Last updated on April 25th, 2022 , 11:18 am

Money is at the core of almost everything we do.

Unless you live in the wild and fully support yourself, you use money.

In this guide, you will deepen your understanding of money by exploring the:

- Functions of money

- Characteristics of money

- Evolution of money

Let’s begin!

Jump To

What is Money?

According to the Merriam-Webster definition, money is generally accepted as a medium of exchange, a measure of value, or a means of payment.

So “money” is:

– Recognized by society as being an acceptable form of payment for things

– People can value goods/services in terms of money

The combination of these things means:

#1: I can walk into a U.S. grocery store and buy food with U.S. dollars, the recognized and acceptable form of currency in the United States.

#2: I can assess how valuable things are by comparing their values in a common unit of measurement (if a bottle of wine is $20, and a car is $20,000, I know the car is more valuable than the bottle of wine).

But it wasn’t always like this.

Thousands of years ago, the barter system (trading goods for goods) was the primary method of exchange.

If I made pots and you made blankets, I could trade you a pot for a blanket:

Goods/Services ⇒ Goods/Services

The barter system is inefficient because of the double coincidence of wants. For a trade to happen, each person must want what the other has to offer.

This is where modern money came to save the day.

By having a common thing that society recognizes, values, and demands, trade can occur between two parties even if they don’t want the goods/services the other has to offer.

We call the collectively recognized and valued thing money.

What Does Money Really Represent?

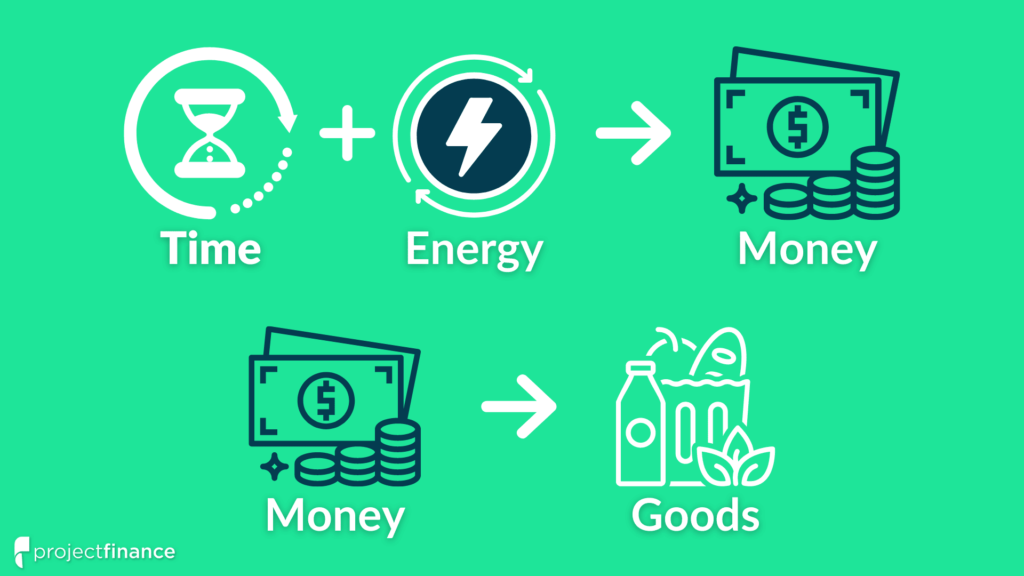

One of the most profound things I’ve come to understand about money is it is effectively stored energy.

Money we earn represents our life/labor energy.

We spend time and energy working to earn money to spend, save, or invest.

We convert our time and energy into money that we can later convert into a good or service.

Time and Energy Spent Working ⇒ Money ⇒ Goods/Services

Throughout history, money has taken many forms: shells, salt, sticks, stones, coins, paper, and now, digital money like digital USD and bitcoin.

The specific types of money have evolved over thousands of years as better forms of money emerged.

What makes a form of money better than another? We will explore that shortly.

The 3 Functions of Money

Regardless of the form of money (gold coins, paper notes, bitcoin) there are three primary functions of money:

Medium of Exchange

Store of Value

Unit of Account

Let’s explore each of these money functions with examples.

Medium of Exchange

The first function of money is a medium of exchange, or a common item that people use to carry out transactions.

Example: I go out to dinner and pay the restaurant U.S. dollars (USD) for my food.

Money (USD) ⇒ Dinner

The restaurant takes my dollars and pays their suppliers for ingredients and staff for serving me.

Money (USD) ⇒ Restaurant Supplies + Payroll

The staff takes their dollars and exchanges them for food, clothes, and shelter.

Money (USD) ⇒ Food, Clothes, and Shelter

Having a medium of exchange makes trade much more efficient because I can pay someone money for goods/services, which they accept because they know someone else will accept that same money for goods/services (money has constant demand).

