Last updated on February 28th, 2022 , 02:14 pm

In options trading, credit spreads are strategies that are entered for a net credit, which means the options you sell are more expensive than the options you buy (you collect option premium when entering the position).

Credit spreads can be structured with all call options (a call credit spread) or all put options (a put credit spread).

➥Call credit spreads are constructed by selling a call option and buying another call option at a higher strike price (same expiration).

➥Put credit spreads are constructed by selling a put option and buying another put option at a lower strike price (same expiration).

In both cases, the option that is sold will be more expensive than the option that is purchased, which leads to a credit when entering the position.

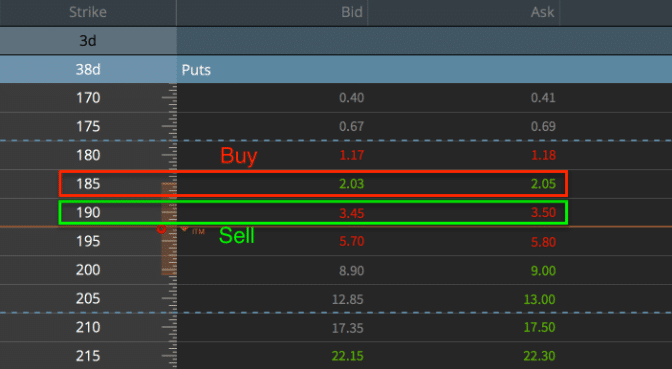

For example, in the image below, selling the 190 put for $3.45 and buying the 185 put for $2.05 would result in a net credit of $1.40 ($3.45 Collected – $2.05 Paid = $1.40 Net Credit):

Software Used: tastyworks Trading Platform

The above trade of selling a put option (shown on a tastyworks options chain) and buying another put option at a lower strike price is an example of a put credit spread, which is a bullish strategy.

Ready to go in-depth?

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Jump To

The Call Credit Spread Options Strategy

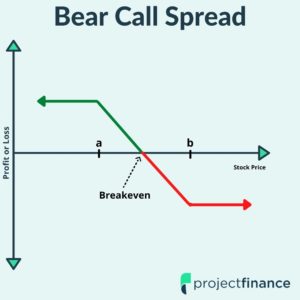

As mentioned earlier, credit spreads can be traded with all calls (call credit spread) or all puts (put credit spread).

When traded with all calls, the strategy is referred to as a call credit spread, or sometimes a “bear” call spread since the strategy is bearish (profits when the stock price decreases).

A call credit spread is constructed by:

✓ Sell 1x Call Option

✓ Buy 1x Call Option (Higher Strike Price, Same Expiration)

Take the following options and their prices as an example:

If the August 100 call was sold for $3.00 and the August 105 call was purchased for $1.00, the position would be entered for a net credit of $2.00 ($3.00 Collected – $1.00 Paid).

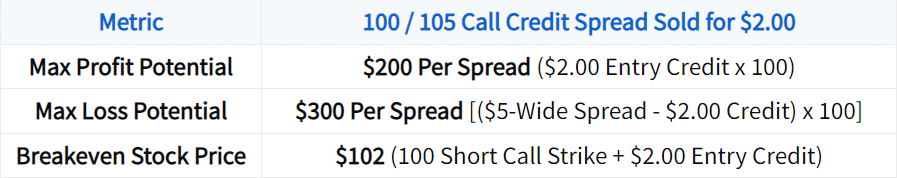

Here are the characteristics of this particular call credit spread example:

➥The maximum profit of a call credit spread occurs when, at expiration, the stock price is below the strike price of the call that was sold. In this case, that means the maximum profit of this spread occurs when the stock price is below $100 at expiration.

➥The maximum loss potential of a call credit spread occurs when, at expiration, the stock price is above the strike price of the call that was purchased. In this case, that means the maximum loss of this spread occurs when the stock price is above $105 at expiration.

➥The breakeven price of a call credit spread is the short call’s strike price plus the credit received. In this case, that’s $102 (Short Call Strike Price = $100; Entry Credit = $2.00). That’s because if the stock price is at $102 at expiration, the 100 call will be worth $2.00 while the 105 call will be worthless, which means the value of the spread will be $2.00.

Let’s look at a call credit spread example with real option data.

