Last updated on February 10th, 2022 , 12:36 pm

Jump To

If you’ve been listening to traders talk on the news, podcasts, or educational videos, you may have heard them use the term “scalping.” So, what is scalping?

Scalping Explained

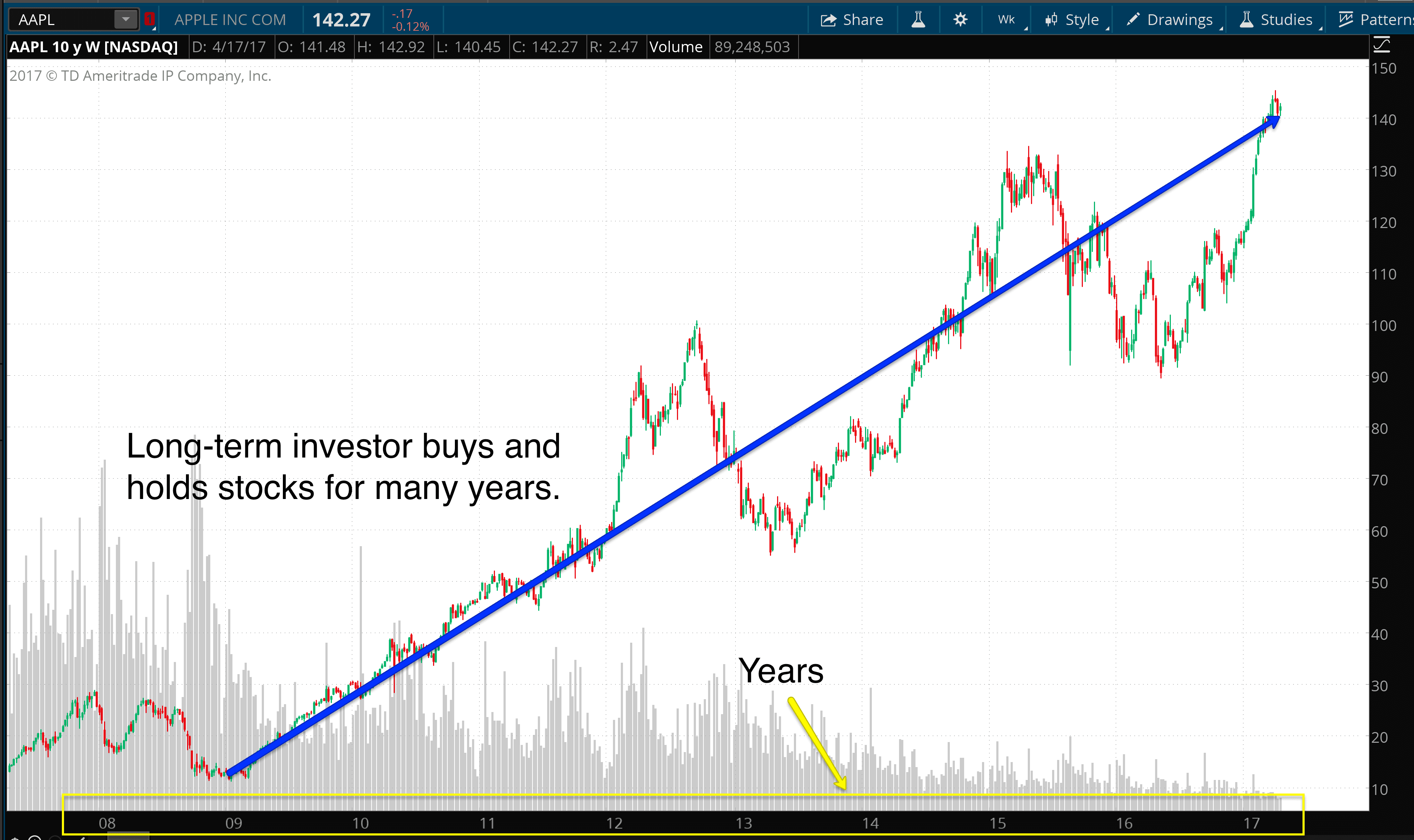

Scalping refers to an activity where traders try to buy or sell securities (stocks, options, or futures contracts) for short-term gains. For example, most long-term investors will buy stocks in their investment portfolios and hold those stocks for many years before selling them.

Let’s look at an example with Apple (AAPL):

In the case of a normal investor, the investment/trade time frame is typically many years.