If the people in a society all recognize and value a common medium of exchange, those people pay and receive payment in that medium of exchange.

In the United States, the recognized medium of exchange is the U.S. Dollar (USD).

In the eurozone, the recognized medium of exchange is the euro.

In El Salvador, the recognized mediums of exchange are USD and bitcoin.

Store of Value

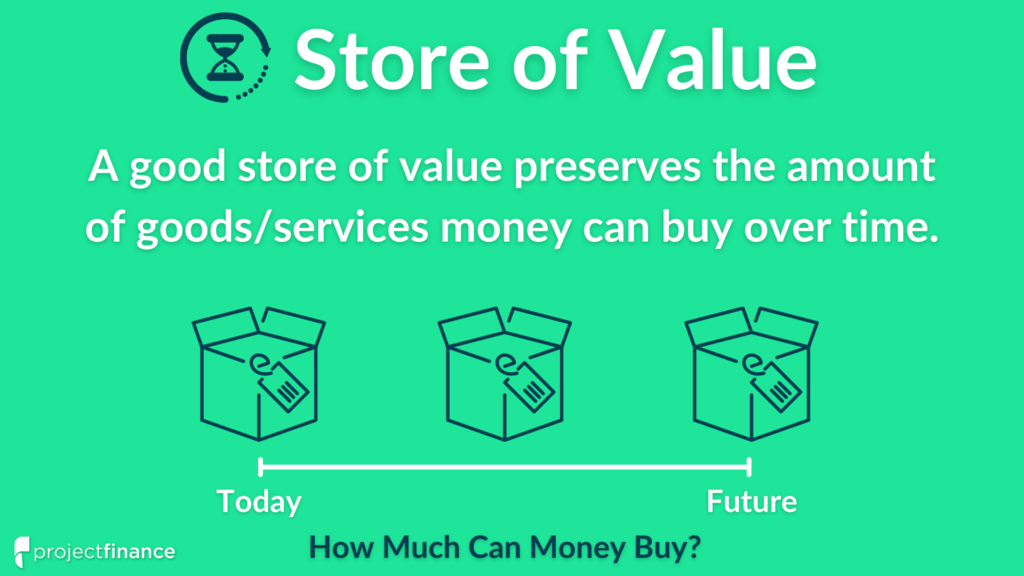

The second function of money is serving as a store of value (preserving value across time).

The benefit of having a store of value is that we don’t have to spend our money immediately if we have no wants or needs.

With no immediate wants or needs, we can save or invest our money to spend it in the future by holding it in a store of value.

Without a store of value, we have to spend our money immediately, even if we don’t have anything we need to buy. Without a store of value, we increase wasteful spending and can’t save for the future.

Ideally, money serves as a store of value by preserving purchasing power over time. As we’ll see in a later section, this hasn’t been the case for modern money over long time periods.

What Makes a Good Store of Value?

A good store of value will preserve (or grow) purchasing power over time.

Purchasing power is how much stuff I can buy with my money.

If $100 in my bank can buy 100 widgets today and 100 widgets a year from now, the money holds its purchasing power and is a fantastic store of value.

Stable/Growing Purchasing Power Over Time ⇒ Great Store of Value

If $100 in my bank can buy 100 widgets today but only 50 widgets a year from now, the money loses purchasing power and is not a store of value.

Loss of Purchasing Power Over Time ⇒ Bad Store of Value

The store of value function is critical to the success of a form of money.

If a money does not hold its purchasing power over time, its users are encouraged to spend their money sooner than later because they will be able to buy less in the future compared to now. Rapid loss of purchasing power prevents people from saving money for future consumption.

Additionally, those selling goods/services may be hesitant to accept something that doesn’t hold its purchasing power over time.

For instance, if I I’m selling a $1,000 item, I’ll be hesitant to accept $1,000 worth of bananas instead of $1,000 in gold.

The bananas will perish within a week and render the entire sale worthless.

The gold doesn’t spoil, and I can hold it comfortably for an extended period of time. It may even appreciate!

If something loses significant purchasing power over time, it is not a store of value.

If something preserves or grows purchasing power over time, it is a good store of value.Good vs. Bad Stores of Value

Unit of Account

The third function of money is acting as a unit of account (common measure of value).

With a common unit of measurement, we can easily track changes in wealth and compare the prices of goods/services.

If a cup of coffee is $5 and a bottle of wine is $100, I know the bottle of wine is more valuable than the coffee.

But if the coffee is $5 and the bottle of wine is 100 shells, it’s not clear which item is more valuable because the measure of value is different.

