Last updated on February 10th, 2022 , 12:30 pm

Jump To

One of the difficult parts of learning how to trade options is getting comfortable with strike price selection for various strategies. At first, the amount of strike prices available can be overwhelming, but in time the process of selecting strike prices becomes natural.

In today’s guide, we’ll discuss our process for selecting strike prices when we trade debit spreads. If you’d like a refresher on the debit spreads we’ll be focusing on, we’ve put together the following strategy guides:

1. Call Debit Spread (also referred to as a “long call spread” or “bull call spread”)

2. Put Debit Spread (also referred to as a “long put spread” or “bear put spread”)

There are two primary ways in which we structure our debit spread trades, which we’ll break down in this guide.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Selecting Strike Prices for Stock-Replication Debit Spreads

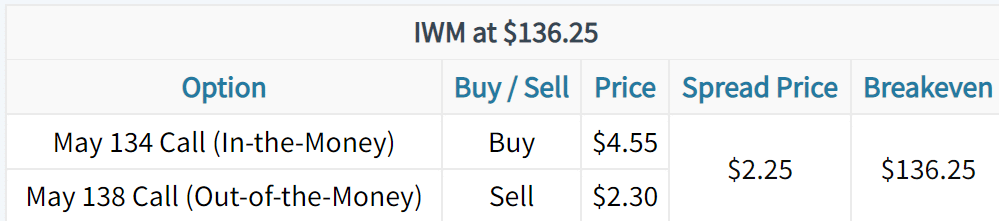

The first way we’ll structure debit spreads is with stock replication in mind. This means we’ll aim to structure our debit spread to have a similar breakeven price as the current stock price. We use this type of spread when we want long or short stock exposure but with less loss potential and the opportunity for a high return on capital. To structure this type of debit spread, we purchase an in-the-money option and sell an out-of-the-money option. The long and short options should both be similarly distanced from the stock price. Here’s an example:

In this case, buying the 134/138 call debit spread with the IWM ETF at $136.28 gives us a breakeven price of $136.25 (Long Call Strike of $134 + Spread Entry Price of $2.25 = $136.25). So, if the stock price remains right at its current level, the call spread will break even, similar to holding the actual stock. Furthermore, the maximum loss potential is $225 ($2.25 x 100) per spread, and the maximum profit potential is $175 [($4 Spread Width – $2.25 Purchase Price) x 100] per spread. For this spread, the margin requirement would be the loss potential of $225, which means the potential return on capital is 78%.

Here’s a visualization of a call debit spread that is structured similarly to the call spread in the table above:

As we can see, the spread’s breakeven price is right near the initial stock price, and the spread doesn’t lose much value when the stock price doesn’t move too much (during the period between 82 to 45 days to expiration). This is because the in-the-money option consists of mostly intrinsic value, which does not decay. Additionally, the short call’s price decay offsets most of the decay of the long option’s extrinsic value.

In short, structuring a debit spread with an in-the-money long option and an out-of-the-money short option minimizes the exposure to losses from time decay. Additionally, the spread’s probability of profit is approximately 50% because the breakeven price is right near the stock price at the time of trade entry.

Selecting Strike Prices for Lower Risk, Higher Return Debit Spreads

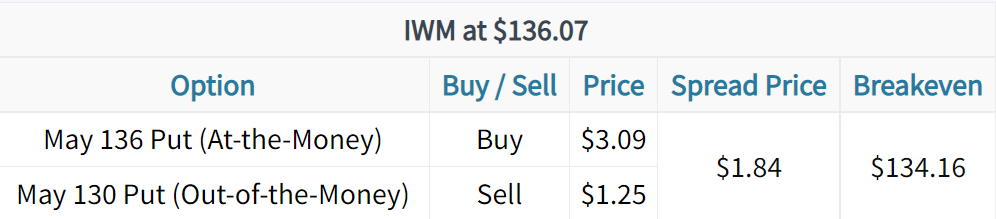

The second type of debit spread setup we use is to structure a strategy with asymmetric return potential, but with less risk and a higher probability of profit than simply buying a call or put. The spread is structured by purchasing an at-the-money option and selling an out-of-the-money option against it. This setup will result in less loss potential, more profit potential, and a lower probability of success.

But how do you choose the short strike in the spread? That depends on your outlook for the stock. A logical placement for the short strike is your “best-case” scenario for the stock’s movement. In other words, the furthest you think the stock will move by the spread’s expiration.

For example, the following spread uses a short strike of 130, which means the trader who buys this debit spread believes $130 is a realistic price target over the time frame of the trade:

As you’ll notice, the breakeven price of this put spread is $134.16, which is $1.91 below the current stock price. Since we need IWM to fall in order to break even at the time of this spread’s expiration date, the spread has a lower probability of profit.

In regards to potential profits and losses, this spread’s price is $1.84, which means the maximum loss potential is $184 ($1.84 x 100) per spread. Since the spread is $6 wide, its maximum potential value is $6, which means the maximum profit potential is $416 ([$6-Wide Spread – $1.84 Purchase Price] x 100) per spread.

Since the margin requirement of this spread is the maximum loss potential of $184, the potential return on capital for this trade is 226% ($416 Profit Potential / $184 Spread Purchase Price). So, by altering our strikes to structure a more directional trade with better return potential and less loss potential, the potential return on capital increased in comparison to the previous spread. However, with more return potential and less loss potential, the probability of making money on the spread decreases.

