Last updated on April 8th, 2022 , 11:09 am

IMPORTANT! On March 14th, 2022, Barclays suspended the sale and future issuance of VXX.

VXX is wildly successful with millions of share/note volume each day and extremely active options contracts.

The original VXX reached its maturity in 2019, causing Barclays to launch VXXB (the same product with a different name). Barclays has since renamed VXXB back to VXX. Order is restored in the world.

Jump To

What is VXX?

To begin understanding what VXX is, let’s look at the product’s description:

VXX: The iPath® Series B S&P 500® VIX Short-Term FuturesTM ETNs (the “ETNs”) are designed to provide exposure to the S&P 500® VIX Short-Term FuturesTM Index Total Return (the “Index”).

You’ll notice that they call VXX the Series B ETN, which is referring to the fact that this is the second VXX product launched by Barclays due to the fact that the original VXX reached its maturity date on January 30th, 2019.

What is the S&P 500 VIX Short-Term Futures Index Total Return?

In order to understand exactly how VXX works, we need to understand the “S&P 500 VIX Short-Term Futures Index Total Return,” or the “Index.”

On the VXX Information Page, the S&P 500 VIX Short-Term Futures Index is described:

The Index is designed to provide access to equity market volatility through Cboe Volatility Index® (the “VIX Index”) futures.

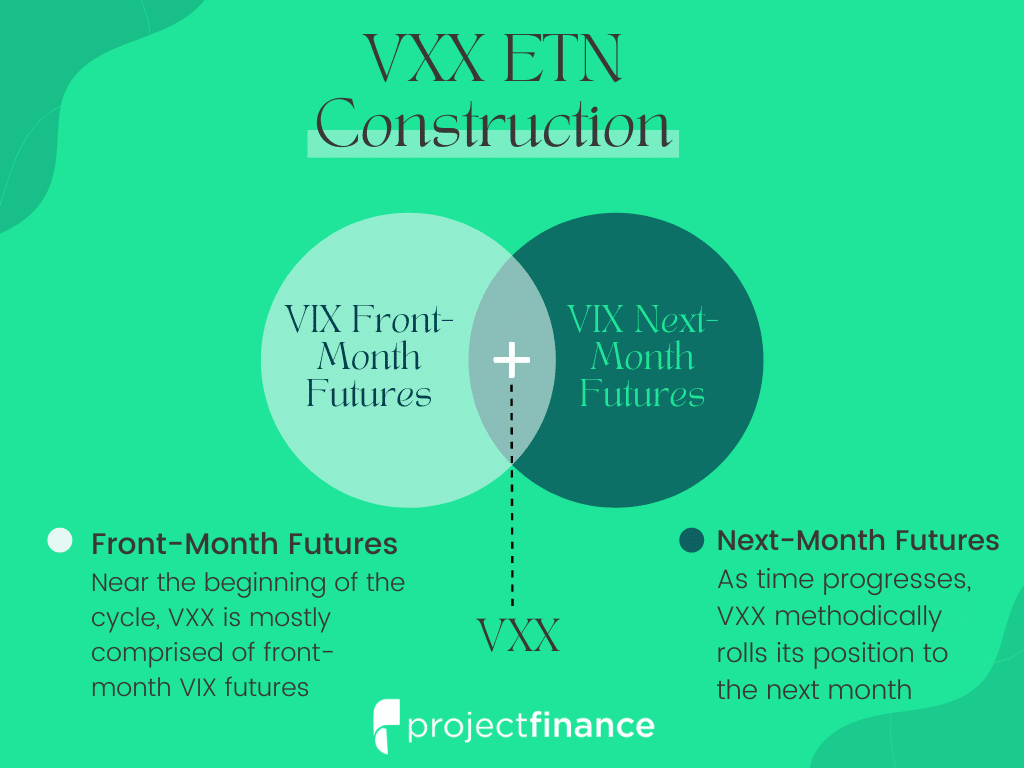

The Index offers exposure to a daily rolling long position in the first and second month VIX futures contracts and reflects market participants’ views of the future direction of the VIX index at the time of expiration of the VIX futures contracts comprising the Index.