This is why it’s confusing traveling to foreign countries: they have a different unit of account than you’re used to, making it hard to understand the value of things. Is 10,000 yen a lot of money? How much are 25 pesos worth in USD? Confusing!

We’ve now explored how money serves as a:

- Medium of exchange

- Store of value

- Unit of account

Technically, anything can be money, so what explains why money has changed forms so many times over the millennia?

The 8 Characteristics of Money

A new form of money should be graded on a basket of characteristics.

Something with high grades in all money characteristics is a better form of money than something with high scores in only a few of the characteristics.

The market will ultimately choose the best form of money—the one with the highest cumulative ranking in all characteristics of money.

What are these characteristics?

Durable

Money that is durable (difficult to destroy) is safer to possess than fragile money. Durability exists in a physical and digital sense.

Wine glasses would be a poor form of money because they are fragile. If your wealth is stored in wine glasses and a bulldozer drives over them, you’re toast.

Gold is virtually indestructible (A+ durability), which is one reason it has stood the test of time as a widely recognized store of value.

If your house was burning down, it would be better to have bars of gold under your mattress as opposed to piles of dollar bills.

Gold is, therefore, more durable than paper money.

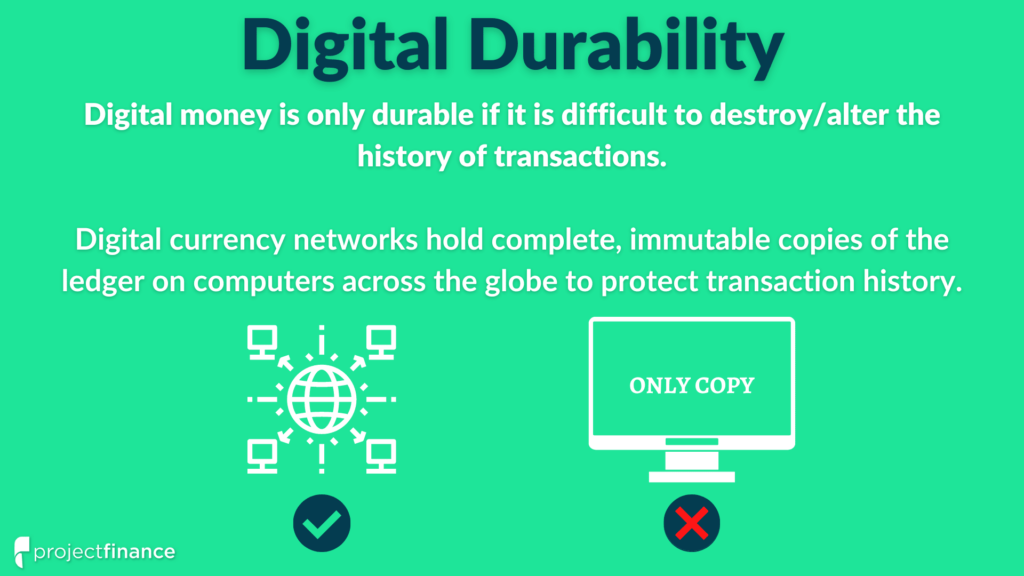

Durability exists in a digital sense too.

For example, bitcoin has no physical form, but it is incredibly durable. So how can digital money be durable?

Bitcoin is entirely digital money requiring the entire history of transactions to keep track of who owns what. If the entire bitcoin ledger (transaction history) was stored on a single computer, the wealth of every user could be erased by destroying the computer storing the ledger (no history of transactions = no way to verify ownership).

Fortunately, the bitcoin ledger is stored and updated on a global computer network consisting of tens of thousands of computers.

Simultaneously destroying every computer storing bitcoin’s transaction history is virtually impossible, making bitcoin highly durable.

Fungible

Money needs to be fungible, or interchangeable with other identical units without loss of value.

Government-issued currencies are highly fungible because it doesn’t matter which $1 bill you have.

If I have $1 and you have $1, we can exchange the notes and be in equal standing.

When gold and silver coins were used as currency, fungibility would be a problem in a scenario where my gold coin was 95% pure while your gold coin was 90% pure. I wouldn’t want to give you my 95% gold coin for your 90% gold coin, even if they were marked the same and supposed to be of equal value.

Even if the coins were marked similarly and said to be equal, they wouldn’t be fungible because of the differing purities. Additionally, early forms of precious metal coins likely differed in shape and size, decreasing fungibility.

If various “identical” units of money are deemed more valuable than others, the money becomes less acceptable than a fully fungible form of money and will not move as freely through the economy.

