Last updated on February 14th, 2022 , 08:38 am

Table of Contents

Inflation's Economic and Human Impact

In 2021, financial news headlines have been dominated by one word: inflation. All indicators point to his trend continuing throughout 2022 as well.

Inflation can be defined quite simply as a broad increase in prices. What prices are we talking about here? Everything. From the orange juice in your glass to the rubber on your tires. When the tidal wave of inflation comes, it lifts nearly everything in its path.

The dangers of inflation on human lives are real, particularly for the elderly.

Generally speaking, a person’s income becomes more fixed as they age. Americans in their twilight years may be relying completely on the income from fixed securities. The danger here comes when the cost of living surpasses the income received. What will a retired senior citizen do when the interest they receive on investments can’t keep up with prices; what will they cut out when their weekly budget for groceries rises suddenly from $100/week to $150/week?

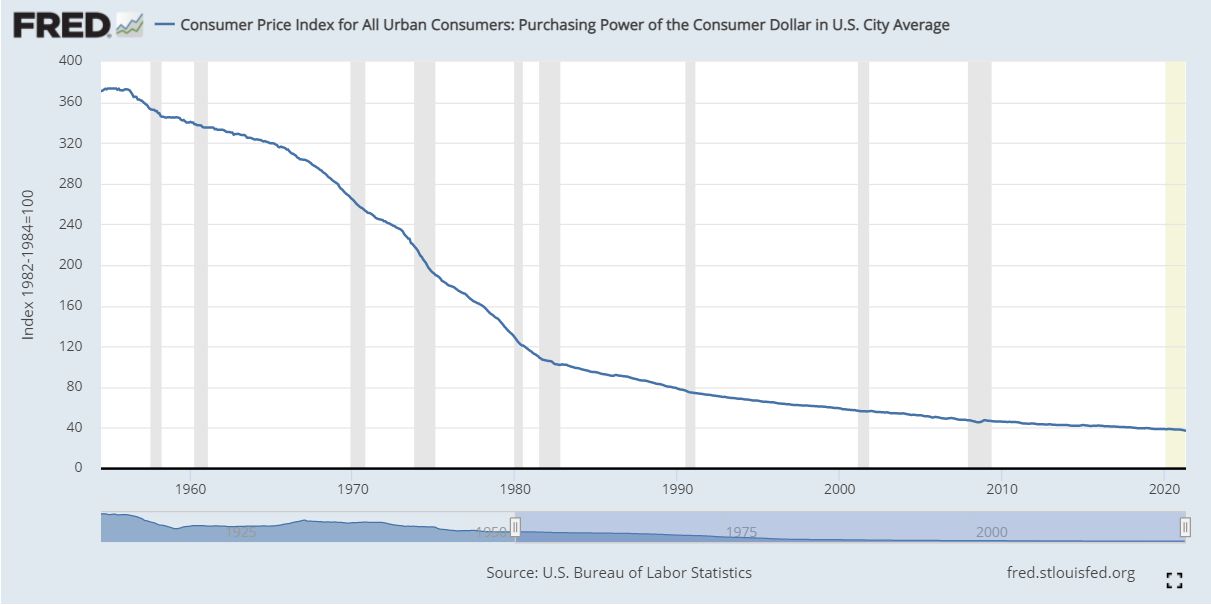

*The above chart from the St. Louis Fed shows the decline in purchasing power which occurred during the 1970’s. Are we headed there again?

The elderly are not the only ones at elevated risk during times of rising prices; the poor are also disproportionately hurt by inflation as well. Inflation is sometimes referred to as a tax on the poor for this reason.

Inflation Advantages

With that being said, inflation brings with it some upside as well. Moderate inflation is even encouraged. Inflation can increase wages, lower unemployment, and spur economic growth. When confronted with the choice between “deflation” (a general decline in prices) and “Inflation”, economists will always choose inflation, so long as it’s moderate.

Moderate inflation is normal and healthy. Can you imagine if a Hershey’s chocolate bar still “cost a nickel”?

What concerns us here is what happens when inflation rises above the Federal Reserve’s recommended level of 2% or below.

This level was recently breached, and a lot of powerful heads are turning. What are they watching?

Before we continue, let’s take a look at a few potential economic cons that excessive inflation brings.

Excessive Inflation Economic Cons

- A wide increase in prices often leads to greater economic uncertainty

- Cost of Borrowing Increases

- Personal Savings decline in proportion to increasing prices

- Broad decrease in purchasing power

- Excessive inflation can trigger a recession

So this is what could happen if excess inflation hits our economy, but are we headed in that direction presently? That is the million-dollar question.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Is Inflation Coming?

If inflation has been the financial word of the year in 2021, then the word “transitory” comes in second place.

