Last updated on February 28th, 2022 , 02:36 pm

The calendar spread is an options strategy that consists of buying and selling two options of the same type and strike price, but different expiration cycles.

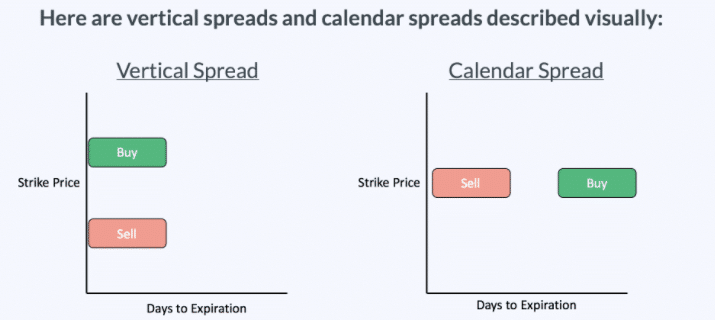

This is different from vertical spreads, which consist of buying and selling an option of the same type and expiration, but with different strike prices.

Here’s a visual representation of how vertical spreads and calendar spreads differ:

Please Note: The Buy/Sell positions in the above graphic could be switched to create a different vertical or calendar spreads. What’s important for now is that you understand vertical spreads are constructed with two strike prices (same expiration) while calendar spreads are constructed with two expiration cycles (same strike price).

Because calendar spreads are constructed with the same options in different expiration cycles, they are sometimes referred to as “time spreads” or “horizontal spreads.”

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Jump To

What is a Calendar Spread?

A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike price, but different expirations. If the trader sells a near-term option and buys a longer-term option, the position is a long calendar spread. If the trader buys a near-term option and sells a longer-term option, the position is a short calendar spread.

The Long Calendar Spread

In this article, we’ll focus on the long calendar spread, which consists of selling a near-term option and buying a longer-term option of the same type and strike price.

Here’s a hypothetical long calendar spread trade constructed with call options on a $100 stock:

Sell the January 100 Call for $3.00 (30 Days to Expiration)

Buy the February 100 Call for $5.00 (60 Days to Expiration)

The trader will pay more for the long-term option than they collect for selling the near-term option, which means the trader will have to pay to enter the spread. In the above example, the trader would pay $2.00 for the call calendar:

$5.00 Paid – $3.00 Collected = $2.00 Net Payment

Let’s walk through a more specific example using real historical option data.

Long Call Calendar Example

Here are the details of the long call calendar spread we’ll analyze:

Stock Price at Entry: $171.98

Long Calendar Components

➜ Short 170 Call (39 Days to Expiration)

➜ Long 170 Call (74 Days to Expiration)

Calendar Spread Entry Price

➜ Sold the 39-Day Call for $5.50

➜ Bought the 74-Day Call for $7.75

➜ $7.75 Paid – $5.50 Collected = $2.25 Paid

When trading long calendar spreads, you want the stock price to trade near the strike price of the spread as time passes. If it does, the near-term short option will decay at a faster rate than the longer-term long option, which will result in profits on the position.

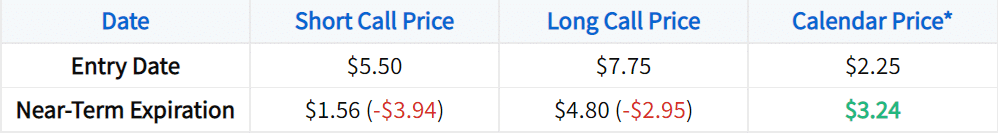

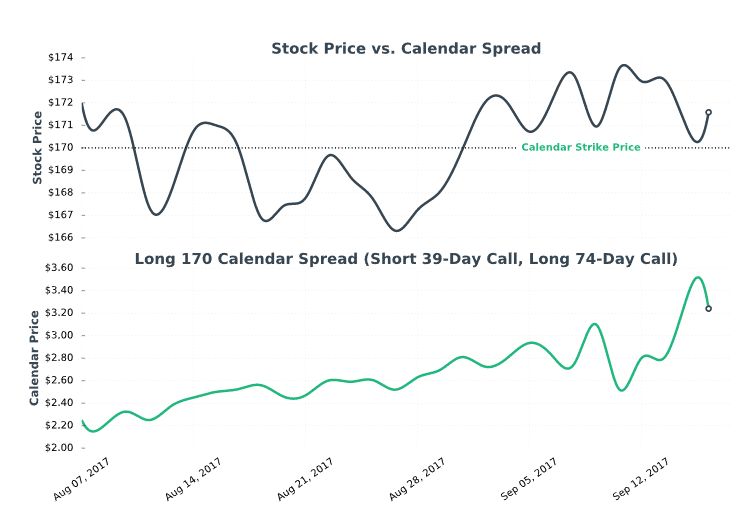

Let’s look at what happened to this calendar spread as time passed and the stock price changed:

As we can see, the stock price stayed close to the calendar’s strike price of $170 as time passed, and the calendar spread increased in value, but why?

