Last updated on April 5th, 2022 , 12:49 pm

The collar spread options strategy consists of simultaneously selling a call option and buying a put option against 100 shares of long stock.

Buying a put option against long shares eliminates the risk of the shares below the put strike, while selling a call option limits the profit potential of shares above the call strike.

By selling a call option, the cost of buying a put option is reduced. When structured properly, the short call can cover the entire cost of buying the put option, resulting in a limited-risk stock position without paying for the insurance.

While the collar spread can be entered for a credit, the true “cost” of implementing the strategy is the elimination of profit potential when the stock price increases significantly. Because of this, some investors prefer to enter into collars only after their long shares have risen significantly.

Let’s first go over the collar’s general characteristics.

Jump To

TAKEAWAYS

- A “collar” consists of buying 100 shares, buying 1 put option and selling 1 call option.

- The options in this strategy are all out-of-the-money.

- A “cashless” collar exists when the premium sold for the call pays for the long put.

- Collars are a great way to hedge long stock, particularly around earnings.

Collar Options Strategy Characteristics

➥ Max Profit Potential:

Collar Credit: [(Short Call Strike – Share Purchase Price) + Credit] x 100

Collar Debit: [(Short Call Strike – Share Purchase Price) – Debit] x 100

➥ Max Loss Potential:

Collar Credit: [(Share Purchase Price – Long Put Strike) – Credit] x 100

Collar Debit: [(Share Purchase Price – Long Put Strike) + Debit] x 100

➥ Expiration Breakeven:

Collar Credit: Share Purchase Price – Credit

Collar Debit: Share Purchase Price + Debit

To demonstrate how a collar is used in practice, we’ll need to run through two examples.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Collar Expiration P/L Example #1

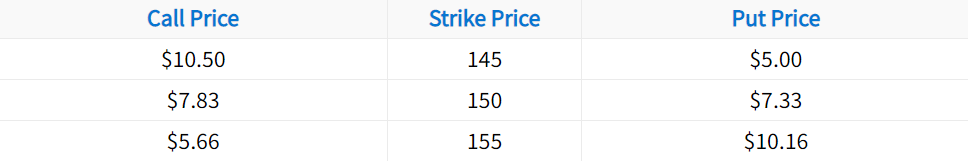

In the first example, we’ll construct a collar from the following option chain:

In this case, we’ll sell the 155 call and buy the 145 put. Let’s assume 100 shares of stock were purchased for $150 per share.

Initial Share Purchase Price: $150

Options Used: Long 145 Put for $5.00; Short 155 Call for $5.66

Credit Received: $5.66 received – $5.00 paid = $0.66

Breakeven Price: $150 share purchase price – $0.66 collar credit = $149.34

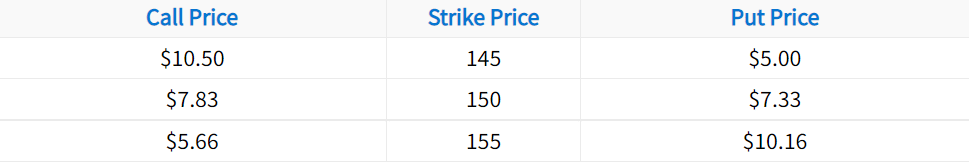

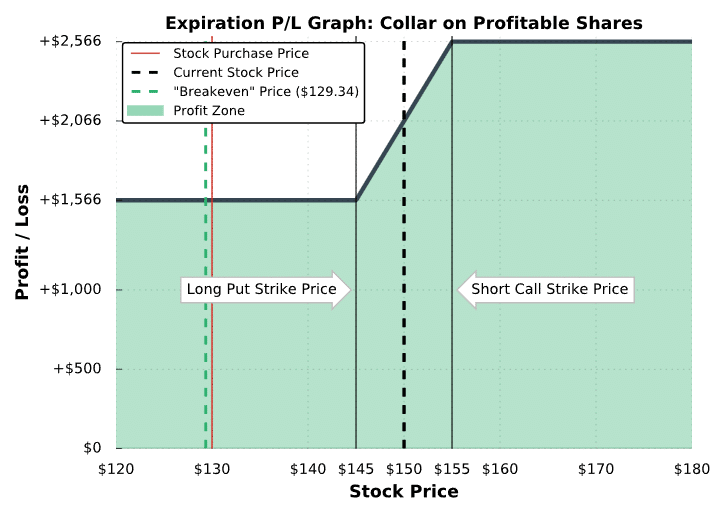

The following visual describes the position’s potential profits and losses at expiration:

Collar Trade Outcomes

As we can see here, the small credit from the collar results in a breakeven price lower than the purchase price of the shares.

