Last updated on February 14th, 2022 , 10:01 am

Learn the absolute essential options trading concepts!

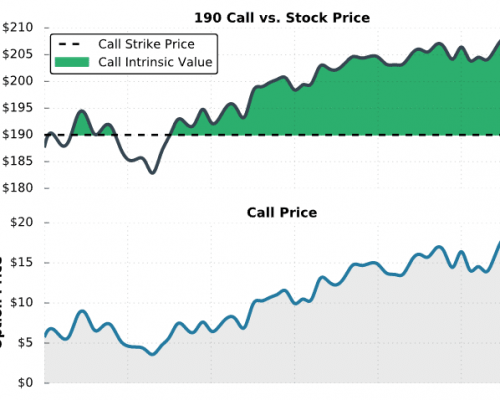

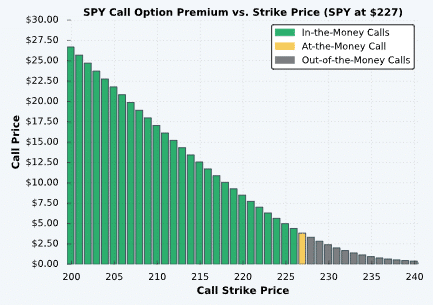

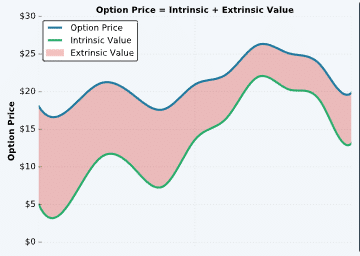

Intrinsic & Extrinsic Value

Every option has two price components: intrinsic and extrinsic value.

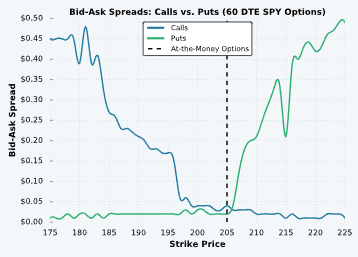

The Bid-Ask Spread

Learn about gauging an option’s “liquidity” with the bid-ask spread.

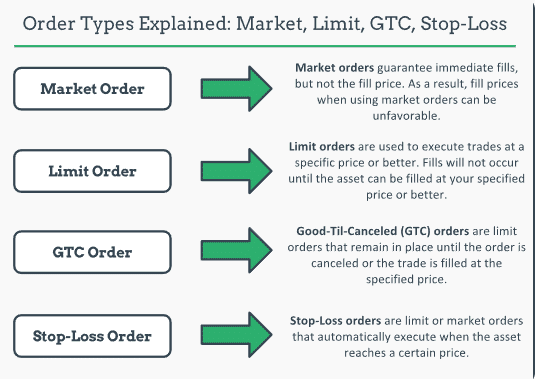

Order Types: Market, Limit, GTC, Stop-Loss

There are numerous order types you can use when trading stocks or options. Which ones are the best and which are the worst?

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.