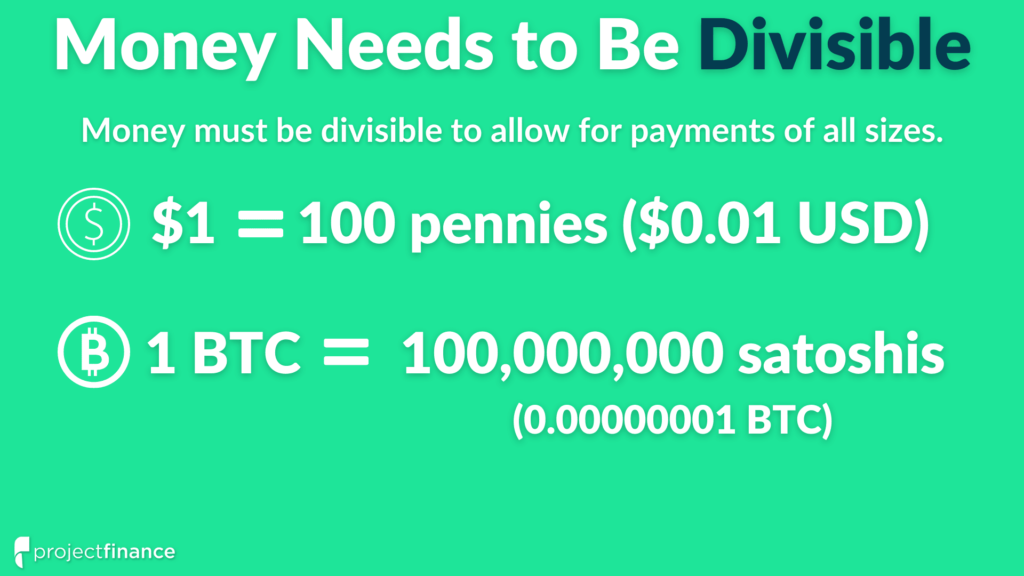

Divisible

Money that is highly divisible allows for accurate payments of any value.

Without divisibility:

Value is lost through inaccurate exchanges.

Small exchanges don’t happen at all

For instance, if our minimum denomination was $5, I could not accurately pay for something worth $7. I’d have to pay $10 and overpay by $3 or the merchant would have to accept $5 and lose $2.

U.S. currency is divisible because each $1 consists of 100 units called pennies.

Bitcoin is divisible because each unit is divisible into 100 million units called satoshis (sats).

It doesn’t matter if a good is worth $1.23 or 0.0003 BTC, I can pay the exact amount because U.S. dollars and bitcoin are highly divisible.

Portable

Money must be portable so that it can move around easily.

A gold bar is not very portable because it’s big and heavy. Not to mention it’s not very divisible either! Therefore, a gold bar is not great day-to-day money.

The introduction of paper currencies convertible to gold made money more portable because paper is light and flexible. It’s easier to carry around a piece of paper that represents $100 in gold than $100 in physical gold.

Today, money is more portable than ever because it is mostly digital.

Portability doesn’t only involve moving money physically, but how easily it can move across borders.

Digital USD is portable within the USA, but less so internationally. There are restrictions on where I can send USD in the world, and it may take days.

Bitcoin is digital and borderless. BTC can be sent anywhere in the world without permission from financial gatekeepers.

Therefore, digital USD is highly portable within the USA but is less portable than BTC in terms of sending global payments.

Verifiable

Money must be verifiable to become counterfeit-resistant.

If the authenticity of money cannot be verified, the potential for counterfeit increases.

Government-issued currencies are verifiable from the serial numbers and intricate markings that appear on each unit of currency, providing them with strong counterfeit-resistance.

Bitcoin cannot be spent without access to the private key associated with a bitcoin wallet. Bitcoin’s ledger, or history of transactions, is public, making it easy to verify any transaction.