The scenarios below explains the performance of this collar position based on various stock prices at expiration:

➥Stock Price Below the Long Put Strike ($145)

The long 145 put locks in the losses of the long shares, resulting in the maximum loss potential for the position.

➥Stock Price at the Breakeven Price ($149.34)

The short call and long put expire worthless, resulting in a profit of $66 based on the $0.66 credit. However, the long shares have losses equal to $66, so the position breaks even overall.

➥Stock Price at the Share Purchase Price ($150)

The long shares have no profits or losses, but the collar expires worthless and the trader keeps the $0.66 credit. The overall profit in this case is $66.

➥Stock Price Above the Short Call Strike ($155)

The profit potential of the long shares is capped because the short call represents an obligation to sell shares at the strike price. At any price higher than the short call strike price, the investor realizes maximum profit.

Collar Expiration P/L Example #2

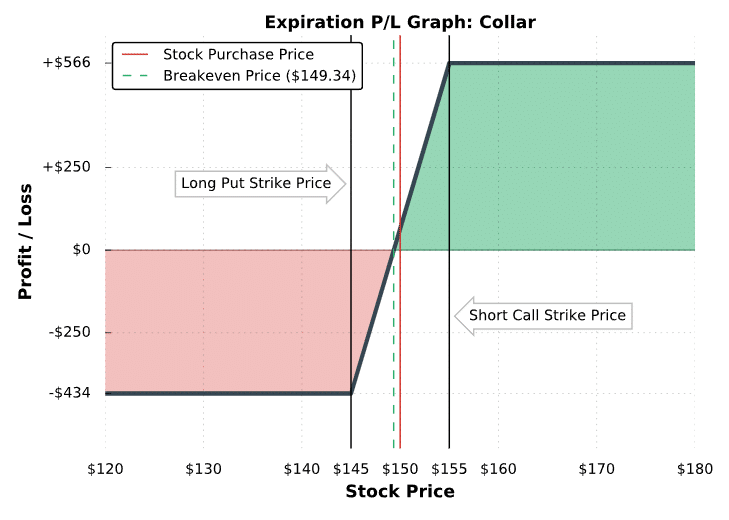

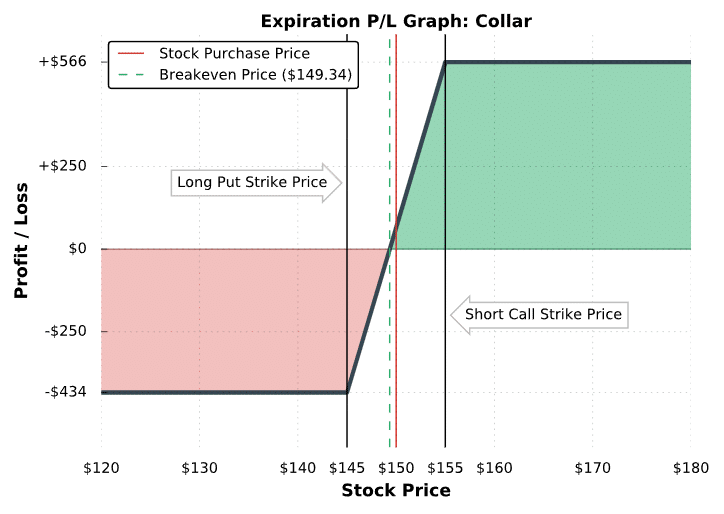

In the next example, we’ll construct a collar from the same option chain as before:

Just like before, we’ll sell the 155 call and buy the 145 put. However, let’s assume that 100 shares of stock were purchased for $130 per share a few months ago.

Initial Share Purchase Price: $130

Options Used: Long 145 Put for $5.00; Short 155 Call for $5.66

Credit Received: $5.66 received – $5.00 paid = $0.66

“Breakeven” Price: $130 share purchase price – $0.66 collar credit = $129.34

As you may notice, we find ourselves in an interesting but favorable situation. The “breakeven” price on this trade is $129.34 because 100 shares of stock were purchased for $130 and $0.66 was just collected from selling the call and buying the put. However, owning the 145 put removes any risk in the long shares below $145. Because of this, there is no loss potential in this position.

The following visual describes the position’s potential profits at expiration:

Collar Trade Outcomes

As we can see here, there is no loss potential for this position because the collar was entered after a significant increase in the stock price and the put strike of the collar is above the share purchase price.

The minimum profit potential in this case is equal to: [($145 Long Put Strike – $130 Share Purchase Price) + $0.66 Credit] x 100 = +$1,566.

