Last updated on February 11th, 2022 , 07:16 am

TAKEAWAYS

- Unlike stocks, all options will eventually expire

- The expiration date of an option marks the last day that it can be traded. After this date, both calls and puts will be null

- In-the-money options post-expiration will be exercised (long options) or assigned (short options) 100 shares of stock

- Out-of-the-money options post-expiration will expire worthless; no action is required

- The closer an option is to expiration, the greater the liquidity on that option will be

Options are unlike stocks in that every single one will eventually expire. This time is known as the “expiration date”.

Option Expiration Date Definition: In options trading, the “expiration date” is the last day on which an option holder can “exercise” their contract. After this date, the derivative is rendered null.

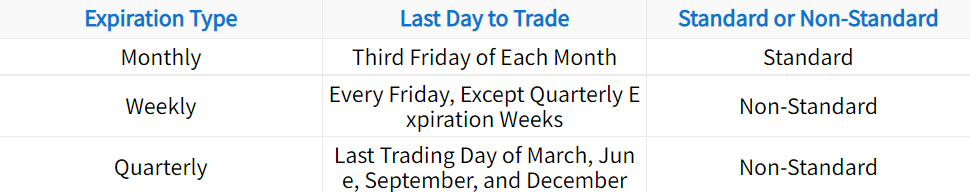

Back in the day, all options expired on the third Friday of every month. When I worked on a trade desk, this was always the busiest day of the month for us, particularly in very bearish or bullish markets.

Over the last 20 years, however, additional expiration dates were added to match exploding demand. The vast majority of options fall into one of the three below categories:

If you’re an options trader, knowing what happens to an option at the end of its life is of utmost importance.

If your option is out-of-the money at the moment it expires, you don’t have to do anything. If that option is in-the-money, actual will be required.

In this article, projectfinance will review option expiration, as well as the appropriate actions traders must take to avoid potentially significant monetary consequences.

When Do Options Expire?

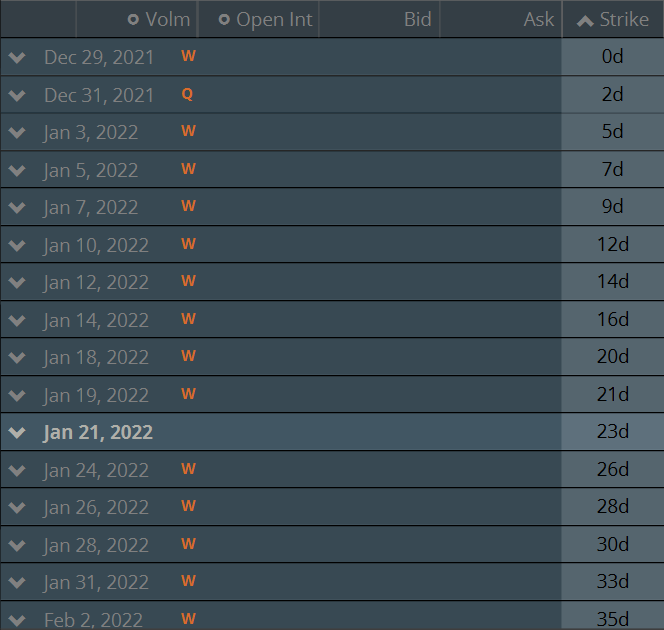

When looking at an options chain, you will see all the various expiration cycles that a particular security offers.

The below options chain on SPY, an S&P 500 tracking exchange-traded fund ETF, is taken from the tastyworks trading platform.

SPY Expiration Dates

We can see in the above image that some options expire today, and other options expire several weeks into the future.

If we were to continue scrolling down that chain, we would see options that don’t expire for years!

These are known as Long-Term Equity Anticipation Securities (LEAPS).

Most options expire at the market-close on their listed expiration date. Some ETFs and indices, however, continue trading until 15 minutes after the closing bell.

It is therefore important to monitor your positions thought the entirety of its last trading day.

Let’s next explore what actions need to be taken at expiration.

What to Do on Option Expiration?

At option expiration, a trader has one of three choices:

- Sell (or buy back) the option in the open market.