The VIX Index measures a constant 30-day weighting by using multiple SPX options expiration cycles. Since there isn’t an exact 30-day expiration cycle on every single trading day, Cboe uses the following methodology to calculate a constant 30-day implied volatility using SPX options:

“Only SPX options with more than 23 days and less than 37 days to the Friday SPX expiration are used to calculate the VIX Index. These SPX options are then weighted to yield a constant, 30-day measure of the expected volatility of the S&P 500 Index.” – Cboe

As mentioned earlier, VXX tracks the S&P 500 VIX Short-Term Futures Index, which tracks the first and second month VIX futures contracts:

The S&P 500® VIX Short-Term Futures Index utilizes prices of the next two near-term VIX® futures contracts to replicate a position that rolls the nearest month VIX futures to the next month on a daily basis in equal fractional amounts. This results in a constant one-month rolling long position in first and second month VIX futures contracts. (source)

VXX’s goal is to track the daily percentage change of a 30-day VIX futures contract. Since there isn’t a VIX futures contract with 30 days to settlement on each trading day, they use the first-month and second-month VIX futures to calculate a 30-day VIX futures contract from the weightings and prices of the futures that are actually trading.

One-Month Weighted VIX Future Example

As an example, consider the following VIX futures contracts:

First-Month VIX Future: 15 Days to Settlement / Current Price of 15

Second-Month VIX Future: 45 Days to Settlement / Current Price of 16

In this particular scenario, the S&P 500 VIX Short-Term Futures Index would use a 50% weighting in each VIX futures contract to come up with the 30-day VIX futures contract:

(15 Days x 50% Weighting) + (45 Days x 50% Weighting) = 7.5 + 22.5 = Weighted 30 Days to Settlement

The calculated price of the 30-day “synthetic” VIX futures contract would be 15.50:

(15 x 50% Weighting) + (16 x 50% Weighting) = 7.5 + 8.0 = 15.50.

VXX tracks the daily percentage change of this one-month VIX futures contract.

For instance, if this hypothetical one-month VIX futures contract went from 15.50 to 16.50 (+6.45%) on this particular trading day, VXX would increase by 6.45%.

On the other hand, if the one-month VIX futures contract went from 15.50 to 14.00 (-9.68%) on this particular trading day, VXX would decrease by 9.68%.

Please keep in mind that this is a hypothetical example, but it is conceptually accurately and describes how the one-month VIX future is calculated and where VXX’s returns come from on a daily basis.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

VXX Movement Examples

VXX’s daily movements are based on the previous day’s closing price.

For instance, if VXX was $50 and the 30-day VIX future increased by 15% on one trading day, VXX would increase to $57.50. If, on the following trading day, the 30-day VIX future increased again by 15%, VXX would go from $57.50 to $66.13. Because of this, VXX can increase exponentially during multi-day streaks of VIX futures increases:

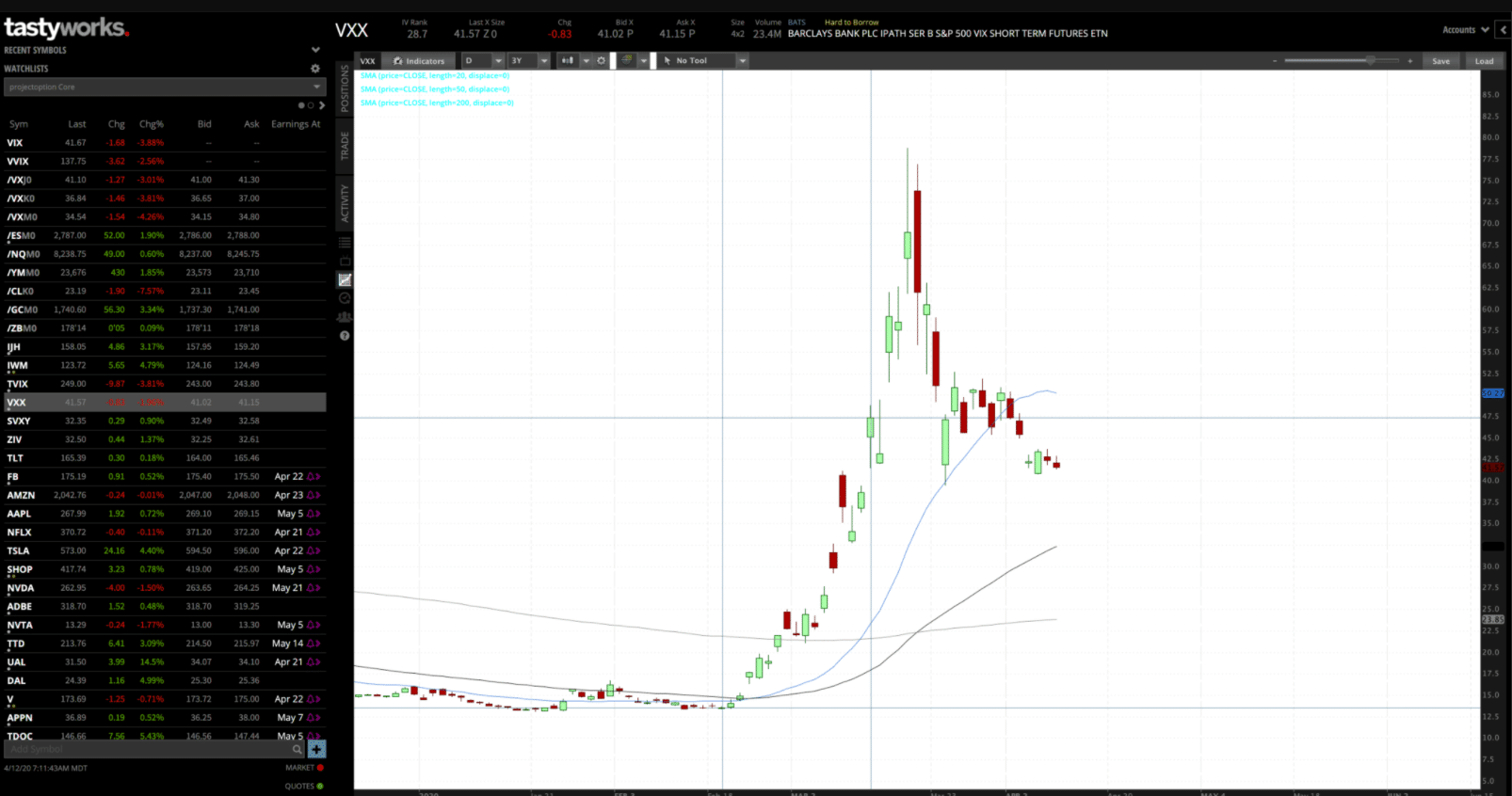

On February 19th, 2020, VXX closed at $13.56.

On March 12th, 2020, VXX closed at $47.36 (249% Increase):