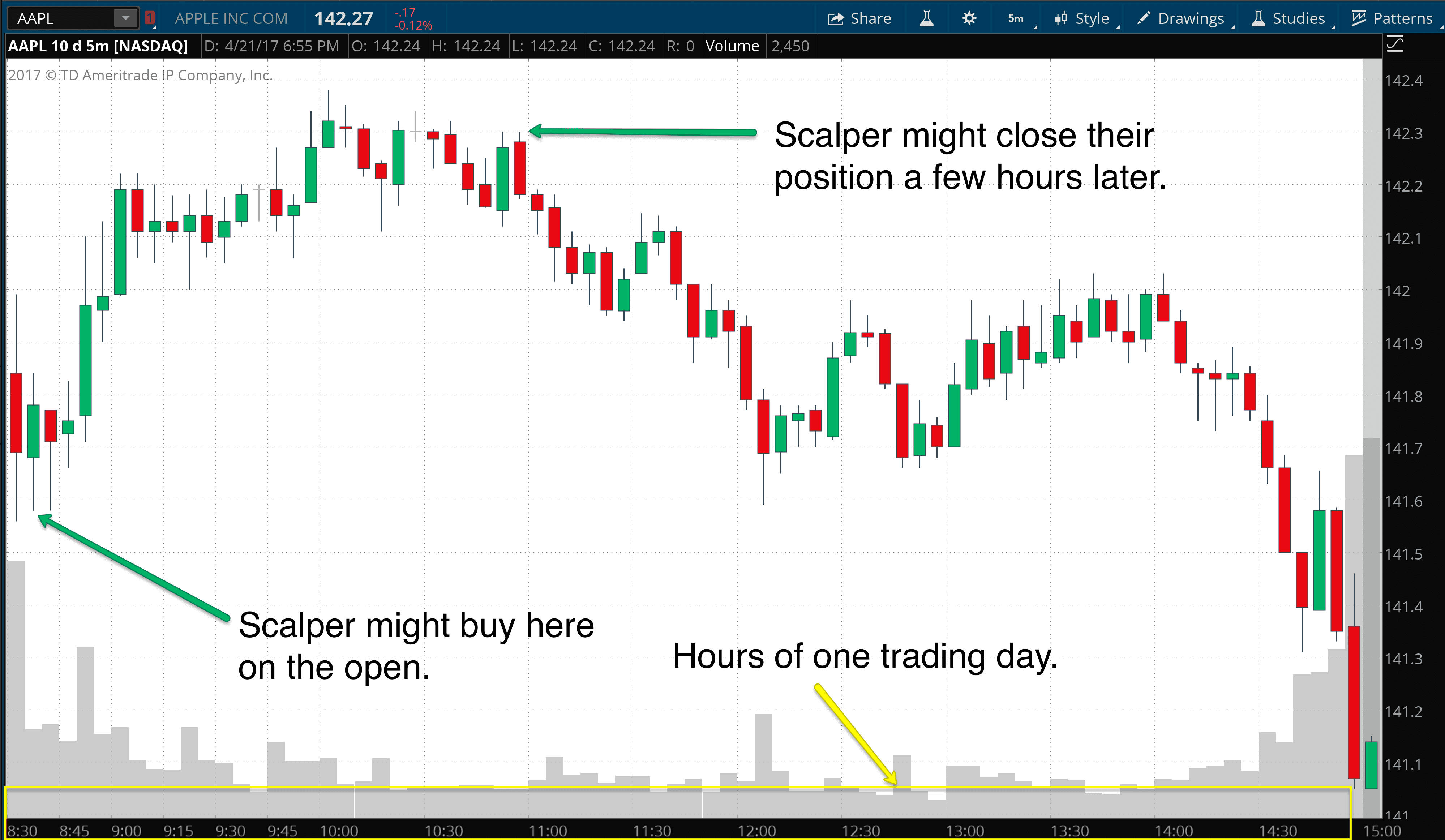

When scalping, the duration of each trade could be as little as a few minutes to a few hours. Generally speaking, scalping is an “intraday trading” activity, which simply means all of the trades are opened and closed within the trading session. Here’s an example of scalping AAPL stock:

In this case, we can see AAPL’s price fluctuations over one trading day (each bar is a 5-minute period). A scalper will try to predict AAPL’s short-term movements to extract profits over time.

What Can Traders Scalp?

In the trading world, any product can be scalped. There are traders who primarily scalp shares of stock, while others may scalp options or futures contracts.

All in all, “scalping” refers to trading over short time frames.

Can You Make Money Scalping?

While the idea of trading short-term fluctuations in stocks, options or futures is enticing, keep in mind that transaction costs are higher for more active, short-term trading.

Additionally, it’s very difficult, if not impossible, to predict stock price movements. So, the profitability of a scalping trading approach will come down to having a solid system that a trader can follow. The system should aim to keep drawdowns small (get out of losing trades when you’ve been proven wrong), and maximize winning trades.

For example, if a scalpers trading system has a 1:3 risk/reward relationship, the trader only has to have a success rate of 25% (since one winning trade evens out three losing trades) to break even. So, if the trader can pick entries that result in a success rate higher than 25%, the strategy will be profitable over time.

At projectoption, we do not scalp in our live trading portfolio, as we typically trade options with 30-60 days to expiration.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.