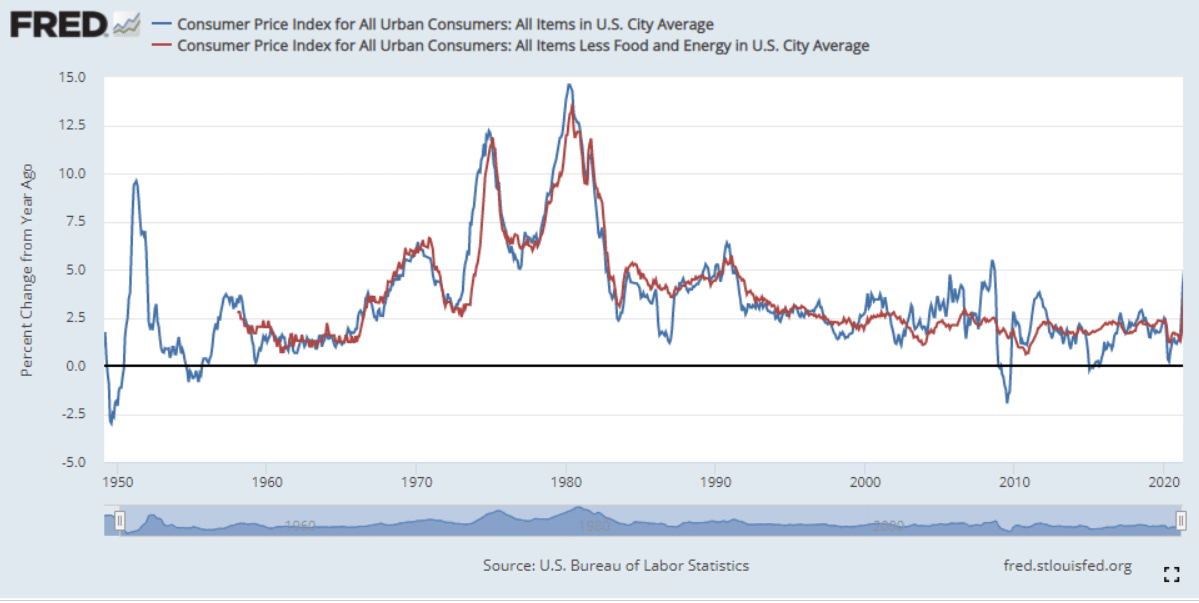

That is the word Jerome Powell, the chairman of the Federal Reserve, used to describe the most recent rise in prices in the US. Take a moment to examine the chart below from The US Bureau of Labor Statistics, which illustrates the historical percentage change in two CPI (Consumer Price Index) metrics. This index measures changes in the price level of a weighted average market basket of consumer goods and services purchased by households.

What concerns investors here is the far right side of the chart. There has been an obvious jump in prices, but, at the moment, it doesn’t appear overly threatening. Investors, however, aren’t concerned about its current level: they’re concerned about where it could potentially go.

This uncertainty has been the catalyst to recent market volatility. Who’s to say it won’t keep going up? Can anyone guarantee inflation won’t reach those levels seen in the early 1980s, triggering all those “Inflation Cons” we looked at above?

Ominous Signals

A study conducted by the University of Michigan recently found that consumer expectations for overall price changes jumped from 3.4% to 4.6% last month. The director of the program, Richard Curtin, stated that this was, “biggest rise in inflation concerns the study has found over the last 50 years.”

That is concerning. However, Curtin also believes that a strong job and income outlook could help to offset portions of the rising inflation sentiment.

When it’s all said and done, Jerome Powell’s hope that the current bout of inflation will be “transitory” appears less likely. The market has been relatively resilient to the latest increase in inflation, but how much higher can the market go before some investors start throwing in the towel, and will they at all?

Inflations Impact on Stocks

So what are the effects of inflation on the stock market? Broadly speaking, stocks tend to do well during periods of high inflation. That is a very generalized statement. Though inflation is very easy to define, the economic repercussions of inflation are manifold.

In theory, an increase in price should result in an increase in revenue, thereby elevating stock prices. The danger comes when input prices increase at a rate greater than revenue. If an orange juice manufacturer is paying more for oranges than they are selling the juice for, that’s no good for business.

Another component to factor in when examining inflation is the market cycle. If inflation occurs during a market expansion (as we are currently in) stocks generally perform well.

But what if we were in a recession when inflation hit? The US experienced an awful period of “stagflation” during the 1970s. Stagnation occurs when high inflation combines together with high unemployment and stagnant demand. The market performed so horribly during this time of inflation that stockbrokers were known as “waiters”.

