 or even 70.

The commonality is the age of required disbursements from investments.

Both IRAs and 401(k)s allow you to start taking payments from them when you hit a certain age.

That age, as of current laws, is 59 ½.

Why the half-year, and not just 59 or 60? Who knows!

There’s probably a reason buried in the depths of time, but if there is, it’s not easy to find.

Additionally, those accounts require you to start taking payments at age 72.

On top of that, some people qualify for early disbursements, starting at age 55. Specifically, if you leave your job once you turn 55, you may be able to take payments from that job’s 401(k) plan without penalty. Like a 401(k) you own or an IRA, other accounts do not allow this exception.

The age of retirement makes a big difference in your payment calculation. The longer you want to live off your investments, the longer those investments need to last. Ideally, you will have enough principal stashed away to live solely on interest payments, but that’s not always possible. More on that later.

The other reason age of retirement matters is market volatility. The longer you want to live on your retirement funds, the more likely you’ll have to cope with a downturn. Investment accounts take advantage of the fact that, over decades, the markets always rise. In the short term, however, volatility can affect interest rates and monetary value, and significant market volatility can have a significant impact, like a global pandemic affecting the world markets.

Additional Investments and Payments

An IRA and a 401(k) are not the only possible investments you can have for your retirement; they’re just two of the most common.

When calculating your eventual retirement paycheck, remember to consider additional income streams.

Two, in particular, are relatively common.

The first is a pension.

A 401(k) is technically a form of pension, but a “traditional” pension operates a little differently. These tend to be most common in major companies and government organizations, and they’re slowly growing less common over time.

If you have one, you will likely have a fixed payment from a company pension, though you may have the option to cash it out or roll it over to another account so the company doesn’t need to deal with it anymore.

The second is Social Security. Throughout your life and your career, you pay taxes. Some of those taxes go to the government to spend as they will, some go to state governments, etc. Some of it, however, goes towards the Social Security fund. Everyone who works in America pays into Social Security, and everyone who worked in America long enough to earn enough credits is entitled to Social Security when they retire.

Social Security payments typically begin at age 62 and are usually calculated to be roughly 40% of your income level when working. Alternatively, you can delay taking your payments until age 70 to increase the amount you get each year.

Keep these two sources of retirement income in mind. Calculating your desired total retirement income requires considering all of your income streams, not just those from your primary accounts.

401(k) vs. IRA

In the title, we mention 401(k)s and IRAs as the two investment vehicles we will calculate.

Is there any significant difference between them in retirement?

The answer is not really.

There are a lot of differences between IRAs and 401(k)s, but they’re all relevant to investing in them, not taking money from them. Once you reach retirement age, taking money from either of them – or even rolling them together – is acceptable. Either way, you have a principal invested in the markets, which earns interest based on its investment package. You take money from it as required once you retire. How much? Well, that’s the question.