- If a long option is in-the-money at expiration, the option will be exercised automatically, resulting in 100 long shares (calls) or 100 short shares (puts) of stock.

- If an option is out-of-the-money on expiration, it will expire worthless; no action is required.

Let’s take a closer look at each of these now.

1. Close the Position in the Market

Call and put options can be closed at any time. Beginner traders often falsely believe a contract has to be held until its expiration date.

To close your option, simply create the exact opposite order that you set up to initiate the position. The vast majority of long option positions with value are exited before expiration to avoid being exercised and converted to stock.

2. Moneyness and Expiration

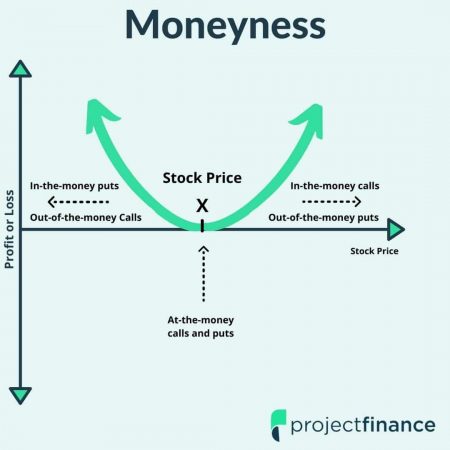

All options exist in one of three “moneyness” states.

1.) In-The-Money

If the strike price of a call option is below the stock price, the call option is in-the-money.

If the strike price of a long put is above the current stock price, that put option will be in-the-money.

2.) At-The-Money

At-the-money options have a strike price that is trading at or very near the current security price. However, just about all options will be in or out-of-the-money; this term is used as a generalization.

3.) Out-Of-The-Money

A call option is considered “out-of-the-money” when its strike price is above the current stock price.

A put option is considered “out-of-the-money” when its strike price is below the current stock price.

If you fail to trade out of an option that is “in-the-money” at expiration, your contract will either be automatically exercised by your broker (long options) or assigned (short options).

This can create a lot of unnecessary risks for traders. Being required to either purchase or sell 100 shares of stock requires a lot more capital than holding a call or put option. If you don’t have the funds to hold this equity, your broker will place you in a margin call. If this call is not met, your account will be liquidated!

The smart thing to do is close out of all in-the-money or at-the-money positions before the closing bell rings on the expiration day. When a stock is hovering near the strike price at expiration, this is known as “pin-risk“. Smart traders close these options well before the bell.

3. Worthless Options at Expiration

Options that are out-of-the-money on expiration will expire worthless.

For long options, this means a total loss. Short options, however, will see a maximum profit.

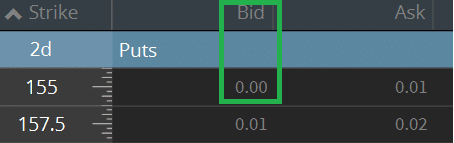

When an option is worthless, that means it is zero bid. This means nobody is willing to buy that option. You can’t even sell these options for a penny.

AAPL Put: Zero Bid

So what do you do? Nothing. The position will simply disappear from your account. But at least you get a tax write-off!

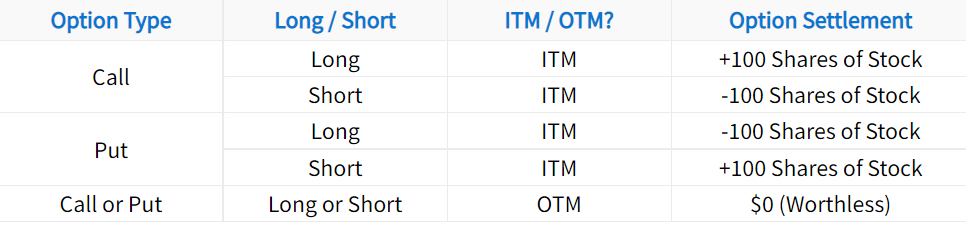

Option Expiration and Assignment / Exercise

If you do indeed neglect to trade out of a long or short in-the-money option before expiration, you will be assigned/exercised.

The below table shows how many shares of stock will appear in your account the following trading day for various option types.

Depending on the security you are trading, 100 shares can be A LOT of money. And that’s only for a one lot!