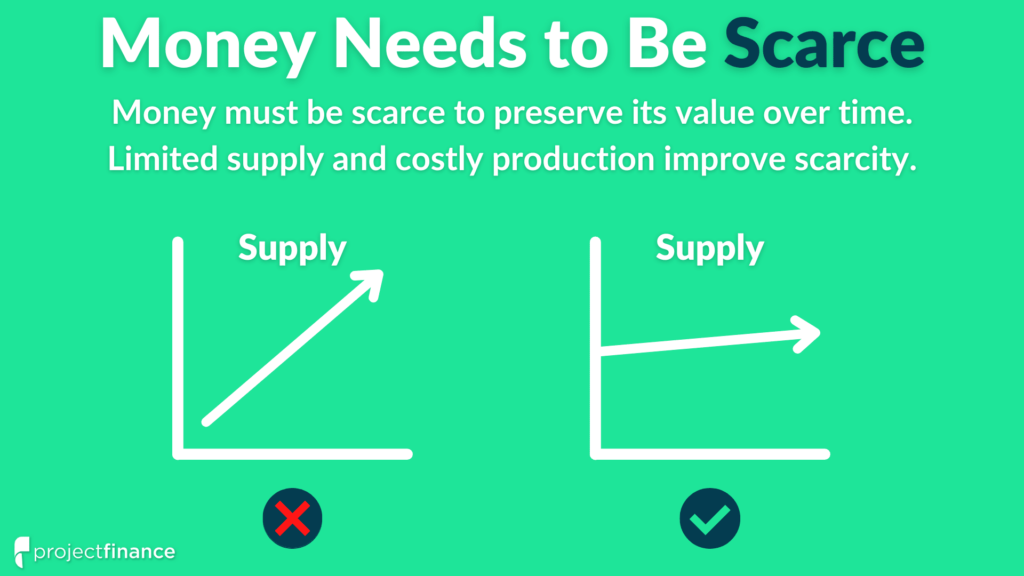

Scarce

Scarcity is a critical characteristic of money because it is essential to the value of money over long periods of time. Everything that is valuable is scarce.

Your life is valuable because it has a time limit.

The Flying Fox yacht is valuable because there are few 450-foot luxury yachts in the world.

Gold is scarce because we must go through the time-intensive and costly process of digging it out of the ground.

Scarcity is essential to the preservation of value over time.

Limited supply and/or costly production improve scarcity.

Resistant to Confiscation and Censorship

Lastly, money should be resistant to confiscation (theft) and censorship (control of how money is used).

If a money is easy to confiscate, people are not safe storing their wealth in it.

After all, money represents our blood, sweat, and tears. If our money is confiscated, our life energy is stolen. Similarly, if our payments can be censored, we aren’t free to spend our money how we’d like to.

Different forms of the same money can be more or less resistant to confiscation and censorship.

For example, physical dollars can easily be stolen by a thief, which is why most people store their money at commercial banks and access it digitally.

Physical money is censorship-resistant because only the carrier of physical money can choose how it is spent/moved.

Digital dollars are much harder to steal, but are much less resistant to censorship (a bank can reject a credit card payment or wire transfer).

The Acceptability of Money

The characteristics of money make it more acceptable.

Money is the most “salable” good in an economy, or the easiest to sell.

Why? Everyone wants money because they can use it for anything.

Since money is highly demanded, it’s easy to sell (which is what you do when you buy something).

A money ranking high in all money characteristics will be more demanded than a money ranking poorly in the money characteristics.

Example: a form of money that is durable, scarce, divisible, portable, and verifiable will be more salable/demanded/acceptable than money that has low rankings in these characteristics.

Commodity Money vs. Representative Money vs. Fiat Money

Money has evolved over many thousands of years.

In the past, commodity money was the norm, which is money that derives value from its material, such as gold and silver coins.

Commodity money like gold and silver coins have intrinsic value because gold and silver are valuable.

Commodity money is inherently lacking in portability, verifiability, and fungibility. It’s inefficient to carry around a pouch of precious metals (not portable), they can be counterfeited (difficult to verify) and come in varying shapes and sizes (not fungible).

To improve the characteristics of commodity money, the world introduced representative money, which is money that is backed by something, such as gold.

An example of representative money would be a currency note convertible to a specified amount of gold.

Instead of carrying around gold coins, people could carry around paper notes representing convertibility to gold coins, increasing portability, verifiability, and fungibility.

Paper notes convertible to gold was the case under the gold standard.

Eventually, fiat money became the global standard, which is money that derives its value from government order.

A $20 bill (USD) is an example of fiat money. It has no intrinsic value because it’s only a piece of paper. But a $20 bill is valuable because the government says it has value, and it is legally recognized as currency in the United States, providing it with constant demand.

What is Legal Tender?

An emerging form of money may have high ranks in the characteristics of money, but that doesn’t mean it will be immediately and widely recognized as money.

Legal tender is a form of money that is legally recognized as an acceptable form of payment in a country.

The U.S. dollar is legal tender in the United States, while the peso is legal tender in Mexico.

In September 2021, El Salvador became the first country in the world to begin recognizing bitcoin as legal tender, making it a widely accepted currency in the country.

The Problems With Fiat Currencies

While fiat money such as the U.S. dollar ranks well on many of the characteristics of money, it falls short in the scarcity category. And, centrally-controlled monies can be censored, cutting out users from the financial system.

Fiat currencies do not have limited supply because governments control their country’s monetary policy, or how the money supply of their currency is managed.

The Federal Reserve is the institution that controls the monetary policy in the United States.

Centralized control of monetary policy allows for quick action in regards to the money supply, but not without consequences.

Central banks can create more units of currency instantly and without cost, like changing a number in a spreadsheet.

If the supply of money rises quickly, each unit of currency is susceptible to loss of purchasing power (more units required to buy the same amount of goods and services).