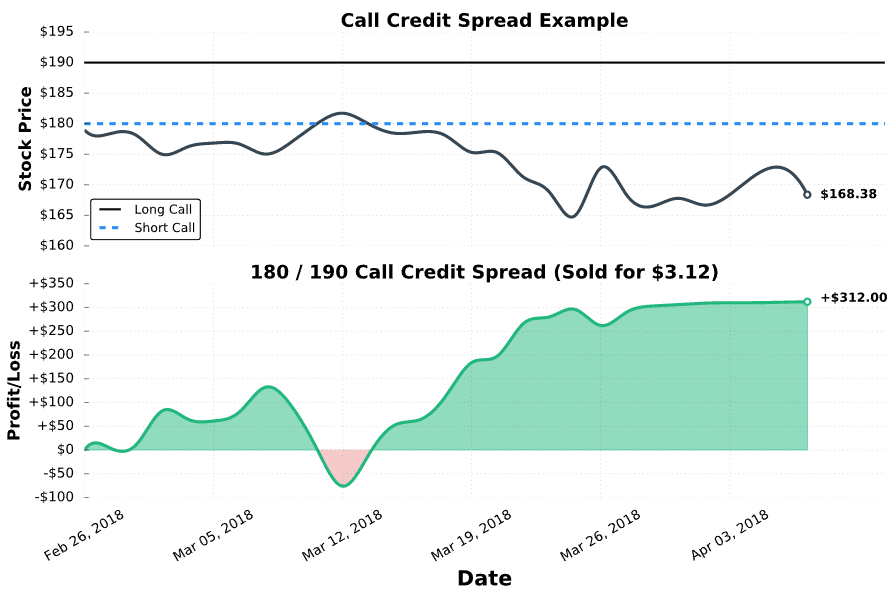

Call Credit Spread Example

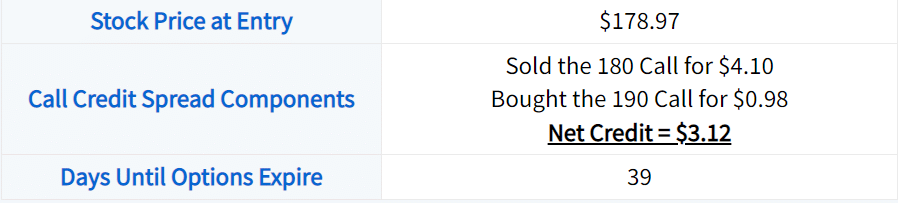

Here are the trade details of this particular call credit spread example:

Here’s how the call spread performed relative to the stock price changes:

As we can see, the spread was profitable most of the time, as the stock price remained below the call spread’s strike prices as time went on.

When the stock price remains below the call spread as time passes, the call options steadily lose value because the probability of them expiring in-the-money decreases. It makes sense because there’s less and less time for the stock to rise above their respective strike prices.

As the call options lose value, the spread’s price also decreases, which results in profits for the call credit spread trader.

At expiration, the stock price was at $168.38, well below the call spread strike prices of $180 and $190. Consequently, the spread expired worthless and the overall profit on the trade was $312 per spread: ($3.12 Entry Credit – $0.00 Expiration Price) x 100 = +$312.

If the stock price was above $190 at the time of expiration, the 180/190 call spread would have been worth $10, in which case the loss per spread would have been $688 ($3.12 Entry Credit – $10 Expiration Price) x 100 = -$688.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

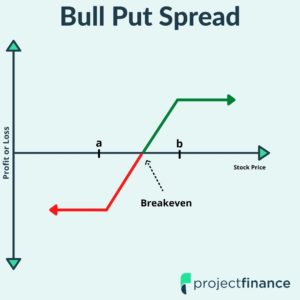

The Put Credit Spread Options Strategy

When credit spreads are traded with all puts, the strategy is called a put credit spread, or sometimes a “bull” put spread since the strategy is bullish (profits when the stock price increases).

A put credit spread is constructed by:

✓ Sell 1x Put Option

✓ Buy 1x Put Option (Lower Strike Price, Same Expiration)

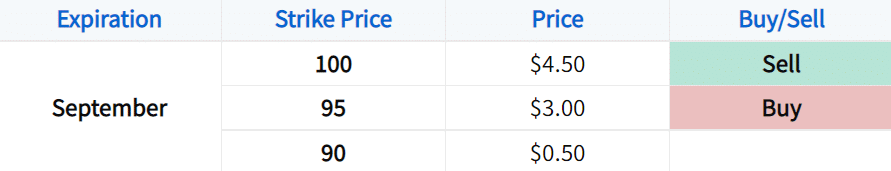

Take the following options and their prices as an example:

If the September 100 put was sold for $4.50 and the September 95 put was purchased for $3.00, the position would be entered for a net credit of $1.50 ($4.50 Collected – $3.00 Paid).