Currently, 100 shares of Amazon (AMZN) would cost you $338,300.

At the moment, an at-the-money call expiring in a few days on AMZN is trading at $14. Taking into account the multiplier effect of option leverage, the total risk here is only $1,400.

That’s a pretty substantial difference in maximum loss potential!

Option Expiration and Liquidity

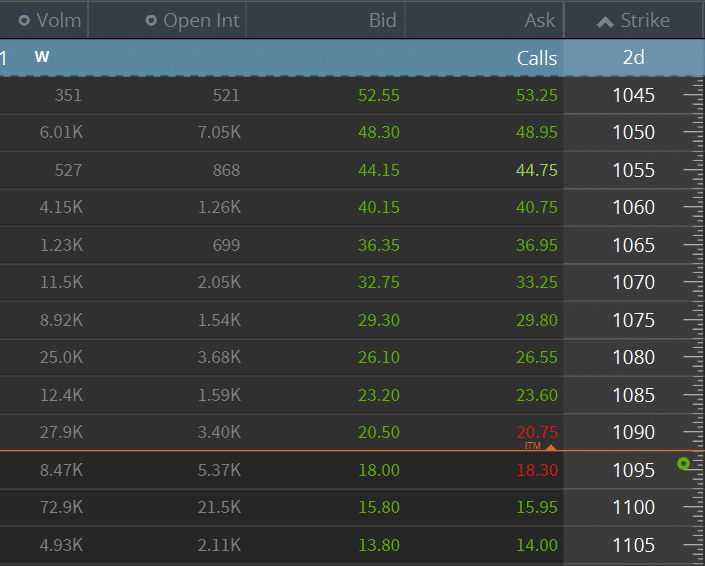

As a rule, liquidity increases for an option cycle as its expiration nears. An option on Tesla expiring tomorrow is going to have much tighter markets when compared to an option of the same strike price expiring one year away.

There are three metrics to measure liquidity:

- Volume (number of contracts traded on a given day)

- Open Interest (total options outstanding)

- Spread (difference between the bid and ask)

Now let’s see these metrics in action.

The below options chain for TSLA (taken from the tastyworks trading platform) shows the markets for options expiring on this stock in 2 days.

TSLA: Front Month Options

Notice how tight the markets are here? Additionally, both the open interest and volumes are very high. This gives me confidence in trading these options.

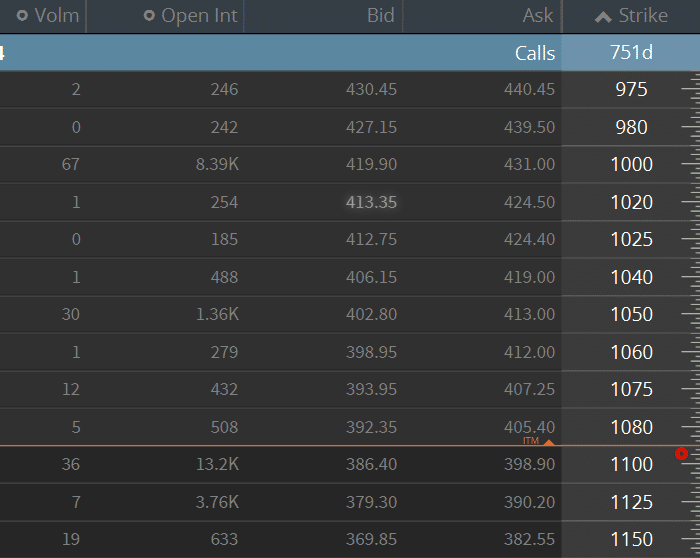

Now let’s look at some TSLA options expiring in 2024, two years away from today’s Jan. 1st, 2021 date.

Look at how wide the markets are in these options, in addition to very low volume and open interest. Unless you plan on holding a LEAP for a long time, stay away!

TSLA: 2024 LEAP Options

Final Word

Understanding exactly what happens on an options expiration date is very important. If you’re new to options trading, please check out our Options Trading for Beginners article below.

In this business, it’s far better to be over-prepared than under-prepared.

If you’d like the 2022 expiration calendar from CBOE, find it here.