Roth vs. Traditional

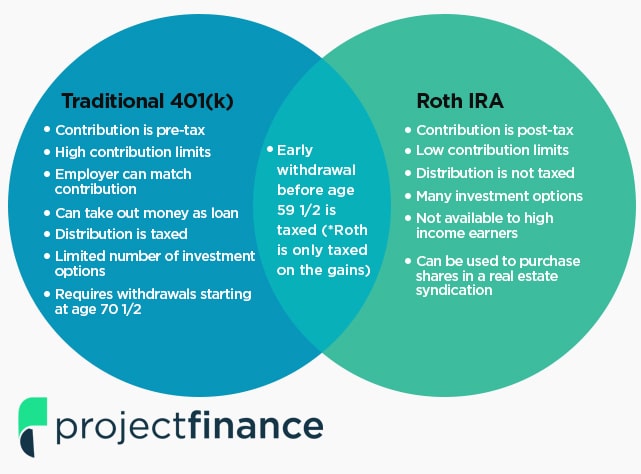

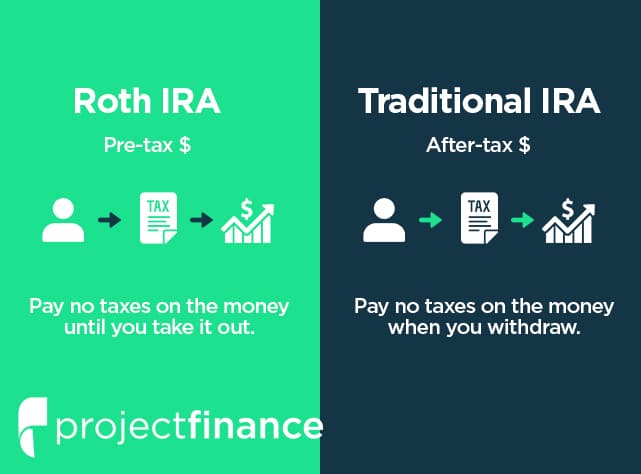

One concern is whether your 401(k) or IRA is a Roth account or a traditional account.

This decision has tax implications which can be relevant to calculating your paycheck in retirement.

With a traditional account, the money contributed to the account is tax-free. When you file your taxes annually, you count the money you put into your investments as a deduction, effectively reducing your overall income and allowing you to invest that money without paying taxes.

The government always gets its due. When you retire and start withdrawing money from a traditional IRA or 401(k), that money you pull is a paycheck and is taxed as income. You may have to pay income tax on that paycheck, calculated based on your income tax bracket with that new income in retirement. The amount of taxes you’ll have to pay depends on your retirement account type and varies from state to state.

Roth accounts work in the exact opposite way. With a Roth account, the money you contribute comes from your money after paying income taxes on your contributions and is not considered a deduction on your taxes when you earn that money and invest it. However, since you already paid taxes on that money, you don’t have to pay taxes on the disbursements you take when you retire.

There are ways to roll a traditional account into a Roth account, but they get into more complicated tax strategies that we’re not going to discuss today. If you have a traditional IRA or 401(k), you have to consider income taxes as an additional drain on your retirement paycheck, whereas if you have Roth accounts, you do not.

There’s one other vital factor to consider: the required minimum withdrawal from your accounts. You must take a distribution every year with a traditional retirement account once you hit age 72. With a Roth, you don’t need to take any money out of it. The only requirement is that when you die, your dependents or beneficiary of your inheritance must take the distribution.

How Payouts Work

Once you reach a certain age, you can begin taking distributions from your retirement accounts. Once you reach an even later age, you will be required to do so. As mentioned above, the earliest age you can take money out of a retirement account without penalty is 55 in specific circumstances, or 59 and a half for most people. Once you hit 72, you’ll be required to take payments.

Note: This can change. The age used to be 70 and a half, but it was changed in 2019 under the Setting Every Community Up for Retirement Enhancement (SECURE) Act. It’s possible that, if you’re not already at retirement age, that age can change by the time you reach it. All of these numbers are subject to change based on the whims of the government.

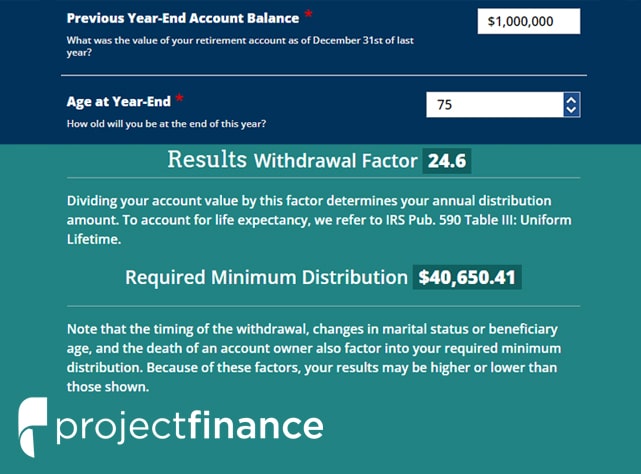

The amount you must take out of your account each year is called the RMD, or Required Minimum Distribution. You can, at any time, take more out of your accounts if you wish, though this is usually a bad idea if it’s not strictly necessary, so we’ll discuss it more in a moment.

