Last updated on March 24th, 2022 , 07:13 am

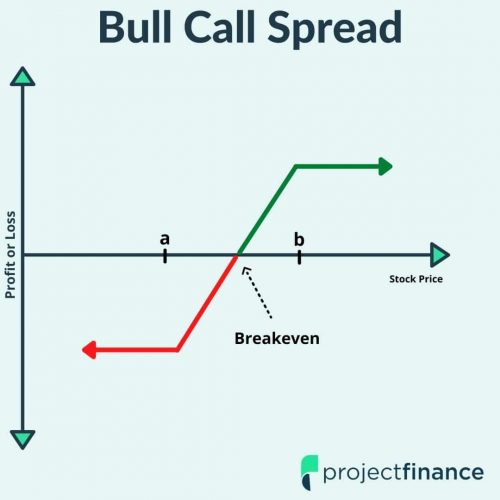

A bull call spread is an options strategy that consists of buying a call option while also selling a call option at a higher strike price.

Both options must be in the same expiration cycle. Buying call spreads is similar to buying calls outright, but less risky due to the premium collected from the sale of a call option at a higher strike. As the name suggests, a bull call spread is a bullish strategy, as it profits when the underlying stock price rises.

We’re going to cover all of this in great detail, so be sure to keep reading if you want to master this strategy!

Let’s go over the strategy’s general characteristics:

Jump To

TAKEAWAYS

- The bull call spread consists of: 1. buying a call at strike price A 2. Selling a call at strike price B.

- Max profit in a bull call spread is the difference between strike A and strike B minus the net premium paid.

- In bull call spreads, max loss is the total premium paid.

- The Breakeven for bull call spreads is strike A plus net debit paid.

- The bull call spread is a cheaper way to go long when compared to straight call buying.

Bull Call Spread Strategy Characteristics

➦Max Profit Potential: (Call Spread Width – Net Debit Paid) x 100

➦Max Loss Potential: Net Debit Paid x 100

➦Expiration Breakeven: Long Call Strike + Net Debit Paid

➦Position After Expiration:

If the long and short call are both in-the-money at expiration, the assignments offset, resulting in no stock position. If only the long call is in-the-money at expiration, the resulting position is +100 shares of stock per call contract.

➦Assignment Risk:

When the short call of a bull call spread is in-the-money, a bull call spread trader is at risk of being assigned -100 shares of stock per short call contract. The probability of being assigned on short calls is higher when the short call has little extrinsic value. Alternatively, short call assignments are common before a stock’s ex-dividend date, primarily when the dividend is greater than the short call’s extrinsic value.

To gain a better understanding of these concepts, let’s walk through a basic example.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Bull Call Spread Profit/Loss Potential at Expiration

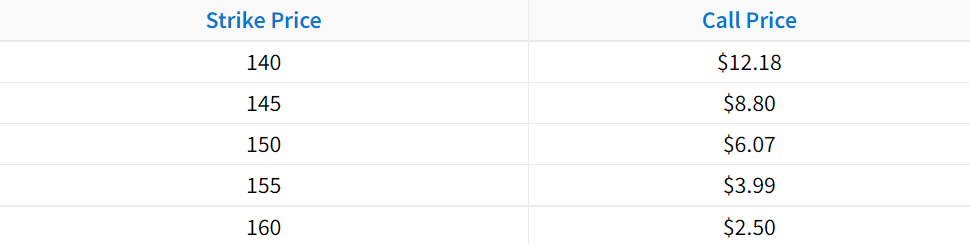

In the following example, we’ll construct a bull call spread from the following option chain:

In this case, let’s assume the stock price is trading for $150 at the time of entering the spread. To construct a bull call spread, we’ll have to buy a call option and sell the same number of calls at a higher strike price. In this example, we’ll buy one of the 145 calls and sell one of the 155 calls.

Initial Stock Price: $150

Long Call Strike: $145

Short Call Strike: $155

Premium Paid for the 145 Call: $8.80

Premium Collected for the 155 Call: $3.99

In this example, buying the 145 call for $8.80 and selling the 155 call for $3.99 results in a net debit of $4.81 (since $8.80 is paid, and $3.99 is collected). Additionally, the “spread width” is the difference between the long and short call strike, which is $10 in this case. Based on a net debit of $4.81 on a $10-wide bull call spread, here are the position’s characteristics:

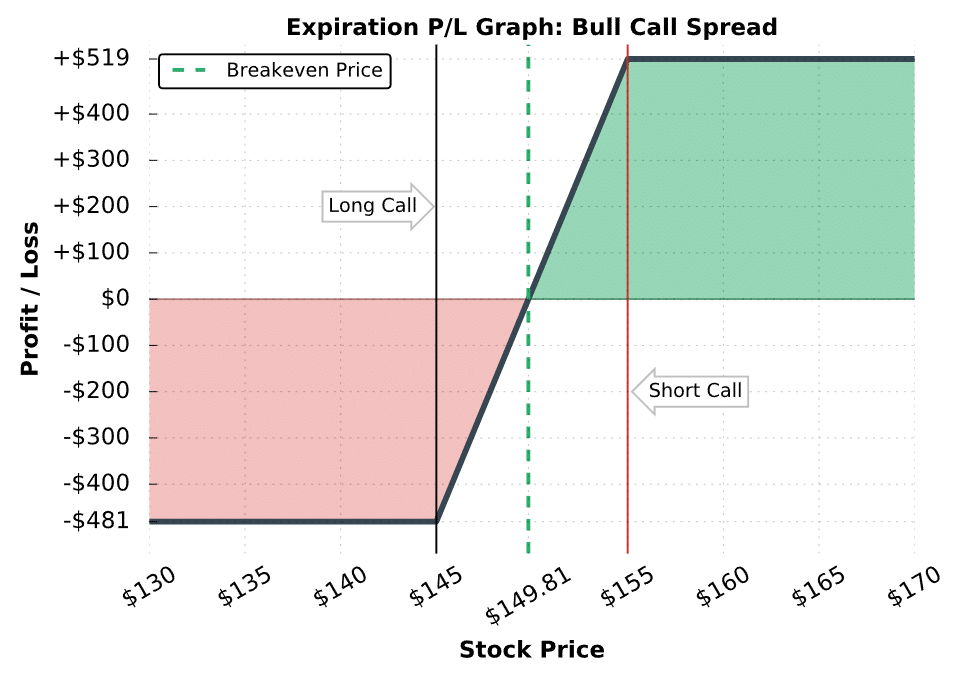

Max Profit Potential: ($10-wide call strikes – $4.81 net debit paid) x 100 = $519

Max Loss Potential: $4.81 net debit paid x 100 = $481

Expiration Breakeven: $145 long call strike price + $4.81 debit paid = $149.81

Probability of Profit

This bull call spread example has a probability of profit slightly greater than 50% because the breakeven price ($149.81) is less than the current stock price ($150), which means the stock price can fall slightly and the position can still profit.

Position After Expiration

If the stock price is above 155 at expiration, both calls expire in-the-money. At expiration, an in-the-money long call expires to +100 shares, and an in-the-money short call expires to -100 shares, which results in no stock position for the call spread buyer.

If the stock price is between 145 and 155 at expiration, only the long call expires in-the-money, resulting in a position of +100 shares for the call spread buyer.

The following visual demonstrates the potential profits and losses for this bull call spread at expiration:

If the stock price is at or below the long call’s strike price of $145 at expiration, both the 145 and 155 call options will expire worthless, resulting in the maximum loss of $481.

If the stock price is in-between the strike prices at expiration, such as $149.81, the long 145 call will have value while the 155 call will expire worthless. At $149.81, the 145 call will be worth $4.81 ($149.81 Stock Price – $145 Strike Price) and the 155 call will be worth $0, resulting in no profit or loss on the trade.

If the stock price is above the short call’s strike price of $155, the entire 145/155 call spread will be worth $10 (the width between the strike prices), which means the profit on each call spread will be +$519.

