Last updated on February 10th, 2022 , 01:16 pm

The long iron butterfly options strategy consists of simultaneously buying a call option and a put option at the same strike price (a long straddle), and selling an out-of-the-money call and out-of-the-money put (a short strangle).

All options must be in the same expiration cycle.

A long iron butterfly position can be conceptualized in two ways:

1) Simultaneously buying a straddle and selling a strangle (as described above).

2) Simultaneously buying a call spread and put spread with the purchased options having the same strike price.

TAKEAWAYS

- The “long butterfly” is simply the combination of a long straddle and a short strangle.

- This position is directional; the trader is hoping for either large upside or downside moves.

- The strategy profits when the underyling breaches the “wings” by expiration.

- Max loss is the net debit paid; max profit is (Strike Width of Widest Spread – Debit Paid).

Long Iron Butterfly Strategy Characteristics

The long iron fly strategy is very similar to a long straddle, except a long iron fly has less risk because the options that are sold reduce the entry cost of the position.

Let’s go over the strategy’s general characteristics:

➥Max Profit Potential: (Strike Width of Widest Spread – Debit Paid) x 100

➥Max Loss Potential: Debit Paid x 100

➥Expiration Breakeven:

Upper Breakeven = Long Strike + Debit Paid

Lower Breakeven = Long Strike – Debit Paid

➥Estimated Probability of Profit: Less than 50% because the stock price must move significantly in either direction and/or implied volatility must increase for profits to occur.

To explain these characteristics in more detail, let’s look at a basic example:

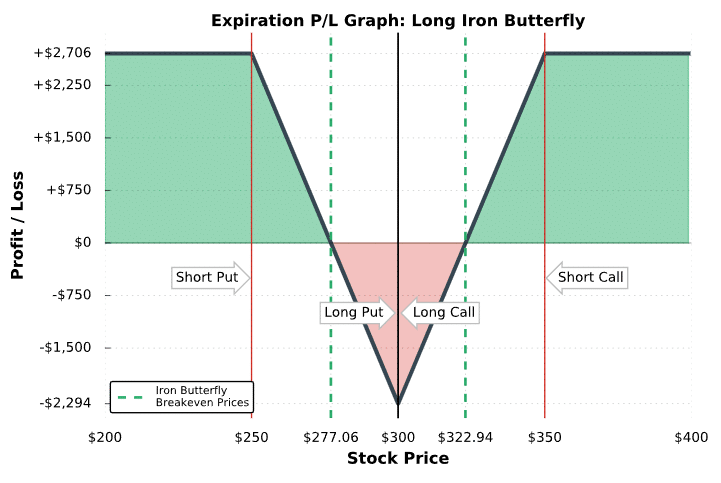

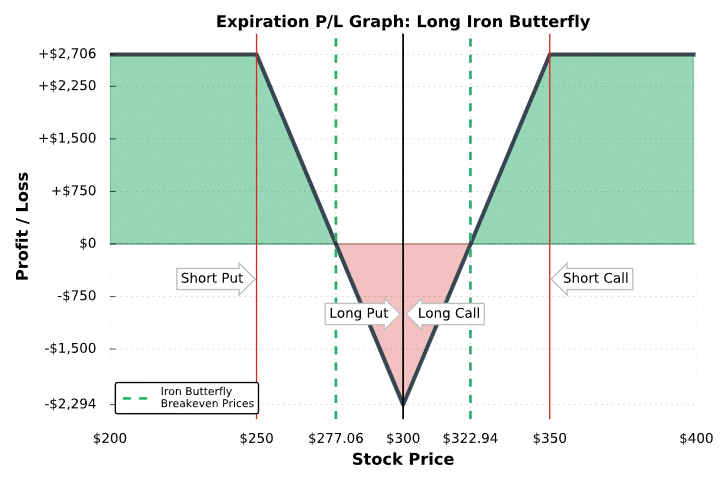

Long Iron Butterfly P/L Potential at Expiration

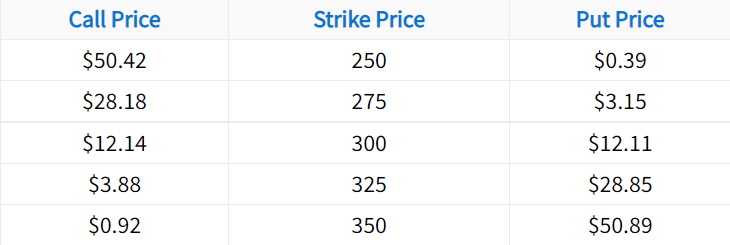

In the following example, we’ll construct a long iron butterfly from the following option chain:

In this case, we’ll buy the 300 call and 300 put for a total debit of $24.25, and we’ll sell the 250 put and 350 call for a total credit of $1.31. Let’s also assume the stock price is trading for $300 when we put this trade on:

Initial Stock Price: $300

Short Strikes: $250 short put, $350 short call

Long Strikes: $300 long put, $300 long call

Credit Received for Short Options: $1.31

Debit Paid for Long Options: $24.25

Total Debit Paid: $24.25 Debit – $1.31 Credit = $22.94

The following visual describes the position’s potential profits and losses at expiration:

Long Iron Butterfly at Expiration

As we can see here, a long butterfly’s profit potential lies well outside of the long strike price. In this example, the stock price must move ±$22.94 just for the position to break even and ±$50 to reach maximum profit at expiration.

As a result, the position has a low probability of profit, which is also supported by the fact that the profit potential is greater than the loss potential.

The table below explains the performance of this position based on various scenarios at expiration:

Stock Price Below the Short Put Strike ($250) -OR- Above the Short Call Strike ($350):

One of the spreads of the long iron butterfly expires fully in-the-money. With spreads strikes that are $50 wide, the iron fly would be worth $50. Due to an initial purchase price of $22.94, the long iron butterfly trader realizes the maximum profit of $2,706: ($50 iron fly expiration value – $22.94 purchase price) x 100 = +$2,706.

Stock Price Between the Short Put Strike ($250) and the Lower Breakeven Price ($277.06):

The long 300 put is worth more than the $22.94 the iron fly was purchased for, and therefore the iron fly position is profitable at expiration. All other options expire worthless.

Stock Price Between the Lower Breakeven Price ($277.06) and the Long Put Strike ($300):

The long 300 put has intrinsic value, but not more than the $22.94 that was paid for the iron butterfly. Because of this, the position is not profitable (or breaks even if the stock price is exactly $277.06). All other options expire worthless.

Stock Price At the Long Strike ($300):

All of the iron butterfly’s options expire worthless, resulting in the maximum loss of $2,294. This scenario is extremely unlikely because it only occurs at one specific price.

Stock Price Between the Long Call Strike ($300) and the Upper Breakeven Price ($322.94):

The long 300 call has intrinsic value, but not more than the $22.94 the iron fly was purchased for. Because of this, the position is not profitable (or breaks even if the stock price is exactly $322.94). All other options expire worthless.

Stock Price Between the Upper Breakeven Price ($322.94) and the Short Call Strike ($350):

The long 300 call has more intrinsic value than the $22.94 paid for the iron fly. Because of this, the position is profitable.

So, you know how the outcomes at expiration when buying iron flies, but what about before expiration? Understanding how profits and losses occur can be explained by the position’s option Greeks (if you want to improve your understanding of the risks your option positions carry, read our ultimate guides on the option Greeks).

You’ve learned the general characteristics of the long iron fly strategy. Next, we’re going to visualize the performance of the strategy over time by looking at some trade examples.

Long Iron Butterfly Trade Examples

In this section, we’re going to visualize the performance of some long iron fly positions that recently traded. Note that we don’t specify the underlying, since the same concepts apply to long iron flies on any stock.

Additionally, each example demonstrates the performance of a single iron fly position. When trading more contracts, the profits and losses in each case will be magnified by the number of iron flies traded.

Let’s do it!

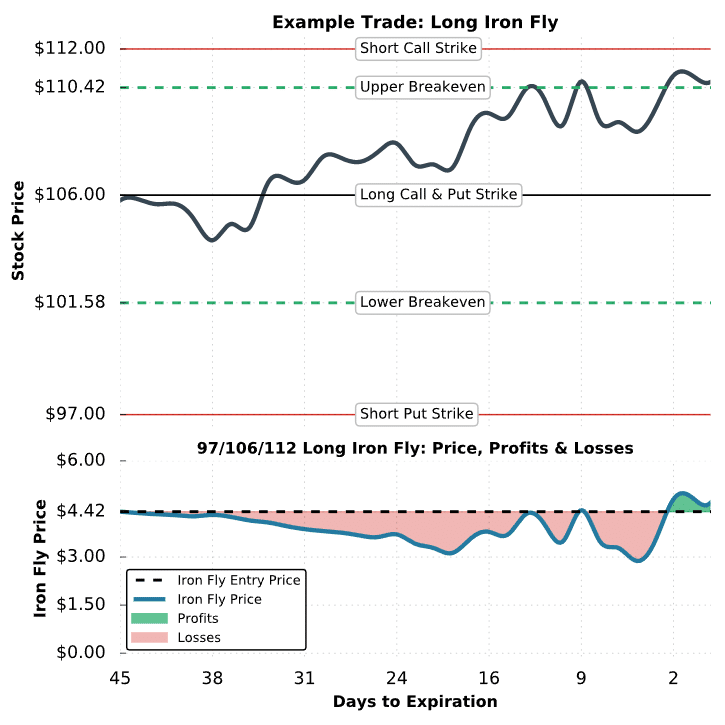

Trade Example #1: Breaking Even

The first example we’ll look at is a scenario where a trader buys an iron fly, but the stock price is near one of the breakeven prices at expiration.