Software: tastyworks

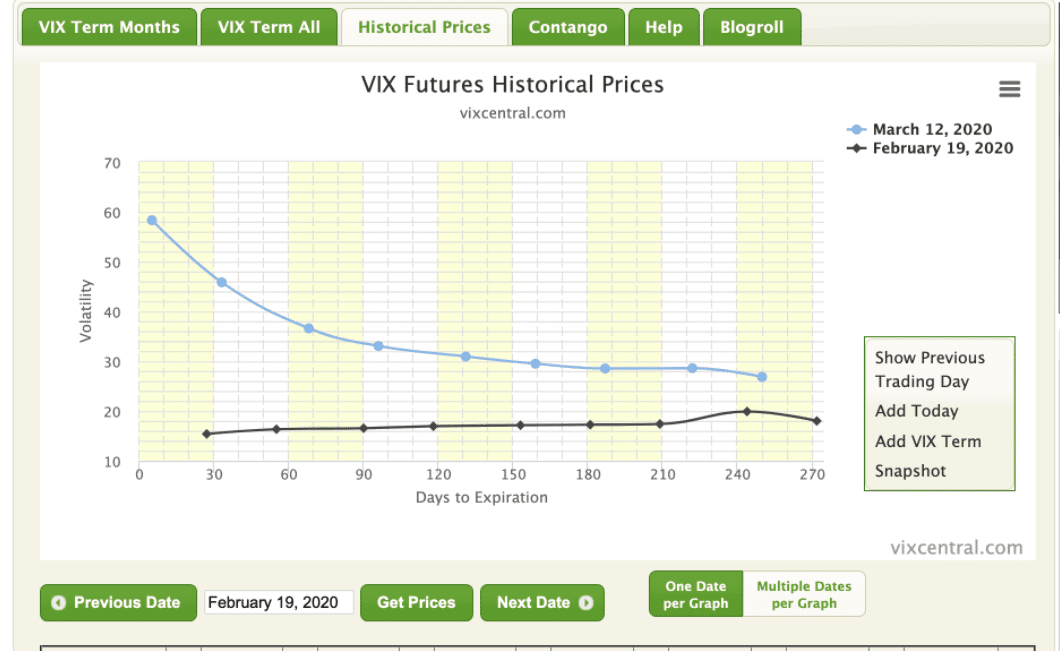

What drove these returns? The VIX futures, of course. Here are the VIX “term structures” or futures curves from February 19th, 2020 and March 12th, 2020 (courtesy of VIXCentral):

As we can see, the March and April VIX futures (the two left-most points on each line) increased substantially.

The March VIX future went from 15.38 to 58.30 during the timeframe (+279%).

The April VIX future went from 16.32 to 45.83 during the timeframe (+181%).

VXX went from $13.56 to $47.36 during the timeframe (+249%).

Notice VXX’s increase was within the range of increases of the March and April VIX futures.

The VXX increase was less than the 279% increase of the March VIX future, and more than the 181% increase of the April VIX future because at the beginning of the period, VXX’s weightings were mostly in the March future. As time passed, the weighting shifted out of the March VIX future and into the April VIX future.

The result is that VXX did not capture the 279% increase in the March VIX future, but did better than the 181% observed in the April VIX future.

VXX vs. Near-Term Futures Example

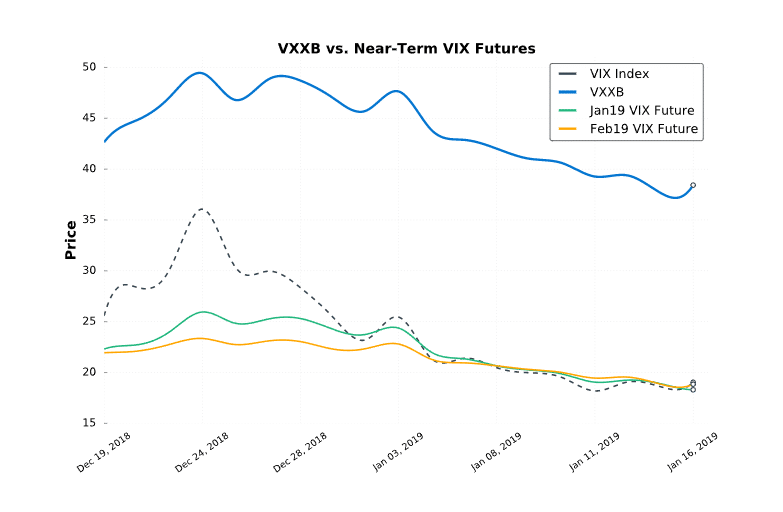

To illustrate VXX’s movements relative to the VIX Index and near-term VIX futures, we plotted recent VXX price action against the VIX Index and futures:

Note: The chart says “VXXB” because the graph was made when VXXB was the ticker symbol for the current VXX. The data in the graph below is still accurate with the exception of the usage of “VXXB” instead of “VXX” as the ticker symbol.

In the above image, we’re looking at VXX (top line), the VIX Index (dashed line) and the first- and second-month VIX futures at the time (January 2019 and February 2019).

As we can see, the VIX Index increases significantly in the December 19 – 24 time period, which “pulls” the Jan/Feb VIX futures higher. It’s important to note that VXX’s increase is caused by the increase in the January and February VIX futures, not the VIX Index itself.

Also, the chart above only shows the price movements in points, not percentages. Over this period, VXX is tracking the daily percentage changes of the weighted 30-day VIX future, which is derived from the January and February VIX futures on each trading day.

Once the January VIX future settles, VXX’s movements will then be derived from the 30-day VIX future that is calculated from the February (first-month) and March (second-month) VIX futures.

The process repeats indefinitely over time.

Expected VXX Performance Over Time

The sections above outline the specific details of how VXX works. To explain everything concisely, remember the following about VXX:

1) VXX tracks the daily percentage change of a one-month VIX futures contract that is calculated using the first-month and second-month VIX futures contracts.