Bull Call Spread Trade Examples

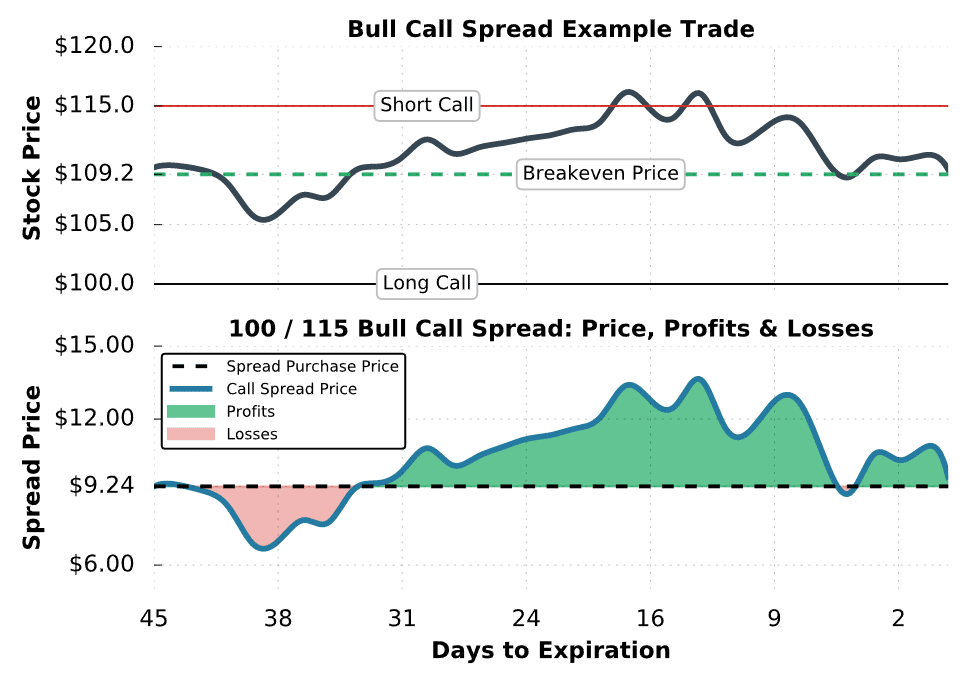

The first example we’ll investigate is a situation where a trader purchases an at-the-money call spread. An at-the-money bull call spread consists of buying an in-the-money call and selling an out-of-the-money call. When constructed properly, the breakeven price is slightly below the current stock price. Here’s the setup:

Initial Stock Price: $109.82

Strikes and Expiration: Long 100 call expiring in 45 days. Short 115 call expiring in 45 days

Net Debit Paid: $11.18 paid for the 100 call – $1.94 received for the 115 call = $9.24

Breakeven Stock Price: 100 long call strike price + $9.24 net debit paid = $109.24

Maximum Profit Potential: ($15-wide call strikes – $9.24 debit paid) x 100 = $576

Maximum Loss Potential: $9.24 net debit paid x 100 = $924

Let’s see what happens!

Bull Call #1 Results

In this example, the bull call spread position had both profits and losses at some point. With 14 days left until expiration, the call spread was worth slightly less than its maximum value of $15.

However, at expiration, the stock price was only slightly above the long call spread’s breakeven price. As a result, the long call spread trader didn’t make or lose any money by holding the trade to expiration.

However, the trade would have been profitable if the trader sold the spread when it was worth more than the entry price of $9.24. To close a bull call spread before expiration, the trader can simultaneously sell the long call and buy the short call at their current prices. As an example, if the trader closed the spread when it was worth $12, they would have realized $276 in profits: ($12 closing price – $9.24 purchase price) x 100 = +$276.

Since the long call is in-the-money at expiration, the trader would end up with +100 shares of stock (per contract) if they did not sell the long call before expiration. Upon selling the long call portion of a bull call spread, it’s wise to buy back the short call. Otherwise, the trader will expose themselves to unlimited loss potential.

Next, we’ll look at an example of a long call spread trade where the stock price moves against the position.

Unprofitable Call Spread Example

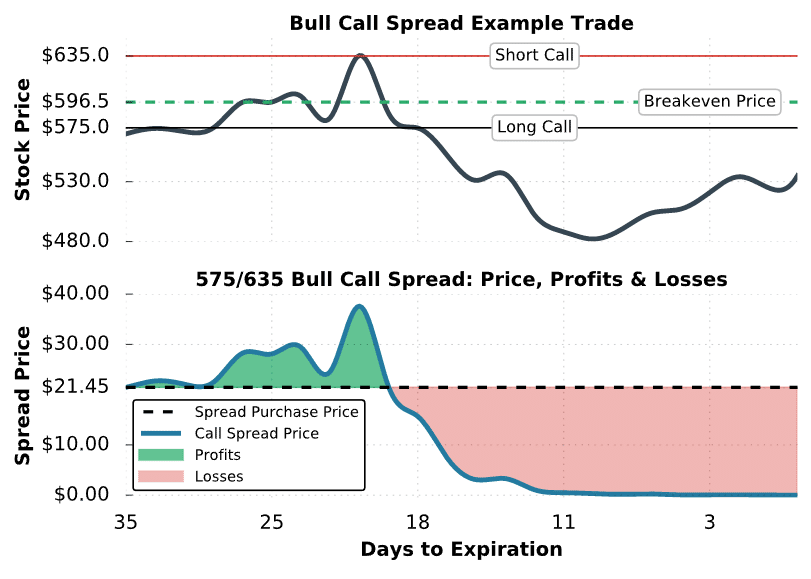

In this example, we’ll look at a situation where a trader buys an out-of-the-money long call spread. An out-of-the-money long call spread is constructed by purchasing an out-of-the-money call while also selling an out-of-the-money call at a higher strike price.

It’s important to note that purchasing out-of-the-money call spreads is a low probability trade because the breakeven price is above the stock price at entry. Additionally, the profit potential is greater than the loss potential.