Calendar Spread Components vs. Stock Price

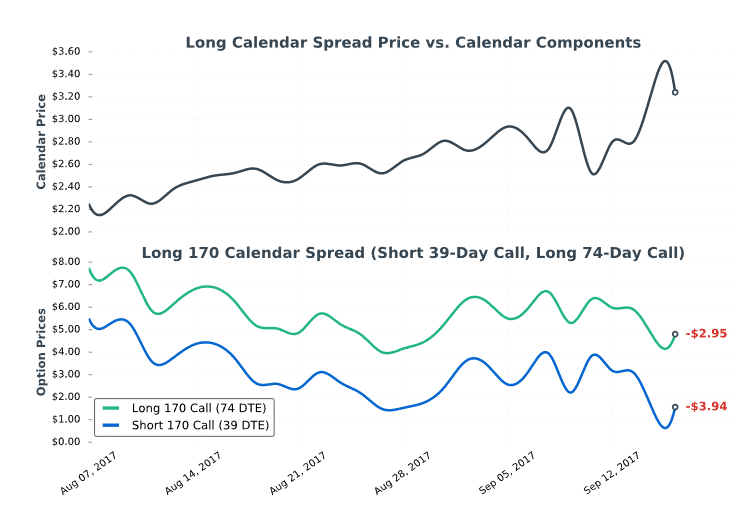

Let’s compare the spread’s price changes to the prices of each call option in the calendar spread:

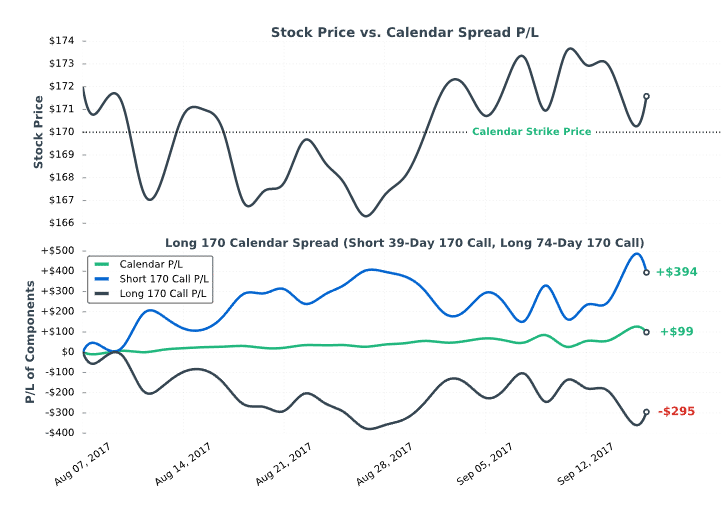

When we dig a little deeper, we find that the calendar spread’s price increased because the short option lost more value compared to the long option:

Since the short call experienced a larger price decrease than the long call, the long call trader experiences profits. More specifically, the short call lost $0.99 more than the long call over the period, which translates to a $0.99 profit ($99 in actual P/L terms per calendar spread) for the trader:

Summary

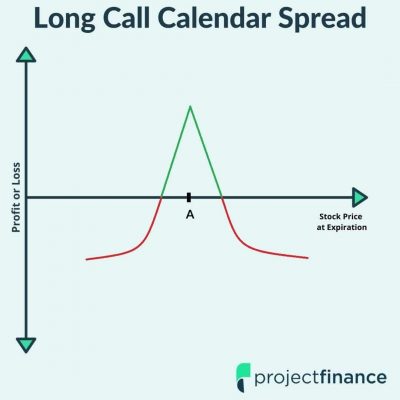

When a trader buys a calendar spread (sell a near-term option, buy a longer-term option of the same type and strike price), they are anticipating the stock price to trade near the strike price as time passes.

If the stock price hovers around the long calendar’s strike price over time, the short option will decay faster than the long option (all else equal), which will lead to an increase in the calendar’s price. This generates profits for the long calendar spread trader.

If the stock price moves significantly in either direction away from the calendar’s strike price, the worst loss that can occur is the price the trader paid for the calendar spread.

Long Calendar Spreads Are NOT Long Volatility Trades

Long calendar spreads are often said to be long volatility trades because the vega of the long option is greater than the vega of the short option, resulting in a positive vega position.

However, my opinion is that long calendar spreads are not long volatility trades.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.