Initial Stock Price: $105.79

Strikes and Expiration: Long 106 Call and Put; Short 97 Put and 112 Call; All options expiring in 45 days

Premium Paid for Long Options: $3.04 for the 106 put + $2.50 for the 106 call = $5.54 in premium paid

Premium Collected From Short Options: $0.77 for the 97 put + $0.35 for the 112 call = $1.12 in premium collected

Net Debit: $5.54 in premium paid – $1.12 in premium collected = $4.42 net debit

Breakeven Prices: $101.58 and $110.42 ($106 – $4.42 and $106 + $4.42)

Maximum Profit Potential (Upside): ($6-wide call spread – $4.42 debit) x 100 = $158

Maximum Profit Potential (Downside): ($9-wide put spread – $4.42 debit) x 100 = $458

Maximum Loss Potential: $4.42 debit x 100 = $442

As mentioned earlier, the maximum profit potential of a long iron butterfly depends on the wider spread. In this example, the long call spread is $6 wide, and the long put spread is $9 wide. Because of this, the maximum profit potential of this iron fly occurs when the stock price collapses through the long put spread. More specifically, this trade has $158 in profit potential on the upside and $458 in potential profits on the downside, resulting in a bearish bias.

Let’s see what happens!

Iron Fly #1 Trade Results

As you can see, the long iron fly position does not perform well because the stock price does not rise fast enough over the period. At expiration, the stock price is just above the upper breakeven price of the position, resulting in minimal profits.

At expiration, the trader would end up with +100 shares of stock because the long 106 call is in-the-money. If the trader wanted to avoid a stock position, they would have to sell the 106 call before expiration.

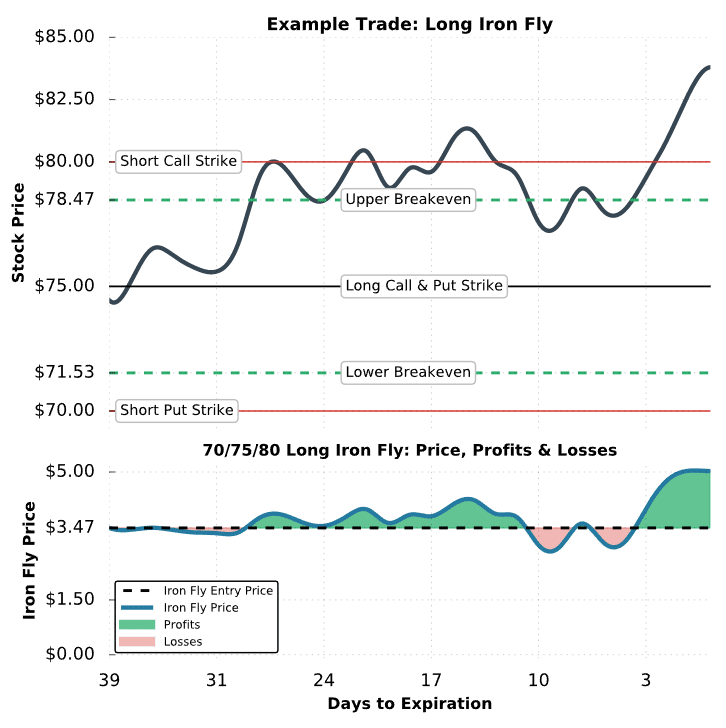

Trade Example #2: Max Profit Iron Fly

In the following example, we’ll investigate a situation where the stock price rises continuosly and is above the long call strike price at expiration.

Here are the specifics:

Initial Stock Price: $74.44

Strikes and Expiration: Long 75 Put and Call; Short 70 Put and 80 Call; All options expiring in 39 days

Premium Paid for Long Options: $2.80 for the 75 put + $2.29 for the 75 call = $5.09 in premium paid

Premium Collected for Short Options: $0.95 for the 70 put + $0.67 for the 80 call = $1.62 in premium collected

Net Debit: $5.09 in premium paid – $1.62 in premium collected = $3.47 net debit

Breakeven Prices: $71.53 and $78.47 ($75 – $3.47 and $75 + $3.47)

Maximum Profit Potential: ($5-wide spreads – $3.47 net debit) x 100 = $153

Maximum Loss Potential: $3.47 net debit x 100 = $347

In this example, both the long call spread and long put spread are $5 wide, so the profit potential is equal on both sides of the trade. Let’s take a look at what happens!