Here’s an example of a put debit spread structured similarly to the put spread from above:

As we can see, the stock price hovers right around the long put’s strike price of $226, and therefore the spread as a whole begins to lose value over time. This is because the long put’s value is all extrinsic, which decays over time.

While the short option also consists of all extrinsic value, the debit spread loses value over time because the long option has more extrinsic value than the short option, and therefore loses more from time decay.

In short, buying a debit spread with an at-the-money long option and an out-of-the-money short option results in less risk and more profit potential than a debit spread with an in-the-money long option. However, the more favorable risk/reward results in a lower probability of success because the stock price has to move by a certain amount in a specific direction. If the stock doesn’t make that favorable move, the spread will lose money from time decay.

Adjusting Strike Prices to Add or Reduce Risk

Once you’ve determined the general structure of the debit spread you want to trade, the final step is to adjust the strikes to tweak the risk of the trade:

1. To increase the risk and reward of a debit spread, widen out the distance between strike prices.

2. To reduce the risk and reward of a debit spread, narrow the distance between the strike prices.

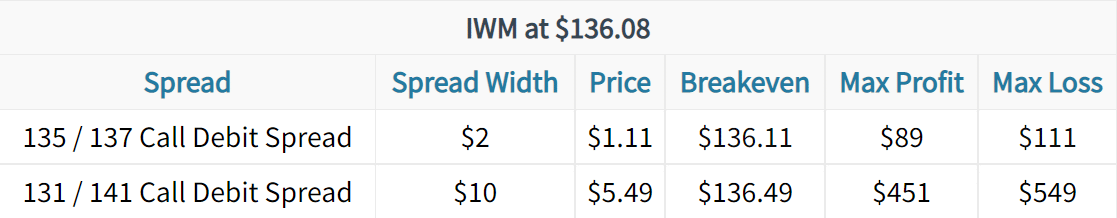

Consider the following positions:

The two spreads are very similar in regards to their breakeven prices and risk/reward ratios. However, they differ in size. The wider spread has more loss potential and more profit potential than the narrower spread.

For smaller accounts targeting lower-risk trades, debit spreads with less distance between the strike prices can be traded. For larger accounts targeting higher-risk trades or a more efficient use of commissions, wider spreads can be traded. Adjust the strike prices until the spread meets your particular risk preference.

Keep an Eye on the Short Option’s Price

The last topic we’ll discuss is the price of the short option in the debit spread. The point of trading debit spreads is to gain bullish or bearish exposure with less risk and a higher probability of profit than simply buying a call or put. The downside of trading a debit spread as opposed to a call or put is that the debit spread has limited profit potential.

Because of this, you’ll want to make sure the option you’re selling against your long option brings in enough premium to justify capping your profit potential.

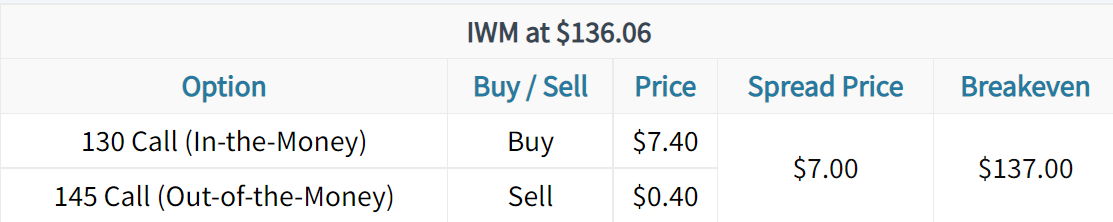

Consider the following trade:

In this particular position, the short 145 call is only bringing in $0.40 in premium, which means the profit potential of the long 130 call is being limited by an option that’s only reducing the cost of the long call by $0.40 (a 5% in reduction the long 130 call’s price).

In this scenario, it may not make sense to sell the 145 call at all. If you’re going to limit the profit potential of your long call by selling a call against it, then make sure the short option’s premium justifies limiting the profit potential.

It will depend on the structure of the debit spread, but as a general guideline, the short option should bring in premium equal to or greater than 20% of the long option’s price.

Summary of Main Concepts

To quickly summarize what this post has covered, here are the key points to remember:

- To structure a debit spread with a breakeven price near the current stock price, purchase an in-the-money option and sell an out-of-the-money option that are similarly distanced from the stock price. This type of spread will be similar to buying or shorting shares of stock, but with lower profit/loss potential and a higher potential return on capital.

- To structure a debit spread with low-risk and high return potential, buy an at-the-money option and sell an out-of-the-money option against it. This type of setup will have lower loss potential, higher profit potential, but more exposure to losses from time decay and a lower probability of success.

- To increase the risk and reward of a debit spread, widen out the distance between the strike prices.

- To reduce the risk of a debit spread, decrease the width of the distance between the strike prices.

- Always be sure to check the premium of the short option in a debit spread. The short option in a debit spread is meant to reduce the cost of the long option. If the short option is too cheap, it doesn’t make sense to sell the option, as the premium collected doesn’t justify capping the profit potential.

- As a general guideline, the short option should bring in premium equal to or greater than 20% of the long option’s price.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.