The maximum profit potential is equal to: [($155 Short Call Strike – $130 Share Purchase Price) + $0.66 Credit] x 100 = +$2,566.

Nice job! You’ve learned the general characteristics of the collar strategy. Now, let’s go through some visual trade examples to see how a collar performs through time.

Collar Example Trades

In the following examples, note that we don’t specify the underlying, since the same concepts apply to collars on any stock. Additionally, each example demonstrates the performance of a single collar position. When trading more contracts, the profits and losses in each case are magnified by the number of collars traded.

Let’s do it!

Maximum Profit - Collar Trade Example #1

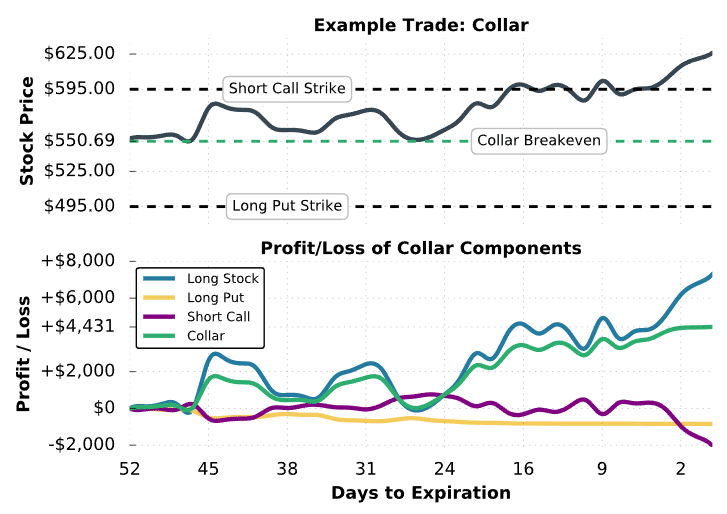

In the following example, we’ll investigate a situation where the stock price rises continuosly and is above the collar’s short call strike at expiration. Here’s the setup:

Initial Stock Price: $552.94

Strikes and Expiration: Long 495 put; Short 595 call; Both options expiring in 52 days

Premium Collected for Call: $10.67

Premium Paid for Put: $8.42

Net Credit: $10.67 in premium collected – $8.42 in premium paid = $2.25 net credit

Breakeven Price: $552.94 share purchase price – $2.25 collar credit = $550.69

Maximum Profit Potential:

[($595 short call strike – $552.94 share purchase price) + $2.25 collar credit] x 100 = $4,431

Maximum Loss Potential:

[($552.94 share purchase price – $495 long put strike) – $2.25 collar credit] x 100 = $5,569

Let’s take a look:

Collar #1 Trade Results

As we can see here, the stock price rallied from $552.94 to $625, resulting in significant profits on the long shares. However, the collar position’s profits are capped because the short call limits the profit potential on the long shares. In this example, the maximum profit potential is $4,431, which is the exact profit at expiration.

At expiration, the trader would be assigned -100 shares of stock at the short call’s strike price of $595. As a result, the trader would be left with no position. If the trader wanted to keep the shares, they would have to buy back the short call for a loss before expiration. However, keep in mind that early assignment is always possible when the short call is in-the-money before expiration.

Maximum Loss - Collar Trade Example #2

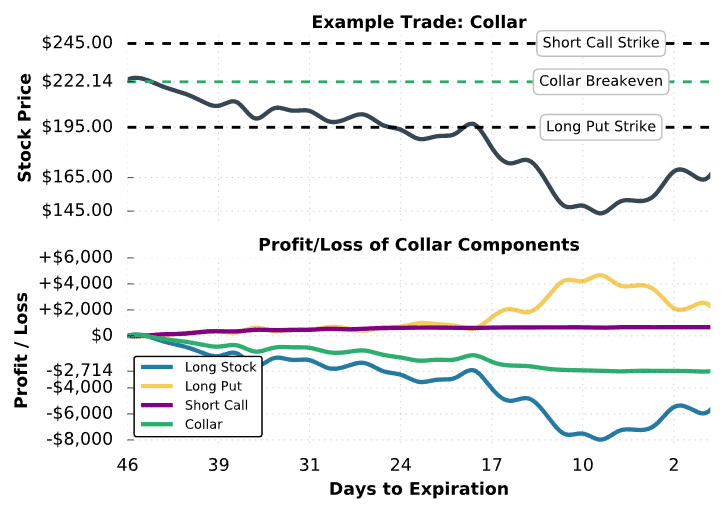

In the second example, we’ll examine how a collar position reduces the loss potential of a long stock investment. Here’s the setup:

➥ Initial Stock Price: $223.41

➥ Strikes and Expiration: Long 195 put; Short 245 call; Both options expiring in 46 days

➥ Premium Collected for Call:$6.70

➥ Premium Paid for Put: $5.43

➥ Net Credit: $6.70 in premium collected – $5.43 in premium paid = $1.27 net credit

➥ Breakeven Price: $223.41 share purchase price – $1.27 collar credit = $222.14

➥ Maximum Profit Potential:

[($245 short call strike – $223.41 share purchase price) + $1.27 collar credit] x 100 = $2,286

➥ Maximum Loss Potential:

[($223.41 share purchase price – $195 long put strike) – $1.27 collar credit] x 100 = $2,714

Let’s see what happens!

Collar #2 Trade Results

In this example, we can see that the stock price collapses from $222 to $145, resulting in huge losses for the long stock position. However, the collar position is protected because the long put gains value as the stock price decreases, which offsets losses on the long shares. Additionally, the short call loses value as the stock price decreases, which also offsets the losses on the long shares.

Compared to the long stock position, the collar in this example only loses $2,714, while the long stock position is down $8,000 at the lowest point.

At expiration, the long put would automatically be exercised and the trader would effectively sell 100 shares of stock at the put’s strike price of $195. If the trader wanted to keep their shares, they could just sell the long put for a profit before expiration.

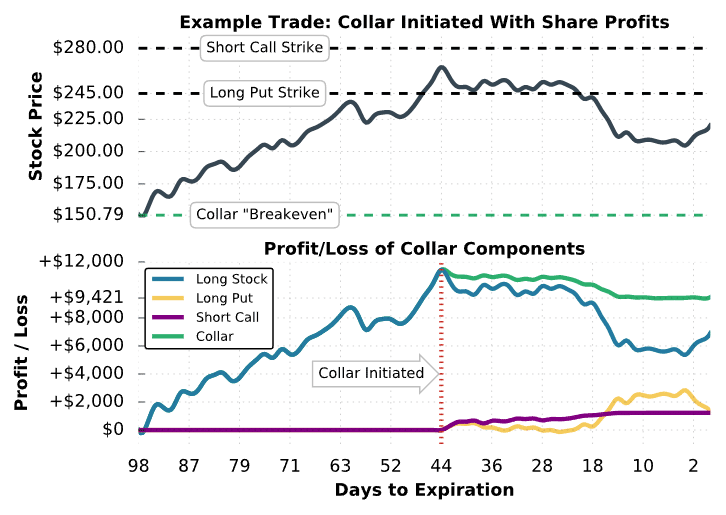

Entering a Collar to Protect Share Profits - Trade Example #3

In the final example, we’ll examine how a collar position can be used to protect the profits on a long share position. Here’s the setup:

➥ Initial Share Purchase Price:$151.04

➥ Share Price When Entering Collar: $265.42

➥ Strikes and Expiration: Long 245 put; Short 280 call; Both options expiring in 44 days

➥ Premium Collected for Call: $12.30

➥ Premium Paid for Put:$12.05

➥Net Credit: $12.30 in premium collected – $12.05 in premium paid = $0.25 net credit

➥ Breakeven Price: $151.04 share purchase price – $0.25 collar credit = $150.79

➥ Maximum Profit Potential:

[($280 short call strike – $151.04 share purchase price) + $0.25 collar credit] x 100 = +$12,921

➥ Maximum Loss Potential:*

[($245 long put strike – $151.04 share purchase price) + $0.25 collar credit] x 100 = +$9,421

*In this example, we’ve altered the maximum loss calculation to result in a positive number because this particular position has no loss potential. Using the standard formula from the other examples would give us a negative maximum loss number, which represents a profit. Adjusting the formula was done to avoid confusion.

As we can see from the table above, there is no loss potential on this position because the share purchase price is well below the long put strike. Let’s see what happens over time:

Collar #3 Trade Results

As we can see from this scenario, the stock price did end up falling after the collar was entered. With the stock price below the long 245 put at expiration, the overall profit on the collar position was +$9,421 like we calculated previously. Meanwhile, the profit on the long stock position without the collar was +$7,500. The outperformance of the collar stems from the profits on both the long 245 put and short 280 call.

The example above demonstrates how collars are most commonly used in practice.

Final Word

Congratulations! You’ve learned the basics of how the collar strategy works, and how it’s commonly used in practice. In a nutshell:

- Collars provide great downside protection in volatile markets.

- Over the long run, outright stock tends to outperform collar trades.

- If the premium collected from the call is equal to or greater than the premium paid for the put, the collar is said to be “cashless”.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.