Iron Fly #2 Trade Results

In this example, the long iron fly performs well because the stock price rises through the long call spread in a timely manner. At expiration, the long 75/80 call spread is entirely in-the-money, resulting in an expiration value of $5. The long put spread expires worthless, but it doesn’t matter. With an initial purchase price of $3.47, the $5 value of the iron fly’s call spread at expiration results in the maximum profit of $153: ($5 iron fly expiration value – $3.47 purchase price) x 100 = +$153.

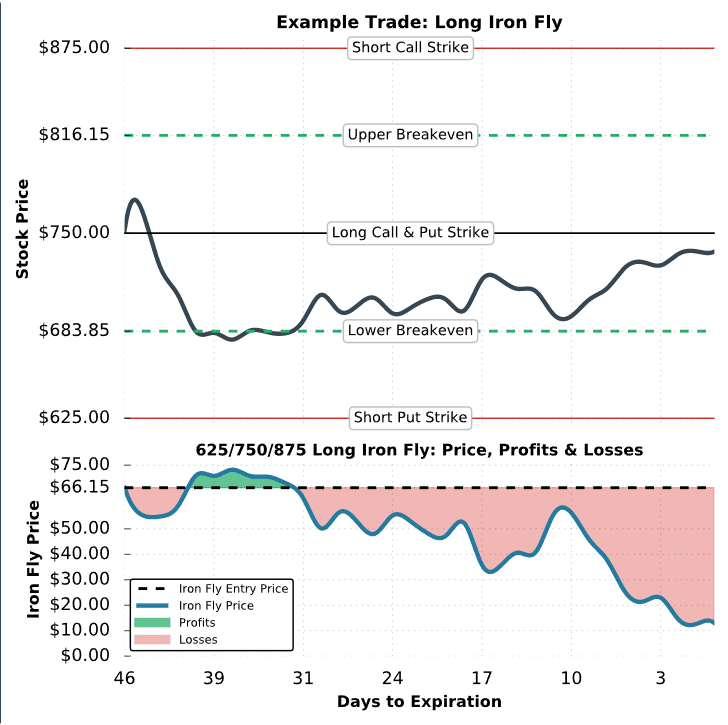

Trade Example #3: Significant Loss

In the final example, we’ll examine the worst-case scenario for a long iron fly, which is when the stock price expires near the long strike. Here’s the setup:

Initial Stock Price: $752

Strikes and Expiration: Long 750 put and call; Short 625 Put and 875 Call; All options expiring in 46 days

Premium Paid for Long Options: $36.25 for the 750 put + $37.30 for the 750 call = $73.55 in premium paid

Premium Collected for Short Options: $4.50 for the 625 put + $2.90 for the 875 call = $7.40 in premium collected

Net Debit: $73.55 in premium paid – $7.40 in premium collected = $66.15 net debit

Breakeven Prices: $683.85 and $816.15 ($750 – $66.15 and $750 + $66.15)

Maximum Profit Potential: ($125-wide spreads – $66.15 net debit) x 100 = $5,885

Maximum Loss Potential: $66.15 debit x 100 = $6,615

In this example, both spreads have equal strike widths, so the profit potential is the same on both sides. Let’s see what happens!

Iron Fly #3 Trade Results

As we can see here, the iron fly in this example did not do well because the stock price remained between the breakeven points as time passed. At expiration, the stock price was trading for $737.60, which means the long 750 put was only worth $12.40 while all of the other options expired worthless. Consequently, the iron fly’s expiration value consists of the long 750 put’s value of $12.40. With an initial purchase price of $66.15, the iron fly buyer realizes a loss of $5,375: ($12.40 iron fly expiration value – $66.15 purchase price) x 100 = -$5,375.

Since the long put is in-the-money at expiration, the trader would end up with -100 shares of stock if the put was held through expiration. To avoid a share assignment, the long 750 put would need to be sold before expiration.

Final Word

- The long iron butterfly is essentially the combining of a long straddle and a short strangle.

- Additionally, this strategy can be thought of as buying a call spread and put spread with the purchased options having the same strike price.

- This strategy profits from either upside or downside movement; it will lose money in neutral markets.

- Max loss is the net debit paid; max profit is (Strike Width of Widest Spread – Debit Paid) x 100