To quote the IRS:

“The required minimum distribution for any year is the account balance as of the end of the immediately preceding calendar year divided by a distribution period from the IRS’s ‘Uniform Lifetime Table.'”

If you thought that table would be simple, here’s the IRS page for it. This page is over 38,000 words long, so settle in for some serious reading.

Luckily, you can use a simple calculator to estimate how much you will need to take out. The IRS provides one here. For example, if your retirement account has one million dollars in it when you turn 75, you must withdraw $40,650.41 from the account that year. These funds work out to be a monthly income from your account of $3,387.53, though it will be subject to whatever the income tax rate will be when you retire.

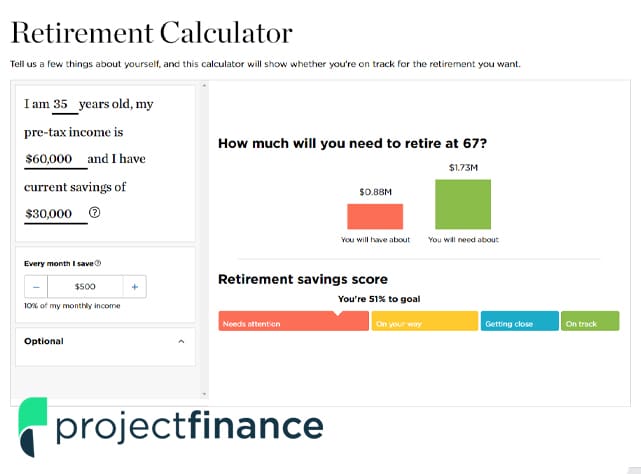

Assuming you have a flat one million in your retirement account is excellent for simple math calculations, but it’s unrealistic. To calculate how much you’ll have in your account at any given age, you will want to use a retirement calculator like this one. By filling in information about your contributions and your investment vehicles, you can estimate how much you’ll be getting paid in your retirement.

The truth is, the amount you earn in retirement will vary by too many factors to offer a simple answer.

You can also always withdraw more than the minimum to maintain a standard of living you’re comfortable with.

The Dangers of Drawing on Principal

Before we wrap up, one thing to mention is the difference between principal and interest in a retirement account.

The goal of every good retirement plan is to have enough money set aside to live entirely off the interest it provides or near enough as it makes no difference. A sufficiently large investment, placed in a series of investments with high rates of return, will earn enough money each year to cover the minimum disbursement plus any extra you want to withdraw.

If you tap into the principal of the investment, however, your overall total investment value declines.

That gives you less leeway for future payments, but it makes the amount you earn from interest even lower. If you don’t take a lower amount of distribution to compensate, you can enter a cycle of ever-decreasing funds until you, eventually, run out of money.

It’s impossible to say with certainty the threshold for this. You may notice that we’ve given very few numbers throughout this post.

That’s because everyone’s situation will be different. It will vary depending on factors like:

- Your life expectancy

- Where your money is invested and what the rate of return is

- Market performance, which is impossible to predict, especially decades into the future

- Chances to the tax and legal code that may make the situation better or worse for you

- Your cost of living and how much money you will need to maintain your standard of living

- Any medical conditions that will require ongoing treatment and the expenses associated with it

There are too many factors to consider. You can use calculators to estimate the minimum required distribution, but it’s an estimate. You can never know for sure until you’re actually at the moment of taking the money, at which point it’s too late to plan.

It’s always best to start investing as early as possible and invest as much as possible as soon as possible. The more you have in your investments, and the longer they have to grow, the less likely you will need to worry about it when you retire.