Last updated on February 10th, 2022 , 07:28 pm

One common criticism of options trading is that the strategies are extremely risky.

While some strategies carry massive loss potential, there are two conservative option strategies that are always less risky than buying 100 shares of stock.

Jump To

Option Strategies Less Risky Than Buying Stock

The two conservative option strategies that are less risky than buying 100 shares of stock are:

1. Covered Calls

2. Cash-Secured Puts

Let’s walk through each of these simple strategies.

Simple Covered Call Explanation

While we won’t get into the specific details of each strategy, we’ll cover a simple breakdown of each.

The covered call strategy consists of selling a call option against 100 shares of stock that you own.

By selling the call option, you collect “option premium,” which you keep if the stock price is below the call’s strike price at expiration.

For example, if you buy 100 shares of stock for $100 per share and sell a 110 call against it for $5.00, you collect $500 in option premium (since an option’s contract multiplier is $100, and $5.00 x $100 = $500).

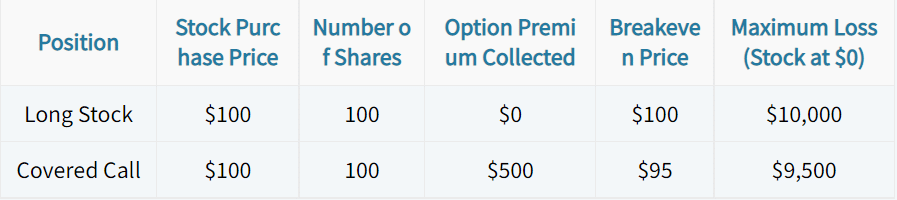

What if the company goes out of business and the stock price goes to $0? Let’s compare the long stock and covered call strategies side-by-side:

If the stock price goes to $0, the loss on a long stock position of 100 shares purchased at $100 per share would be $10,000: $100 Loss Per Share x 100 Shares = -$10,000.

However, if the stock price goes to $0, the 110 call option would also expire worthless, which means the covered call trader would have a $500 profit on the call they sold (since it was sold for $500 in premium and is now worth $0).

As a result, their net loss is $9,500: $100 Loss Per Share x 100 Shares + $500 Profit on Call = -$9,500.

In fact, at any price below $110 at the expiration date of the call option, the covered call position will outperform the long stock position by the amount of the call premium ($500 in this case).

Covered Calls vs. Long Stock

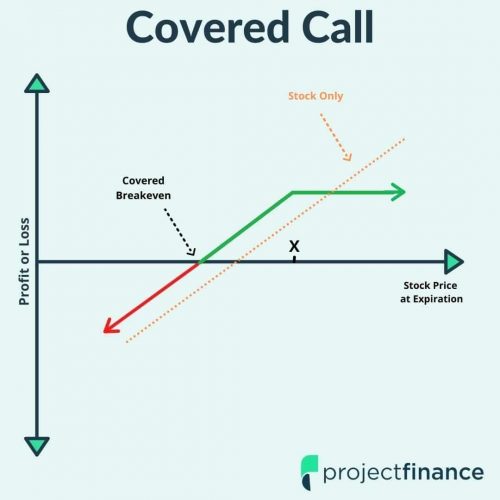

By selling a call option against 100 shares of stock, the premium collected reduces the maximum loss potential of the position.

At any price below the call’s strike price at expiration, the covered call position will outperform a long stock position by the amount of the call premium collected.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Simple Cash-Secured Put Explanation

The second conservative option strategy less risky than buying stock is the cash-secured put.

A cash-secured put refers to a short put option (a put is sold) that is fully secured by cash. For example, if you sell a put option with a strike price of $50, the maximum loss on that put option is $5,000, which means you’d need to have $5,000 in available option buying power to sell that put.

However, if you collect $2.50 ($250 in option premium) for selling that put, then you’d only need $4,750 in available option buying power to sell that put.

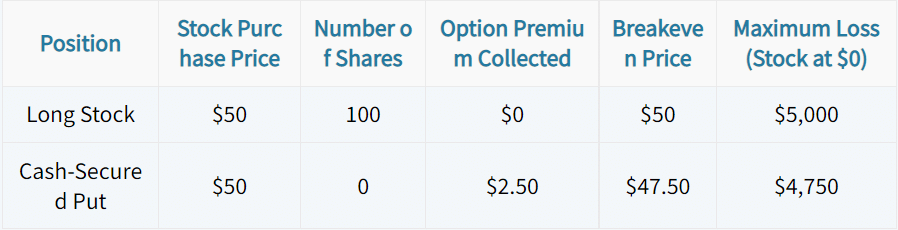

Let’s compare the long stock position to the cash-secured put position:

When comparing purchasing 100 shares of stock for $50 per share to selling a 50 put for $2.50, the cash-secured put position has less risk.

If the stock price goes to $0, the loss on the long stock position is $5,000: $50 Loss Per Share x 100 Shares = -$5,000.

At the same time, a put option with a strike price of $50 would be worth $50 if the stock fell to $0. However, since the put was sold for $2.50, the loss would only be $4,750: $47.50 Loss on the Put x $100 Option Contract Multiplier = -$4,750.

Cash-Secured Puts vs. Long Stock

By selling a cash-secured put option, the premium collected reduces the maximum loss potential on the position (compared to buying 100 shares of stock at that put’s strike price).

The Downsides of Covered Calls & Cash-Secured Puts

Unfortunately, it’s not all great news in regards to covered calls and cash-secured puts when compared to buying 100 shares of stock.

Unlike long stock positions, covered calls and cash-secured puts have limited profit potential, while owning shares of stock is an unlimited profit potential position (theoretically).

However, if the stock price does not increase substantially, covered calls and cash-secured put positions will outperform long stock positions, as they can profit when the stock price doesn’t increase, or even decreases slightly.

Concept Checks

Here are the essential points to remember about these two conservative option strategies:

➥ Covered calls and cash-secured puts both carry less loss potential compared to simply buying 100 shares of stock.

➥ However, both of these option strategies have limited profit potential, which means they will underperform just owning 100 shares of stock if the stock price surges.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.