Here’s the setup:

Initial Stock Price: $569.92

Strikes and Expiration: Long 575 call expiring in 35 days Short 635 call expiring in 35 days

Net Debit Paid: $32.45 paid for the 575 call – $11.00 received for the 635 call = $21.45

Breakeven Stock Price: $575 long call strike price + $21.45 debit paid = $596.45

Maximum Profit Potential: ($60-wide call strikes – $21.45 debit paid) x 100 = $3,855

Maximum Loss Potential: $21.45 debit paid x 100 = $2,145

As you can see, the long call spread’s breakeven price is more than $25 higher than the stock price when entering the trade, which means the stock price must increase more than $25 for the position to breakeven at expiration.

Let’s take a look at what happens:

Bull Call #2 Results

This example demonstrates that a significant stock price increase results in healthy profits for a bull call spread trader. Unfortunately, the stock price ends up dropping just as quickly. With the stock $45 points below the long 575 call at expiration, the long call spread expires worthless. The resulting loss for the call spread buyer is $2,145 ($21.45 debit paid x 100).

As mentioned before, a spread can always be closed before expiration if a trader wishes to lock in profits or losses. For example, if the trader in this example wanted to cut their losses when the spread traded down to $15, they would lock in $645 in losses: ($15 sale price – $21.45 purchase price) x 100 = -$645.

Alright, you’ve seen long call spread examples that break even and realize the maximum loss. In the final example, we’ll investigate a long call spread trade that winds up with its maximum profit potential.

Profitable Call Spread Example

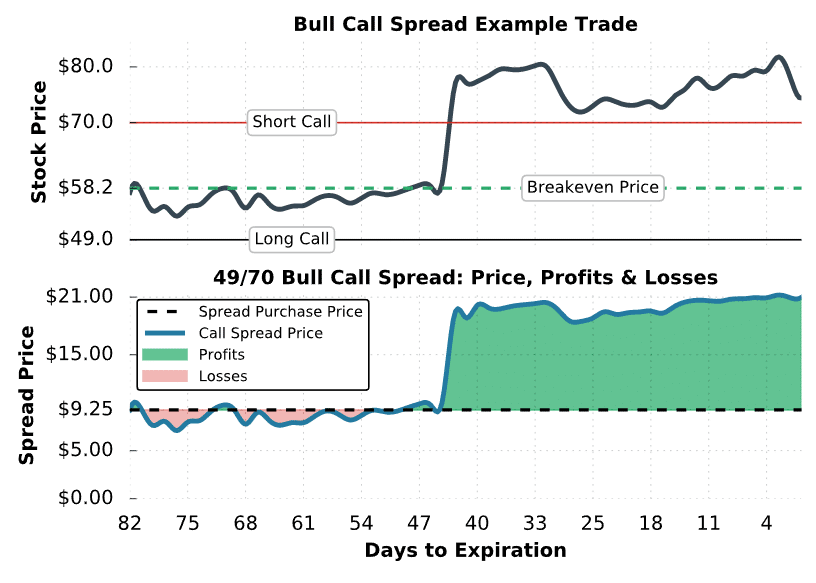

In the final example, we’ll examine a long call spread example that ends up with its maximum profit potential.

Here are the specifics of the final example:

Initial Stock Price: $57.47

Strikes and Expiration: Long 49 call expiring in 82 days. Short 70 call expiring in 82 days.

Net Debit Paid: $11.10 paid for the 49 call – $1.85 received for the 70 call = $9.25

Breakeven Stock Price: $49 long call strike + $9.25 debit paid = $58.25

Maximum Profit Potential: ($21-wide call strikes – $9.25 debit paid) x 100 = $1,175

Maximum Loss Potential: $9.25 net debit paid x 100 = $925

Let’s see what happens!

Bull Call #3 Results

In the first 30 days of the trade, the stock price stagnates around the breakeven price of the long call spread. However, with around 45 days to expiration, the stock jumps 30% to $80 after an earnings announcement.

With the stock price $10 above the short call strike, the long call spread is worth around $20. With $21-wide strikes, the spread’s maximum value is $21. So, even though the position has around 45 days to expiration, the long call spread is worth near its maximum potential value.

When the call spread is worth $20, it’s likely that the long call spread trader closes the position for a profit because there’s only $1 left to make and $20 to lose.

If the trader did sell the spread for $20, the realized profit would be $1,075: ($20 sale price – $9.25 purchase price) x 100 = +$1,075.

Finally, if the spread was held through expiration, no stock position would be taken on because the exercise/assignment of the long and short call options cancel each other out. However, it’s possible that the spread trader is assigned on the short call when it’s deep-in-the-money before expiration.

Final Word

Congratulations! You now know how the bull call spread works as an options trading strategy. In summation, here is what we learned:

- In a bull call spread, risk is limited to the net debit paid.

- Bull call spreads can allow for less risk than just buying straight calls.

- In the bull call spread, both upside and downside are capped.

projectfinance Options Tutorials

Next Lesson

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.