Currencies can lose purchasing power rapidly in the case of severe mismanagement of a nation’s currency.

Over time, the U.S. dollar has lost purchasing power. The longer the time period, the greater the loss of purchasing power.

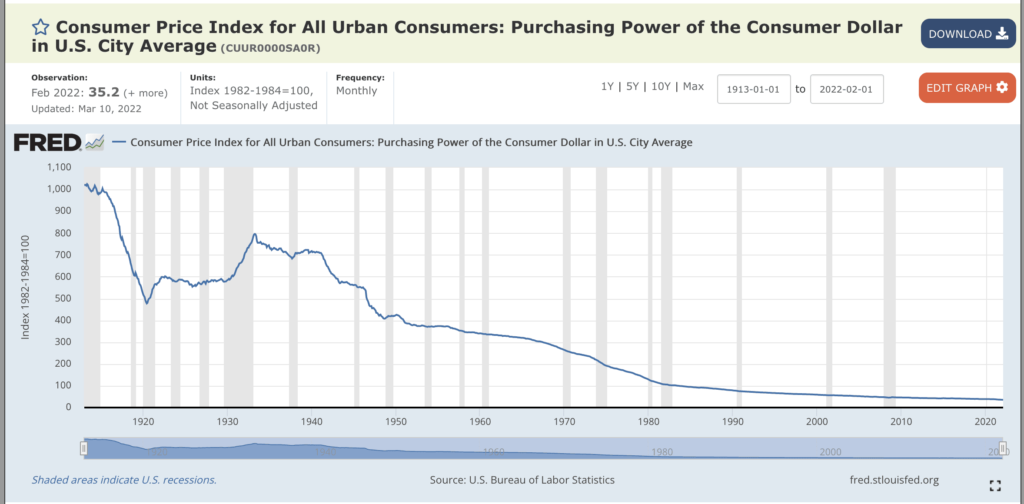

Here’s a graph from the U.S. Bureau of Labor Statistics of the purchasing power of the U.S. dollar since 1913:

While there have been periods of increasing purchasing power, the long-term trend is down.

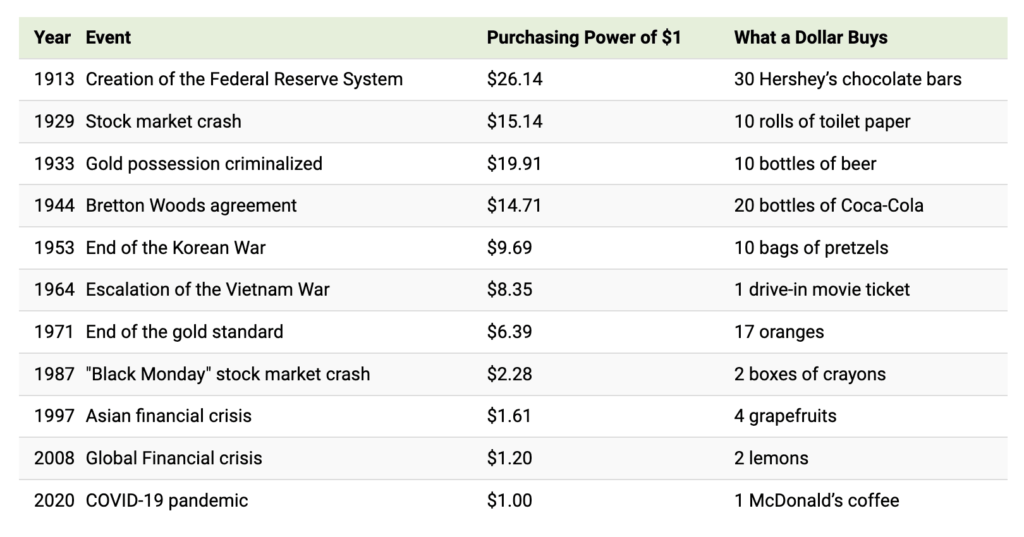

According to Visual Capitalist, $1 in 1913 could buy 30 Hershey’s chocolate bars, but only one McDonald’s coffee in 2020:

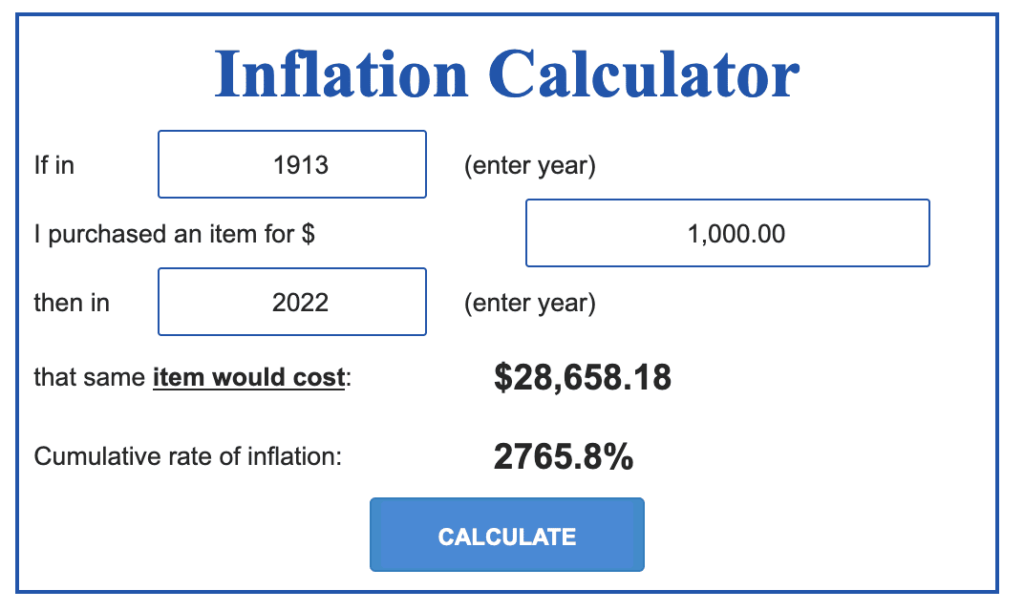

To provide more context, according to usinflationcalculator.com, $1,000 in 1913 had the same purchasing power as $28,658 in 2022:

In other words, if you held $1,000 in a bank account during that period and didn’t grow it, your $1,000 in 2022 is nearly worthless compared to what it could buy in 1913.

You needed to grow each dollar 28x to maintain purchasing power since 1913. Any returns lower than a 28x resulted in lower purchasing power.

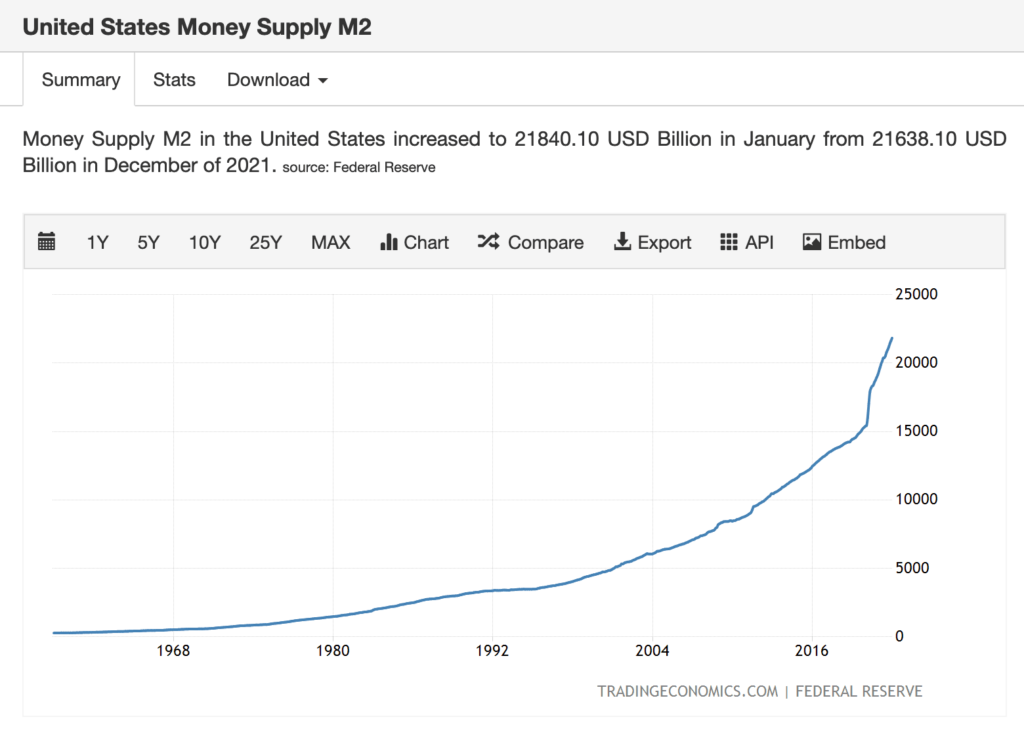

We can compare the purchasing power loss of the U.S. dollar to the US money supply since the late 1950s:

Source: Trading Economics

The U.S. dollar has lost almost all purchasing power since the early 1900s as the Federal Reserve printed more of them.

Some economists argue that an increase in the money supply doesn’t cause inflation.

As I write this, the Federal Reserve is printing money (increasing the money supply) faster than ever before, and CPI inflation is at 7.9% year-over-year (as of Feb 2022), the highest in 40 years.