2) If the first-month and second-month VIX futures decrease, VXX will lose value.

3) If the first-month and second-month VIX futures increase, VXX will gain value.

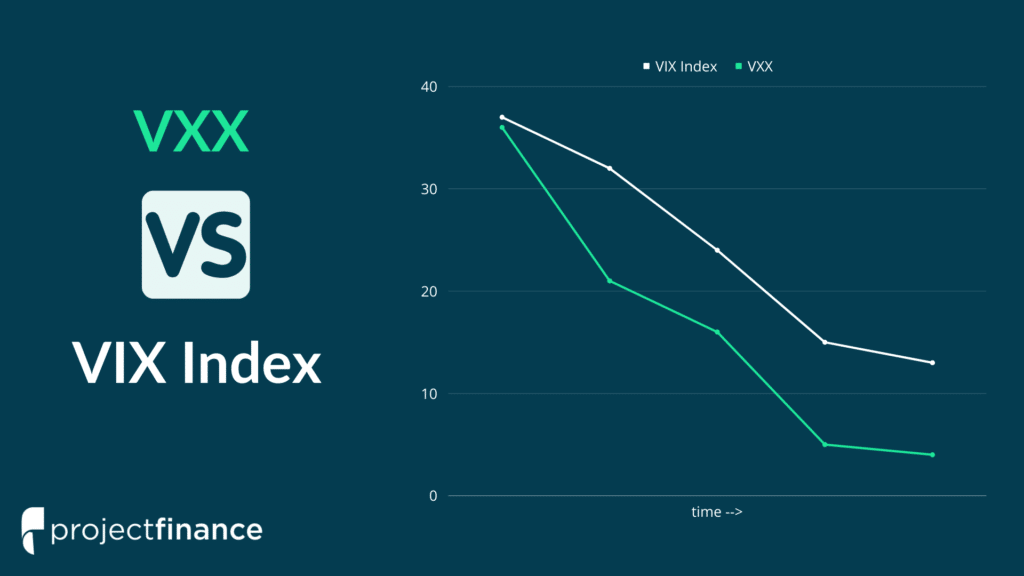

4) Because of its VIX futures composition, contango causes VXX to decay in value greater than the VIX index.

It’s important to understand that from VXX’s inception date to maturity date, the product underwent numerous reverse splits to keep the product’s price from reaching $0.

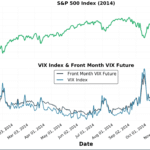

Under “normal” market conditions, the VIX Index is typically below the near-term VIX futures contracts (a state of “contango”). As time passes, VIX futures contracts slowly converge towards the VIX Index. If the VIX Index is below the near-term VIX futures, the contracts will lose value over time, leading to losses in VXX.

Conversely, when the VIX Index is above the near-term VIX futures (a state of “backwardation”), the contracts will gain value over time, which leads to appreciation in VXX.

From VXX’s inception date (January 2009) to maturity date (January 2019), the product lost 99.99% of its value because the VIX futures are usually in contango.

Going forward, we should expect VXX to follow the same depreciation towards $0 over the long-term.

Additional VXX Resources

Hopefully, this post has helped you understand what VXX is and how it works on a daily basis.

For more information regarding VXX, refer to the following resources:

VXX FAQ's

VIX is an index which does not offer shares.

VXX is an ETN which does offer shares.

VIX and VXX can vary widely in price because VXX performance is based on the daily percentage changes of short-term futures in multiple expirations. Read more about differences between these two products in our article, VIX vs VXX.

In the short-term, VXX can be a great hedge against S&P 500 stocks. However, over the long-run, VXX generally decays significantly in price due to the VIX futures being in contango a majority of the time.

VXX is not an ETF, but an ETN. ETN stands for exchange-traded note. ETN’s are instruments of debt, not equity (like ETFs).

The price of VXX is not necessarily calculated like the VIX Index because VXX shares fluctuate based on supply and demand.

However, the performance of VXX each day is based on the daily percentage change of a portfolio of near-term VIX futures with a 30-day weighted time to settlement. VXX share trading activity should keep the price of VXX in-line with this performance.

If VXX begins at $50 and the portfolio of near-term VIX futures rises 7% in a single trading day, VXX will increase to $53.50 ($50 x 1.07).

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.