But we are not in a recession today. Quite the opposite actually. With the exception of a few hiccups (labor and inventory shortages), the United States has roared back to life as never before. Even with the inflation fears, the S&P 500 is at a record high as I write this article.

Red Flags

With all that being said, there are clouds on the horizon. Rising yields and Fed tapering are two red flags that could precipitate inflation. Both of these factors are broadly considered to be negative for equities in general. Yet, stocks continue to climb.

So which stocks will perform the best in this environment?

Before we explore a few trade ideas to help hedge your portfolio against inflation, it is important to note the already elevated price of many of these securities

Premium for Inflation Hedges

In mid-2021, inflation hedged assets are not a novel idea. Money has been pouring into these securities for the past few months in anticipation of rising inflation, thus driving up the prices. If you decide to diversify your portfolio to include inflation hedges, it’s important to know that if inflation does not meet the lofty prices expected by many, these securities could very well lose more money than the overall market.

In other words, it’s likely your “hedge” could cost you much more than if you had no protection at all.

But if you’re of the “better late than never” mentality, here are a few sectors and stocks which tend to hold their own during inflationary times.

1) Consumer Staples

Consumer staples tend to perform well during times of rising prices. Staples consist of goods and services which are used on a daily basis, such as clothing and food. People are willing to pay up for essentials (because they have no choice), and the companies producing these goods and services can therefore pass on their increased input costs to the customer. Here are a few of the more popular stocks and ETFs in this sector.

Consumer Staple Stocks

- WalMart (WMT)

- Procter & Gamble Co. (PG)

- General Mills Inc. (GIS)

Consumer Staple ETFs

2) Commodities

Commodities are often thought to be a leading indicator of inflation because they represent the building blocks of an economy. A cereal company such as General Mills would never dramatically increase the price of a box of Cheerios unless the cost of oats was soaring. In that vein of thought, commodities can be thought of as an extension to consumer staples, in that these staples are composed primarily of commodities. You don’t have to look far to see how these two sectors connect – even the cost of your toilet paper has gone up recently because of skyrocketing wood and lumber prices.

Commodity Stocks

- Archer-Daniels-Midland (ADM)

- West Fraser Timber (WFG)

Commodity ETFs

3) Gold

Though technically a commodity in itself, gold gets its own section on this list because of its historically superior performance during inflationary periods. Though lately gold has been losing some of its luster due to the rise of cryptocurrency and bitcoin ETFs like ProShares BITO.

To keep up with rising costs, governments often print money. When you have more of anything, its value goes down. Investors frequently flock to gold during these times because of its scarcity. You can’t print bullion as you can a dollar bill.

Gold Stocks

Newmont Corporation (NEM)

- Barrick Gold Corp (GOLD)

Gold ETFs

4) Real Estate

Investors in real estate tend to do better during times of inflation than the market in general. Property prices tend to rise with inflation. With an increase in property prices comes an increase in rent. This scenario just adds to why many call inflation a tax on the poor.

That being said, real estate prices are at the moment extremely high. As noted in the Wall Street Journal, this tactic may backfire.

Real Estate Stocks

Simon Property Group (SPG)

- PulteGroup, Inc (PHM)

Real Estate ETFs

Additionally, you can direct in Real Estate Investment Trusts. You can learn more about equity REITs and mortgage REITs in our article here.

5) Treasury Inflation-Protected Securities (TIPS)

In a normal, mild inflationary environment, bonds are a great investment. They offer a reliable source of relatively low-risk income. During times of high inflation, however, bonds are notorious for their poor performance. Since the value of money is going down, so is the value of the interest we receive on bonds. What good is a 2% yield on a bond if inflation is growing at 5%?

This is when TIPS (Treasury Inflation-Protected Securities) ETFs come in handy. These kinds of securities take into account cost-of-living increases and adjust their principle values right along with inflation. It is also worth noting that when prices begin to decrease, these types of bonds will underperform more traditional bonds

TIPS ETFs

6) Healthcare

Last on our list in the healthcare sector. Why? Healthcare demand is largely immune to inflationary pressures. Big pharma and biotech stocks alike should remain resilient (if not thrive) while other sectors are struggling with rising prices.

Bankrate has produced a great list of healthcare ETFs. Here are a few of the highlights from this list:

Healthcare ETFs

Final Word

Nobody can say for certain where inflation will be in two months, let alone three years down the road. The media has been engaged in a months-long tug-of-war on the subject, and no winners have emerged yet. Inflation has indeed been rising, but it is too soon to tell whether it will rise high enough to affect the markets materially.

When making adjustments to your portfolio, try to not only consider what you may gain by making adjustments for inflation but also what you may lose in any specific sectors should inflation indeed prove transitory.