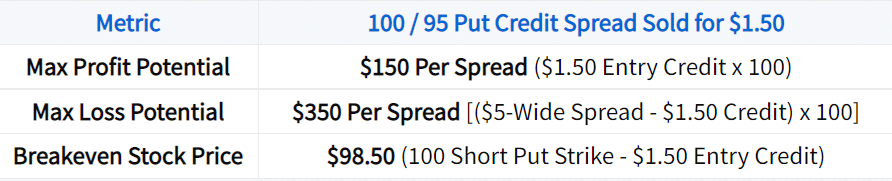

Here are the characteristics of this particular put credit spread example:

➥The maximum profit of a put credit spread occurs when, at expiration, the stock price is above the strike price of the put that was sold. In this case, that means the maximum profit of this spread occurs when the stock price is above $100 at expiration.

➥The maximum loss potential of a put credit spread occurs when, at expiration, the stock price is below the strike price of the put that was purchased. In this case, that means the maximum loss of this spread occurs when the stock price is below $95 at expiration.

➥The breakeven price of a put credit spread is the short put’s strike price minus the credit received. In this case, that’s $98.50 (Short Put Strike Price = $100; Entry Credit = $1.50). That’s because if the stock price is at $98.50 at expiration, the 100 put will be worth $1.50 while the 95 put will be worthless, which means the value of the spread will be $1.50.

Let’s look at a put credit spread example with real option data

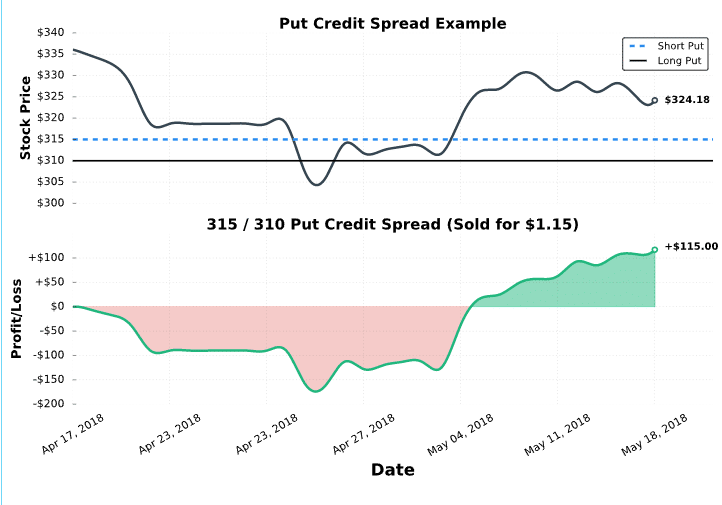

Put Credit Spread Example

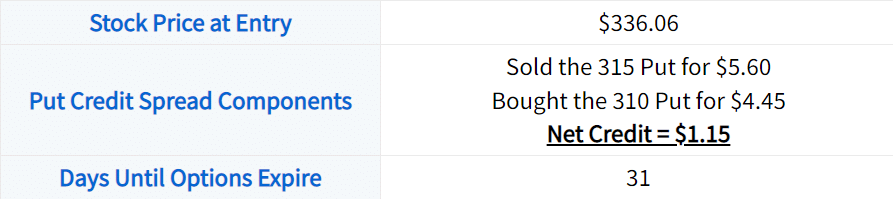

Here are the trade details of this particular put credit spread example:

Here’s how the put spread performed relative to the stock price changes:

In this example, the trade was unprofitable for a few weeks after entering the position, as the stock price decreased notably immediately after selling the spread.

When the stock price decreases towards/through the put spread’s strike prices, the put options gain value and the price of the spread increases. When the spread price is more than what the trader initially collected, the position will have losses.

Fortunately, the stock price recovered and was above the put spread’s strike prices at expiration.

At expiration, the stock price was at $324.18, well above the put spread strike prices of $315 and $310. Consequently, the spread expired worthless and the overall profit on the trade was $115 per spread: ($1.15 Entry Credit – $0.00 Expiration Price) x 100 = +$115.

If the stock price was below $310 at the time of expiration, the 315/310 put spread would have been worth $5, in which case the loss per spread would have been $385 ($1.15 Entry Credit – $5 Expiration Price) x 100 = -$385.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.