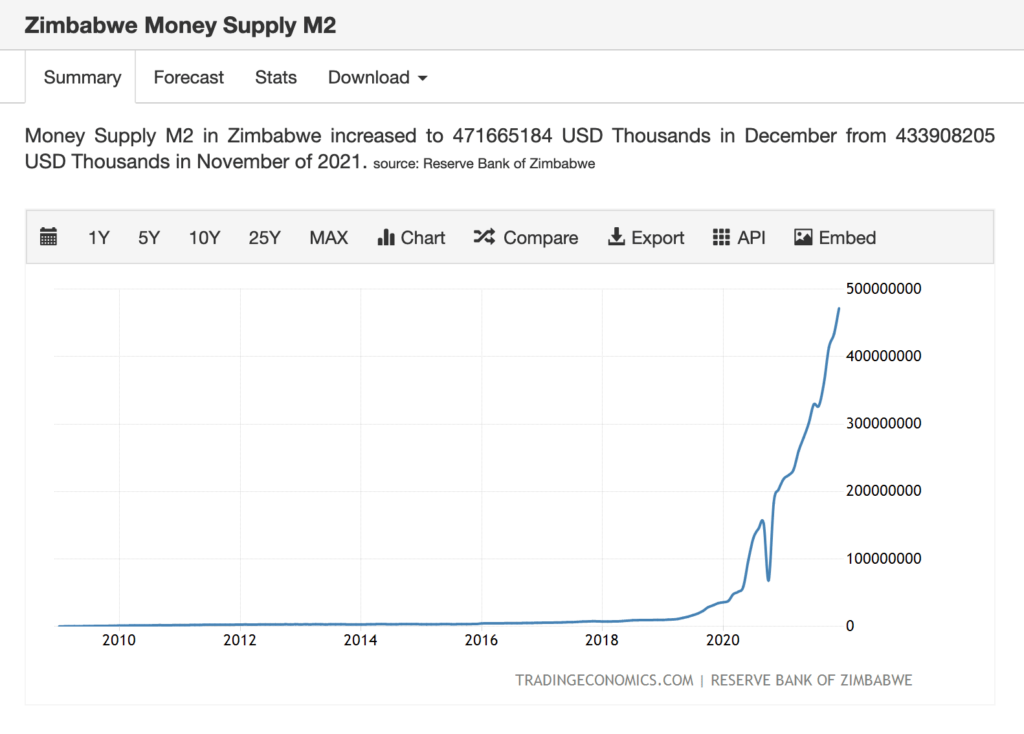

Other countries have experienced hyperinflation, which is essentially a currency failure because prices are rising so fast (higher prices = lower purchasing power).

The Zimbabwe dollar is one example of a currency that became worthless due to hyperinflation, which isn’t surprising when we look at the changes in the money supply:

Source: Trading Economics

The conclusion is that fiat currencies are not long-term stores of value. Historically, long-term holding periods of fiat currencies has led to significant loss of purchasing power.

While fiat money is efficient for short-term saving and spending (and required for payment of federal taxes) investors seeking to preserve/grow their purchasing power over time need to allocate money to other financial assets such as stocks, real estate, precious metals, or bitcoin.

Conclusion

Money serves a critical role in modern economies:

1) It serves as a medium of exchange, allowing for more trade to occur by removing the double coincidence of wants (two parties simultaneously wanting the good or service the other has to offer).

2) It serves as a unit of account or common measure of value, allowing for societies to easily understand the relative costs of things and keep track of changes in financial accounts.

3) It serves as a store of value, allowing us to preserve purchasing power (though not over long periods of time in the case of fiat currencies) and not spend all of our earnings immediately.

But not all forms of money are good.

The best forms of money rank high on a list of characteristics: durability, fungibility, divisibility, portability, verifiability, scarcity, and resistance to both confiscation and censorship.

Over the millennia, money has evolved and taken many different forms, each time advancing to a new form of money with better overall rankings in monetary characteristics.

Fiat currencies are the current global standard, as they rank high in most monetary characteristics.

Unfortunately, the history of fiat currencies shows that they fail as a store of value over time due to their unlimited supply and zero cost of creation, deteriorating the wealth of those confined to them.

Additionally, users of centrally-controlled currencies are subject to the mismanagement of the money supply and financial censorship.

Will the emergence of digital money like bitcoin, following rules of code that aren’t controlled by a central authority, be the next global standard for money?

Or will we remain on a fiat standard for centuries to come?

Time will tell.

One thing is likely: money will continue evolving over time as superior forms of money come into existence.

I truly enjoyed putting this piece together, and I hope it was insightful and succeeded in deepening your understanding of money.