Last updated on March 16th, 2022 , 01:23 pm

Jump To

The VIX term structure (sometimes called the “VIX futures curve”) is the relationship between the prices of short-term and long-term VIX futures contracts.

The shape of the VIX futures prices when plotted (upwards, downwards, or flat) indicates whether the market is expecting more or less market volatility in shorter-term or longer-term periods.

Additionally, the shape of the VIX futures curve has implications for the performance of volatility-related products.

The shape of the VIX term structure will fall into one of three categories:

➼ Contango (Upward Sloping): Longer-term VIX futures contracts are more expensive than shorter-term contracts. Contango tends to occur in quiet market periods and is also the most common shape of the VIX futures curve.

➼ Backwardation (Downward Sloping): Longer-term VIX futures contracts are less expensive than shorter-term contracts. Backwardation tends to occur during periods of extreme market volatility.

➼ Flat: Longer-term VIX futures contracts are about the same price as shorter-term contracts.

To understand each of these curves, let’s look at an example of each scenario.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Contango: Upward-Sloping VIX Futures Curve

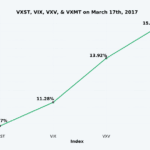

The following chart demonstrates what an upward-sloping (contango) VIX term structure looks like:

Data gathered from the Cboe’s Historical VIX Futures Database

In this example, the VIX Index itself is just above 13 while the August VIX future (approximately 120 days away from settlement) is six points higher at 19. The upward sloping nature of the curve suggests that market participants believe volatility will increase from 13 in the future, which makes sense because the long-term average VIX level is around 20.

In the event that the VIX Index (prices of S&P 500 options) remains around 13, the price of each of these VIX futures contracts will lose value as time passes.

Consequently, any long VIX futures traders will lose money, as well as traders who have on bullish trades in related volatility products (bullish VIX option trades, VXX, UVXY, etc.). On the other hand, traders with short VIX futures contracts or bearish positions in volatility products will are likely to profit (bearish VIX option trades, long XIV or SVXY, etc.).

Backwardation: Downward-Sloping VIX Futures Curve

The following chart demonstrates what a downward-sloping (backwardated) VIX term structure looks like:

Data gathered from the Cboe’s Historical VIX Futures Database

In this case, the VIX Index is above 27. However, the June VIX futures contract (roughly 150 days until settlement) is four points lower at 23. The downward-sloping nature of the curve suggests that market participants believe volatility will decrease from 27 in the future, which makes sense because the long-term average VIX level is around 20.

In the event that the VIX Index (prices of S&P 500 options) remains around 27, the price of each of these VIX futures contracts will “slide up the curve” as time passes. Consequently, any short VIX futures traders will lose money, as well as traders who have on bearish trades in related volatility products (VIX options, VXX, UVXY, etc.). However, any traders who are long VIX futures or have bullish positions in volatility products are likely to make money.d

Flat VIX Futures Curve

In the final example, we’ll look at a relatively flat VIX term structure from early 2016:

Data gathered from the Cboe’s Historical VIX Futures Database

In this case, the VIX index is at 20 while the five subsequent VIX futures contracts are near 21. While not exactly equal, this VIX futures curve can be described as flat. When the VIX term structure is flat, long and short volatility trades don’t stand to gain or lose too much money if the VIX remains at its current level of 20. However, this could change quickly if the shape of the curve transitions into steep contango or backwardation.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.